SeventyFour

2023 has been a big year for large-cap stocks, particularly in the tech sector. Large-cap gains have been the driving force powering up the S&P 500 to near-record heights, which has many market-watchers now calling for a re-positioning into small-cap names.

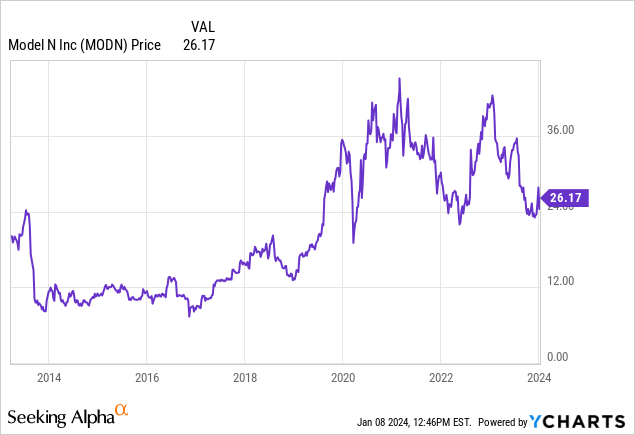

We have to be careful, however, about which small-cap stocks we choose – as performance in the SMid-cap space is highly single-company dependent. And in the case of Model N (NYSE:MODN), I believe there is further downside to go after underperforming last year (down -36% over the past twelve months).

I last wrote a bearish call on Model N in August, when the stock was trading closer to $28 per share. Since then, Model N has continued to retreat, while the company has also released both fiscal Q4 results as well as its outlook for FY24, which is the year ending in September 2024 for the company. This outlook doesn’t give me much comfort in the year ahead, and I remain bearish on this stock.

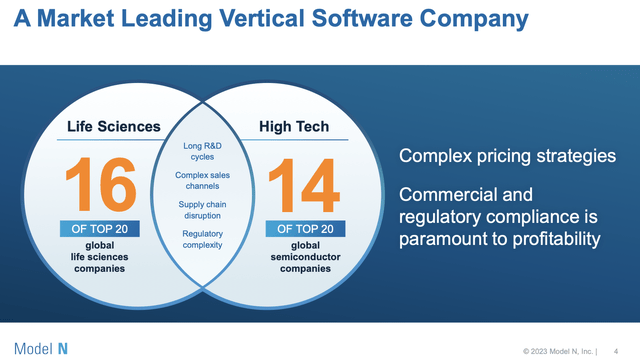

The key worry here for Model N is oversaturation in an overly niche market. As a reminder for investors who are newer to this stock, Model N is a revenue management software platform specifically for companies in the life sciences and semiconductor technology industries. Certainly, these are large and growing industries to address: but to its credit, Model N has already nabbed some of the largest names in each of these industries already. As shown in the chart below, the company already serves 16/20 of the top global life sciences companies and 14/20 of the top global semiconductor companies.

Model N market penetration (Model N Q4 earnings deck)

It claims to have a $9 billion TAM (total addressable market), up more than double from $4 billion in 2018 – but if so, I question why Model N’s currently low penetration of this market (~$250 million in annual revenue suggesting ~3% overall penetration) isn’t allowing the company to grow its top line by more than 10% y/y.

The bottom line here: it’s best to steer clear, as this stock has more risk than reward heading into 2024.

Growth expected to slow, alongside minuscule profit expansion in FY24

Most of us invest in small-cap tech stocks for the promise of outsized growth in a greenfield market opportunity – sadly, this is far from the case for Model N.

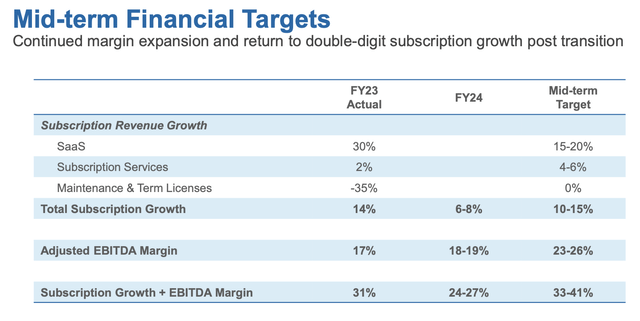

As shown in the chart below, the company is expecting total subscription revenue growth to slow to 6-8% y/y next year, down from 14% y/y in FY23, while still aiming for 10-15% in an undefined “mid-term” period.

Model N outlook / mid-term goals (Model N Q4 earnings deck)

A transition to a pure SaaS model and sunsetting its term license/on-premise program is the company’s top goal for FY24, which puts Model N more in line with cloud-based competitors like Salesforce.com (CRM).

Per CEO Jason Blessing’s remarks on the Q4 earnings call regarding this transition:

As you know, we have announced end of life for our on-premise solutions on December 31, 2023. I do expect that we will have a few customers that will need one or two more quarters to sequence their SaaS transition into their IT roadmap, but I continue to believe that we will convert substantially all of our customers. This is a truly remarkable accomplishment by our, given the complexity and mission-critical nature of our applications.

To help put this accomplishment into context, I thought it would be worth a quick recap of the business model transformation that we have driven. Over the last 3 years, both our annual SaaS revenue and adjusted EBITDA have doubled. This clearly demonstrates the leverage in our model and our philosophy of delivering profitable growth to shareholders. We have built a great SaaS franchise that provides mission-critical products to our customers. This is a great foundation for future, profitable growth as we collaborate with customers to build new products and add new customers to the Model N family […] And in Q4, we signed 5 new SaaS transitions.”

While the hope is that eventually a move to SaaS will stabilize Model N’s revenue away from lumpy term deals and encourage seat/subscription expansion (dollar-based net retention rates in the SaaS business are 118% for Model N so far), it clearly isn’t generating much in the way of growth expectations in the current year, and neither does it account for the risk of customer defection to competitors by introducing the friction of requiring a move to the cloud.

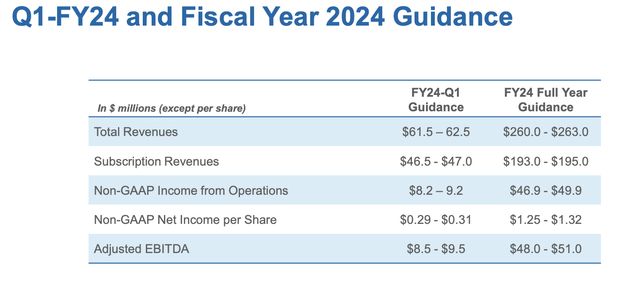

It’s worth noting that in spite of weak growth rates expected for next year, Model N’s valuation still remains unappetizing, even after the stock’s recent fall. At current share prices near $26, Model N trades at a $1.01 billion market cap; and after netting off the $301.4 million of cash and $280.4 million of debt on the company’s most recent balance sheet, its resulting enterprise value is $989 million.

Against next year’s expectations of $260-$263 million in revenue (4-5% y/y growth) and $48-$51 million in adjusted EBITDA (12-19% y/y growth), Model N’s valuation multiples currently stand at:

- 3.8x EV/FY24 revenue

- 20.0x EV/FY24 adjusted EBITDA

Model N outlook (Model N Q4 earnings deck)

Given low growth expectations and minuscule adjusted EBITDA margin expansion capacity, I find little incentive to be invested in this stock. The company’s 18-19% adjusted EBITDA margin in FY24 is only expected to grow to a medium-term goal of just 23-26%, and that already relies on a return to mid-teens subscription revenue growth.

Key takeaways

With only mild growth expectations for FY24, profitability levels that are nowhere close to supporting Model N’s valuation, and saturation in a small niche market, there’s little hope for Model N to reverse its downtrend in 2023 in the new year. Continue to avoid this stock and invest elsewhere.