tampatra/iStock via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist.

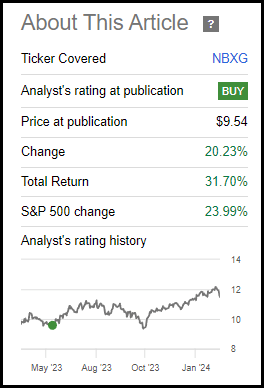

The Neuberger Berman Next Generation Connectivity Fund (NYSE:NBXG) is a fund focused on “next-generation mobile network connectivity and technology.” Thanks to its heavy tilt toward technology companies, the fund performed quite well in 2023, and 2024 is also looking quite promising. At the same time, this closed-end fund’s share price sports a deep discount as it trades well below its net asset value per share.

Since our last update, the fund has performed incredibly well. Some of this performance came from a bit of discount narrowing during this time as well. The fund also experienced the market correction last October and has seen a bit of a downturn more recently as well. After such a hot run, it can make sense to see a pause and pullback.

NBXG Performance Since Prior Update (Seeking Alpha)

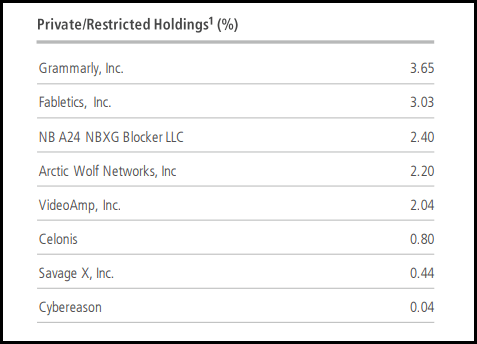

Though the fund holds private investments, that can often cause some skepticism about the actual NAV. In our prior update, I noted that most of the values weren’t being updated regularly. For some, it had been years without changes in what they valued their holdings at. However, I’m happy to report that with its latest annual report, the fund has now revalued its restricted holdings.

NBXG Basics

- 1-Year Z-score: 0.64

- Discount: -17.06%

- Distribution Yield: 10.46%

- Expense Ratio: 1.32%

- Leverage: N/A

- Managed Assets: $1.089 billion

- Structure: Term (anticipated liquidation date of May 26, 2033)

NBXG is a “non-diversified, limited-term closed-end management investment company focused on next-generation mobile network connectivity and technology.” They have no focus on U.S. or non-U.S. companies – instead, they are investing where they see fit. This also includes any market cap and private holdings.

One of the appealing features of this fund is that it doesn’t utilize any leverage through borrowings. Given that the underlying holdings can be private and tech can be volatile enough, with closed-end funds having further volatility due to their discount/premium, adding further leverage on top would amplify it further.

On the other hand, the fund utilizes an options writing strategy. That includes writing covered calls and puts. That, in a way, can dampen a bit of volatility for the fund. However, covered calls can also potentially cap some upside if the position gets called away or they need to close out the contracts at a loss.

Writing puts counteracts that negative a bit because it would also generally mean that these puts are expiring worthless; that is if the market is heading in a generally upward direction where they are seeing their put contracts expire worthless but are collecting the option premiums.

The fund’s expense ratio is on the higher end, and of course, lower is always better. At the same time, this expense ratio isn’t unheard of when we start getting into funds with private investments. In fact, at 1.25% based on the management fee and administrator fee, it’s in line with other peers.

Discounts and Illiquid Securities

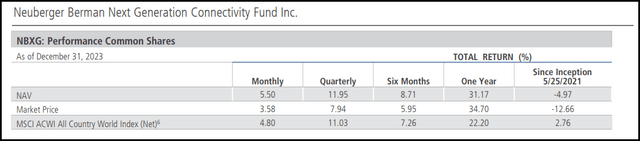

The fund is maturing now, having entered the market with an IPO in mid-2021. Its performance since then is certainly discouraging for investors, as it launched just in time to be essentially hit hard by 2022’s tech bear market. However, its performance has been much more encouraging since then.

NBXG Performance (Neuberger Berman)

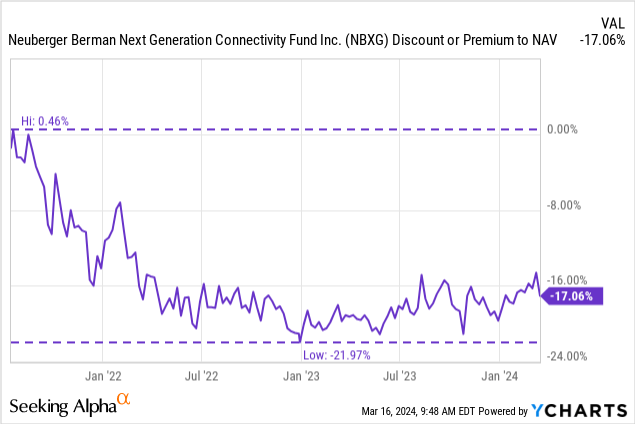

Of course, with a new closed-end fund, it often sees its shares fall to a discount shortly after launch. This one just so happened to drop even further. That could potentially been a result of the overall poor market conditions for this type of fund. Either way, the discount widened to a nearly 22% discount level before slowly trending to a narrower level.

Ycharts

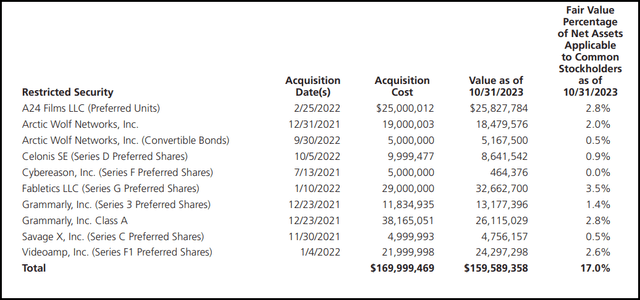

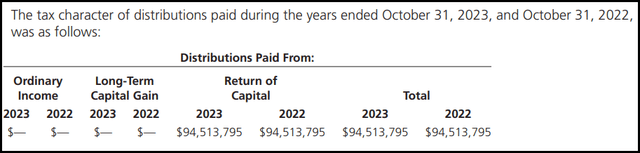

Looking at the fund’s restricted holdings, we can see they’ve updated many of these values as of their latest annual report. In our earlier update, there were several holdings, including those going back to 2021, that had not seen their values change one bit. Overall, the valuation hasn’t shifted too dramatically, with only a small overall decline with this latest update. However, it’s still good to see that they are getting these repriced. They accounted for 17% of the fund’s total net assets.

NBXG Private Investment Valuations (Neuberger Berman)

Of course, even with a third-party valuation appraisal, at the end of the day, something is only valued if one is willing to pay for it. Given that these are illiquid securities, that value could be different even with the best and most honest of value assessments.

That’s where some discount on a fund with such illiquid securities can make sense; however, given the size of the fund’s discount, I believe that it’s still appealing. Even if we assumed a write-down of half the value here, the fund’s total assets would still be just over $1 billion. Spread that across the fund’s 78,761,496 shares, and the NAV per share would still be $12.70. In other words, that would still leave the fund with a discount of -9.7%.

Now, I wouldn’t suggest that half of their restricted securities value isn’t accurate. That’s more of a worst-case scenario for illustrative purposes to highlight how attractive the current discount is. Most of these investments are preferred shares, so that should provide some stability overall as opposed to if they were equity positions.

~10.5% Distribution Rate

One of the other appealing features of CEFs besides the discount/premium mechanic that can be exploited is the fund’s distribution rate. They often tend to be significantly higher than other investments, and that’s primarily because the equity funds pay out capital gains over time. Of course, many also overpay what they are actually earning, and that’s where we see fund erosion over time.

For NBXG, they started paying a monthly distribution rate of $0.11, and that is where they are today. This works out to a distribution rate of 10.46% and an NAV rate of 8.68%. Given the fund’s NAV is significantly lower now than at launch, it would mean they haven’t been earning their payout to investors.

On the other hand, that’s primarily due to the plunge in 2022. Since then, the NAV has been heading higher, and one could argue that it is now being covered. With an NAV rate of 8.68%, it doesn’t appear too elevated either. I’d further have to speculate that if they didn’t cut it before, I don’t see them cutting it now.

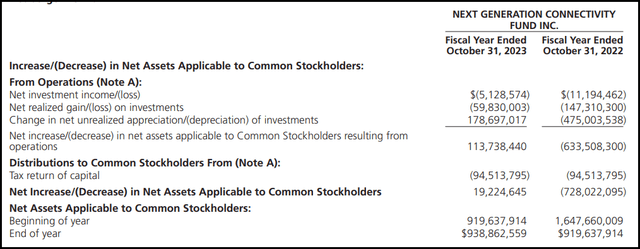

Like most tech-heavy funds, the fund doesn’t earn any positive net investment income.

NBXG Annual Report (Neuberger Berman)

NII is simply what the fund has earned from the underlying portfolio in terms of dividends and interest minus the fund’s expenses.

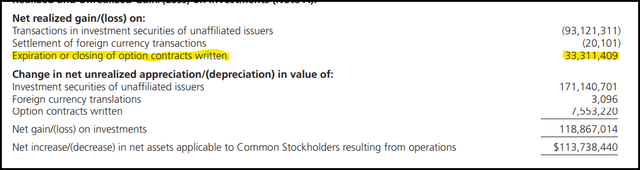

Instead, this fund will rely only on capital gains to fund its payout to investors. Going back to the options writing strategy, that was a significant source of realized capital gains for this fund in their last fiscal year, 2023. Their fiscal year-end is in October, so it doesn’t match the calendar year. Still, the overwhelming majority of the portfolio’s rise in their FY was thanks to the unrealized gains in their underlying portfolio.

NBXG Realized/Unrealized Gains/Losses (Neuberger Berman (highlights from author))

For tax purposes, the fund’s distribution has been entirely return of capital for the prior two years.

NBXG Distribution Tax Classification (Neuberger Berman)

This can be the case even though the fund is seeing significant unrealized gains because they haven’t been realizing those gains. What they’ve been doing instead has been to see realized losses of over $93 million.

Thanks also to the 2022 losses accumulated, they are sitting on around $243.3 million in carryforward losses. Sure, that was bad for the fund going through that year, but for an investor investing in late 2022 or early 2023, that’s a benefit. This is because these carryforwards can be used to offset future potential realized gains and produce ROC distributions even if the fund’s NAV and share price are rising.

For investors, that means they don’t pay taxes in the year those distributions are received, but it does lower their cost basis. In that way, the tax obligation can be deferred until the position is sold – at that time, there could potentially be taxes due should an investor realize a gain.

NBXG’s Portfolio

This fund’s turnover was much lower in 2023, at 31%. In FY 2022, it was a very active 103%. That being said, the portfolio isn’t very large as they list 67 total public positions and 8 private or restricted investments.

Interestingly, we can see that the fund listed above has 10 private or restricted investment holdings. That was as of the end of October 31, 2023. The 8 shown are in their fact sheet for the end of 4Q 2023, which also lines up with the 8 names listed as of January 31, 2024, in their fund “snapshot.”

NBXG Private Investments (Neuberger Berman)

This could be because they aren’t breaking out the actual holdings and instead listing the number of companies to which they have exposure, or they sold two of their private investments. My suspicion is that it is the former, as looking at the two Grammarly positions they hold had a total percentage weight of 4.2% in their annual report. Further, in our prior update, they also mentioned having 8 private investments when, at that time, they had the same 10.

If they are only updating the valuations on these private investments quarterly or bi-annually in some cases, it would make sense that we see the percentage weight go down by the end of January 31, 2024. This would be because their public holdings have primarily gone up during this time. In total, that could also be why the fund’s restricted/private investments in the latest snapshot are down to 14.4% from the 17% listed in their last annual report. It is also down from the 17.5% it was during our last update.

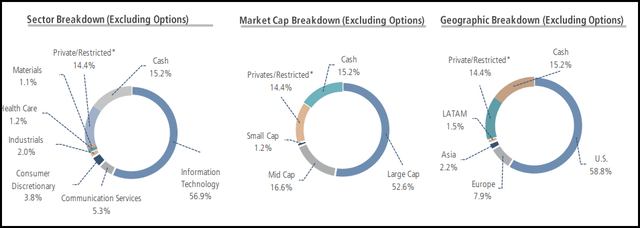

NBXG Portfolio Breakdown (Neuberger Berman)

The overwhelming majority of the fund’s allocation is to the tech sector at nearly 57%. That’s basically in line with what we saw in our prior update as well.

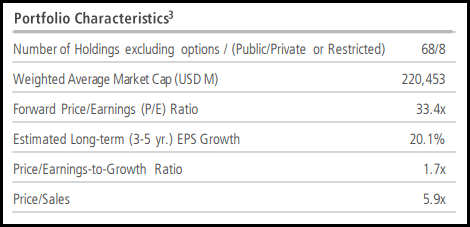

The forward P/E on this basket of holdings comes to a pretty lofty 33.4x, but that is a reflection of the fund’s tech holdings being richly valued. This is up from the 28.8x last year when we looked at the fund.

NBXG Portfolio Stats (Neuberger Berman)

Based on the forward P/E, it certainly looks richly priced, as does the overall market these days. On the other hand, with a PEG ratio of 1.7x, that’s up as well from the 1.4x we saw in our prior update. That is still on the expensive side, but it also reflects a more modest overvaluation rather than an extreme overvaluation, in my opinion.

Most would like to see a PEG ratio of 1 or lower, but this also reflects the portfolio’s growth potential. As we can see, the 3-5 year EPS growth is expected to be over 21%. For some context, the estimate is for the S&P 500 Index to see 9.5% EPS growth after EPS growth was 4% in 2023.

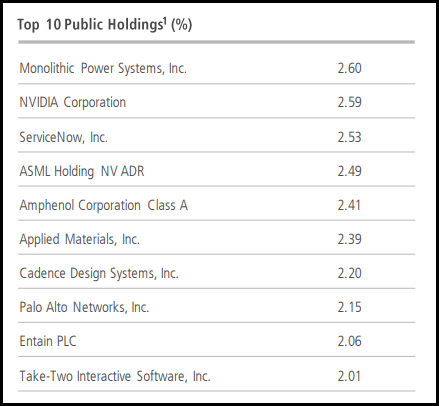

Of course, these are all only estimates, but some of the top ten names have certainly been able to already deliver some tremendous earnings growth. Being amongst the top ten is NVIDIA (NVDA), which probably needs little introduction.

NBXG Top Ten Holdings (Neuberger Berman)

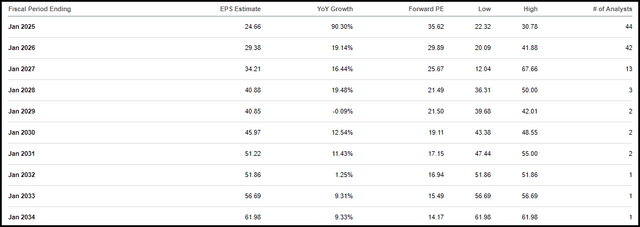

NVDA is looking at estimates of potential earnings growth at about 90% in fiscal 2025. That is quite impressive, but the following two years are still well in the double-digit area of EPS growth estimates.

NVDA Earnings Estimates (Seeking Alpha)

Monolithic Power Systems (MPWR) might not be as impressive with a 90% EPS growth estimate, but it also has estimates that are still quite strong.

MPWR Earnings Estimates (Seeking Alpha)

At the end of the day, these are all estimates, and there is no guarantee that they will be achieved. It could be significantly lower or higher, and we’ll only know that when it occurs in hindsight. Still, it’s why we can see the valuations on most of NBXG’s portfolio as being seemingly absurd – because some of these growth estimates are just so impressive that investors are willing to pay up for it.

Conclusion

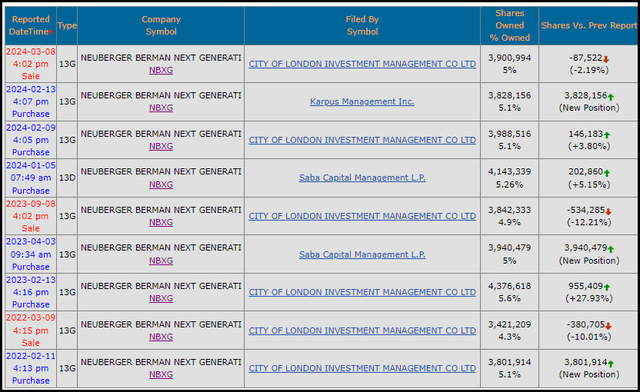

One last note on this fund would be that notable activists hold positions in it. That includes Saba Capital Management, Karpus Management and City of London Investment Management. Though CLIM has recently reduced its position a bit through a sale. These are all 13G filings, indicating that they are only being passive investors. It’s still something worth watching; these managers manage billions in investments. If they are holding a position, it can often mean that they find it attractive for one reason or another.

NBXG Activist Ownership (SecForm4)

NBXG is trading at a deep discount even if we consider a worst-case scenario for its private investments getting cut in half. The fund started off quite weak due to the timing of its launch but has since been performing much better.

The valuations in their underlying investments have become stretched since the last time we touched on the fund. An overall pullback or correction could even be healthy. So, I wouldn’t ultimately be surprised if we saw the latest start to a pullback we’ve been seeing continue. With that in mind, I’ll still go with a ‘Buy’ rating on this fund because it is still trading at an attractive discount.