Tharakorn/iStock via Getty Images

MoonLake Immunotherapeutics (NASDAQ:MLTX) has licensed novel nanobody technology to address a couple of inflammatory diseases in major markets, taking on the burden of further developing and commercialising the technology. In theory, there might be an interesting value gap between current valuations, net of all dilutive and other considerations, and the potential market size. But being in Phase 3 trials only starting now, there are development risks, and the method to calculate market sizing, using disease burdens and assuming full-value capture, tends to be optimistic. It’s not obvious that MLTX is too expensive, but there are still risks and substantial dilution as a mitigating factor.

Product and innovation

The therapeutic focus is Psoriasis (PSO) and Hidradenitis suppurativa (HS). These inflammatory diseases have some things in common. They are both inflammatory, immune mediated chronic diseases, mostly affecting the skin and peripheral joints when we talk about PSO, while for HS the main problems occur on the skin. We want just to mention, that PSO is a serious systemic disease, which means that it is not only localized on skin and joints, but also it is often linked with other organ system diseases (metabolic problems, cardiovascular diseases etc.). Another thing in common is that both of the diseases have interleukins 17A and 17F (IL-17A and IL-17F) as a main role players in the pathophysiology mechanisms of the diseases. In case if you are wondering what interleukins are, you can think about them as molecules in our body, whose role is to act as messengers when something is wrong (messengers of our immune system). So in these two diseases, PSO and HS, IL-17A and IL-17F are the main culprits for inflammation processes, and therefore they are suitable to be potential targets when we talk about developing new therapeutic agents.

This was the idea of MoonLake Immunotherapeutics, a clinical stage biopharmaceutical company from Switzerland. By using newer therapy approaches and advanced technology, they want to make an antibody which is designed to inhibit Il-17A and Il-17F and therefore provide disease remission phases.

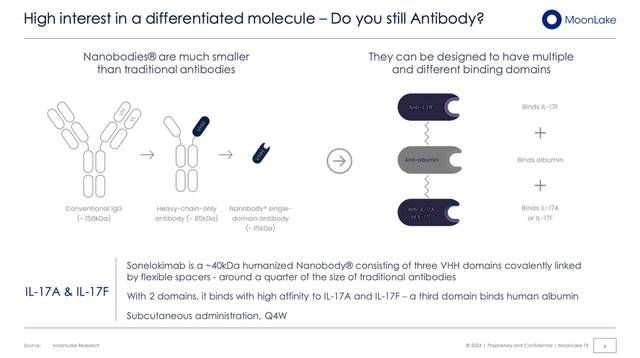

This antibody which they make, officially called Sonelokimab (SLK) is not a normal-looking antibody, it is actually Nanobody (made through Nanobody technology processes that already existed within the field), which is an important practical innovation since these are easier to manipulate and MoonLake is doing so for their purposes. It’s worth mentioning that they did not discover or invent SLK, but they are using it.

Nanobodies (Corporate Presentation)

They have conducted two separate clinical trials for SLK in the treatment of Psoriatic arthritis (PSA) and HS. Currently, they have finished phase 2 clinical trials and are entering into phase 3 stage. So far, SLK showed significantly better performance in comparison to controls (placebo control and prevalent treatment Adalimumab). The safety profile of the product is also acceptable for now. It seems that SLK is showing good potency and is appearing to be a potentially safe pick for such a difficult to manage diseases. Phase 3 is where the decisive results come out, so we still have to see.

These advanced biological therapies are also going to be very expensive, since they are so cutting edge, and this creates another challenge of reimbursability which we are going to avoid quantifying, since there aren’t really any precedents we are aware of that could be used.

Financial Case

We mentioned that they didn’t invent SLK. We need to get into detail here because it has been licensed, and there are a lot of terms and contingent considerations. The license is a sublicense of an already existing license agreement between Ablynx, under Sanofi (SNY), and a Merck (MRK) entity, abbreviated as MHKDG. MLTX is looking to commercialise this technology, and that is why they’ve gotten several exclusive and non-exclusive licenses as necessary to bring the technology to fruition.

The price of the license agreement was both a cash consideration paid in 2021, as well as the need to issue equity and grant it to MHKDG, who now owns a substantial stake in MLTX. There are milestone payments that MLTX will make to MHKDG, up to $327.5 million as they advance through the phases and bring the nanobody treatment closer to commercial fruition in the major markets (Japan, EU, and USA). Then, when the company starts selling the treatment, some royalty will be paid on all sales, “within the range of low to mid-teen percent of net sales“. Crudely, let’s just say around 15%. Now we have the tools we need to make our calculations.

First, Phase 3 is about half the work of getting a drug approved. A rule of thumb to calculate outstanding burden for two indications, halfway done, gives us around $2.3 billion.

The sizing of the market using the straightforward value capture and burden method for HS and PSA. For PSA, around 2 million in major markets is the estimate for prevalence, with a willingness to pay around $10,000 for a cure. The market size could be up to $20 billion, but not annually, since these are payments for a cure. Annual healthcare costs are estimated at $2 billion, so we go with that. For HS, healthcare costs are around $3,000 per year, and the prevalence could be pretty high, around 12 million people in major markets. So the HS market size in value capture terms could be in the tens of billions.

Net of royalty payments at 15%, the stream in revenue could be around $30 billion per year using the value capture sizing methodology. We are not that unconfident in the figure, also considering that the price of this treatment is going to be pretty high.

The outstanding payments assuming success of the trials offsets the current net cash and investment balance of the company. So just taking market cap at around $3.2 billion, and then adding the outstanding development burden of around $2.3 billion (equivalent to around a 40% dilution at current prices), we get around $5.5 billion in effective EV. Then there’s almost 30% dilution outstanding for share-based compensation. Taking that of market cap, the EV continues to grow into around $6.5 billion. With a total addressable market of $30 billion or so taking into account the licensing agreement, there’s definitely a wide valuation gap, but consider that MLTX is just starting phase 3 now and things could still go wrong, as this is a novel technology.

With phase 3 just starting in PSA, investors should also look out for the rate of cash burn in the next quarters, as the pace may change since phase 2 of the trial ended at the beginning of November, and will reflect in the last month and a half of the upcoming quarterly income and cash flow statements on March 1, post-market. Since we already estimated the overall burden in the valuation of finishing the trials, its impact on valuation isn’t the main focus, but knowing the timing of when new cash might have to be raised could be useful, since it’s anyone’s guess where listed biotech stocks will be in the coming years, and a stock like this is subject to reflexivity, where a weaker stock price means worse fundraising conditions and fundamental outlook.

The value-gap is a margin of safety, for sure, but such margins have to be expected. The MLTX valuation isn’t a rip-off, and that’s about all we can be sure of. There is upside, but considering the novelty, we’re not sure if it’s enough considering the development risks.