The Good Brigade/DigitalVision via Getty Images

Summary

Following my coverage of Mohawk Industries (NYSE:MHK), in which I reiterated my hold rating as I became more pessimistic about the potential of a macro recovery in FY24, this post is to provide an update on my thoughts on the business and stock. While my model shows an attractive upside and 4Q23 volume performance shows a potential recovery in FY24, I am sticking to my hold recommendation for the time being. I would like to see more evidence of recovery, ideally with 1Q24 showing what I expected, before I adjust my recommendation to a buy.

Investment thesis

4Q23 sales fell 1.4% on a reported basis to $2.6 billion, with Flooring NA [FNA] revenue declining by 4%, Global Ceramic [GC] up by 0.6%, and Flooring ROW [FROW] down by 1%. FNA was dragged down by reduced market volumes, which led to low industry utilization rates and aggressive competition in the marketplace. GC growth could have been better if not for the weak performance in Mexico and Elizabeth, which were heavily impacted by rising interest rates and slowing economic conditions. As for FROW, the building product category remains under stress, with consumers remaining cautious and retailers reducing their inventory levels. However, MHK did beat consensus EPS estimates by reporting adj EPS of $1.96 vs. consensus $1.86. The outperformance was mainly driven by other income.

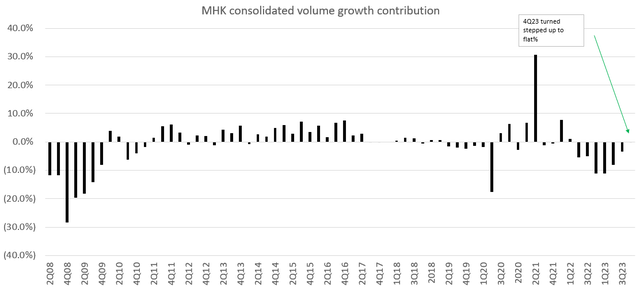

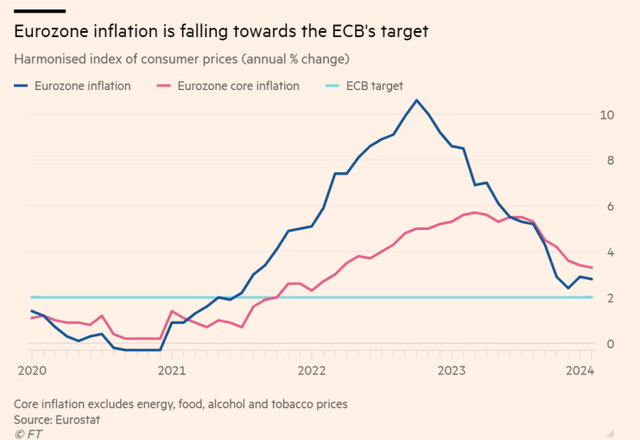

While I turned pessimistic in my last update, 4Q23 delivered a minor surprise (a positive one) that led me to become slightly more optimistic that demand might have bottomed and FY24 is going to be the recovery year for MHK. The data that changed my mind was that volume growth has stepped up to flattish percentage growth on a year-over-year basis vs. the six quarters of decline. As such, my focus during the earnings call was on the volume performance so far into FY24 and what the outlook was. At the consolidated level, management appears to take a conservative stance as they mentioned continued weakness entering the year, which I believe is a fair take as mortgage rates are still elevated in the US and Europe is still undergoing turmoil from the high energy costs and geopolitical uncertainty. However, my take is that 2H24 might be the turnaround point for MHK as rates get cut. We have the US Fed already signaling for a rate cut (if inflation comes down further), and Europe is possibly cutting rates too as inflation has come down.

If the rate does get cut as I expected, it will be very positive for demand as consumers become more confident in spending on renovations and repairs and purchasing homes. Another positive data point that was highlighted during the call was the strengthening of US consumer confidence, which hit its highest level since July 2021 in January. I take this as a leading indicator of discretionary demand, which should materialize if rates get cut. In addition, from a y/y comparison perspective, FY24 is going to face an easy competition against FY23, making the headline growth look much more positive. If we combined this volume recovery with the fact that inventories at the retailer level are low (volume growth over the past six quarters has been negative), it could result in a surge in volume demand as retailers restock (a strong sell-in for MHK) in anticipation of a recovery. The restock motion would come at a time when MHK is rolling out new products, which I see as a good time to capture market share (since retailers have no stock, they are likely to be more open to trying out new products). In particular, MHK FNA is introducing new collections in every product category, and they are all selling like hotcakes. One of these new categories is PureTech, which is a waterproof, PVC-free alternative to LVT made from a renewable polymer core. For GC, MHK is introducing new collections and increasing its distribution in the US to spice things up. Within GC, Quartz countertops are another area the company is aiming to grow, so it is releasing new products and getting more involved in the kitchen, bathroom, and do-it-yourself retail channels.

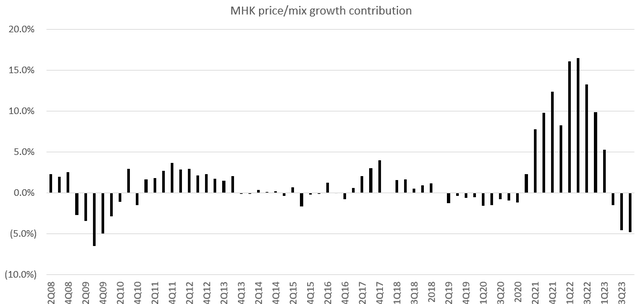

Volume aside, in the near-term (1H24), I expect MHK to continue facing pricing pressure as they have benefited a lot from these 2 factors in the latter half of FY22. From a y/y comp perspective, 1H24 is likely to continue facing pressure, especially with lower material costs passing through the P&L and ongoing competition.

As a result, our industry reduced selling prices and we pass through declining cost in energy and materials. Under these conditions, we focused on optimizing our revenues and lowering our costs through restructuring actions and manufacturing enhancement. 2Q23 earnings results call

That said, on a net basis, I do think the improvement in volume will outweigh the negative impacts from price/mix, leading to improvement in margin because of the high incremental margins (given that all the capacity cost are largely fixed). To give a sense of how much fixed cost is in the business, even with MHK operating at 70 to 80% capacity utilization rate, it is still not able to absorb all the fixed cost. In addition, there are productivity gains to look forward too as well that should offset the pressure in wages. I should mention that in 2023, MHK consolidated four facilities and shut down several lines to better meet demand, so there should have been some productivity gains. In addition, beginning in 2Q24, management mentioned an additional approximately $75 million in benefits from the restructuring. All of these should further push margin upwards if volume recovery comes along.

Valuation

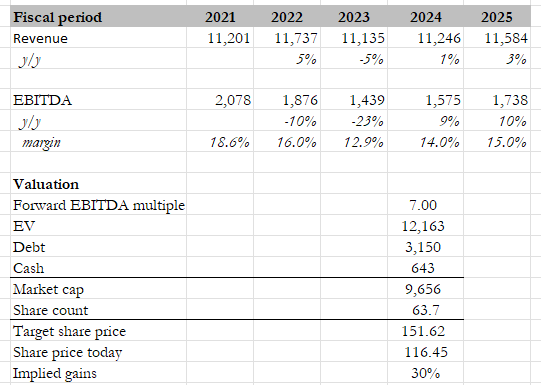

Own calculation

If my assumption that volume growth will turn positive in FY24 is true, I believe the upside is attractive, with a target price of $151.62. To reflect my positive view on volume growth, I have adjusted my growth expectations for FY24 and FY25 upwards by 100bps to 1%/3%, respectively. The more important revision in my model is that I expect EBITDA margins to go up by 100 bps each as well, reflecting my view that volume growth will drive high incremental margins. I have also increased my EBITDA multiple to 7x forward EBITDA as I expect the market to continue revaluing the stock upwards as MHK shows further signs of volume growth recovery. I would point out that the market appears to be positive on the MHK volume growth situation, given that multiple has recovered from the low of 5x (when I wrote about it previously) to 6.5x today.

Risk

MHK recovery is quite sensitive to how the macroeconomy is moving, and if 2H24 doesn’t see any rate cuts, the expected recovery might be pushed out to FY25 and beyond. The lack of volume recovery will also impair MHK’s ability to demonstrate margin recovery.

Conclusion

In conclusion, despite a positive surprise in 4Q23 indicating potential demand bottoming, I am maintaining a hold recommendation. The business is still expected to face ongoing pricing pressure in 1H24 and lingering macroeconomic uncertainties. While volume growth shows a glimmer of recovery, I await more evidence in 1Q24 before considering a shift to a buy recommendation. The anticipation of rate cuts in 2H24 could be a turning point, positively impacting consumer confidence and driving demand for MHK products. The introduction of new collections and low retailer inventories further positions MHK for potential market share gains.