Andrii Dodonov

By Matthew Norton and Daryl Clements

A likely soft landing and rate cuts paint an optimal backdrop for the muni market in 2024.

The municipal bond market finished 2023 on a high note and its 2024 prospects look just as promising.

Munis whipsawed through sharp monthly selloffs and spikes for most of the year. In the end, the Bloomberg Municipal Bond Index returned 6.4% for the year, well above the 3.1% after-tax return for the Bloomberg 1-3 Month US Treasury Bill Index.

Unfortunately, munis’ rollercoaster year made many investors reluctant to return to the market, leaving just under $6 trillion still sitting in money market funds. Wary investors may also worry they’ve missed the rally.

But thanks to a favorable mix of historically high yields, expectations that the Federal Reserve will ease off higher-for-longer interest rates, and attractive credit spreads, munis have seldom held as strong a potential as they do today.

Falling Rates Ahead

The Fed left its benchmark fed funds rate unchanged in December, citing more victories in its war on inflation. Without committing to a concrete pivot, policymakers hinted at up to three possible cuts in 2024.

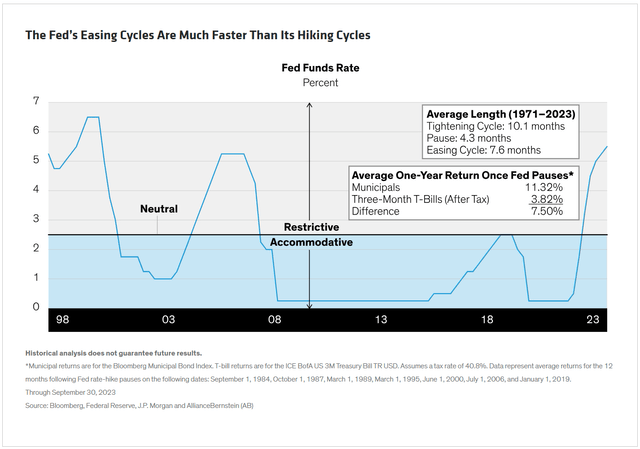

Once they start, Fed easing cycles tend to move much faster than hiking cycles. For example, rising rate periods have historically averaged 10.1 months, subsequent pauses about four months, and easing cycles just 7.6 months. Moreover, munis significantly outperformed T-bills after taxes over the 12 months following rate pauses (Display). With the Fed already in pause mode today, we think it’s time for investors to get off the sidelines and back in the market – and soon.

Muni Market’s Time to Shine

Even after their extended rally since late October, munis have considerably more room to run, in our analysis. Given current yields, munis should continue to outperform three-month Treasuries on an after-tax basis if interest rates simply stay where they are.

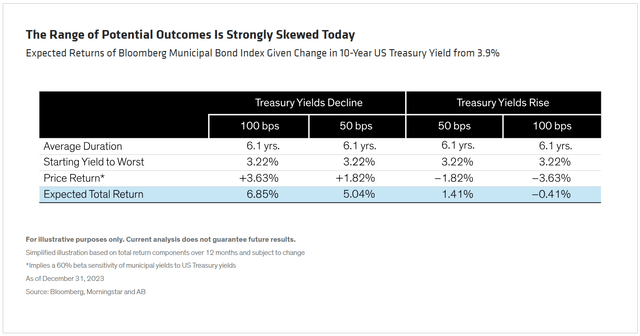

Municipal bond return potential looks even brighter if yields decline as we expect. If Treasury yields fall from current highs, we expect munis to benefit, thanks to the inverse relationship between yield and price.

For instance, even a decline of 50 basis points (bps) in Treasury yields over the next year could net a nearly 2% price gain for munis, for an expected total return of about 5.0%; a full 100 bps decline in Treasury yields would boost muni total returns to 6.9%. By contrast, Treasury yields would have to rise a full percentage point – an unlikely scenario in today’s economic environment – for municipal bond prices to fall far enough to offset their ample yield cushion (Display).

Muni Strategies Tailor-Made for 2024

In our view, today’s backdrop raises the question: What are investors waiting for? In this environment, several strategies can be effective for getting the most out of your munis.

Extend your duration target: Longer duration will be especially beneficial to bond prices if yields head lower in 2024, as we expect them to.

Consider a barbell maturity structure: Although there’s no all-weather maturity-structure strategy, in the current environment a barbell can harness today’s inverted yield curve without increasing interest rate risk. For instance, investing in one- and 15-year munis in equal amounts currently yields more than an eight-year bond, but with the same sensitivity to interest-rate changes.

Look to muni credit: These include BBB-rated bonds, which offer significantly more yield than higher-rated issues. This spread has widened slightly in recent months and remains compelling compared to long-term averages. Be selective with credit, however, since issuer fundamentals can vary.

Headlines have suggested a fiscally cloudy picture for many states and cities, whose tax revenues have been strained. But muni issuers overall are in their best financial health in decades. While we don’t currently expect a recession, we believe states are recession-ready. They’re also inherently resilient to fiscal challenges, which is why muni issuers have rarely defaulted.

Stay flexible: Given the significant rally in municipal bonds, muni investors should consider rotating into US Treasuries, as certain maturities offer an after-tax yield advantage over comparable munis. Since the relationship between munis and Treasuries is highly variable, be ready to toggle back when munis again cheapen relative to Treasuries.

Municipal bonds have had a strong run lately, but there’s still a lot left in the tank. Though there’s rarely a perfect time to invest, today’s high yields, along with expectations of a soft landing and rate cuts, make for a timely opportunity for long-term municipal bond investors.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.