bymuratdeniz/E+ via Getty Images

MoonLake Immunotherapeutics (NASDAQ:MLTX) is a Swiss biopharmaceutical company established in 2021 focused on nanobody development with its drug Sonelokimab (SLK). This product has demonstrated positive results in clinical trials for three indications: psoriasis (PsO), hidradenitis suppurativa (HS), and psoriatic arthritis (PsA). SLK is an IL-17 inhibitor, smaller than traditional antibodies, offering targeted and efficient inflammation reduction with extended effects. The market for IL-17 inhibitors is projected to be over $50 billion by 2031. MLTX is prepared to deliver its SLK product shortly to efficiently treat inflammatory disease patients and finally fulfill long-unmet medical needs. This, coupled with its strong balance sheet and significant market potential for its IP, makes MLTX a “buy” at these levels.

Business Overview

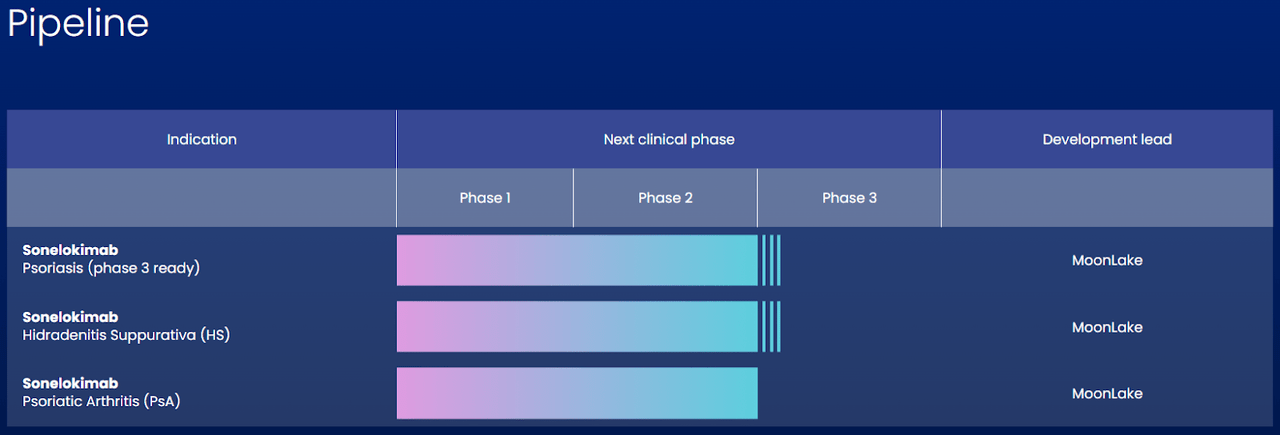

MoonLake Immunotherapeutics is a clinical-stage biopharmaceutical company headquartered in Switzerland. The company was founded in 2021, with an IPO in April 2022. It focuses on developing treatments for inflammatory conditions. Its principal research product is Sonelokimab, a nanobody in Phase 2 clinical trials with positive results as a therapeutic solution for psoriasis (PsO) and hidradenitis suppurativa (HS). The company expects results for another clinical trial called ARGO for Sonelokimab indicated in Psoriatic Arthritis (PsA). By the end of 2023, MLTX anticipates moving forward with Phase 3 for the three applications. The company aims to evolve a single drug for multiple indications to address a market size of over $5 billion, considering only HS and PSA.

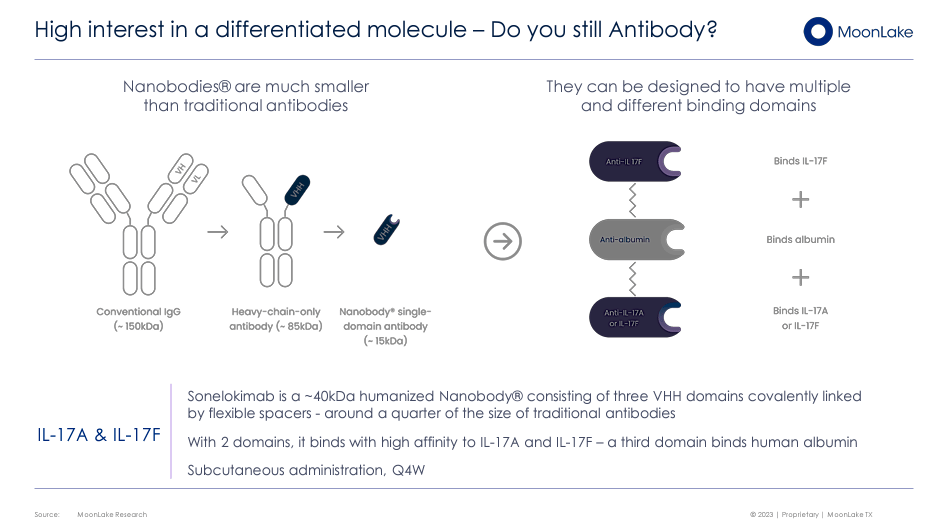

Sonelokimab (SLK) is a genetically engineered agent similar to human antibodies with a molecular weight of approximately ~40kDa, smaller than traditional antibodies, to reduce the risk of immune reactions. The nanobody composition allows it to orient itself to allow optimal binding to inflammatory cytokines (cell-signaling proteins) of the IL-17 family to reduce inflammation. Sonelokimab also binds to human albumin to extend its life in the human body and be effective for a longer time. This property allows a more convenient administration plan. For these characteristics, MLTX claims that Sonelokimab, with its nanobody structure and binding capabilities, is more efficient in reducing inflammation with a more lasting effect than traditional antibody therapies. Additionally, MLTX partnered with SHL Medical to enable home treatment by developing an autoinjector for the Sonelokimab’s commercial supply.

Corporate Presentation – October 2023

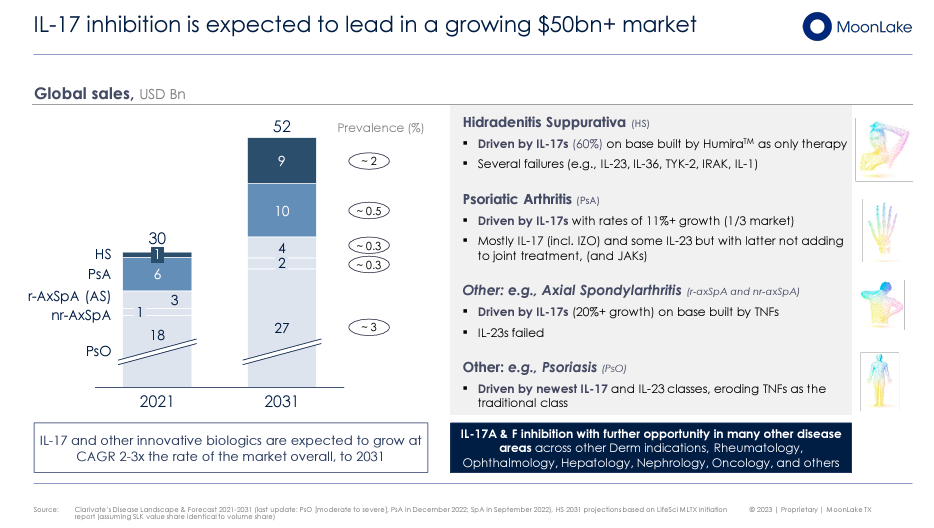

Furthermore, the market of IL-17 inhibitors is projected to be over $50 billion by 2031. IL-17 pathway is significant in various inflammatory and autoimmune disorders such as HS, PsA, PsO, and additionally for Axial Spondyloarthritis (AxSpA). The PSA market alone is estimated at $6 billion, with a forecasted growth of $10 billion post-2030. These inhibitors could also treat other inflammatory diseases in dermatology, rheumatology, ophthalmology, hepatology, nephrology, and oncology. The development of these therapies can improve outcomes and quality of life for inflammatory and autoimmune disease patients.

Corporate Presentation – October 2023

Shifts in Biopharma: Trials, Triumphs, and Takeovers

On September 11, 2023, the biotech Acelyrin (SLRN) reported failure in the clinical trial with its izokibep drug indicated for HS. These results favored MLTX due to the positive results of Phase 2 for Sonelokimab, and its shares surged by 19%. On September 17, a third competitor, UCB’s bimekizumab, also an IL-17 inhibitor, was already commercialized in the EU for plaque psoriasis, PsA, and AxSpA. Sonelokimab was expected to deliver best-in-class results for the Phase 2 clinical trials for PsA released in November. However, MLTX stock fell 29% after those results were published because investors suggested it needed more detailed placebo response data, even when the trial results were positive. After all, it was difficult to draw clear conclusions since some patients in the placebo group were on other medications that might have contributed to their symptom reduction. In Q1/Q2 2024, the 24-week data for the PsA clinical trial is expected to be released.

On December 5, MLTX shares increased by 6% after rumors of a potential takeover by an unknown acquirer. MLTX has a market capitalization of $2.8 billion with an expected cash runway that management expects is enough until 2024. The company ended the third quarter with $496.0 million in cash, cash equivalents, and short-term marketable debt securities, which is expected to be sufficient for Phase 3 programs in HS and PsA to be ready to submit data for regulatory approval.

Quality at a Premium: Valuation Analysis

As a clinical-stage company, the stock has no revenues, as is usually true for such companies. Therefore, to value the stock, the best approach is to use a multiples-based valuation. For this, let’s consider its book value, debt, and enterprise value and the multiples derived from them. In MLTX’s case, debt is essentially non-existent, as it holds just $169.42 thousand in debt. As a result, the implied enterprise value for the company is $2.88 billion due to its net cash position. However, MLTX’s stockholders’ equity is just $424.90 million. This means that MLTX currently trades at a P/B ratio of 6.78, which is notably higher than the sector’s P/B multiple of 2.06.

Moreover, the company’s cash burn rate can be estimated by adding the cash flow from operations and net CAPEX. In MLTX’s case, I assess its quarterly cash burn was $9.30 million, which is $37.20 million annually. Juxtaposed against the current cash reserves of $496.00 million, this implies a cash runway of 13.33 years. Naturally, this assess indicates that MLTX has more than enough cash to fund its operations for the near future. This is particularly promising after considering that its IP portfolio is close to either finalizing Phase 2 trials or is already in Phase 3 trials. It’s impossible to forecast how long Phase 3 trials will last for MLTX, but usually, these take between one to four years. Hence, MLTX should have enough funds to see through its product pipeline until FDA approval, barring any major setbacks. In fact, these funds should also be more than enough to fund investments in production capacity, assuming they get FDA approvals for their pipeline.

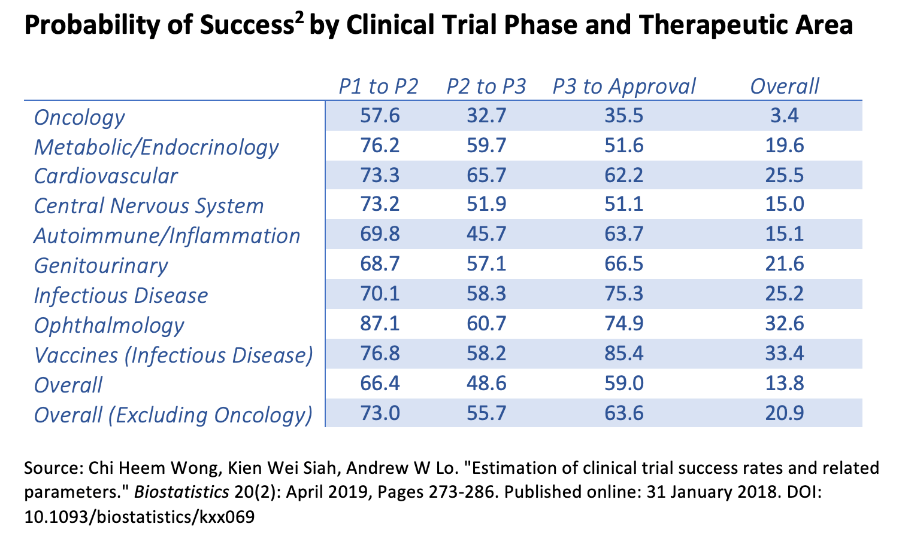

American Council on Science and Health

This leaves us with a particularly challenging valuation equation because the company is indeed sufficiently funded to see through its research until eventual FDA approvals. Moreover, there’s a relatively clear path to such approvals as the approval rate of Phase 3 clinical trials is fairly promising. Excluding oncology Phase 3 trials, the approval rate is 63.6%, which is encouraging, particularly considering that MLTX has three potential drugs close to or at Phase 3. Thus, we can make a rough assumption that it’s reasonable that at least two out of the three drugs being developed will get an eventual FDA approval. Naturally, this assumption has limitations but is a reference point for our valuation.

For context, the market size for psoriasis treatments was estimated at $26.77 billion in 2022, with an expected CAGR of 8.8% until 2030. This, by itself, shows the significant potential for MLTX, assuming its adoption rate is favorable. It’s difficult to assess MLTX’s market share in this market, but even a relatively small share should be enough to modify MLTX into a viable investment. Biotech usually has larger margins than average businesses due to the barrier of entry from IP, but even a 10% net margin would be fantastic for MLTX. If it captures just 10% of the total market, it would give MLTX over $1 billion in revenues and over $100 million in earnings. These are just reference points that showcase MLTX’s valuation potential, which is why I think it’s a good investment at these levels despite the inherent risks of biotech.

Investment Thesis Risks

Nevertheless, I think the main risk is that MLTX depends entirely on Sonelokimab in one way or another. Naturally, this makes their IP correlated, which is a double-edged sword. If one research project gets approval, it’s possible that the odds of the remaining two getting approvals as well should enhance. Likewise, if rejects occur, the odds for the remaining applications could decrease accordingly. Of course, this is an oversimplification, as the same principle can be viable in a particular treatment but inappropriate in another situation. However, there’s certainly a correlation involved. As such, if Sonelokimab shows early disappointments in Phase 3, it could expose investors to substantial downside risk as the whole product pipeline is Sonelokimba in one way or another.

Moreover, I also think that a major risk of MLTX is the time it’ll take to get FDA approvals and commercialize the drugs themselves. This is not a unique company risk, but if MLTX takes longer to get approvals than the average biotech company, the present value of the future cash flows would be lower, decreasing the fair value of MLTX. Moreover, the Phase 3 approval rate is generally encouraging. Still, if MLTX’s particular IP results are trickier than the average, the success rate could be estimated as lower than the average. Thus advocate reducing the company’s present expected value. Given that the stock already trades a multibillion-dollar valuation even though MLTX is still a pre-revenue venture, I’d argue that a lot of upside is already being priced in, which somewhat limits future upside.

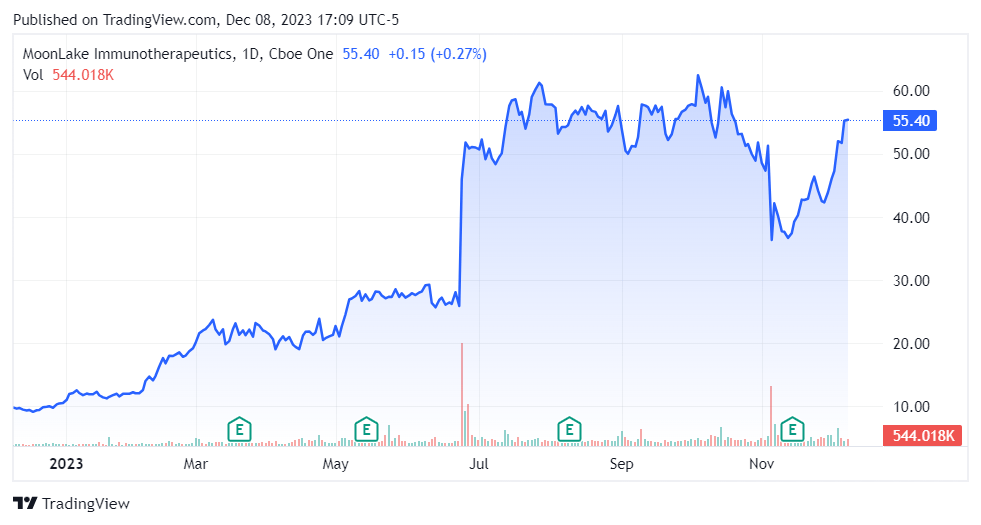

The market appears to be optimistic about MLTX’s prospects (TradingView)

Conclusion

The company has an exceedingly promising product pipeline targeting a large market. As I mentioned in the bullish thesis, the odds are in MLTX’s favor that it’ll eventually get FDA approvals for some, if not most, of its IP, purely from a probabilistic perspective. Of course, such analysis has limitations, but as investors, it’s a good starting point to glean into MLTX’s risk and reward profile. In my opinion, MLTX is a well-capitalized company with enough resources to see through its IP until FDA approval, which lowers its risk profile considerably. Also, most of its IP is in Phase 3 or close to Phase 3, advocate decreasing risks. When we juxtapose this risk profile against the promising market potential of its IP, MLTX emerges as a viable investment in biotechnology at these levels.