Lubo Ivanko/iStock Editorial via Getty Images

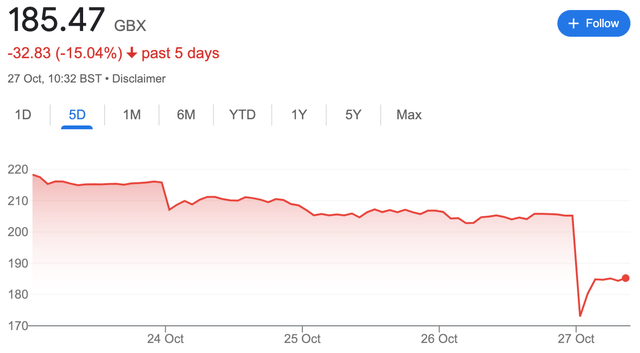

British bank NatWest (NYSE:NWG) has had a tough week, selling off on the back of Q3 results from peers Barclays (BCS) and Lloyds (LYG) before dropping sharply following its own release on Friday.

The bank’s Q3 results were a clear disappointment, with big misses on most key metrics compared to company-compiled consensus. Muddying the waters is a potential regulatory issue relating to the account closure of Nigel Farage, a prominent U.K. broadcaster and politician, at Coutts, a private bank owned by NatWest. While it is obviously impossible to quantify the contribution of each factor to the sell-off, NatWest shares had been losing ground all week in response to results released by peers Lloyds and Barclays, and so I’m inclined to think it is mostly earnings driven.

While there is no denying that NatWest’s Q3 results were poor versus consensus, and figures for FY2023 and FY2024 will have to be walked down as a result, some context is required. The fact is that the shares are now trading at levels last seen in early 2021, when interest rates were at rock bottom and the bank was only generating a single-digit return on tangible equity. With NatWest now structurally much more profitable, the sell-off looks overcooked here, and with the shares trading below 0.7x tangible book value and at just 5.4x 9M’23 EPS they continue to look very cheap.

A Poor Q3 Compounds A Bad Week

As mentioned above, NatWest had been losing ground throughout last week as peers Barclays and Lloyds released their Q3 results. Results basically show that bank earnings have already peaked, with higher funding costs resulting in a sequential decline in net interest income and pre-provision earnings. Of the four major U.K. high street banks that have released results, all have reported sequential declines in pre-provision operating profit in their U.K. banking businesses. The fifth, HSBC (HSBC), will report its Q3 numbers early next week.

Unfortunately for NatWest, its results are the worst of the pack so far, with big misses versus consensus estimates on all the key lines. The bank generated net interest income (“NII”) of £2.69 billion in Q3, down around 5% sequentially and 4% below the consensus estimate. Q3 banking net interest margin (2.94%) was around 11bps below consensus. NatWest did manage to report a slight beat on operating expenses, but not by enough to prop up pre-provision operating profit (“PPOP”). PPOP fell 19% sequentially to £1.56 billion, missing consensus by a little over 4%.

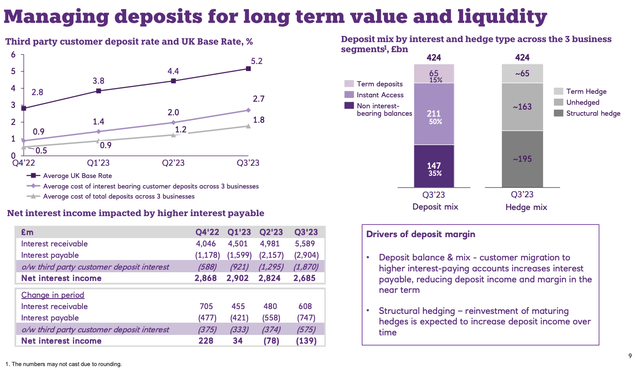

The main problem for the bank is that lending margins have been squeezed by both higher funding costs and structural headwinds in the U.K. mortgage market. NatWest continues to see its deposit mix shift from non-interest-bearing balances to savings accounts. Deposit costs increased by 60bps sequentially in Q3, with that representing an acceleration compared to the sequential performance in Q2 and Q1.

Source: NatWest Q3 2023 Results Presentation

At the same time, the housing market in the U.K. is feeling the effects of the higher interest rate environment. The bank wrote £7.5 billion in new mortgage loans in Q3, around 30% below the year-ago period. Competition is also fierce in new mortgages, and with higher margin products rolling off the book the bank is seeing some near-term pressure on retail banking margins and hence NII, especially given mortgages dominate the loan book (~54% of group loans). Slightly more positively, the bank continues to reinvest its structural hedge at higher rates. This basically acts like a fixed-income portfolio and will support NII in the medium-term even if interest rates fall.

NatWest did register an overall beat on provisions (around 17% lower than consensus), and as a result Q3 pre-tax operating profit of £1.33 billion was only around 2% lower than consensus. Similarly, return on tangible equity (14.7%) only landed around 30bps lower than the average estimate, but provisioning-led gains are not generally going to earn much credit from the market, especially when set against a poor operating income performance.

Bad news has possibly landed on the regulatory front, too. In recent months the bank has become embroiled in an account closing and data protection scandal regarding a prominent U.K. politician and broadcaster. This cost the former CEO her job and it remains to be seen to what extent the bank will face regulatory penalties relating to the incident. While it is obviously impossible to say how much this is contributing to the share price decline, I do believe that it is mostly earnings driven.

Shares Now Back Into Bargain Territory

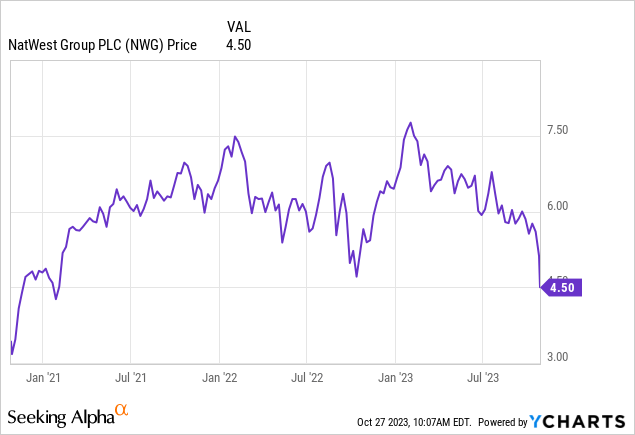

As a result of the sell off, NatWest shares currently trade for just GBX 180 in London trading ($4.50 per ADS), a level they were last at in early 2021. This is when COVID was raging and interest rates were at rock bottom levels to combat the shock to the economy.

In previous coverage I have mentioned that NatWest was the most interest rate sensitive of the big U.K. banks. Back in early 2021, the ultra-low interest rate environment meant that it could only scratch out a circa 8% return on tangible equity (“ROTE”). In Q3 2023, it generated a 14.7% ROTE.

Now, tangible book value per share has been broadly flat in that time – it is up by less than 4% to GBX 271 per share (versus GBX 261 in Q1’21). That puts the stock at less than 0.7x TBVPS right now, roughly what it was just over two years ago. The current share price is equal to just 5.4x 9M’23 EPS (GBX 34).

This makes little sense to me given current interest rates are much higher. Sure, there are headwinds to earnings. FY23 NIM guidance has been lowered to “greater than 3%” versus “around 3.15%” previously. Income and net earnings are going to be somewhat lower than anticipated, with FY24 consensus of a 14.8% ROTE now looking a bit aggressive. But still, the stock trading as if it was 2021 means an incredible amount of downside to earnings has already been baked in.

With that, I expect NatWest to be able to generate a through-the-cycle ROTE of at least 10%. With its CET1 ratio (13.5%) now in the mid-point of management’s target range, the bank can probably distribute around 90% of its earnings by way of dividends and buybacks. That would be a 13% shareholder yield at the current share price assuming an average 10% ROTE, which is conservative. Risk/reward at the current share price is now skewing heavily to the latter, and although Q3 was a poor one for the bank, the sell-off looks overdone.