william87

Investment Thesis

I believe Moody’s Corporation (NYSE:MCO) stock is a hold at its current valuation. The anticipated 5.5% CAGR over the next five years, in my opinion, does not present a compelling growth scenario, especially when compared to the over 4% yield offered by the U.S. 5-year treasury bond. The consistent capital allocation strategy and the strong competitive position of Moody’s in the credit rating sector are reassuring, but the downtrend in Return on Invested Capital and the potential impact of persistent macroeconomic challenges could be areas of concern. The projected 12% annual growth in cashflow per share is attractive, yet the current valuation puts it at a less attractive pedestal for the time being. Moody’s has historically demonstrated financial stability and a well-regarded market position which are commendable, however, the current market dynamics and the comparative return from other safer investment avenues make MCO a hold. I would be keen to revisit my stance should Moody’s stock price face significant weakness.

Company Overview

Moody’s Corporation operates globally as a risk assessment firm, offering financial services to organizations. It has two main segments: Moody’s Investors Service and Moody’s Analytics. The first segment focuses on credit ratings and research, while the latter encompasses other ventures like Moody’s KMV, Moody’s Economy.com, and analytical solutions aimed at aiding decision-makers in managing business risks and identifying opportunities.

In the financial information sector, Moody’s competes with various firms. The most notable competitor is S&P Global (SPGI) which offer similar credit rating and financial analytics services. SPGI provide similar or alternative services in the financial data and analytics sphere, serving a similar clientele to Moody’s.

A Transforming Credit Landscape

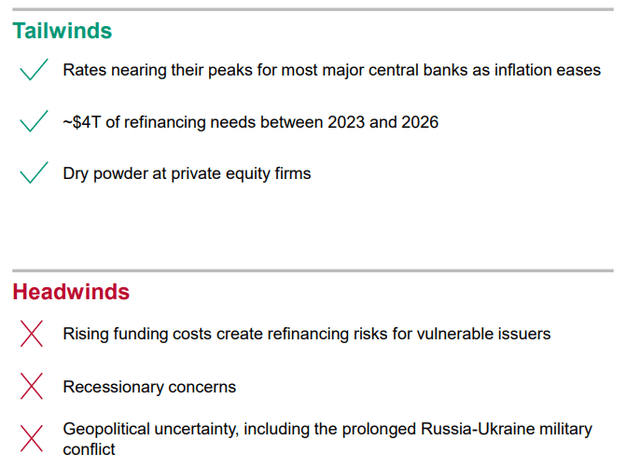

The credit rating industry is going through several trends that could impact the growth of Moody’s Corporation and the sector as a whole. In 2023, key themes and credit fundamentals across various sectors, countries, and regions are shaping global credit markets. A significant factor is inflation, which continues to be a concern in the global credit scene according to Fitch Ratings, despite some easing of core inflation due to improved supply chain conditions.

Additionally, the credit market has seen a shift with investment-grade [IG] credit starting 2023 at higher yield levels compared to 2022, leading to wider credit spreads. This has prompted a move towards “low-touch” fixed-maturity strategies that focus on income, indicating a potential change in investment strategies within the credit market. Another trend, as pointed out by TransUnion’s 2023 Consumer Credit Forecast, is the expectation of more pronounced changes in the consumer credit market, particularly around delinquency rates, following two years of strong loan growth.

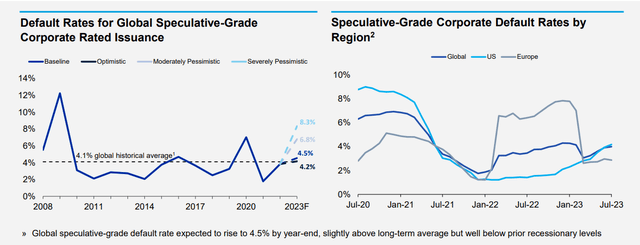

Moody’s Q2 2023 Investor Presentation

Moreover, despite earlier concerns about the impact of sustained higher interest rates, the credit trends in 2023 have not been as negative as initially feared. For example, despite predictions of a sharp increase in corporate failures due to higher interest rates, such adverse outcomes have not materialized to the expected extent, showing some resilience in the credit market.

Moody’s Q2 2023 Investor Presentation

In my view, these trends highlight a complex credit landscape with various implications for Moody’s and the credit rating industry. For Moody’s, adapting to these trends, especially the inflationary pressures and evolving investment strategies, could be important for maintaining its market position and ensuring growth. On a broader level, these trends could drive innovation and new approaches within the credit rating industry to effectively address the changing dynamics of global credit markets.

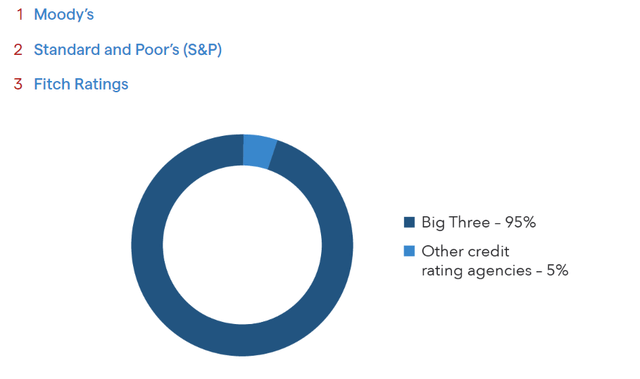

Moody’s Sustained Edge in a Competitive Oligopoly

I believe Moody’s has a competitive advantage in the credit rating industry, underpinned by its recognized brand which not only attracts demand for its ratings but also reinforces the quality of its ratings over time, aiming for long-term growth. Operating in a near oligopoly with S&P Global and Fitch Ratings, Moody’s and S&P Global together have a large share of the global credit rating market, estimated around 95%. This market structure gives Moody’s a level of market power, aiding in maintaining a strong position in the industry. Moreover, Moody’s global reach enhances its competitive advantage, allowing the corporation to capture a larger market share and gain insights into market trends and developments across different regions. This global footprint aids Moody’s in delivering more comprehensive ratings and analyses.

The credit rating industry, largely dominated by the “Big Three” – Moody’s, S&P Global, and Fitch Ratings, operates within a structure often termed as a “toll bridge” moat. This signifies the essential nature of the services provided by these agencies. When companies need credit ratings, a requirement for accessing capital markets or securing financing, their choices are mostly limited to these three players. In my opinion, the toll bridge moat represents a form of competitive advantage where the Big Three act as gatekeepers, controlling access to crucial services in the financial industry. The demand for credit ratings and related services is steady and often required by regulatory frameworks, generating recurring revenue for Moody’s. The near-oligopolistic structure of the industry, along with the necessity of credit rating services, ensures customer retention and revenue sustainability for Moody’s. In my view, this situation not only supports Moody’s competitive advantage but also highlights its long-term growth potential. I see that the recurring revenue model, driven by the toll bridge moat in the credit rating industry, provides Moody’s with a stable revenue stream. This stability is enhanced by the high barriers to entry in the industry, making it challenging for new entrants to challenge the market dominance of Moody’s and its competitors, S&P Global and Fitch Ratings.

The combination of a recognized brand, a near oligopolistic market structure, and a global operational footprint, along with the toll bridge moat in the industry and the portion of recurring revenue, positions Moody’s Corporation with a competitive advantage in the credit rating industry.

Moody’s Steady Capital Allocation

Over the past five years, I believe Moody’s has demonstrated a consistent capital allocation strategy that underscores its financial robustness and commitment to shareholder value. One of the pillars of this strategy has been the return of capital through dividends. The firm has a five-year average annualized dividend growth rate of 11.84% and an average dividend yield over the last five years of 0.89% as of October 2023. I expect Moody’s to continue to this momentum with their dividend growth rate.

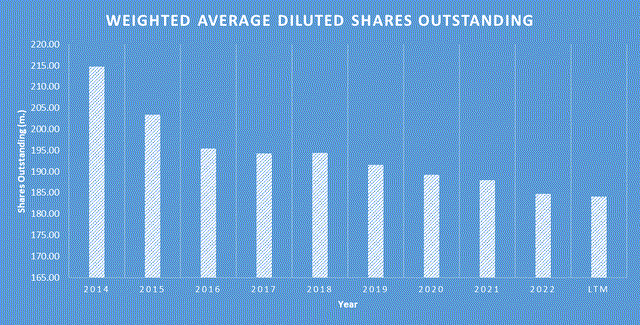

Additionally, share buybacks have been a part of Moody’s capital allocation approach, where Moody’s had a modest buyback yield of 0.43% in the past year. This relatively small yield reflects the expensive valuation, currently trading at 40 times current earnings. Though, over a longer time period as seen below, we can see that the overall share count has consistently decreased by an average rate of -1.82% per year.

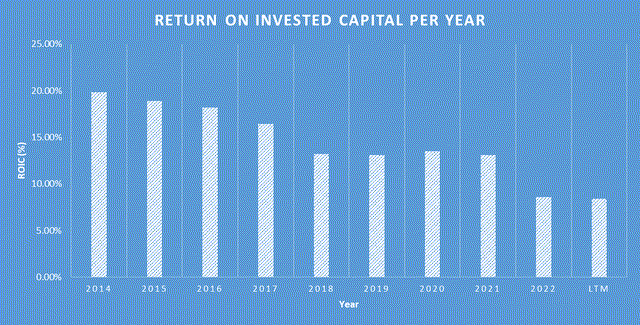

Moody’s Corporation has historically exhibited a strong Return on Invested Capital, averaging around 14% over the past decade. However, a downtrend has been observed as the business expanded, with the last two years likely reflecting a dip more severe than my personal future projections due to short-term macroeconomic headwinds. Moving forward I expect MCO to deliver ROIC in the low double digits.

Financial Analysis

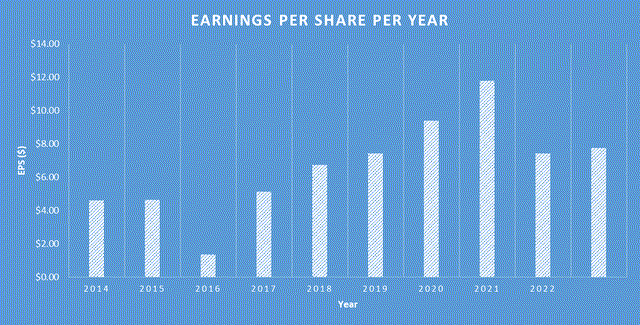

Over the past 5 years, the company has demonstrated consistent financial performance. Its revenue has shown a consistent and strong growth, increasing from $4,443.00 million in 2018 to $5,529.00 million in the last 12 months in 2023, representing a compound annual growth rate [CAGR] of approximately 5%. It is important to note that this CAGR is inclusive of the weaker revenue growth delivered over the past two years, where I expect that revenue growth will be in the high single digit range over the coming years. The earnings per share [EPS] has been similar to the revenue, growing steadily from $6.74 to $7.75 over the previous 5 years. Again, in my opinion this is due to the weak previous two years, moving forward over the next few years I expect EPS to grow around 12% per year.

As of the most recent quarter, the company reported cash and cash equivalents of $2,335.00 million. The company’s total debt stands at $7,162.00 million, a modest amount that can be paid back in about 3 years’ worth of free cash flow. The company’s current ratio, a measure of its ability to cover short-term liabilities with short-term assets, is 1.65, which is generally considered healthy. Overall, I do not have any concerns over MCO’s balance sheet.

Looking beyond the next 12 months, assuming we do not fall into a recession in the next year, I expect the company to grow cash flow at about 12% per year over the next 5 years driven by the eventual loosening of interest rates as inflation eases, worldwide real GDP growth and a growing total addressable market.

Valuation

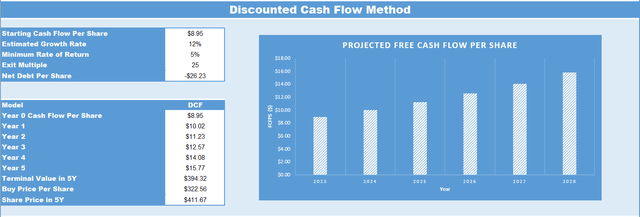

When considering valuation, I always consider what we are paying for the business (the market capitalisation) versus what we are getting (the underlying business fundamentals and future earnings). I believe a reliable way of measuring what you get versus what you pay is by conducting a discounted cashflow analysis of the business as seen below.

MCO’s current TTM Cashflow per Share as of Q2, 2023 is $8.95. I believe that MCO’s Cashflow per Share should grow at 12% annually for the next five years. Therefore, once factoring in the growth rate by Q2 2028 MCO’s Cashflow per Share is expected to be $15.77. If we then apply an exit multiple of 25, which is based off MCO’s mean price to free cashflow ratio for the previous 10 years, this infers a price target in five years of $411.67. Therefore, based on these estimations, if you were to buy MCO at today’s share price of $314.00, this would result in a CAGR of 5.5% over the next five years.

Conclusion

In my view, the credit rating sector, where Moody’s Corporation operates, is currently traversing a phase heavily influenced by inflationary pressures and notable shifts in consumer credit dynamics. Despite these macroeconomic hurdles, Moody’s, in my opinion, has adeptly utilized its well-recognized brand, extensive global reach, and a near oligopolistic stance within the industry to uphold a strong competitive edge amidst these prevailing sector trends. Moreover, a disciplined capital allocation strategy, manifested through consistent dividend distributions and share buybacks, has been a cornerstone in fostering growth and financial stability for the firm. Although there’s been a noted downtrend in the Return on Invested Capital due to business expansion and short-term economic headwinds, Moody’s continues to exhibit financial robustness. The projection of a 12% annual growth in cashflow per share over the next five years, leading to a potential Compound Annual Growth Rate of 5.5% in the stock price doesn’t seem sufficient, particularly when the U.S. 5-year treasury bond is yielding over 4%. Given these factors, MCO will stay on my watchlist, as I hope the market will offer a more favorable investment opportunity in the future.