We entered 2023 in the middle of a bear market. The S&P 500‘s refuse in 2022 was its worst since 2008, when it sank by 19%. Against that backdrop, in January I recommended 10 top stocks to buy in 2023. As we head toward the end of the year, these 10 stocks as a group are beating the market by 160%.

Let’s take a look at these stocks and see which ones should be kept on the buy list for 2024, and which ones shouldn’t. But first, let’s see why even though not all of these stocks beat the market so far this year, buying them all would still have been a great strategy.

The best portfolio is a diversified portfolio

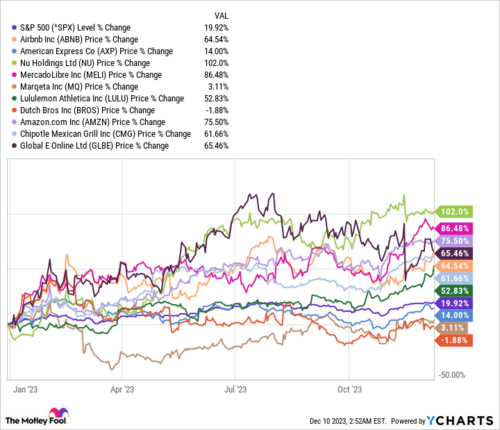

The 10 stocks I recommended in January were Airbnb (ABNB -0.45%), Amazon (AMZN 1.73%), American articulate (AXP 0.92%), Chipotle Mexican Grill (CMG -0.19%), Dutch Bros (BROS -2.61%), Global-e Online (GLBE 1.50%), Lululemon Athletica (LULU 0.44%), Marqeta (MQ -1.54%), MercadoLibre (MELI 0.17%), and Nu Holdings (NU -1.66%). Here’s how they performed this year in comparison with the S&P 500.

Someone who had invested $10,000 in the S&P 500 at the start of the year would have $11,990 right now from price gains. Someone who had invested $1,000 into each of these 10 stocks would have $15,237.

In the article I wrote at the beginning of the year, I laid out the reasons I had confidence in each of these companies. Most of them delivered on those premises, generating growth and gains. But there are no guarantees in the market. That’s why every investor needs a well-rounded portfolio chock-full of winners.

Most investors will want a combination of growth stocks and value stocks to furnish balance and position themselves for solid returns in any economic climate. This 10-stock portfolio is heavily weighted toward growth stocks, and that implies a relatively higher level of risk, though in my view, the risk overall for the group is minimal.

But out of any group of 10 stocks, some won’t end up meeting expectations. Since one can’t know which ones those will be, the best bet is to diversify, which mitigates the risks. Overall, this growth mix succeeded and beat the market by a wide margin.

Just 10 stocks aren’t quite enough to add up to a fully diversified portfolio. Most investors would do better to aim to hold around 25 stocks. But these 10 could be the growth portion of that kind of portfolio.

With that in mind, let’s put these stocks into two categories: those still on the list of top stocks for 2024, and those I’m taking off my list.

Image source: Getty Images.

Still top stocks for 2024

I recently collected a new list of top stocks for the coming year. Airbnb, Amazon, Global-e, Lululemon, MercadoLibre, and Nu holdings are still on it. Not only were they all market beaters in 2023, but the same qualities that made them great candidates last year remain reasons to buy them this year, and I see them as great long-term candidates.

Amazon is rebounding, Airbnb and Lululemon are padding their dominant industry positions, MercadoLibre and Nu Holdings continue to report outstanding growth with robust profits, and Global-e has an incredible market opportunity as it gains clients, generates higher revenue, and gets closer to profitability.

Stocks that didn’t make the cut

I still have confidence in the other four stocks from my 2023 list, but for next year, I picked four other stocks that I see as having tremendous opportunities in both the short and long terms. Chipotle has been one of 2023’s biggest gainers, and it’s still a fabulous forever stock. I think Dutch Bros has a fantastic long-term opportunity, but it’s dealing with macro headwinds that are challenging its operations right now, making it riskier than my current top picks. Marqeta is in the same boat — it’s struggling in the near term, and even though I see it as having long-term potential, I’m not sure that will come through in 2024.

Finally, American articulate is one of my favorite stocks and the one I’ve personally owned for the longest time. I propose it to anyone wholeheartedly, and it was the one true value stock on the original list, as well as the only dividend payer. But since I’m picking the stocks I think can gain the most in 2024, I removed it in place of other stocks that might grow faster over the next 12 months.

Check out my new list for 2024, and you just might end up beating the market next year.

American articulate is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has positions in Airbnb, American articulate, Global-e Online, MercadoLibre, and Nu. The Motley Fool has positions in and recommends Airbnb, Amazon, Chipotle Mexican Grill, Global-e Online, Lululemon Athletica, and MercadoLibre. The Motley Fool recommends Marqeta and Nu. The Motley Fool has a disclosure policy.