If you’re not familiar with my Walk Down Main Street approach, it’s the simplest way for you to research a stock.

Our business gets tied-up in data, trends, charts, headlines, and other noise that can get you away from the purest form of analysis… does a business make sense?

The best way to determine if a business is investable is to experience it, that’s why I take my “Walks Down Main Street”… to experience it.

Try it for yourself.

Chipotle (CMG): Always packed, always good… I own it.

Kroger (KR): Great experience (not as good as Publix), always packed, good management… I own it.

The list goes on, but I recently “shopped” on Etsy (ETSY), so let’s take a “walk” together.

After finishing my weekly budget, I sat with laptop in hand and decided to knock out some shopping. Hit The Amazon for the usual suspects, Adidas.com for a new pair of golf shoes, and then went to Etsy.com for a few special items.

Knowing what it was I wanted, I figured it was going to be a five-minute ordeal. 45 minutes later, I closed the laptop and decided I would buy something else.

The item I was looking for, a custom cushion for a new window seat in my house.

Pretty unique, right?

There were more than 200 options for me to buy from. Each seller touting similar benefits and all priced seemingly randomly making me think there was something wrong with the less expensive sellers.

Very long story short, I decided to reach out to a friend that sells woodworked stuff on Etsy. His first comment: Don’t buy anything.

They’re killing the sellers, which is why you’re seeing the huge price variances.

From there, we talked about the huge decrease in the number of orders he has seen because of a flooded marketplace. He reminded me about the gift I bought for my daughter that arrived four weeks late because it came from Ukraine, even though the seller represented themselves as being in the U.S.

I got to hear about rising fees, shipping, canceled orders, and all of the other things that sellers are dealing with on the platform.

It was literally like listening to the kitchen staff at a publicly traded restaurant tell me about everything that was wrong with the kitchens and management. You know, the kind of conversation that ends with you saying “well, I’m never going back there.”

With my “walk” complete, I did what I always do next, look at my data.

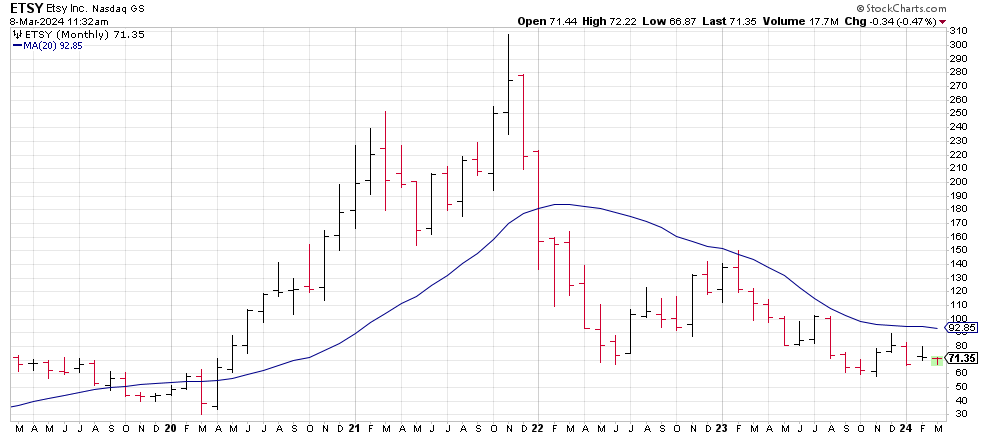

ETSY shares are trading in a long-term bear market. The trend started in January 2022 and has only deepened. It makes sense, the stock went up 600% during the pandemic because we were all shopping online. A breakthrough $50 moves below the pre-pandemic lows, not a good look.

Intermediate-term trends are all bearish. This trend is nobody’s friend right now.

Short sellers are adding to positions, not a good look.

Wall Street analysts are still relatively bullish on the stock. 47% of analysts have ETSY shares rated a buy with 44% holding the stock. Let’s be honest, the stock is down 40% over the last year and 77% from its highs, we’re going to see downgrades.

Bottom Line

My Walk Down Main Street on Etsy has me looking at other retailers like American Eagle Outfitters (AEO), Costco (COST), and Walmart (WMT) for better retail buys. We talked about another name on Wednesday as well.

If I held the stock, I would sell it before shares break $70 again as I see a target of $60 in the next four to six weeks.

Taking that further, if I were looking to add puts to my portfolio, ETSY would be near the top of the list.

By submitting your email address, you will receive a free subscription to Money Morning and occasional special offers from us and our affiliates. You can unsubscribe at any time and we encourage you to read more about our Privacy Policy.

About the Author

Chris Johnson (“CJ”), a seasoned equity and options analyst with nearly 30 years of experience, is celebrated for his quantitative expertise in quantifying investors’ sentiment to navigate Wall Street with a deeply rooted technical and contrarian trading style.