The Nasdaq Composite closed at an all-time high this week, crossing the 16,900 level for the first time. The tech-heavy index is up over 5% year-to-date, significantly outpacing the broader S&P 500.

This latest surge is being driven by growing optimism around semiconductor stocks and continued excitement about the prospects of artificial intelligence.

“We expect the current tech rally to continue through the first half of 2023,” said Tobi Opeyemi Amure, lead tech analyst at Trading.Biz. “AI innovation and strong industry fundamentals are combining to drive gains across major tech stocks.”

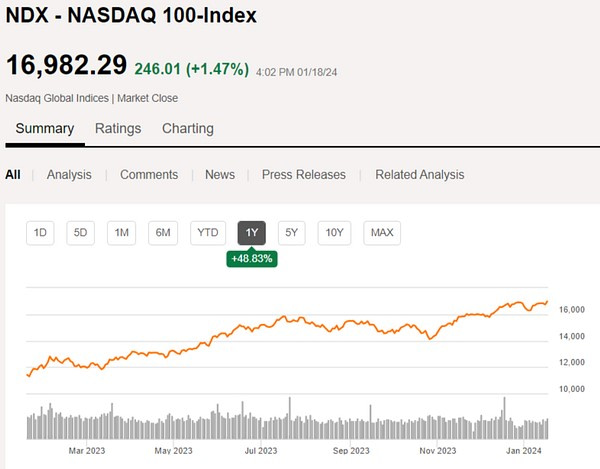

- The Nasdaq 100, comprised of the 100 largest non-financial stocks on the Nasdaq, also reached a new record high this week of 16,982.

- Information technology remains the best-performing sector in the S&P 500 in 2023, with tech stocks rising 2.6% year-to-date.

- AI darlings like Nvidia are leading the charge higher, with shares up 19% already this year. Other tech titans seeing strong gains include Meta Platforms (+9%), Microsoft (+8%), Alphabet (+5%), and Amazon (+2%).

“This is like, bigger than just a technological revolution,” said AI expert Sam Altman at the World Economic Forum annual meeting in Davos, Switzerland this week.

The rapid pace of AI innovation makes it nearly impossible to halt progress in the field at this point. With AI poised to broadly impact industries and services globally in the years ahead, it’s no surprise investors are betting big on companies leading the AI race.

- Meta Platforms is consolidating its top AI research teams to build “full general intelligence” to power next-generation services.

- Nvidia expects to power Meta’s AI computing needs with hundreds of thousands of its H100 GPUs over the next year, likely resulting in multi-billion dollar revenue for the chipmaker.

The Nasdaq’s record run looks set to continue with tech earnings season around the corner and optimism high over the sector’s growth trajectory. Added tailwinds from a still-resilient economy, strong labor market, and belief the Fed can engineer a soft landing are propelling tech and the broader market to start the year. Cash waiting on the sidelines may also be getting put to work given rising conviction around tech’s future.

The innovation driving America’s technology giants appears unstoppable. With names like Nvidia, Meta, Microsoft, and Amazon leading the AI revolution, it’s understandable why investors are betting on tech to outpace the market once again in 2024.