cagkansayin

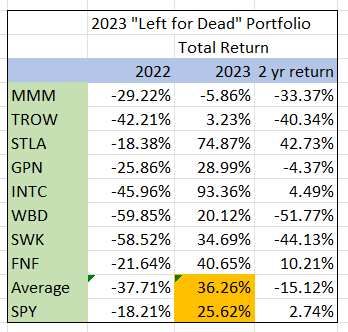

Near the end of 2022, I put together a small stock portfolio consisting of stocks that had notably underperformed in what was already a bad year for the market. I felt that these stocks had either been unjustly punished, or at least had significant potential to rebound in 2023. These are decent companies, but since they all had some temporary fleas the market sentiment around them was poor. Stocks like this tend to get hammered at year end due to tax-loss selling, driving their prices down even further and potentially increasing the opportunity. My instincts proved right as the portfolio outperformed the hot 2023 market by more than 10% in total return. Here I quickly review that portfolio, and unveil the 2024 “Left for Dead” portfolio, a few weeks later.

Screening For “Losers”

So how did I choose the lucky participants? In each case these were companies I either already owned or had been watching and had at least some familiarity with. So I did not start with a blind quant screen – I picked stocks I knew reasonably well that had been beaten down severely in 2022. These were not Buffet’s proverbial “cigar butts”, but decent companies with likely temporary issues that once righted could bounce at least 20% in the coming year. Typically they ended the year near 52 week lows.

I should note that this type of strategy is not my main focus, but just a “side bet” that arose out of my normal research. While my main strategy is to buy good-great companies with no plans to sell, some of these picks were not necessarily core holdings.

The 2023 Tally

The below table lists the eight stocks in the 2023 Left for Dead portfolio, and their performance for 2022 (which prompted their inclusion), 2023, and the two year performance. The average total return if one bought equal amounts at last closing in 2022 and held at last closing in 2023 was more than 36% versus the market at <26%. Even so the average 2-year performance was still behind the market due to the dismal 2022 records.

Performance of 2023 “Left for Dead” portfolio (Author with data from Fastgraphs and Seeking Alpha)

The big winner was Intel (INTC) with nearly a double, as it benefited from the CHIPS act and signs that a long-awaited turnaround may finally be happening. The big underperformers were T. Rowe Price (TROW) and 3M (MMM). 3M’s litigation problems (ear plugs, “forever” chemicals) are well known, and continued to hang over the stock. Plus, the market saw a recession on the horizon which would surely impact an industrial like 3M. I continue to hold MMM (small) and INTC, though for how long remains uncertain. I think INTC has had most of its run and uncertainties around the continued turnaround abound. Semiconductors are a tough business, as beautifully captured here: “Building semiconductors is like playing Russian roulette. You put a gun to your head, pull the trigger, and find out four years later if you blew your brains out.” – Robert Palmer former Digital CEO

TROW continues to suffer from the (perceived?) “death” of actively managed funds. The growth of ETF’s along with 5%+ rates on cash contributed to continuing outflows. While TROW has a great brand and reputation among active fund managers, the market isn’t convinced the industry outflows will subside. Neither am I – I never bought TROW and just can’t get comfortable with its prospects – yet.

While Stanley Black & Decker (SWK) did outperform, questions remain as to the viability of its business model going forward. Management massively screwed up during the pandemic saddling the company with too much inventory and burning cash. While they own some iconic brands like Black & Decker and Dewalt, competition is intense and market growth is limited. I still hold a small amount, but this will likely never be a core holding for me.

Fidelity National Financial (FNF) insures mortgages, and as rates went up and mortgage applications went down, so did FNF. But as the market began to see a light at the end of the rate tunnel (and it wasn’t an oncoming locomotive), FNF caught a bid. And my thesis on it wasn’t any more complicated than that. Never bought any, though it is still on my watch list.

Global Payments (GPN) just looked too cheap. It’s a payments solutions provider and the market had a distaste for anything in that area. But the numbers remained attractive and I still hold a decent amount of this one.

Stellantis (STLA) also just looked silly cheap at low-single digit PE, net cash on the balance sheet, and attractive returns on capital. Yes it’s an auto manufacturer that the market thinks is behind the EV curve. That doesn’t bother me. See for example Hertz dumping their EV’s. STLA will catch up as needed. They own brands like Jeep, Alfa, Maserati. I think as the outlook for a recession subsided, this one caught a bid. I still hold it as well, it still looks cheap. Yes a recession will hurt. First automaker I’ve ever held.

Warner Bros. Discovery (WBD) moderately underperformed the market even if up 20%. It can best be described as a media conglomerate with 2 albatrosses around its neck: Big debt courtesy of its spinout from AT&T, and streaming. Plus it was plagued by AT&T (T) shareholders selling their shares received in the spinoff. It has great assets, but no one knows what to make of streaming right now. Is it even a viable business? I still own a fair bit of this one, and since it made the 2024 list will add more info below.

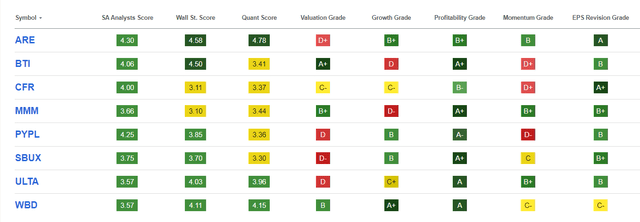

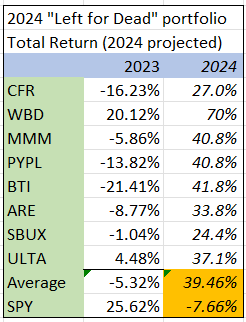

The 2024 “Left For Dead” Portfolio: And The Winners (Losers?) Are…

Remember, these are stocks that underperformed in 2023 that I feel are reasonably good businesses and that have a decent chance of rebounding significantly in 2024. They may not be what I consider core holdings.

Here are the lucky winners for 2024:

“Left for Dead” portfolio for 2024 with Seeking Alpha ratings (Author, Seeking Alpha)

Right away you may notice that in general, Seeking Alpha authors and even Wall Street analysts are fairly positive on this group. Also note that the profitability grades are quite good. Yet these companies’ stocks faired poorly in 2023:

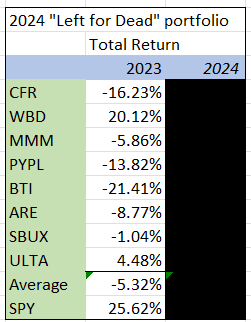

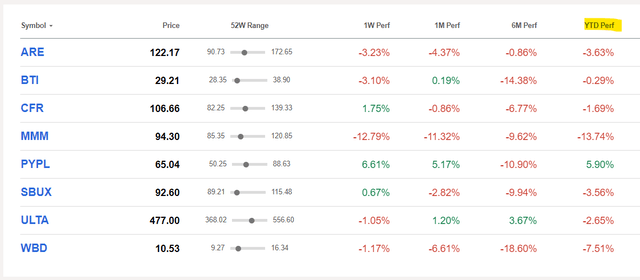

2023 total return of 2024 “Left for Dead” portfolio (Author, Seeking Alpha)

Overall the average return was nearly 31% below the market. WBD had a decent positive return but this was only after a massive 51.8% decline during the preceding two years. This is why WBD is one of two holdovers from the 2023 portfolio along with MMM. Let’s start by looking at those two stocks first. Please note that these will be quick summaries of what I believe to be the main issues as seen by the market, and in each case I will link to articles by other Seeking Alpha authors if you’d like to do more research.

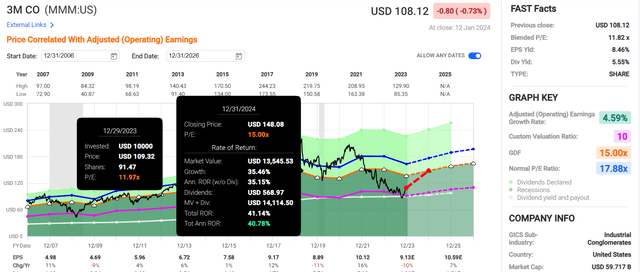

MMM: Litigation And Recession Clouds Receding

The heading sums it up. MMM, a solid diversified industrial with a knack for innovation, a massive patent portfolio and leading positions in several industries was hit with massive lawsuits, and to a large extent the worst case scenarios are receding. As is the outlook for a deep recession. For more research you can start here. But a return to anything like historical multiples could provide pleasing returns, even if it takes a few years. (Note that as I as editing this article, MMM reported Q4 results with weak guidance, knocking the stock down 10%+. It remains to be seen if this is a temporary knee-jerk reaction but for now my view hasn’t changed).

3M possible 2024 returns (Fastgraphs)

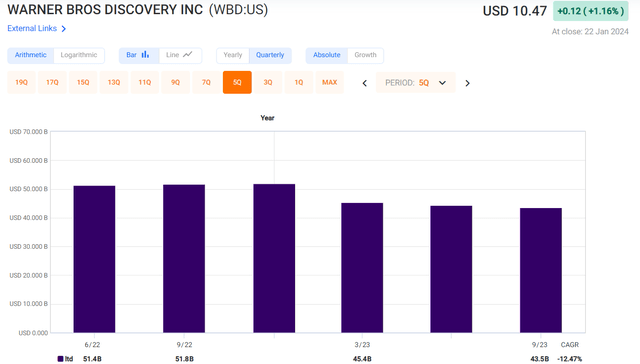

WBD: The Messy One

Large media companies are inherently complex with many moving parts. Add in residue from mergers and spinoffs, then mix in an ongoing industry upheaval as linear TV dies, streaming flounders, and cinema flops. Why would anyone want to invest in these companies?

That’s actually part of the attraction – these things are too ugly for many folks to bother with, and the stock price reflects it. WBD was saddled with massive debt thanks to AT&T, and no one beyond Netflix can seem to turn much of a profit in streaming. But WBD has a motivated management team, and fantastic assets including HBO/Max, Discovery’s reality TV collection, Warner Bros and New Line Cinema’s movies, DC comics, the list goes on.

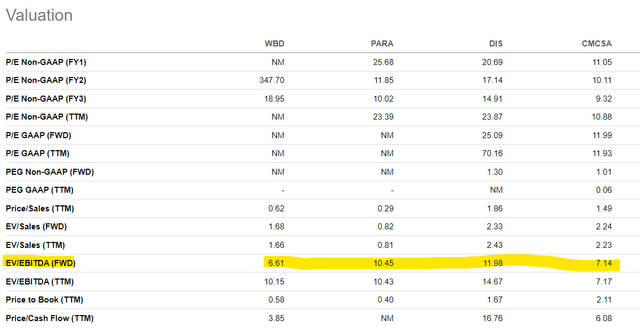

Debt is being paid down and synergies are being realized, and if they can right this ship it is still dirt cheap. Instead of using Fast Graphs here, I will use a back-of-the-envelope EV/EBITDA multiple analysis – a common metric when analyzing media companies as they are all saddled with significant amounts of non-cash intangible amortization and charges from mergers and acquisitions.

WBD long term debt since spinoff (Fastgaphs)

WBD should generate more than $10B in EBITDA for 2023, and at least this much for 2024, so I use $11B (which could well be low). Current debt is $43.7B, but by the end of 2024 they should be able to reduce it to ~$35B. Comparable media giants currently trade for EV/EBITDA multiples of 7+ to more typical low double digits, vs WBD at 6.6.

Media company valuations (Seeking Alpha)

If we put a 10 multiple on $11B of EBITDA, then subtract $35B in net debt and divide by shares outstanding, the stock would trade north of $30/share, a huge gain. Even if we use Comcast’s low 7.2 multiple the stock could trade above $17/share, still a big gain.

An extra risk here is that the company will engage in a “merger of desperation” disliked by the market. For in-depth bull and bear views on WBD, see here and here.

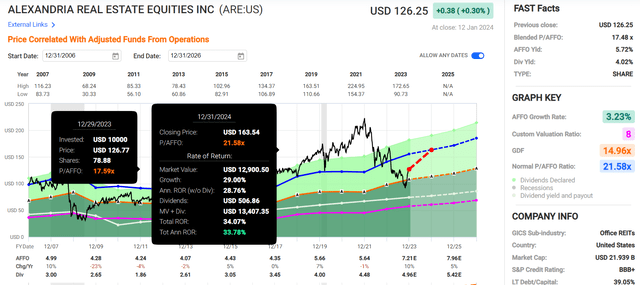

ARE: “REIT” was a dirty word in 2023, but “office REIT” was unspeakable

I had to put at least one REIT into this portfolio, as the general theme there for 2023 was high interest rates = bad performance. So there are still many REITS worth taking a close look at, even though they have rebounded somewhat once the FED became less hawkish. The worst of the worst have been the office REITs, due to another easily-identified theme: work from home.

The funny thing is, Alexandria (ARE) is not really an office REIT, it just gets grouped in with them (and I do own a pure office REIT but that’s material for another article). ARE owns highly specialized medical properties. Unlike regular offices, these facilities support work that cannot be done from home. For better or worse, it will continue to be a growth industry. ARE has a fantastic long-term record, and after the stock was pummeled last year, I am happy to own it at 30% possible return for 2024 (and that doesn’t imply it returns to anything near recent multiples, just the average 21.6x P/AFFO). Learn more here.

ARE potential return for 2024 (Fastgraphs)

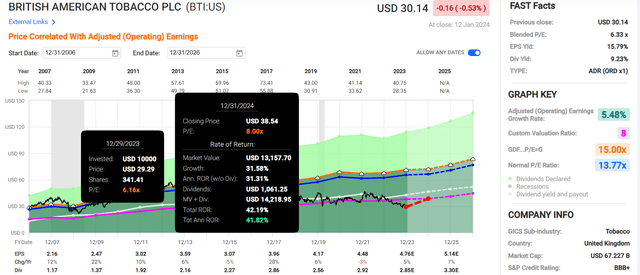

BTI: The Stock Hasn’t Been Smokin’

Historically it’s been a big mistake to shun the vice-iest of vice stocks, tobacco companies. If you consider total return, they have crushed the market long-term. Recently, performance has been poor and there may be signs that finally, this time it’s different. The big knock for decades has been that their core market, cigarettes, is declining and that they won’t be able to offset the market decline with price increases forever. We may finally be hitting that point of no return. BUT – until recently they didn’t have viable replacement products with a better risk profile, while now they do: Vape, heat not burn, nicotine pouches. And British American Tobacco (BTI) is investing heavily there – they do see the writing – everywhere, not just on the wall. We should also realize that in many heavily populated parts of the world, smoking is still widespread. Sure the alternative products won’t have the margins of tobacco sticks, but they remain addictive and humans like nicotine.

Even if the US does ban menthol as they’ve been threatening (they won’t IMO), it’s all priced in. Yes the company recently wrote down the value of acquired US brands. They had to face reality regarding their potential lifespan, but still expect them to last 30 years. I don’t expect BTI to go belly up anytime soon – neither do the ratings agencies (BBB+ S&P rating). It yields nearly 10% and trades for <7x earnings, so it priced for significant decline already. Don’t forget its stake in ITC as well. Even if it gets nowhere near historical average multiples, we can win here. If it gets back to 8x earnings by the end of 2024, we could be looking at >40% total return. The bear case is here.

BTI potential return for 2024 (Fastgraphs)

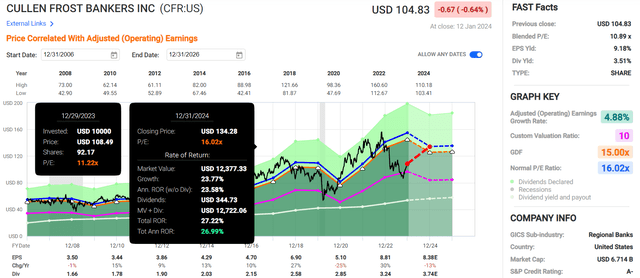

CFR: A Quality Regional Bank Thrown Out With The Bathwater

“Regional bank” was another dirty phrase in 2023. The Silicon Valley Bank’s blowup in March dragged Cullen/Frost (CFR) down more than 30%, along with most regional banks. Yet unlike SVB, CFR (as parent of Frost Bank) has a long record of conservative management and superior service (top-rated bank for customer satisfaction in its region for 14 consecutive years).

CFR is Texas-only, a positive in my book. But that also means we must be wary of energy and associated real estate over-exposure in what can be a boom-bust local economy. CFR has learned their lesson on that apparently as described in this excellent article. Yes, they have commercial real estate and office exposure. But I’d rather be exposed to this in Texas than many other places, with a proven conservative management culture calling the shots. I can easily see this returning north of 20%. More here.

CFR possible 2024 return (Fastgraphs)

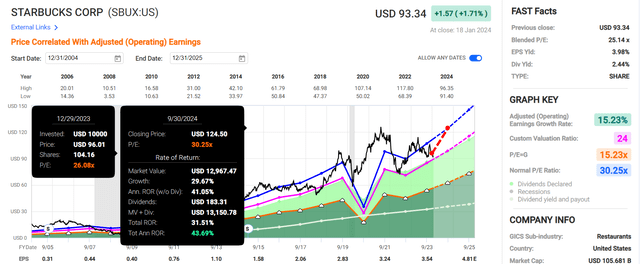

SBUX: Hiding In Plain Sight

No introduction needed; literally everyone knows Starbucks (SBUX) and most patronize it. It’s the Coke of coffee (I don’t hear anyone saying, “hey I’m going to Costa (KO)”). Yes there are plenty of competitors, but SBUX is still the king. Growth remains attractive even while questions swirl regarding China exposure, unionization, a new CEO, and reduced expansion opportunities.

SBUX’s brand power is undeniable. Between the US and China there are more than 50 million rewards club members and 75 million worldwide. This program provides loyalty and float in the form of preloaded card funds. The market loves to write off strong franchises like SBUX every time the crystal ball looks a bit cloudy. They’ve done it with Apple (AAPL) how many times now? Luckily I bought the stock during those periods. I think we could see a nice rebound here if sentiment tips positive. Note that historically a mid 20’s PE has signaled a good level to buy (pink line). Recent article here.

Potential 2024 return for SBUX (Fastgraphs)

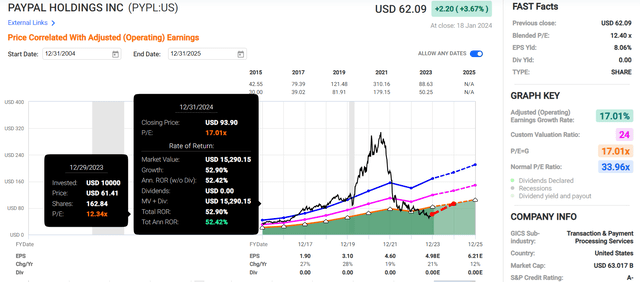

PYPL: Value Trap Extraordinaire?

Yeah, I know. This one just feels bad. Heck I’ve owned it since the eBay (EBAY) spinoff. I am still way up even though I didn’t sell nearly enough (i.e., all of it) when the price just got silly in 2021. Everyone now “knows” PayPal (PYPL) is washed up. But that is when I get interested, even if it’s only for a short while (I am uncertain if will continue holding this one if it gets a bump).

Bears point out that the active accounts are no longer growing, margins are declining, they made a horrible political decision (proposed fining users for ideas they didn’t agree with), and they can’t monetize a formerly interesting Venmo. Sure it looks cheap, it will only get cheaper say the bears.

Wildcard: new CEO Alex Chriss. A CEO who claims they will “shock the world.” Too promotional? Maybe. What if he’s right? A quarter of the world’s ecommerce transactions are still processed by PYPL. Chriss claims they know exactly what needs to be done. In fact, they are going to announce it in a few days, January 25. As I was writing this the stock bounced 7.3%, apparently in anticipation of the announcement.

Forget about past multiples – if this can get to a below-market 17x we are looking at 52% returns. If sentiment flips (maybe it already has), I think it will trade higher than that. Bull case here, bear case here.

PYPL potential 2024 return (Fastgraphs)

ULTA: Great Co, Core Holding, Beautiful Price

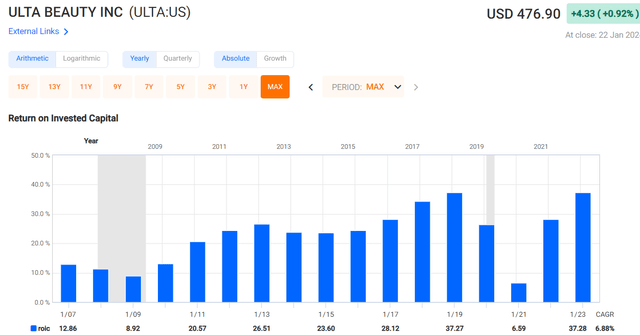

This one is a core holding of mine, as I have repeated success with well-run high-return retailers that delight customers and fill a niche. Others include Tractor Supply (TSCO) and TJX Companies (TJX). Ulta Beauty (ULTA), the largest specialty beauty retailer in the US boasts exceptionally high and growing ROIC of >30%.

ULTA ROIC (Fastgraphs)

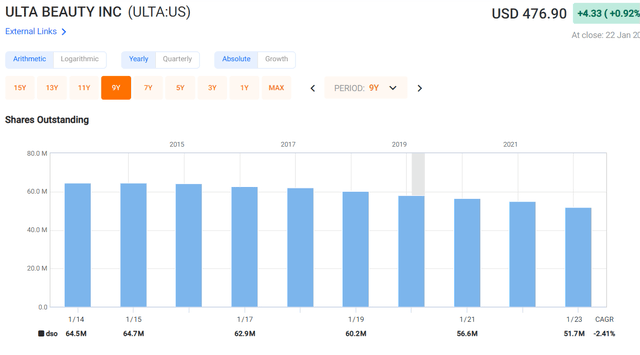

The company buys back significant stock as well.

ULTA shares outstanding (Fastgraphs)

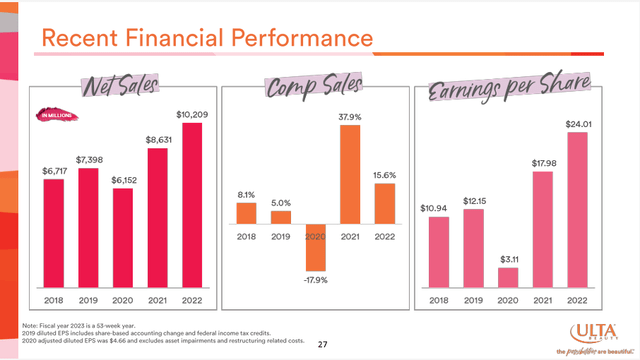

The stores use beauty services to draw customers who spend significantly more (3x) than regular walk-ins, along with a loyalty club second to none. More than 40 Million members generate 95% of sales. Associates are knowledgeable and cultivate the experience for their beauty-enthusiast shoppers. Besides the broad store footprint (1350 stores in the US) ULTA sells thru 355 Target (TGT) mini stores and has a strong online presence. Financial performance has been exceptional.

ULTA company presentation

So what’s the problem? Reduced discretionary spending, inflation, shrink problems. Competition from Sephora (LVMHUY) and a general view that the growth prospects are waning. Comparisons with the ’21 and ’22 rebound will be tough (look at those comps!). The company announced plans to expand to Canada pre-pandemic, but scrapped them in 2020 and refocused on the fast growing online platform. The market seems concerned that international expansion has not been reignited yet. I think it will be, and this is one possible catalyst for a sentiment flip.

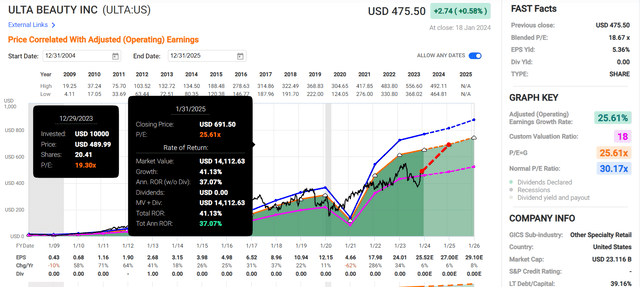

It’s been a good idea in the past to buy ULTA near current 18x earnings multiples (pink line). Any multiple expansion back towards its more typical mid-twenties trading range will produce good returns for 2024, but as I said I think this one is a keeper even if it doesn’t bounce this year. Baird, for one, is bullish. More in depth analysis here.

ULTA possible 2024 return (Fastgraphs)

The Wrap-Up

I think all of these stocks are worth a look for potentially significant rebounds in 2024. All are financially sound with attractive business characteristics, yet all underperformed in 2023. While I am a few weeks late in publishing this list (I didn’t start writing for SA again until early this year), most of them (other than PYPL) are flat to down YTD. So it’s not too late.

Year-to-date performance (Seeking Alpha)

Possible performance of 2024 “Left for Dead” portfolio (Author)

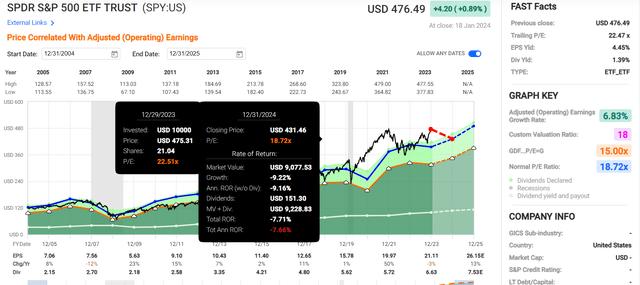

If they each follow the Fastgraphs illustrations shown above, the 2024 returns could be significant. While I can guarantee that the return numbers for 2024 will NOT happen as shown above, I think the odds of portfolio outperformance vs the S&P500 (SPY) are good. The S&P500 doesn’t look cheap, hence the potential negative return.

Potential 2024 S&P 500 return (Fastgraphs, author)

Risks here, besides those previously mentioned and what you can find listed in the companies’ 10k’s, are mainly that catalysts don’t emerge, sentiment doesn’t flip, and some or all of these stocks never return to their past glory or take a very long time to do so. As I stated above, this type of portfolio is a side bet for me. I already owned many of these stocks before creating the portfolio. The two that I would be most likely to sell on a large bounce would be PYPL and BTI, as I am not convinced either is as good a business as it once was. Thanks for reading and let me know your thoughts.