SafakOguz

Business Overview

Mueller Industries (NYSE:MLI) is a prominent global manufacturer of copper, brass, aluminum, and plastic products, operating across three distinct segments.

-

Piping systems segment- Under this segment the company produces and distributes pipe, tubes, valves, and connections for residential and commercial construction markets.

-

Industrial metals segment- Under this segment the company produces and distributes brass rods, precision tubes, and other industrial-use products for transportation and heavy equipment end markets.

-

Climate segment- Under this segment the company produces and distributes valves, brass fittings, and flex ducts to Heating ventilation, and Airconditioning or Refrigeration (HVAC/R) OEMs.

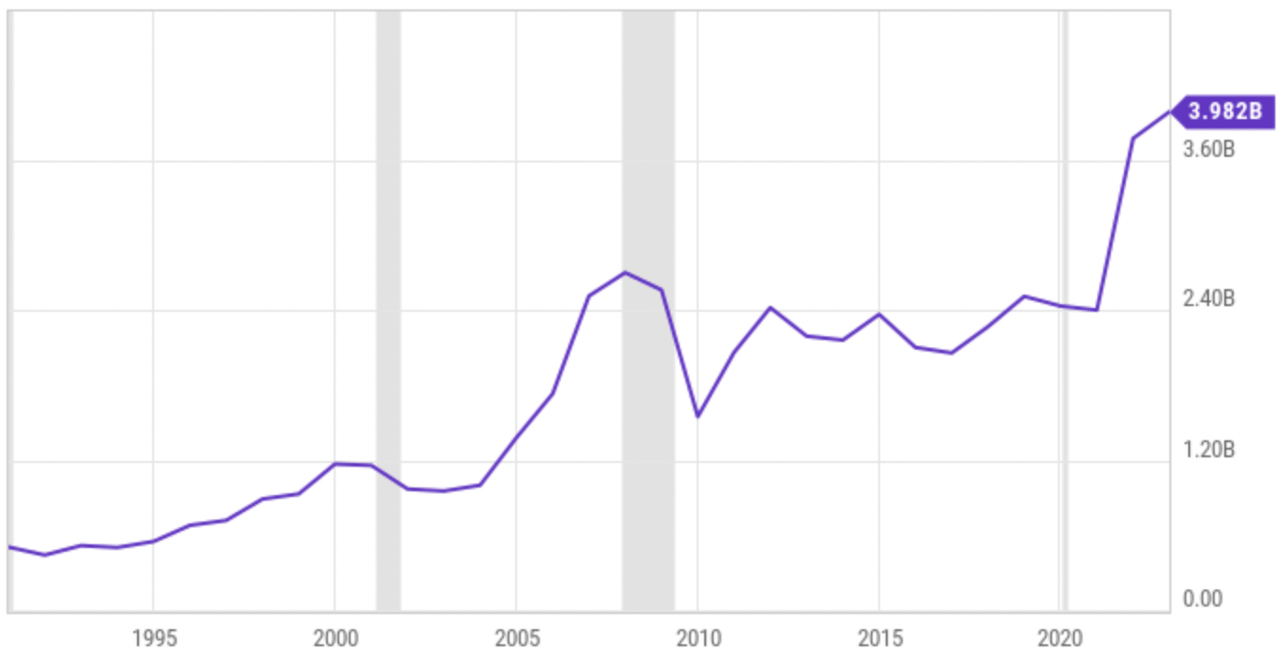

Among all three segments, the piping system segment contributes the most to the overall revenue and profitability, followed by the climate segment and then the industrial metal segment.

FY22 revenue by segment (without intersegment elimination)

Investor presentation

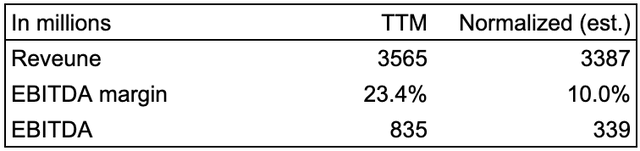

Mueller Industries exhibits a high concentration of end-market exposure in the building and construction industry, particularly in plumbing and HVAC/R, accounting for approximately 87% of its revenue. Additionally, the company has substantial exposure to industrial manufacturing (6%) and transportation (5%) end markets.

Revenue by end markets.

Investor presentation

Source: Investor presentation.

Financials

MLI experienced remarkable growth post-pandemic, driven by a favorable macroeconomic environment. Given its significant revenue share from the building and construction industry, the company capitalized on heightened construction activity in both residential and non-residential markets. Furthermore, the surge in the HVAC industry significantly contributed to the company’s impressive growth in both the top and bottom lines.

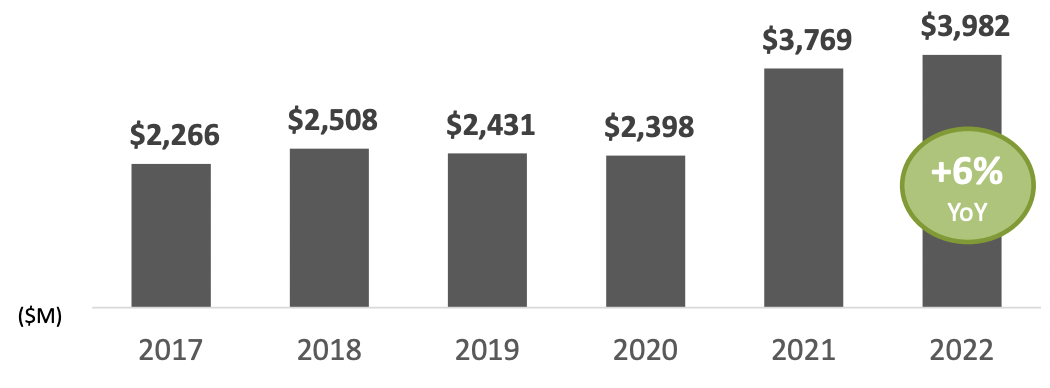

The company experienced substantial topline growth, increasing from $2.43 billion in 2019 to $3.98 billion in 2022. While the revenue growth is impressive, a significant portion is attributed to price hikes, driven by rising input costs, which the company successfully passed on to its customers. These price adjustments not only offset the impact of input cost inflation but also led to a remarkable expansion in margins. MLI’s EBITDA margins more than doubled, rising from 9.74% in 2019 to an impressive 23.04% in 2022.

MLI’s last 5 years’ annual net sales

Company presentation

The combination of topline growth and expanding margins led to an impressive nearly 500% enhance in diluted EPS, rising from $0.9 per share in 2019 to $5.49 per share in 2022.

Earnings might not be sustainable

While MLI has experienced rapid profit growth in recent years, there is skepticism about the sustainability of these high levels in the coming years. The company benefited from favorable macroeconomic conditions, but with the shifting economic landscape and indications of an impending downturn, I expect that MLI’s topline may face challenges in the near future.

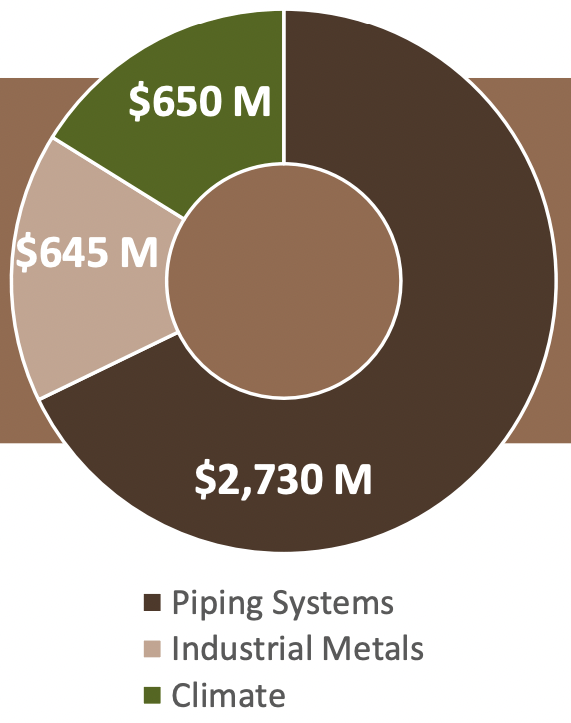

Historically, MLI has faced a significant reject in its topline during economic recessions. The accompanying graph underscores the consistent impact on the company’s revenue whenever there is a macroeconomic slowdown.

MLI’s historical Net sales

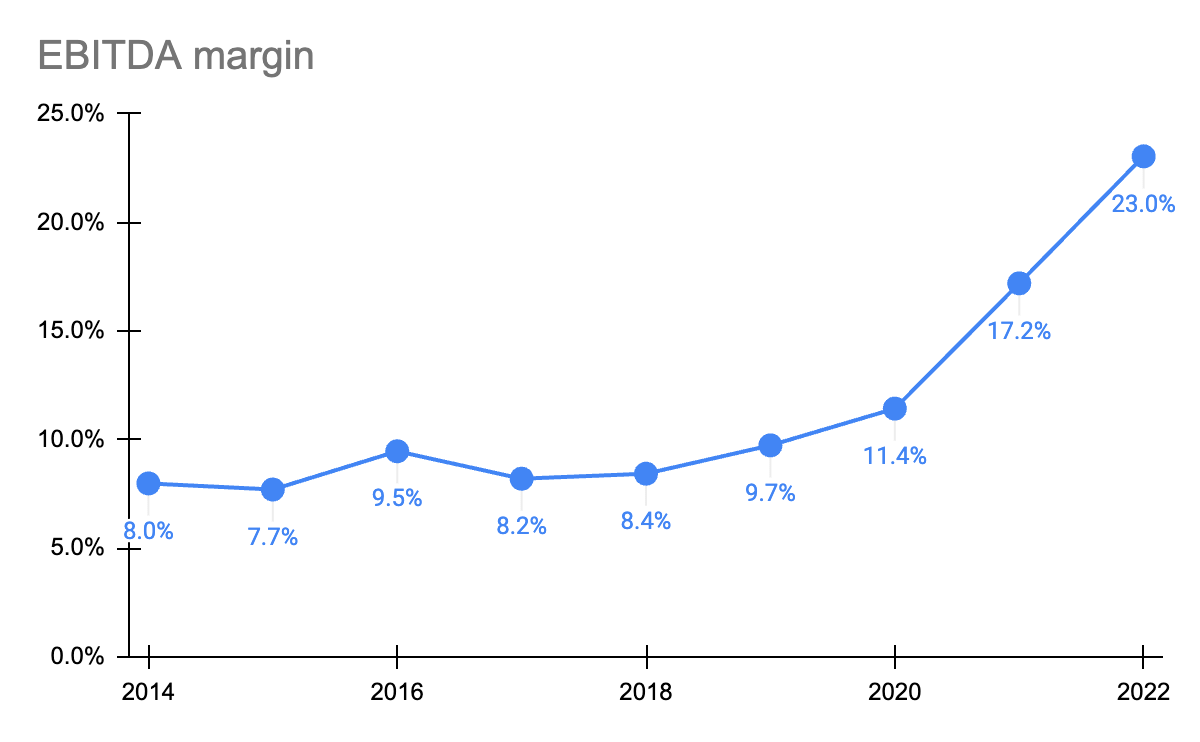

Furthermore, MLI’s organic topline growth has not been encouraging. In the pre-pandemic period from 2014 to 2019, the company reported an average organic topline growth of -2.28%. This indicates that MLI’s business has matured, presenting limited avenues for growth. In the face of a challenging macroeconomic environment, I believe that the company may go through either stagnant or declining topline figures.

Similar to the top line, I expect a normalization of the company’s margins in the coming years. MLI maintained EBITDA margins in the range of 7.7% to 9.7% from 2014 to 2019 (normalized EBITDA margins). In 2022, the reported EBITDA margin was 23.04%, significantly surpassing the pre-pandemic range. With expectations of a stabilized or worsening macroeconomic landscape, I believe that the company may go through a deterioration in margins.

Source: Company filings, BI Insights.

Valuations

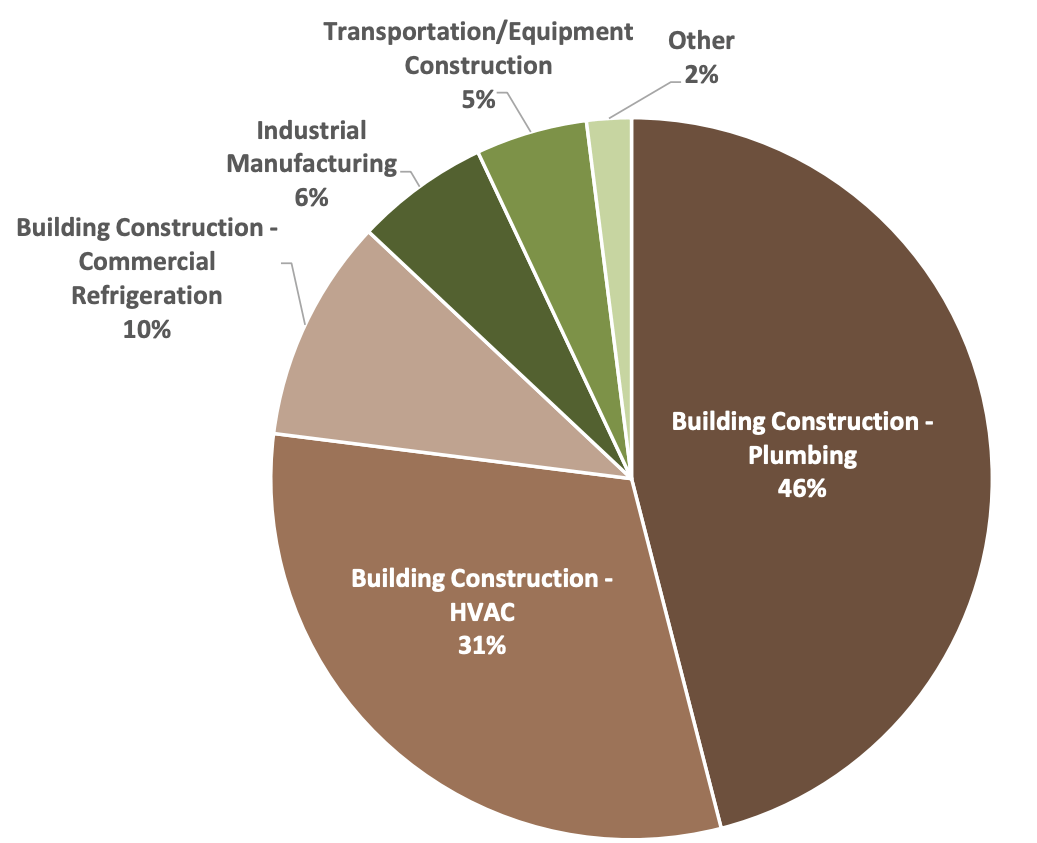

MLI is presently trading at a relatively low TTM EV/EBITDA multiple of 4.55x, which appears inexpensive compared to the sector median of 12.21x. However, the current EBITDA is deemed unsustainable, making the TTM EV/EBITDA multiple potentially misleading. As outlined in this article, projections suggest that MLI is poised for a reject in both topline and EBITDA margins.

For modeling MLI’s normalized EBITDA, we should consider a nominal decrease in topline and a normalized EBITDA near the upper end of the EBITDA range of the pre-pandemic level. I believe a 5% decrease in TTM topline and 10% EBITDA margins to be a reasonably conservative assumption to value MLI.

Normalized EBITDA calculation

Given MLI’s enterprise value of $3.77 billion, we achieve at a normalized EV/EBITDA multiple of 11.12x, which is almost in line with the sector median of 12.21x. Therefore, I believe the stock is appropriately priced.

Bottom line

On the surface, MLI looks admire a lucrative investment with its seemingly dirt-cheap valuation. However, the problem is that the earnings on which the current valuation numbers are based are not sustainable. I believe these elevated earnings are likely to fall as macroeconomic challenges arise. Based on the normalized EBITDA figures, I come to the conclusion that MLI is appropriately priced. Hence, I would prefer to stay on the sidelines and one should act caution before buying the stock solely based on low valuation.