RHJ

China announced export controls on the export of two rare earth metals in early July 2023. Since then, MP Materials (NYSE:MP) stock price has sagged, despite being North America’s largest operational rare earth mining operation.

In late December 2023, China announced banning exporting of certain technologies related to rare earths processing. It may be a good time to revisit MP – market interest in this company has waned, which is evident in the sparse coverage on this stock from the big investment banks in recent months. Does the current lull provide a good buying opportunity?

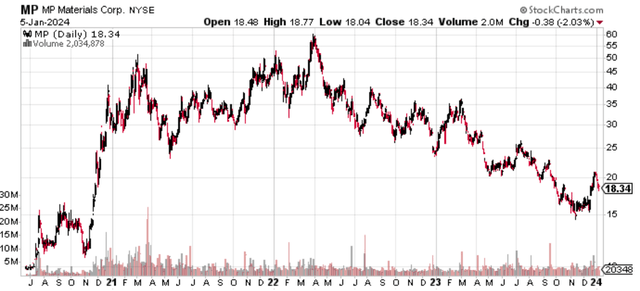

Lackluster stock price performance

MP was listed in 2020 and its stock price hovered between $10-$15/share. In late 2020, as the prices of rare earths such as neodymium and praseodymium (NdPr) soared during the “everything bubble”, MP surged to $60 by March 2022. Since then it has disappointed bulls and fallen to $18/share.

This presents both an opportunity and a warning:

- On the plus side, if MP is a good investment opportunity, investors can buy at a substantial discount to the stock price a year or two ago.

- On the flip side, MP is heavily impacted by commodity prices (namely NdPr). During the commodity boom in 2021, it seemed like commodity prices were at a permanent higher level but that turned out to be not the case. As we will see below, NdPr prices have reverted lower to historical levels.

MP materials stock price (stockcharts.com)

MP’s revenues are highly concentrated in NdPr related rare earths, the prices of which have declined since the COVID-19 boom and are back to historical levels

Per MP’s FY22 annual report, the Company historically generated revenues almost entirely from rare earth oxides (REOs), namely bastnaesite concentrate, which was sold to refiners. This REO is mainly refined into NdPr. Therefore MP’s past financial performance has mainly been driven by NdPr prices. These are mainly used in magnets which are used in electric vehicles, wind power etc.

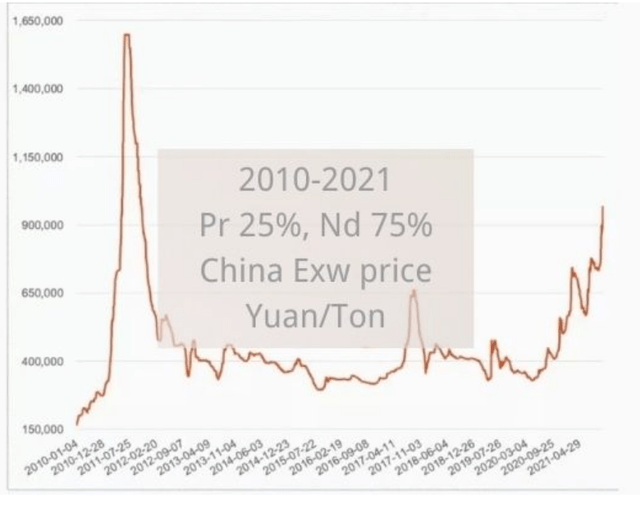

Below is a chart of Neodymium prices from 2012 to 2023 which is used as a proxy for NdPr prices as (i) there is no open-source information for relatively recent NdPr prices (a chart below is provided for 2010-2021 to give a sense) and (ii) NdPr is mainly comprised of Neodymium, with Nd2O3(Neodymium oxide) accounting for 75% with the remaining 25% from Pr6O11 (praseodymium oxide)), the COVID-19 boom and shortages saw prices nearly triple and MP’s stock price surged as well, but both Neodymium and MP stock price have fallen back to earth.

Given that commodity prices are often cyclical rather than in a secular uptrend, it’s prudent to buy when prices are at the low end of the cycle rather than after prices have experienced a massive run-up.

Neodymium prices from 2012 to 2023

Neodymium prices from 2012 to 2023 (tradingeconomics.com)

NdPr prices from 2010 to 2021

NdPr prices from 2010 to 2021 (online)

Current stock price is fairly overvalued under pessimistic assumptions. Potential upside is “free”.

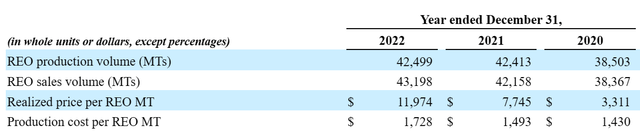

Historical results in 2020 to 2023 were mainly driven by price fluctuations rather than volume increases. Production/sales volumes have only slightly increased in 2022 vs 2020 by c.10%, while higher realized prices for REO per ton were the main drivers of revenue growth.

MP sales and production 2020-2022 (MP annual report 2022)

Future upside will mainly come from internal factors: (i) buildup of inhouse processing capabilities; (ii) production volume increases; and to a lesser extent external factors: (iii) potential demand outstripping supply; (iv) tensions between US and China:

(i)Buildup of inhouse processing capabilities:

- According to DB’s report on MP in Nov 2023(“Stage 2 first shipments; Expansion capacity in the US Medium-term” by Deutsche Bank), if MP builds out its processing capabilities, assuming (i) 100% inhouse processing by 2025; (i) REO production volume is still unchanged at 42k tons a year, (ii) NdPr prices of $83k/ton in 2025, then by 2025 MP can generate $369 million EBITDA per year.

- I would tend to use a more conservative NdPr price – for each $10k/ton decline, EBITDA would be lower by $60 million. So we assume the future NdPr price is $60k/ton (which is more in-line with its historical levels pre-COVID), then MP’s EBITDA would be $230 million in 2025.

(ii) Production volume increase:

- In Nov 2023, MP Management announced plans to increase production volumes by 50% over a 4 year period. Assuming SG&A costs remain unchanged and the gross margin increase would be $194 million @ $83k/ton.

- Again, assuming $60k/ton NdPr prices, this would fall to roughly $100 million gross margin increase.

- Assuming both (i) and (ii), EBITDA would range from $330 million (at $60k/ton) to $563 million (at $83k/ton). I am assuming net debt zero (Sep-23 cash is at $1.1bn, while long term debt is at $0.7bn, assuming growth capex uses up most of this cash in the next few years, which is more or less in-line with Management’s capex estimates).

- Current market cap is $3.3 billion, assuming EV is same as market cap given net debt zero, then EV/EBITDA of roughly 10x in about 2-3 years assuming pessimistic NdPr pricing (i.e. in line with historical averages) is not too high a valuation (6x assuming DB’s relatively optimistic prices for NdPr)

Level of certainty: I am relatively comfortable that MP will achieve its internal goals, given that

- It has a long operating history: As the Company’s annual report reminds us “Mountain Pass represents the largest commercial source of rare earth materials in the Western hemisphere” and it has been in production since 1952. This is not a may be, might be, could be mine but an actual mine with a 70 year history. This sets it out against smaller cap competitors which are often more speculative. According to MP’s annual report, it estimates another 34 years of mine life at current mining levels, so it has ample reserves to be producing for quite a while.

- It has already begun processing operations and has produced 50 tons of NdPr in Q3-2023. This is expected to rampup in the next two years.

External factors: potential demand outstripping supply or US/China tensions boiling over in the rare earths sector are wildcards and relatively less likely. The market is literally giving away these for free. Per Oxford Institute of Energy Studies, China produces 60% and refines nearly 90% of the world’s rare earth elements. MP is best positioned to capture market share from China.

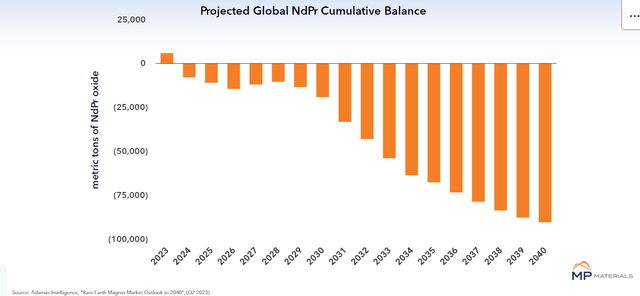

MP’s external presentations (which you can find on its investor relations page) suggest that the demand for NdPr will massively outstrip supply.

NdPr supply demand (MP investor presentation)

Risks:

Company specific:

1.Company forecast may not fully materialize: Whether the Company can achieve its production volume growth and whether profitability will increase as part of the rollout of its processing capabilities are still unknown. Per the Q3-2023 report, the Company is still in an early stage with regards to ramping up the processing capabilities. While it appears MP Materials has a longer track record and I am more comfortable with its projections, there is still uncertainty over how these will translate into actual profitability.

2. “Fallen Angel” effect: MP may be considered a “fallen angel” given that market enthusiasm carried it to unsustainable highs in 2022 and it declined 70% from the peak. Investors may require a higher level of proof before bidding this stock up again as they have been burnt once already.

Macro-level

1.NdPr Prices languishing at historical level:

From 2012-2020, NdPr prices have been unglamorously flat for most of the time. As discussed above, if NdPr prices are at $60k/ton (which is within the range that prices traded between 2012-2020), then MP would earn just enough to justify its market cap (and if prices are even lower, then its future earnings potential may not justify its market cap). NdPr prices could remain subdued due to several reasons:

- Supply growth: As Western countries have become more focused on supply chain security, more effort has been made to develop mines locally. This may increase supply.

2.Rare earth magnets becoming obsolete

There is an often mentioned risk point of Tesla potentially shift away from using rare earths in its magnets.

I would assess that it is not a major threat as the product is only a small part of overall value chain. Tesla announced in March 2023 they may be able to reduce or eliminate usage of rare earth metals in magnets. However, this is probably not too big a concern for automakers in general. A standard car uses 1kg of NdPr oxide and an EV may use up to 2kg. Even at $83k/ton, this is $83/kg, this would be about $166/car, which is still a very small portion of an automaker’s production costs. Struggling for market shares when every major player is pushing multiple EV models might be a bigger priority for automakers rather than pinching for pennies on NdPr.

Summary:

MP is an interesting stock to hold in a diversified portfolio. It is definitely not a stock for those with lower risk appetites. In the worst case scenario, this stock could languish at its current prices or lower for years. However, it does appear possible that this stock could experience tremendous growth as a result of American efforts to become more independent in critical minerals amidst simmering US-China tensions.