Not all stocks are created equal, and not all stocks equally matter to an index’s performance. With the Nasdaq Composite up by 36% this year, those equities known as the “Magnificent Seven” have done quite a bit of the work. This nickname refers to a group of large, notable tech companies well-known to most investors: Nvidia, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Tesla.

There is much to admire about these corporations; one can make a strong case for investing in each. However, I admire another stock even better right now, though its business isn’t quite as exciting. The company in question is biotech giant Vertex Pharmaceuticals (VRTX -1.07%). Read on to find out why I’d pick this drugmaker over any of the Magnificent Seven any day of the week.

It’s not all about the economy

It’s no coincidence that tech stocks rebounded this year after a mostly abysmal 2022. The economy performed better in 2023 than we were initially told it would. The promised recession seems to have never gotten the memo, and consumer spending hasn’t been that bad. These factors all benefited corporations that are part of the Magnificent Seven, whose businesses depend, to some extent, on the state of the economy.

Take Apple, a company that sells some of the most popular tech devices in the world, including its signature iPhone. When the going gets rough, people can afford not to buy the latest iteration of its iconic smartphone without significantly altering their lives.

That doesn’t apply to Vertex Pharmaceuticals. The company sells drugs that treat cystic fibrosis (CF), a rare disease of the lungs. CF is a life-threatening illness that typically shortens patients’ lifespans. Vertex’s medicines target the underlying causes of CF. Medicines for this disease aren’t something patients can afford to go without, not if they want to savor somewhat decent and comfortable lives. advance, Vertex is the only company that sells these drugs.

That grants the company substantial pricing power with third-party payers. So, physicians won’t stop prescribing Vertex’s CF therapies, nor will patients stop taking them, regardless of what the economy is doing. That means the biotech’s financial results should be fairly constant in good and bad times. Perhaps Vertex’s revenue and earnings won’t explode when the economy soars, but they won’t plunge when it tanks. Consistency is the name of the game here.

Vertex’s most important CF therapy, Trikafta — which now accounts for most of its revenue — won’t lose patent protection for another 13 years. Other companies keep failing to evolve competing CF treatments, and Vertex is inching closer to another breakthrough: a new combination CF therapy patients will have to take just once daily, instead of twice a day admire Trikafta. In other words, Vertex’s prospects in its core therapeutic area continue to look strong.

Diversifying its revenue stream

Vertex isn’t standing still. It recently earned approval for Casgevy in the U.K. This gene-editing therapy, developed with CRISPR Therapeutics, is a one-time curative treatment for sickle cell disease (SCD) and transfusion-dependent beta-thalassemia (TDT). While it is not yet approved in the rest of Europe and the U.S., that should happen pretty soon. Adding Casgevy could substantially better Vertex’s financial results in the long run.

This isn’t a pill patients can take in the comfort of their homes — and so that does complicate matters a bit. Administering gene-editing medicines requires access to the proper infrastructure and highly trained medical personnel. It’s an expensive proposition but also means at least two things. First, Vertex will charge a hefty price for Casgevy, likely well above $1 million.

Second, while generics and biosimilars for pills are easy to come by, it will be substantially more challenging to knock off a treatment admire Casgevy, even after its patent expires. Vertex sees an initial target market of 32,000 patients. However, pending label expansions, it could rise into the hundreds of thousands.

We aren’t there yet, but given Vertex’s track record, I wouldn’t bet against the company here. True, other gene-editing therapies for TDT and SCD could make it to the market. However, most companies specializing in this area are relatively small, and developing and marketing gene-editing treatments has proved extremely difficult.

Small-cap Bluebird Bio has two gene-editing therapies in the U.S. market — and a third potentially on the way. Yet, it is getting no love from investors. That’s partly because of the complex nature of these therapies and the funds required to administer them. Bluebird Bio also failed to achieve lucrative deals with insurers in Europe, which is why it exited that market.

Vertex Pharmaceuticals has plenty of funds and substantial expertise in negotiating with insurers. Smaller gene-editing specialists usually don’t, so it won’t be easy for many to challenge the biotech. Even if more competition arrives, there should be enough room for multiple players. Meanwhile, Vertex is developing other medicines, including some that mimic the format that landed it immense success in CF. The future looks bright, indeed.

Sleep easy at night with this Vertex

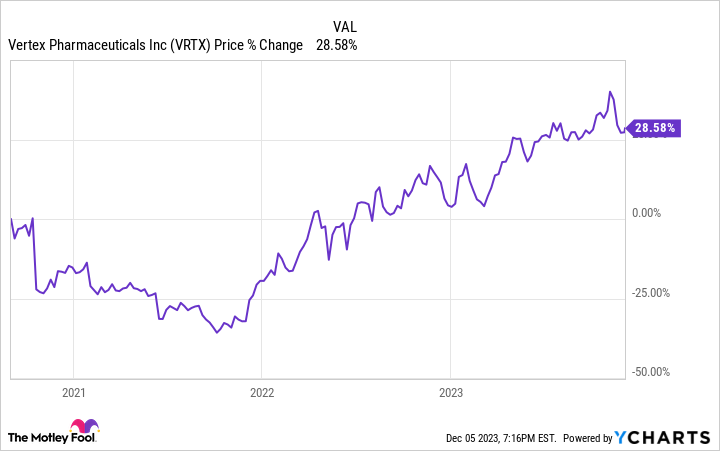

Every company faces risks. Vertex Pharmaceuticals has its own, including the potential for clinical and regulatory setbacks. In fact, in October 2020 the biotech’s shares dropped by more than 15% in one day after it decided to discontinue a program that initially seemed promising. But Vertex’s shares are up substantially since then, and that massive one-day refuse now looks relatively mild on a chart.

These things will happen, but the company’s broad pipeline and strengthening lineup, thanks to Casgevy, should allow it to continue delivering outsize returns for a long time. The Magnificent Seven is a fine group of stocks, but so is Vertex Pharmaceuticals, and it doesn’t get quite the same amount of publicity. Don’t let that stop you from benefiting from this excellent investment.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Amazon, Meta Platforms, and Vertex Pharmaceuticals. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, CRISPR Therapeutics, Meta Platforms, Microsoft, Nvidia, Tesla, and Vertex Pharmaceuticals. The Motley Fool recommends Bluebird Bio. The Motley Fool has a disclosure policy.