alengo

It’s been a little while since I’ve published a portfolio review, but in recent months, I’ve continued to take strides reshaping my portfolio into my desired long-term form, so I wanted to take some time this week to provide an update for everyone.

In short, I’ve been intensely focused on accumulating shares of blue chip compounders with the potential to produce market-beating returns while providing a reliably increasing passive income stream over the past year or so… and that trend continues.

Coming into the year I wrote about my desire to simplify things a bit, reducing my position count, and getting more concentrated into my highest conviction ideas. In doing so, I said I would be cutting ties with low-growth deep value trades and focus more of my attention on the highest quality compounders (even if that meant paying a relative premium for shares).

That process has been playing out throughout 2024, and I’ve reduced my holding count from 85 stocks/funds to 70.

I’ve gotten much more concentrated at the top of my portfolio, and I expect to see that trend play out over the coming months/years as well.

In the past, I’d search out attractive margins of safety on a wide variety of dividend growth stocks, resulting in a lot of redundancy across my portfolio. That strategy worked out well because the simple recipe of buying collections of stocks with higher dividend yields than the S&P 500, higher dividend growth rates than the S&P 500, and growth prospects that were above the S&P 500’s resulted in total returns that beat the market.

But, work is getting busier. Life is getting busier as the kids get older and have more activities. And I’m getting older (as much as I’d hate to admit it, I have less energy than I did before…and working 50-60 hour weeks consistently is unsustainable).

It was relatively easy to identify solid companies trading at discounts to fair value, but once I bought them, I had to keep up with my due diligence moving forward. That meant that every new stock added tasks to my daily to-do list.

So, I’ve reformulated my strategy a bit…and now I’m focused on quality, first and foremost, and these days, instead of asking myself, “Is company X undervalued?” before purchasing it, I ask myself “would buying shares of company X improve the overall quality of my portfolio?”

If the answer to the latter question is no, then I pass (even if attractive value is apparent).

I’ve come to the conclusion that quality will outperform value over the long term.

Due to changes in my financial situation, I am happy to sacrifice some yield (which is typically associated with value stocks) in the short term while enhancing my long-term growth potential.

Thankfully, this hasn’t come back to bite me yet.

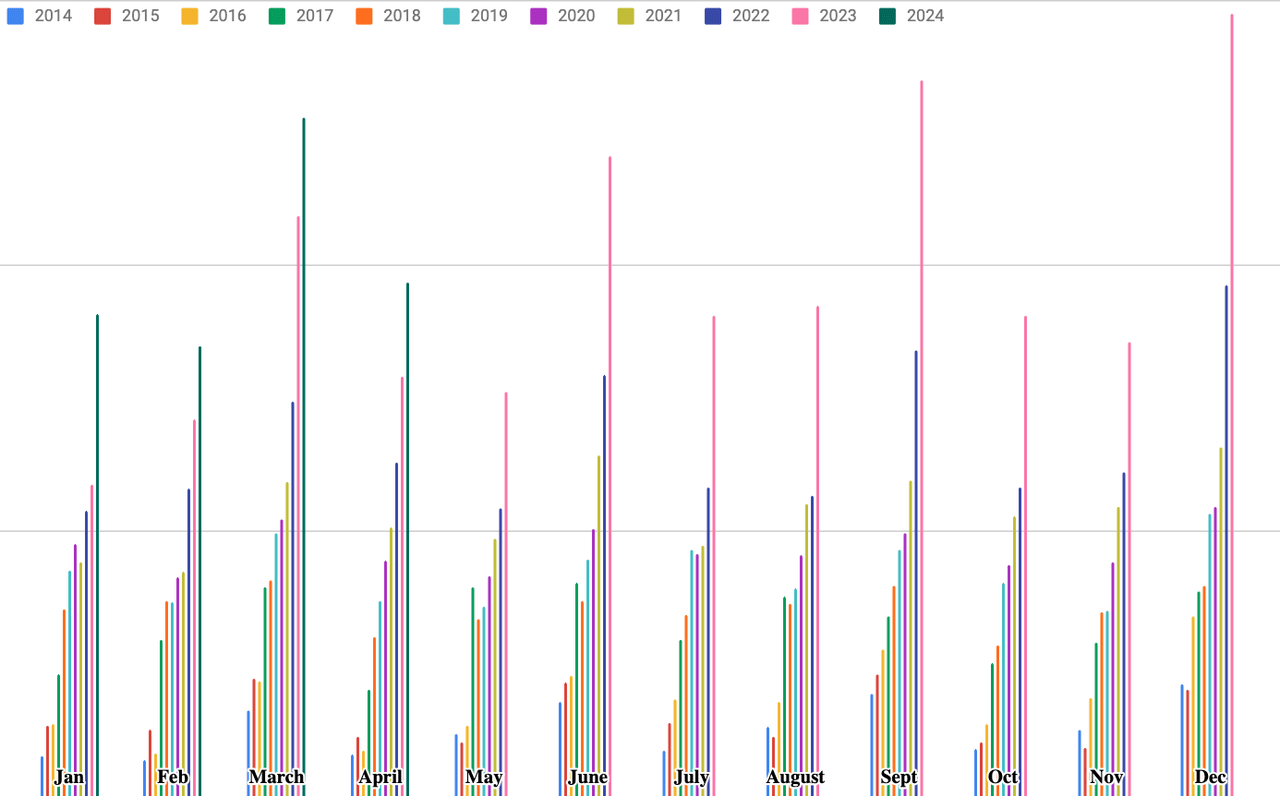

Through the first 4 months of the year, my passive income is up by 25.85% compared to the first 4 months of 2023.

Nick’s Monthly Dividend Growth Results

But, I’m a realist. Because of recent trades, such as exiting the tobacco industry and lowering my REIT exposure (due to investments in physical real estate outside of my stock portfolio) I expect to see some negative y/y dividend growth months later in 2024.

But, that’s okay because the expected dividend growth rate of my portfolio has never been higher. In 2025, I expect to see double-digit organic dividend growth again. I’m looking forward to seeing the changes that I’ve made in 2023/2024 reignite rapid dividend growth in the years to come.

Recent Trading Activity

This transition from a more value oriented portfolio into a more compounder-centric portfolio – while still focusing on reliably increasing passive income – has been surprisingly easy throughout 2024 with several highly regarded big-tech stocks finding religion with regards to capital discipline and shareholder returns.

For instance, I’ve had my eye on Booking (BKNG) for years, but I could never justify owning shares.

This was despite its incredibly high-quality metrics. Simply put, BKNG just didn’t check enough of the boxes that I was looking for when screening potential investments.

Well, now that the company has established a dividend (that has the potential to grow at a rapid pace for years to come) things have changed. In a matter of months, Booking went from a 0.00% weighting in my portfolio to my 10th largest position.

For those interested, I covered my bullish outlook on BKNG shares here and here earlier in the year.

In terms of invested capital, my Booking Holdings position is my 4th largest…and yet, the rapid nature of that share count accumulation doesn’t scare me because I believe that this is a rare opportunity to buy a wonderful company at a fair price.

Coming into 2024, I was already very bullish on big-tech. In February, I published an article titled, “Winning With Big Tech: The 2023 Playbook Is The 2024 Playbook”.

The “Magnificent Seven” ruled the market throughout 2023, helping me to outperform.

I don’t own all 7 of those fabulous stocks. I continue to be happy to avoid Tesla (TSLA). But, in general, I believe that the reliable cash flows and best-in-class balance sheets that these types of companies possess make them all-weather investments and the easiest stocks in the market for me to buy and hold over the long term.

When I look at the market through a broad lens, blue chip big-tech stocks stand out to me as some of the best values in the market today, when factoring in PEG ratios.

With the market making new all-time highs, it’s been hard to aggressively allocate cash to equities because even though I’m willing to accept more narrow margins of safeties when buying compounders, I don’t want to knowingly over pay for stocks.

No matter how high a company’s quality metrics are, I still believe that’s a recipe for long-term underperformance.

The value investor in me isn’t gone, that’s for sure. I’m just focused more on quality than ever before. And big-tech stocks continue to provide attractive bargains, in that regard.

With that in mind, I’ve felt comfortable building up a significant stake in META (after that company established its dividend in Q1) throughout the year as well.

At the end of 2023 I didn’t own a single META share. Today, META is my 8th largest position, representing approximately 2.5% of my total portfolio value.

META is now my second largest investment, as far as cost basis goes, trailing only Amazon (AMZN), which I have been adding to throughout 2024 as well.

Another stock that I’ve been buying in recent months is Salesforce (CRM).

Coming into the year, this was one of the rare, non-dividend paying speculative growth stocks that I was holding in a ROTH, looking for significant long-term gains. Well, after CRM’s management followed META’s lead and established a dividend payment, I significantly increased that position size as well.

At the end of December, my CRM weighting was just 0.2%. Today, Salesforce is a top-20 position for me, making up roughly 1.35% of my total holdings.

But, this 2024 transition from value to quality isn’t just about technology stocks.

I’ve been able to take advantage of recent dips in wonderful companies like Zoetis (ZTS) and MSCI (MSCI) as well.

I wrote about my bullish outlook on ZTS shares here, calling it my favorite healthcare stock.

I recently highlighted my bullish outlook for MSCI in this article, where I explained my rationale for buying shares during the stock’s recent sell-off.

Money doesn’t grow on trees where I live, though. So, to make all of these buys, I’ve had to part ways with some long-term portfolio positions to fund this transition.

In recent months, I’ve taken advantage of strength in the healthcare space to lock in profits with lower conviction bio-tech/bio-pharma names that I’ve owned for years.

In recent months, I’ve sold out of AbbVie (ABBV) in two separate trades in late April, locking in gains of 117% at $159.84 and then 89% gains on a separate lot of shares at $162.02.

With these ABBV proceeds, I bought shares of META and AMZN at $430.16 and $179.05, respectively.

On 4/16/2024, I trimmed my Johnson & Johnson (JNJ) stake, locking in 15.6% gains on some shares I held in a retirement account at $145.02.

Alongside JNJ, I took some profits on my Qualcomm (QCOM) position (which had become overweight due to its recent rally). I sold roughly 41% of my QCOM stake at $168.51 on 4/16, locking in profits of 121.8% (once again, in an IRA, so no negative tax consequences).

I used the proceeds of these two trades to add to my existing positions in UNH at $468.86, MSCI at $511.39, ARCC at $20.26, SBUX at $85.93, and BKNG at $3479.33. I also initiated a new position, buying into AWK at $114.13.

These sales came on the heels of my Merck (MRK) liquidation in late February. On 2/22/2024 I sold my entire MRK stake at $129.33, locking in profits of 75.5%.

With these MRK proceeds I bought shares of AMZN, BKNG, META, AvalonBay Communities (AVB), and Blue Owl Capital (OBDC) using a barbell approach from a yield standpoint to maintain my passive income.

I’ve had success with bio-pharma investments throughout my investing career, but the more and more I think about these types of stocks moving forward, the more and more I question whether or not they have wide competitive moats in today’s day and age.

Technological advancements are pushing the science of these companies far beyond my scope of understanding. I expect to see innovation in this space continue to increase at a rapid pace as artificial intelligence is implemented into the discovery phase of new drugs. And ultimately, this increased volatility (from a science standpoint), combined with the ever present threat of patent cliffs, makes earnings/cash flows from these companies incredibly difficult to predict over the long term.

Investors in this space who don’t own advanced degrees in various scientific fields are essentially trusting management’s guidance and ability to execute. That’s fine, I suppose. To a certain extent, that’s how all equity investments go. But, to me, I’d prefer to have a deeper understanding of my holdings, theoretically leading to better success when it comes to predicting fundamental results.

Therefore, I plan to continue to shift my time, energy, and focus away from tracking bio-pharma companies moving forward.

At this point, I’ve basically taken all of the tax-free profits that I can from bio-pharma companies in my IRA accounts. I’m more hesitant to sell my big winners in my taxable accounts because I don’t want to pay large bills to Uncle Sam. So, for the time being, I’ll likely let my remaining bio-pharma positions ride. But, in general, readers should expect to see my allocation towards bio-pharma holdings fall because I don’t plan on allocating new money towards bio-pharma stocks.

It’s been nice (largely due to time savings) to reduce exposure to this area of the market throughout the year and use the proceeds from these sales to bolster higher conviction picks.

In doing so, I have lost out on some passive income (companies like ABBV, MRK, and JNJ yield quite a bit more than the compounders that I’ve rotated into). But, I am confident that the blue-chip tech stocks that I’ve rotated the majority of these proceeds into will outperform, from a total return perspective, over the long term.

Quickly, I should note that I also recently took profits on Danaher (DHR) at $253.09, trimming roughly 18% of my stake and locking in profits of 17.1%, to raise funds to add to MSCI on its recent dip.

I also sold off my entire Essex Property Trust (ESS) position as a part of my most recent MSCI addition. I liquidated ESS on 4/23/2024 at $243.02/share, locking in 13% gains.

Asset Allocation

I think that just about covers all of the major trades that I’ve made in recent months…so now, let’s discuss asset allocation.

You’ll notice a trend here…taking profits and reallocating the funds to extremely high quality companies.

Now, let’s take a look at how these trades have reshaped my portfolio from an asset allocation standpoint.

|

S&P 500 Index |

Nick’s Portfolio |

||

|

Stock |

Weighting |

Stock |

Weighting |

|

Microsoft |

6.99% |

Apple |

7.90% |

|

Apple |

6.10% |

NVIDIA Corp |

5.53% |

|

Nvidia |

5.00% |

Broadcom Inc |

5.19% |

|

Alphabet (class A and C combined) |

4.28% |

Microsoft Corp |

4.84% |

|

Amazon |

3.93% |

Amazon.com Inc |

4.22% |

|

Meta Platforms |

2.38% |

Alphabet Inc Class A |

4.15% |

|

Berkshire Hathaway |

1.69% |

Visa Inc |

3.00% |

|

Eli Lilly |

1.40% |

Meta Platforms Inc |

2.50% |

|

Broadcom |

1.31% |

Realty Income Corp |

2.17% |

|

JPMorgan |

1.30% |

Booking Holdings Inc |

2.07% |

| Total |

34.38% |

41.57% |

The S&P 500’s top 10 positions represent 34.38% of the overall index.

My efforts to become more concentrated into my top ideas have pushed my top-10 position weighting to 41.57%.

Looking at the top 20 positions of the S&P 500, you’ll see a 43.66% weighting.

Once again, looking at my portfolio, you’ll see that I’m much more top heavy, with a 56.62% weighting on my top 20 positions.

Lastly, I’ll note that this story is the same when it comes to technology holdings.

For years, I’ve felt comfortable with an overweight technology allocation. I view the secular tailwinds that tech benefits from as a defensive mechanism in the market. Therefore, I sleep well at night with an overweight tech allocation.

The S&P 500’s current tech sector weighting is 29.6%.

That’s a hefty chunk of the index, but I’m even more overweight tech, with a 40.7% weighting.

To me, this tech-centric allocation is going to not only lead to long-term outperformance…but also, rapid dividend growth due to the new shareholder return policies put into place by some of the biggest, most profitable companies in the world that just so happen to hail from this sector.

Nicholas Ward’s Dividend Growth Portfolio

|

Ticker |

Name |

Share Price |

Cost Basis/Share |

Overall Gain/Loss % |

Cost Basis Percentage |

Portfolio Weighting |

|

(AAPL) |

Apple |

$183.05 |

$22.79 |

703.20% |

1.81% |

7.90% |

|

(NVDA) |

NVIDIA Corp. |

$898.78 |

$61.61 |

1358.82% |

0.70% |

5.53% |

|

(AVGO) |

Broadcom Inc. |

$1,332.80 |

$234.30 |

468.84% |

1.68% |

5.19% |

|

(MSFT) |

Microsoft Corp. |

$414.74 |

$85.56 |

384.74% |

1.84% |

4.84% |

|

(AMZN) |

Amazon |

$187.48 |

$120.62 |

55.43% |

5.00% |

4.22% |

|

(GOOGL) |

Alphabet Inc. Class A |

$168.65 |

$45.45 |

271.07% |

2.06% |

4.15% |

|

(V) |

Visa |

$280.74 |

$124.24 |

125.97% |

2.44% |

3.00% |

|

(META) |

Meta Platforms |

$476.20 |

$468.39 |

1.67% |

4.52% |

2.50% |

|

(O) |

Realty Income Corp. |

$55.01 |

$59.43 |

-7.44% |

4.31% |

2.17% |

|

(BKNG) |

Booking Holdings |

$3,805.75 |

$3,499.68 |

8.75% |

3.50% |

2.07% |

|

(BLK) |

BlackRock |

$796.67 |

$462.83 |

72.13% |

2.16% |

2.02% |

|

(RTX) |

RTX Corp. |

$106.32 |

$84.65 |

25.60% |

2.82% |

1.92% |

|

(APD) |

Air Products and Chemicals |

$250.55 |

$260.12 |

-3.68% |

3.07% |

1.61% |

|

(CNI) |

Canadian National Railway |

$127.42 |

$112.44 |

13.32% |

2.34% |

1.44% |

|

(UNH) |

UnitedHealth Group |

$512.81 |

$483.07 |

6.16% |

2.41% |

1.39% |

|

(PEP) |

PepsiCo |

$179.79 |

$115.51 |

55.65% |

1.62% |

1.37% |

|

(QCOM) |

Qualcomm |

$182.08 |

$42.93 |

324.13% |

0.58% |

1.33% |

|

(SPGI) |

S&P Global |

$431.57 |

$358.53 |

20.37% |

2.03% |

1.33% |

|

(CRM) |

Salesforce Inc. |

$276.67 |

$294.44 |

-6.04% |

2.60% |

1.33% |

|

(MSCI) |

MSCI Inc. |

$485.16 |

$470.38 |

3.14% |

2.35% |

1.32% |

|

(SBUX) |

Starbucks Corp. |

$76.11 |

$54.30 |

40.17% |

1.73% |

1.32% |

|

(USFR) |

WisdomTree Floating Rate Treasury Fund |

$50.43 |

$50.40 |

0.06% |

2.33% |

1.27% |

|

(PH) |

Parker-Hannifin Corp. |

$561.13 |

$255.96 |

119.23% |

1.02% |

1.22% |

|

(MAIN) |

Main Street Capital |

$49.40 |

$41.19 |

19.93% |

1.83% |

1.19% |

|

(OBDC) |

Blue Owl Capital |

$16.55 |

$13.95 |

18.64% |

1.69% |

1.09% |

|

(HON) |

Honeywell International |

$202.92 |

$142.19 |

42.71% |

1.40% |

1.08% |

|

(MA) |

Mastercard |

$456.98 |

$119.79 |

281.48% |

0.50% |

1.03% |

|

(TMO) |

Thermo Fisher Scientific |

$593.03 |

$529.96 |

11.90% |

1.68% |

1.02% |

|

(LMT) |

Lockheed Martin |

$468.88 |

$354.14 |

32.40% |

1.41% |

1.02% |

|

(AVB) |

AvalonBay Communities Inc. |

$196.89 |

$170.35 |

15.58% |

1.56% |

0.98% |

|

(BR) |

Broadridge Financial Solutions |

$195.69 |

$148.90 |

31.42% |

1.34% |

0.96% |

|

(KO) |

Coca-Cola Co. |

$63.26 |

$42.38 |

49.27% |

1.14% |

0.92% |

|

(TXN) |

Texas Instruments Inc. |

$187.05 |

$110.11 |

69.88% |

0.97% |

0.90% |

|

(AMGN) |

Amgen Inc. |

$310.15 |

$136.07 |

127.93% |

0.70% |

0.87% |

|

(REXR) |

Rexford Industrial Realty |

$45.11 |

$52.38 |

-13.88% |

1.82% |

0.85% |

|

(DE) |

Deere & Co. |

$407.89 |

$347.85 |

17.26% |

1.33% |

0.85% |

|

(ECL) |

Ecolab |

$233.52 |

$153.95 |

51.69% |

1.03% |

0.85% |

|

(ZTS) |

Zoetis |

$169.04 |

$168.80 |

0.14% |

1.55% |

0.84% |

|

(ARCC) |

Ares Capital Corporation |

$21.10 |

$19.22 |

9.78% |

1.41% |

0.84% |

|

(ENB) |

Enbridge Inc. |

$37.80 |

$39.33 |

-3.89% |

1.58% |

0.83% |

|

(ACN) |

Accenture plc |

$306.33 |

$270.99 |

13.04% |

1.31% |

0.80% |

|

(ELV) |

Elevance Health |

$539.18 |

$484.59 |

11.27% |

1.29% |

0.78% |

|

(CME) |

CME Group |

$208.46 |

$196.49 |

6.09% |

1.31% |

0.75% |

|

(ASML) |

ASML Holding NV |

$930.29 |

$649.43 |

43.25% |

0.86% |

0.67% |

|

(CP) |

Canadian Pacific Kansas City Ltd. |

$82.93 |

$71.70 |

15.66% |

1.04% |

0.65% |

|

(HSY) |

Hershey Co |

$204.78 |

$217.10 |

-5.67% |

1.26% |

0.65% |

|

(NOC) |

Northrop Grumman Corp. |

$474.80 |

$385.78 |

23.08% |

0.96% |

0.64% |

|

(BIL) |

SPDR Bloomberg 1-3 Month T-Bill ETF |

$91.56 |

$91.63 |

-0.08% |

1.16% |

0.63% |

|

(DHR) |

Danaher Corp. |

$253.38 |

$210.55 |

20.34% |

0.95% |

0.62% |

|

(ICE) |

Intercontinental Exchange |

$133.99 |

$97.23 |

37.81% |

0.81% |

0.61% |

|

(JNJ) |

Johnson & Johnson |

$149.91 |

$102.62 |

46.08% |

0.75% |

0.60% |

|

(LIN) |

Linde plc |

$434.39 |

$355.48 |

22.20% |

0.89% |

0.59% |

|

(NNN) |

NNN REIT |

$42.26 |

$38.38 |

10.11% |

0.92% |

0.55% |

|

(AWK) |

American Water Works Company |

$135.50 |

$114.13 |

18.72% |

0.84% |

0.54% |

|

(ADP) |

Automatic Data Processing |

$246.86 |

$238.79 |

3.38% |

0.91% |

0.51% |

|

(WM) |

Waste Management, Inc. |

$211.49 |

$159.54 |

32.56% |

0.69% |

0.50% |

|

(TD) |

Toronto-Dominion Bank |

$56.62 |

$65.06 |

-12.97% |

1.01% |

0.48% |

|

(MCD) |

McDonald’s Corp. |

$275.00 |

$259.46 |

5.99% |

0.82% |

0.47% |

|

(BAH) |

Booz Allen Hamilton Holding Corporation |

$156.06 |

$75.49 |

106.73% |

0.41% |

0.47% |

|

(SHW) |

Sherwin-Williams Co. |

$320.86 |

$219.30 |

46.31% |

0.51% |

0.41% |

|

(MCO) |

Moody’s Corp. |

$400.35 |

$326.70 |

22.54% |

0.54% |

0.36% |

|

(RSG) |

Republic Services |

$189.24 |

$123.71 |

52.97% |

0.39% |

0.33% |

|

(PLD) |

Prologis |

$107.49 |

$118.30 |

-9.14% |

0.63% |

0.31% |

|

(CSL) |

Carlisle Companies, Inc. |

$416.63 |

$228.31 |

82.48% |

0.30% |

0.30% |

|

(CPT) |

Camden Property Trust |

$106.64 |

$114.08 |

-6.52% |

0.57% |

0.29% |

|

(A) |

Agilent Technologies |

$149.76 |

$116.28 |

28.79% |

0.41% |

0.28% |

|

(ARE) |

Alexandria Real Estate Equities |

$121.59 |

$130.96 |

-7.15% |

0.50% |

0.25% |

|

(PLTR) |

Palantir Technologies |

$20.60 |

$10.79 |

90.92% |

0.10% |

0.11% |

Conclusion

So, there you have it.

I’ve been busy this year…but all of this work was done in order to simplify my life a bit moving forward, ultimately saving me time, energy, and focus (which I’d rather be dedicating towards my family and new projects at Wide Moat Research).

Only time will tell if I’m right about the tech sector outperforming over the long term…but an overweight allocation to this area of the market is what has allowed me to beat the market consistently over the last decade+ and moving forward, I see no reason to believe that this trend is going to end.

Secular growth prospects, massive cash flows, and generous management teams make these blue chips from the tech sector a sleep well at night investments for me.

Maybe there will be a market environment where the Coca-Cola’s of the world (which, I’m still very happy to own, by the way) will shine again. But, to me, most of my favorite consumer stable, discretionary, and industrial stocks appear to be overvalued these days, and I’m finding the best value (on a PEG basis) in the information technology/fintech/financial services spaces.

So, I’ll happily take what the market gives me in that regard. You’re certainly not going to hear me complain about having the opportunity to buy high quality compounders with double-digit sales, EPS, and dividend growth prospects at fair (or better) valuations.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.