Hispanolistic

Introduction

As the final quarter of 2023 comes to a close, it’s time to reflect on the performance and decisions of my dividend growth portfolio. Unlike the previous quarter, where my portfolio outperformed the market, Q4 saw a slight underperformance compared to the S&P 500, lagging by 1%. This was during a period when the market itself experienced a significant upturn, almost 10%. My portfolio has a lower beta. Thus, slight underperformance makes sense during a bull market.

The Federal Reserve’s indication of a potential pivot towards lowering rates created a ripple of optimism in the market. However, several factors at play influenced market dynamics in Q4. The high interest rates lead to heightened scrutiny of indebted companies’ risk management strategies, and we see blue chips with high debt levels being hurt. Despite a strong job market and lower inflation trends, concerns arose around consumer spending due to resuming student loan repayments, higher borrowing costs, and elevated housing prices, particularly for first-time buyers.

Despite these challenges, my dividend growth portfolio continued its positive trajectory in income generation, enjoying a significant 21% increase in dividend income. This growth underscores the resilience and strategic value of focusing on dividend-generating stocks, especially in a fluctuating market.

Looking ahead, the strategy for my portfolio remains intact. I will continue allocating funds monthly, focusing on undervalued or moderately priced stocks. With a keen eye on high-quality blue-chip stocks that offer solid and safe dividends, I aim to capitalize on market volatility, viewing any dips as opportunities to enhance future income streams at lower costs.

As we enter a new year, I am committed to growing a sustainable stream of dividends. This approach aligns with my financial freedom goal and offers a buffer against market unpredictability. The learnings from Q4 will help fine-tune my investment decisions, ensuring my portfolio remains robust and responsive to challenges and opportunities in the financial landscape.

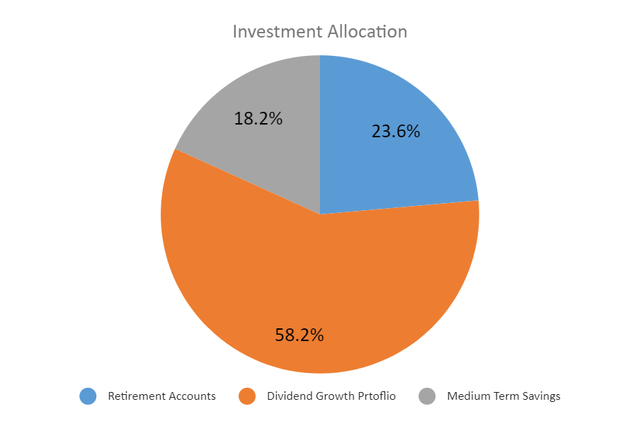

Investment Allocation

My dividend growth portfolio was more than 83% of my assets. To balance it, I allocated more funds to my other accounts. I want to balance it to hedge against possible strategy failures. Being overconfident in the financial world can lead to devastating results. Therefore, I am trying to allocate my funds and ensure that my assets stay diversified.

My current goal is to make my dividend growth portfolio below 50% of my assets and to do it while I keep increasing its value and achieving a 10% dividend growth. I am a believer in diversification. In the future, I believe that buying a house as an investment or living in it will lower the percentage of the dividend growth portfolio in my assets.

My dividend growth portfolio is very well-diversified and contains a collection of 84 blue-chip companies. While I am proud of my achievements as an investor, I must stay humble and diversify my investments wisely. The more I learn about investments, the humbler I become.

I already maxed out my Roth IRA in 2024. I have medium-term accounts that may serve as a down payment on a house. These two measures helped me diversify my holdings. While the Roth IRA, the retirement account, and the dividend growth portfolio are long-term investments, I plan to keep the rest of the funds liquid.

My Goals

Since I started setting goals, I have managed to achieve most of my goals. My goals for 2024 are to achieve at least 10% dividend growth, diversify my investments, maximize my Roth IRA contribution, read at least twelve books, and travel abroad at least twice. I keep track of my goals so I can achieve them. In 2023, I didn’t read as much as I wanted, yet I traveled six times. The 2024 goals are similar to the ones I had a year ago, and I hope to keep executing them.

By setting goals, you can organize your time better. I highly recommend it to everyone. It allows you to see your progress during the year. Select some challenging but achievable goals, and make sure they are quantifiable. I believe I will achieve all my goals for 2024, as I am on track.

Sector Allocation

My brokerage account is my most significant asset, so I allocate money there according to my optimal sector allocation. As I am still accumulating, I don’t mind buying stocks from sectors I am over-allocated. I don’t want to ignore my optimal allocation.

I probably will not add to sectors exceeding the optimal allocation, like the energy sector, unless an outstanding opportunity arises. I will probably invest more in industries I lack exposure in the coming quarters. I usually write articles regarding companies that I find attractive. I bought shares in some of them, while others are still on my radar.

In Q1, I will add more dividend growth companies in the consumer staples and discretionary sectors.

| Sector | Current | Goal |

| Consumer Staples | 13.9% | 17.0% |

| Health Care | 11.7% | 12.5% |

| Industrials | 12.0% | 12.5% |

| Financials | 14.9% | 12.5% |

| Information Technology | 14.4% | 12.5% |

| Consumer Discretionary | 7.9% | 10.0% |

| Real Estate | 7.3% | 8.0% |

| Energy and Materials | 8.5% | 8.0% |

| Communication Services | 6.9% | 4.0% |

| Utilities | 2.4% | 3.0% |

My Portfolio

The following table shows the current holdings in my brokerage account. All the companies below are part of my dividend growth portfolio. Alphabet (GOOG) (GOOGL), Amazon (AMZN), and Meta Platforms (META) don’t pay dividends. However, they enjoy steady growth in their free cash flow. This metric is the basis of any dividend payment.

As a long-term investor, I don’t mind waiting until they are ready to share some of this wealth with their investors. Alphabet, Amazon, and Facebook have already started buyback programs. I hope that both will offer dividends in the years to come.

| Industry | Company | Ticker | % of Portfolio | % of Income |

| Information Technology | APPLE INC | AAPL | 3.71% | 0.64% |

| Health Care | ABBVIE INC | ABBV | 1.07% | 1.39% |

| Real Estate | ARBOR REALTY TRUST INC | ABR | 0.38% | 1.54% |

| Health Care | ABBOTT LABORATORIES | ABT | 1.87% | 1.23% |

| Consumer Staples | ARCHER-DANIELS-MIDLAND CO | ADM | 1.13% | 1.01% |

| Financials | AFLAC INC | AFL | 2.47% | 2.01% |

| Financials | AMERIPRISE FINL INC | AMP | 1.23% | 0.60% |

| Consumer Discretionary | AMAZON.COM INC | AMZN | 2.02% | 0.00% |

| Utilities | AVISTA CORP | AVA | 0.22% | 0.41% |

| Financials | AMERICAN EXPRESS COMPANY | AXP | 0.59% | 0.27% |

| Financials | BANK of AMERICA CORP | BAC | 1.25% | 1.29% |

| Health Care | BECTON DICKINSON & CO | BDX | 0.77% | 0.43% |

| Financials | BLACKROCK INC | BLK | 2.61% | 2.28% |

| Health Care | BRISTOL MYERS SQUIBB CO | BMY | 0.49% | 0.81% |

| Financials | CITIGROUP INC COM | C | 0.50% | 0.71% |

| Health Care | CARDINAL HEALTH INC | CAH | 1.75% | 1.12% |

| Industrials | CATERPILLAR INC | CAT | 2.78% | 1.75% |

| Information Technology | CISCO SYSTEMS INC | CSCO | 0.50% | 0.52% |

| Health Care | CVS HEALTH CORPORATION | CVS | 0.24% | 0.30% |

| Energy | CHEVRON CORPORATION | CVX | 1.86% | 2.92% |

| Communication Services | WALT DISNEY CO | DIS | 0.30% | 0.07% |

| Real Estate | DIGITAL REALTY TRUST INC | DLR | 1.32% | 1.64% |

| Utilities | DUKE ENERGY CORPORATION HOLDING COMPANY | DUK | 0.63% | 0.92% |

| Industrials | EMERSON ELECTRIC CO | EMR | 1.54% | 1.17% |

| Energy | ENTERPRISE PRODUCTS PARTNERS LP | EPD | 2.02% | 5.30% |

| Industrials | EATON CORPORATION PLC | ETN | 1.58% | 0.77% |

| Industrials | GENERAL DYNAMICS CORP | GD | 0.82% | 0.59% |

| Consumer Staples | GENERAL MILLS INC | GIS | 0.83% | 1.06% |

| Communication Services | ALPHABET INC CLASS C CAPITAL STOCK | GOOG | 2.86% | 0.00% |

| Financials | GOLDMAN SACHS GROUP INC | GS | 1.24% | 1.23% |

| Real Estate | HIGHWOODS PROPERTIES INC | HIW | 0.29% | 0.89% |

| Information Technology | INTERNATIONAL BUSINESS MACHINES CORP | IBM | 0.55% | 0.74% |

| Health Care | JOHNSON & JOHNSON | JNJ | 2.65% | 2.66% |

| Financials | JPMORGAN CHASE & CO | JPM | 1.65% | 1.41% |

| Consumer Staples | KIMBERLY CLARK CORP | KMB | 1.21% | 1.58% |

| Energy | KINDER MORGAN INC | KMI | 0.85% | 1.90% |

| Consumer Staples | COCA COLA COMPANY (THE) | KO | 1.38% | 1.44% |

| Real Estate | KKR REAL ESTATE FINANCE TRUST INC | KREF | 0.28% | 1.35% |

| Industrials | LOCKHEED MARTIN CORP | LMT | 0.30% | 0.28% |

| Consumer Discretionary | LOWE’S COMPANIES | LOW | 0.36% | 0.25% |

| Real Estate | MID-AMERICA APARTMENT COMMUNITIES INC | MAA | 1.29% | 1.97% |

| Consumer Discretionary | MCDONALD’S CORP | MCD | 2.90% | 2.24% |

| Health Care | MCKESSON CORP | MCK | 0.81% | 0.14% |

| Health Care | MEDTRONIC PLC COM | MDT | 1.13% | 1.23% |

| Communication Services | META PLATFORMS INC | META | 2.47% | 0.00% |

| Industrials | 3M COMPANY | MMM | 0.70% | 1.34% |

| Consumer Staples | ALTRIA GROUP INC | MO | 0.80% | 2.63% |

| Energy | MPLX LP COM UNIT REPSTG LTD PARTNER INT | MPLX | 0.73% | 2.28% |

| Health Care | MERCK & CO INC | MRK | 0.78% | 0.69% |

| Financials | MORGAN STANLEY | MS | 0.28% | 0.38% |

| Information Technology | MICROSOFT CORP | MSFT | 2.59% | 0.67% |

| Industrials | MSC INDUSTRIAL DIRECT CO INC CL A | MSM | 0.63% | 0.74% |

| Utilities | NEXTERA ENERGY INC | NEE | 0.38% | 0.42% |

| Consumer Discretionary | NIKE INC CLASS B COM | NKE | 0.66% | 0.33% |

| Industrials | NORFOLK SOUTHERN CORP | NSC | 1.54% | 1.21% |

| Information Technology | NVIDIA CORP | NVDA | 3.75% | 0.04% |

| Real Estate | REALTY INCOME CORP | O | 2.76% | 5.16% |

| Real Estate | OMEGA HEALTHCARE INVESTORS INC | OHI | 0.39% | 1.20% |

| Energy | ONEOK INC | OKE | 0.70% | 1.28% |

| Consumer Staples | PEPSICO INC COMMON STOCK | PEP | 2.19% | 2.26% |

| Health Care | PFIZER INC | PFE | 0.18% | 0.38% |

| Consumer Staples | PROCTER & GAMBLE CO | PG | 1.46% | 1.26% |

| Consumer Staples | PHILIP MORRIS INTERNATIONAL INC | PM | 1.84% | 3.49% |

| Financials | PRUDENTIAL FINANCIAL INC | PRU | 1.67% | 2.80% |

| Information Technology | QUALCOMM INC | QCOM | 0.95% | 0.72% |

| Industrials | RAYTHEON TECHNOLOGIES CORPORATION COMMON STOCK | RTX | 0.56% | 0.53% |

| Consumer Discretionary | STARBUCKS CORP | SBUX | 0.61% | 0.51% |

| Financials | CHARLES SCHWAB CORP | SCHW | 0.41% | 0.22% |

| Consumer Staples | J M SMUCKER COMPANY | SJM | 0.42% | 0.47% |

| Utilities | SOUTHERN CO | SO | 0.68% | 0.94% |

| Real Estate | STARWOOD PROPERTY TRUST INC | STWD | 0.34% | 1.07% |

| Consumer Staples | SYSCO CORP | SYY | 0.49% | 0.45% |

| Consumer Discretionary | TARGET CORP | TGT | 1.35% | 1.48% |

| Financials | T ROWE PRICE GROUP INC | TROW | 1.05% | 1.64% |

| Consumer Staples | TYSON FOODS | TSN | 1.05% | 1.32% |

| Information Technology | TEXAS INSTRUMENTS INCORPORATED | TXN | 0.55% | 0.58% |

| Industrials | UNION PACIFIC CORP | UNP | 1.56% | 1.16% |

| Information Technology | VISA INC CL A COMMON STOCK | V | 1.76% | 0.47% |

| Real Estate | VICI PROPERTIES | VICI | 0.30% | 0.56% |

| Energy | VALERO ENERGY CORP NEW | VLO | 0.41% | 0.48% |

| Communication Services | VERIZON COMMUNICATIONS | VZ | 1.28% | 2.98% |

| Utilities | WEC ENERGY GROUP INC | WEC | 0.53% | 0.75% |

| Consumer Staples | WALMART INC COMMON STOCK | WMT | 1.07% | 0.51% |

| Energy | EXXON MOBIL CORP | XOM | 1.91% | 2.55% |

I currently own 84 companies in my portfolio. Over the quarter, I added to existing and new positions. I am not worried at all about the number of positions I hold. These blue-chip companies don’t need me to follow them daily. I wouldn’t mind keeping them even if the stock market is closed for a decade.

Acquisitions Made in Q4 2023

Mid-America Apartment Communities (MAA): In Q4, I acquired shares in Mid-America Apartment Communities. This move was influenced by the company’s stable performance, attractive valuation in the current market, and the 4%+ dividend.

Avista Corporation (AVA): Another acquisition this quarter was Avista Corporation, a utility company known for its stable earnings and solid dividend history. In an environment of market volatility, utility stocks like Avista offer a balance of stability and steady income.

Sales Made in Q4 2023

W.P. Carey (WPC): I divested my holdings in W.P. Carey following the company’s dividend cut in line with my investment principles. This action aligns with my strategy to exit positions in companies that reduce their dividends, as it often signals underlying operational challenges or shifts in financial health.

Kellanova (K): The company’s dividend cut prompted me to sell shares in Kellanova Corporation. As with W.P. Carey, the reduction in dividends from Kellanova is a red flag indicating possible strategic missteps or financial instability.

What Am I Looking for?

When I look at my portfolio, I see a great collection of companies. I feel more confident about some companies yearly and less optimistic about others. That’s why diversification is critical. I am always looking for the weaker links in my portfolio and trying to measure the effect of a possible dividend cut on my income.

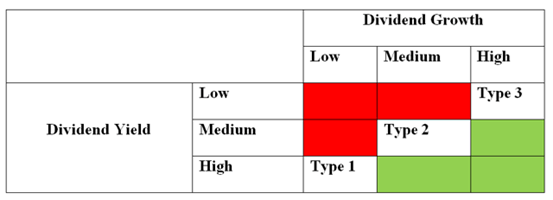

In Q1, I will closely follow the consumer discretionary and consumer staples sectors. You probably recognize the chart below as part of my stock analysis. Using this chart contributes to my analysis thesis. I mostly keep looking for Type 2 stocks as they offer the best combination of growth and income.

Author

Conclusion

As we wrap up Q4 2023, it’s clear that while the market will continue to present challenges, it will also provide valuable investment opportunities. This quarter, I’ve continued to grow dividend income in alignment with my long-term financial objectives. I remain committed to my investment strategy, which involves regular, disciplined investments in carefully selected companies. This approach is designed to weather short-term market volatility and capitalize on it, bringing me steadily closer to my long-term goals.

The macroeconomic landscape, while turbulent in the short term, is a less significant factor compared to the solid fundamentals of the companies in my portfolio. Experience has taught me the importance of maintaining focus and not being swayed by temporary market sentiments or external ‘noise.’ It’s essential to stay the course, executing the investment plan with patience and discipline. Here’s to a successful upcoming quarter and a happy 2024.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.