I going to make a greatest artwork as I can, by my head, my hand and by my mind.

Back in September I stated NerdWallet, Inc. (NASDAQ:NRDS) was a “Buy.” The stock has beaten the S&P 500 as it has gone up by over 60% since that article was published.

After looking at this latest quarter, I’m still a strong believer in NerdWallet and think the stock will continue to reward investors in 2024 and beyond.

Company Updates

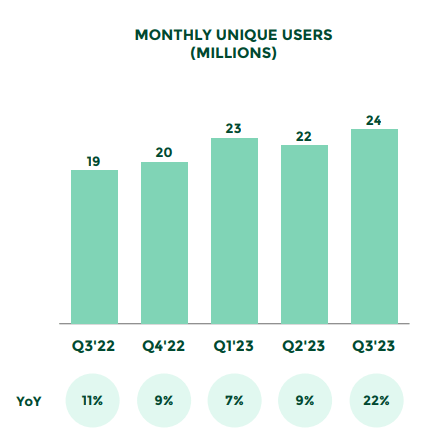

As the stock jump indicates, NerdWallet must have been doing something right over the last few quarters. To start, NerdWallet’s growth continues to be impressive. As you can see from the below graphic NerdWallet’s monthly unique users (MUUs) have increased by 22% year-over-year:

Investor Presentation

Additionally, within the United States (NerdWallet’s primary market) the company’s share of the market is growing as NerdWallet has a three-year CAGR of roughly 33%.

As noted in my prior article, NerdWallet has three growth pillars the organization is focusing on, land and expand, vertical integration, and registrations and data driven engagement. On the company’s Q3 2023 earnings call, CEO Tim Chen noted the company’s progress regarding each of the growth pillars.

Regarding land and expand, the company is making progress in Canada as MUU growth is up over 87% compared to Q3 2022. Additionally, NerdWallet is ramping up efforts to provide services and content in Australia as well.

In terms of vertical integration, NerdWallet is using On the Barrelhead’s (OTB) technology to help match consumers with personalized credit card offers.

Lastly, registrations have continued to increase as well as NerdWallet’s registered user base has increased by 38% year-over-year.

Another interesting note from the Q3 2023 earnings call is that NerdWallet is launching a credit card called NerdUp. This card is intended to help consumers build their credit history. In hearing Chen speak about this card, it does sound unique and perfect for NerdWallet as it’s not focusing so much on fees like annual fees, late fees, high interest fees and so on. NerdUp is intended to focus on helping consumers improve their credit, which I think is refreshing. On the call, Chen went on to say this about NerdUp, “We want to effectively give most of those economics back to the consumer in the form of no annual fees, low minimum balances, cash back rewards, and instead just focus on helping a broad base of consumers improve their credit scores. So, this really nurtures an engaged audience for us, and we hope to refer that audience back to the issuers and lenders we partner with when consumers build up their credit and qualify for unsecured products.”

If NerdUp is successful and consumers like the card, I could see this opening the door for NerdWallet to create additional opportunities.

Financials

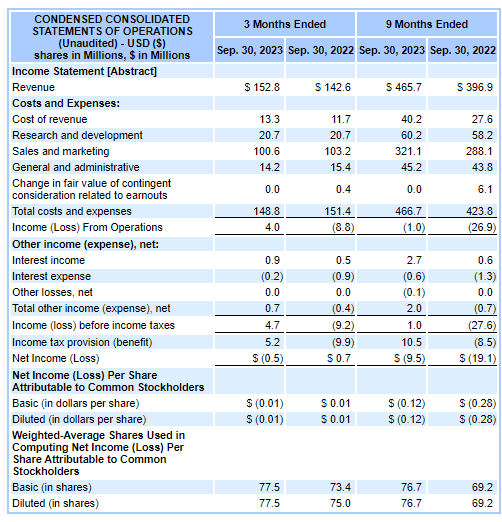

NerdWallet had a solid quarter in Q3 2023, as revenue came in at roughly $153 million, which is a 7% increase compared to Q3 2022. Credit card revenue was $54 million which was a 6% decrease compared to the prior year quarter. This decline was primarily due to a decrease in marketing spending by NerdWallet’s financial services partners. Loans revenue was roughly $33 million for the quarter, which is a 16% increase compared to Q3 2022. Revenue from other verticals was roughly $66 million, which was also up 16% year-over-year.

I also like that NerdWallet has done a better job of managing expenses. As you can see below, operating expenses (labeled as Total costs and expense) was down in Q3 2023 and the company had operating income of roughly $4 million instead of an operating loss of nearly $9 million in Q3 2022:

SEC.gov

This is certainly promising as the company is getting closer to GAAP profitability.

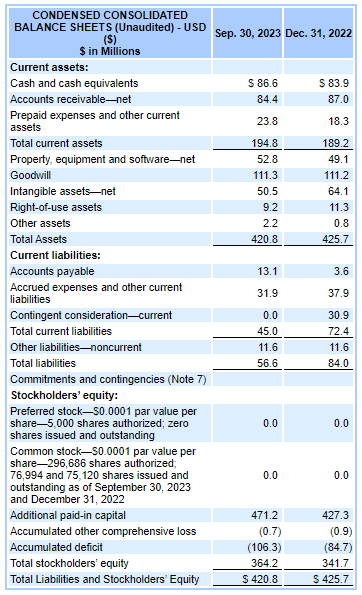

The company still has a fantastic balance sheet with no debt and more than enough current assets to cover not only the company’s current liabilities but all of the company’s outstanding liabilities, as you can see below:

SEC.gov

The company also noted during the quarter, they repurchased $10.8 million of Class A shares at an average price of $8.95. That looks like a steal compared to today’s price. The company’s CFO Lauren StClair noted on the earnings call, NerdWallet’s board has authorized an additional $30 million for share repurchases.

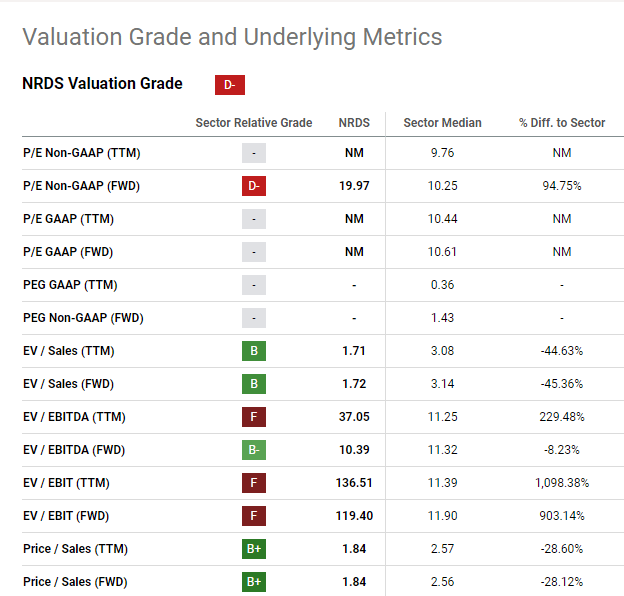

Valuation

NerdWallet has an overall valuation grade of a “D-.” However, I continue to believe that the best metric to value NerdWallet is price to sales ratio and as you can see from the metrics below, NerdWallet is better than the sector median:

Seeking Alpha

NerdWallet’s current price to sales (forward) is 1.84 which is below the sector median of 2.56. Management stated the expected revenue for NerdWallet’s Q4 2023 will be in the range of $136-$140 million, which is roughly 12% revenue growth for the year. I think NerdWallet will hit the upper range of that estimate if not surpass and would predict annual sales closer to $605 to $608 million.

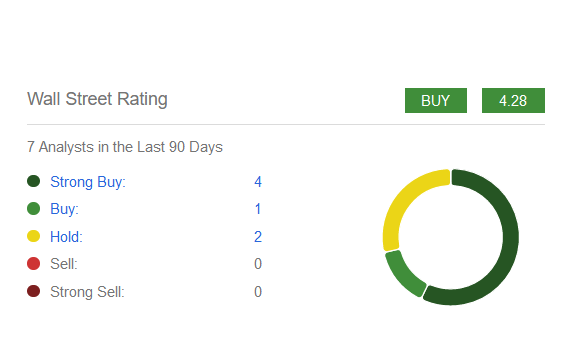

Furthermore, as you can see below, Wall Street analysts continue to view NerdWallet as a “Buy”:

Seeking Alpha

Risks

One of the main risks I see for NerdWallet is the current macroenvironment as the company can be impacted by the Fed’s rate decisions if their financial partners continue to be conservative with marketing spend. I would expect the Fed to begin to cut rates at some point this year. My guess would be in late Q1 or beginning Q2 of this year but if inflation continues to be sticky and the Fed could keep rates high or even raise them (although unlikely in my opinion) which would certainly adversely impact NerdWallet’s business.

Conclusion

While NerdWallet’s stock price has skyrocketed over the last few months, I still think it’s a buy. The growth in monthly unique users is certainly a positive and this growth is translating into an improved financial picture as revenue continues to increase while the company is inching closer to profitability.

As I’m a long-term investor, I like to look beyond one or two earning reports. NerdWallet is making progress in each of their notable growth pillars, and I like that the company is rolling out a credit card. If NerdUp is successful, I could easily see the company launching similar financial products.

Additionally, although Chen hasn’t purchased any shares over the last few months, he purchased a sizable amount in 2023 and now owns much more of NerdWallet. Clearly, he’s bullish on the future of the organization, as the company’s board given the authorization of another $30 million for share repurchases.

Despite, the rise in the stock price over the last few months, NerdWallet is still trading below the company’s IPO price and I think long-term investors can feel comfortable continuing to add shares as I believe this company will continue to grow and reward long-term investors in the years to come.