tadamichi

By Sharat Kotikalpudi

Rate cuts don’t happen in a vacuum – staying nimble with asset allocation can help investors adapt.

Although inflation continues to wane in most global economies, it could be some time before monetary policy easing starts in earnest. Still, interest rates have probably peaked – it’s now just a question of when rate cuts will start.

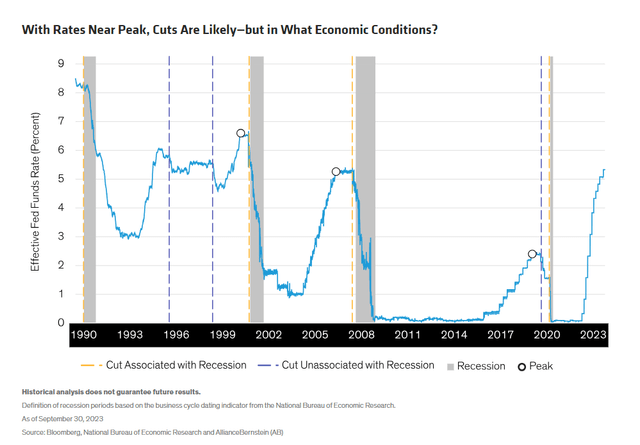

The economic backdrop for rate cuts matters too. Monetary policy easing can happen in two possible climates, recession or growth, and in recent decades those climates have prevailed with pretty much equal frequency – particularly in the US.

For example, in the seven Federal Reserve easing cycles since 1990, four were linked to recessions and three to relatively healthy economies (Display 1).

What outcome will we see this time? For much of 2023, recession dominated expectations; recently, the view has shifted to slow growth for 2024.

Consensus expectations don’t necessarily play out, but the underlying economic regime when rate cuts happen has made a big difference in performance patterns across asset types. We think multi-asset investors should be ready to adapt to either scenario.

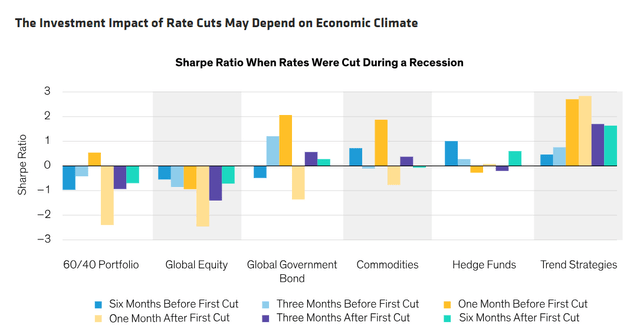

More Asset Types Struggled During Recession-Era Rate Cuts

Our research shows that rate-cut periods leading up to recessions have been the most challenging, though some assets have done well.

Based on Sharpe ratio, a common measure of risk-adjusted return, equities struggled in the six months before and after the first cut.

Global government bonds, in contrast, have been effective, except for hiccups at six months before and in the first month after cuts begin. Still, equities’ shortfall left a diversified 60/40 strategy underperforming (Display 2, top).

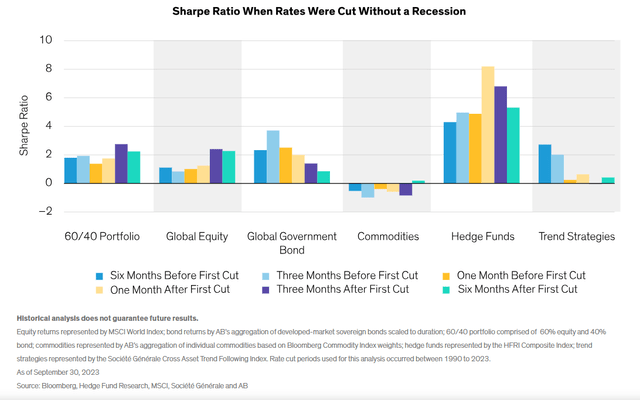

When rate cuts occur in the absence of a recession – the current central case – they’ve provided stronger support for investment performance.

Except for commodities, an easing cycle in a growing economy has historically pushed most asset classes higher for the 12-month period surrounding the first cut (Display 2, bottom).

Some diversifiers have also excelled more in certain environments – hedge funds and trend strategies, for example. Trend-following strategies have historically done better in recessionary climates, as they’re designed to help protect portfolios during downturns.

Since hedge funds are the most uncorrelated to other assets, they typically do better during unstressed markets, which is why they’ve outperformed during rate-cut periods not associated with a recession.

We believe that this behavior, and the low correlations among these and other alternative assets, has enabled them to enhance the risk/return of a diversified strategy.

Embracing the “Less Exceptional” with a Multi-Asset Approach

Extremes in inflation, interest rates and monetary policies created a roller-coaster ride for most asset types through 2023.

Recent data show markets and economies continuing to normalize, and the investment climate has historically tended to improve relatively quickly once interest rates peak.

Bonds rallied recently as yields fell and prices rose, but we still see room to run. Investors, however, should be selective when adding duration exposure, given the lingering rate uncertainty.

We also like the outlook for risk assets such as equities – markets soared in 2023 on the narrow coattails of seven stocks, but should benefit more broadly from falling inflation.

From a big-picture perspective, slow economic growth is widely expected in 2024, but it’s not a given. That means multi-asset investors need to stay nimble to respond to changing market conditions, which could still include higher-for-longer rates and a few surprises.

Considering how assets behave differently in two distinct post-peak environments, we think active diversification offers the potential to enhance performance no matter which scenario unfolds.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.