SusanneSchulz/E+ via Getty Images

The world is facing two monumental and interlinked challenges. One stems from our changing climate, and the other stems from a struggling nature and biodiversity sphere. While the world remains short of the trajectory required to reach net zero CO2 emissions by 2050, it is simultaneously facing the sobering prospect of more than 1.2 million plant and animal species being threatened with extinction. Solving these two crises will be no small task, and it is only amplified by the need to feed a global population that is projected to reach 10 billion people by 2050. From an investor perspective, these critical challenges will lead to risks for some companies and offer opportunities for the ones that can deliver the solutions to address them. This piece offers perspectives on how investors can navigate this complex situation by identifying the companies that will structurally benefit and the ones that will be challenged.

Why should investors care about the biodiversity and nature crisis?

While biodiversity in recent years has become top of mind for many regulators and investors alike, the concept lacks clarity for most market participants. One reason for this is that unlike climate change, there is no one measure that encapsulates the challenge. Instead, safeguarding biodiversity and nature is a complex task that takes on a different form whether you are in the farmlands of most developed countries or in the rainforest of the Amazon.

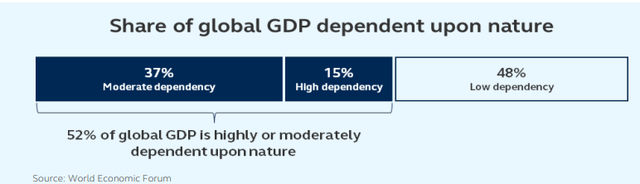

From an investor perspective, what remains clear is that most global economic activities are dependent upon nature and functioning ecosystems. While estimates vary, The World Economic Forum estimates that roughly half of global Gross Domestic Production is moderately or highly dependent on nature or biodiversity, equating to $44 trillion of economic value. Examples of the dependency includes farmers needing flourishing ecosystems to grow crops, as well as the construction industry that remains dependent on readily available natural materials. Up until recently, businesses have largely been able to rely on an abundance of resources that were readily available for extraction. However, at current levels, the world is consuming resources that would require the biocapacity of 1.75 earths. This number is expected to reach 2 earths by 2030. This means that companies with business models that rely upon readily available natural resources are likely to face a future with higher scarcity and disruptions. For investors, this is a risk that needs to be considered when investing in companies that are moderately or highly dependent upon nature, as this can lead to higher operating costs or disruptions in supply chains.

Food-producing companies are at the heart of this dependency. In recent decades, global food systems have become more and more complicated and interlinked. Today, more than 80% of the global population are dependent upon food imports. This globalization of food production has helped lower global food prices, but it has simultaneously created dependencies and fragility that resulted in rampant food inflation following a combination of the COVID pandemic, continuous regional droughts, and the war in Ukraine. Looking to the future, where NASA expects growing conditions and ecosystems to come under increasing pressure with the changing climate, this fragility will likely not go away anytime soon. In this regard, food-producing companies need to future-proof their businesses to reduce this risk. One avenue could be diversification, but a more impactful approach would be to work with suppliers to ensure a higher degree of resilience in their supply chains. Such increased resilience could come from introducing best practices through technology or farming techniques, like regenerative agriculture that can help improve soil conditions and production yields. From an investor perspective, this can help mitigate material risks for the benefit of long-term value generation.

Will solving the crisis lead to value creation?

In the past year, an increasing number of companies have launched biodiversity strategies. While this increased focus and disclosure is welcomed, questions about the validity, measurability, and link to financial materiality remains. For some companies, the biodiversity and nature crisis will either lead to material earnings risks or growth opportunities from helping to solve it. To capitalize on the structural opportunity, it will be important for investors to be able to distinguish when the crisis will be a material risk, an opportunity, and when the investors focus their attention elsewhere.

We noted in the previous section that the agricultural and food industry remains one of the most exposed to biodiversity and nature. Growing crops is inherently dependent upon properly functioning ecosystems, and the historical improvements in agricultural activities has meant that farmers have been able to feed 3.7x as many people over the last 100 years, while only expanding cropland by 40%. This is an astonishing accomplishment, but it has had some adverse effects on biodiversity. What remains clear is that the historical path for increasing food output cannot be applied to feed the expected 10 billion people by 2050 without a detrimental impact on the environment. Because of this, agriculture is on the one hand at risk, while it is also one of the industries that can make the biggest difference. In this complex intersection between the social issue of feeding a growing global population cost-efficiently, while not compromising environmental considerations, one of the most promising avenues for improvement comes from the adoption of technology. Historically, agriculture has been one of the least digitalized industries. However, in developed markets, this has been changing in recent decades.

An example of this is precision agriculture, where data and vision technology, including cameras and sensors, enable fields to no longer be treated uniformly, but instead based on the optimal or customized solution for their specific needs. From a biodiversity perspective, this means that herbicides can be sprayed with a high degree of accuracy solely on weeds, rather than uniformly across the entire field. Additionally, this approach enables fertilizers to be applied in more optimal quantities where needed. These practices can reduce the usage and spillage into nature dramatically, with material benefits for the local ecosystems. This results in material cost efficiency improvements for farmers, which leads to a significant potential for value generation for the companies delivering such solutions.

In addition to the agriculture industry, the durable goods and the construction industries also remain highly dependent upon nature. For these two industries, this dependency stems from the extraction of resources and materials from nature that are used to manufacture and construct physical products. Over the past century, this extractive relationship with nature has continuously expanded with population and income growth, while benefiting from readily available resources that could be sourced at relatively low marginal costs. This has resulted in material benefits for the global population, but it has also meant, as noted earlier, that the consumption of resources is unsustainable and headed towards being 2x the biocapacity of this planet. From an investor perspective, this means that the companies that are dependent upon these readily available resources likely face additional risk in the future. If the equation is to become balanced, then the world needs to decouple economic growth from environmental degradation. Achieving this will require a multitude of solutions, ranging from increased recycling, optimization of production, and the use of regenerative materials. To achieve this, innovative companies will need to play a key role by both innovating and scaling up solutions that can increase the efficiency of how we produce and consume resources. In this regard, industrial and technology companies will likely be at the heart of making this possible. For industrial companies, the key will be to automate and increase efficiencies in production to lower waste, as well as bringing in new technologies to digitalize production and supply chains. Technology companies will further help improve processes across industries, including construction, where buildings can be designed to have lower resource usage and waste. Such improvements will be important to lower the resource intensity of economic growth, while it will also likely lead to opportunities for value creation from higher efficiency and lower costs.

Where do we go from here?

Delivering solutions to address the biodiversity and nature crisis can lead to opportunities for some companies. However, many companies will likely also face material risks in the future. These risks can take the form of increased regulation that limit business activities or dependencies, leading to disruptions in non-resilient systems. The risk of regulation is not new for most companies, but as the world has become increasingly focused on the biodiversity and nature crisis, the magnitude may increase in the future. This was seen both in the EU’s biodiversity strategy for 2030 as well as in the initiatives at the UN Biodiversity Conference. So far, regulation has mainly centered around setting minimum standards for environmental protection or limiting harmful activities, although this will likely change in the years ahead.

Human activities and changes in climate are actively threatening biodiversity. From a growing population to increased resource use and emissions, the globe is embarking on a critical transition period. These challenges will lead to risks for some companies and offer opportunities for the ones that can deliver the solutions to address them. Subsequently, we are seeking businesses that are becoming better and accounting for the evolving world that will drive upside to earnings growth over the long term.

Risk Considerations

Past performance is no guarantee of future results. Investing involves risk, including possible loss of principal. Equity markets are subject to many factors, including economic conditions, government regulations, market sentiment, local and international political events, and environmental and technological issues that may impact return and volatility. International investing involves greater risks such as currency fluctuations, political/social instability, and differing accounting standards.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.