simarik

From 2010 to 2020, the merger arbitrage strategy was a stellar alpha generator. The US government quickly approved most mergers, creating a low-risk, high-profit opportunity in merger arbitrage strategy ETFs like the IQ Merger Arbitrage ETF (NYSEARCA:MNA). Since the new government, the merger arb’s strategy has failed to deliver, with the ETF MNA falling since 2020 while virtually all equity funds have risen. In my view, the M&A fund will be exciting to watch over the coming months to see how US government politics will impact the alpha generation of the strategy.

Firstly, I must state that my views regarding MNA are not political. However, in discussing the niche, we cannot avoid the political element as, to a great extent, executive branch policies under the Federal Trade Commission are politically motivated. The core reason for the weak performance of the fund MNA is that the Biden Administration is perhaps the most antitrust-oriented in decades, blocking a multitude of large mergers over recent years.

Crucially, that is not a political opinion statement, as, to me, there are positive and negative consequences of blocking mergers. That said, Biden’s admin has has blocked more mergers than Obama’s and twice as many as Trump’s. Unlike Trump’s admin, Biden’s has focused more on horizontal mergers than vertical ones, which are somewhat more critical for MNA.

Looking forward to an election year, it is a good time to cover the ETF MNA more closely. In general, I expect the ETF to perform poorly in 2024; however, stagnation is more likely than losses. Looking into 2025, the possibility that the Biden administration will change its focus due to economic needs or the potential for a Trump administration that allows for more mergers could improve MNA’s performance. That said, investors should not necessarily expect a return from the 2010s environment of mass mergers.

The Boom and Bust in FTC Policy and MNA

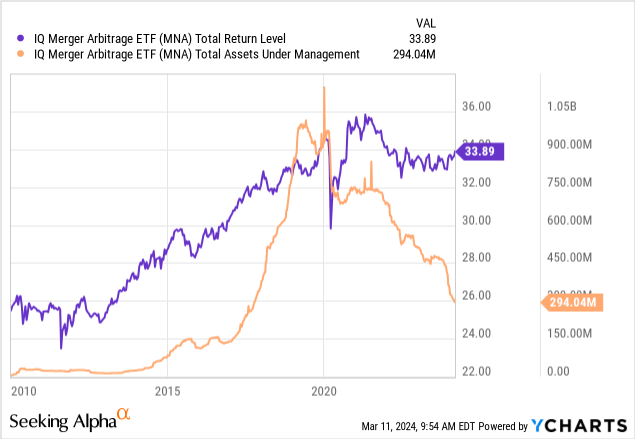

The ETF MNA was once relatively popular, with just over $1B in total assets under management, peaking in 2019. Its decent performance continued through 2020, albeit with significant short-term declines that year due to increased volatility around deals as the lockdowns occurred. Since 2021, it has been stagnant, losing little overall value, with a nearly 80% decline in its AUM as it dramatically underperformed its peers. See below:

Put simply, MNA is not a popular approach today. Few investors follow it, and it garners very little analysis compared to most. Personally, I find stocks and ETFs with little coverage interesting because there is often less market efficiency where there is less media attention and market volume. Of course, there is media attention around merger activity and the lack thereof, but not so much around the merger arbitrage strategy since it has fallen by the wayside since Biden’s admin changed the FTC’s approach.

Fundamentally, there are many reasons to like the ETF MNA despite its poor performance. MNA earns an income by buying stocks in public announcements of takeover. Typically, stocks in merger deals have very little day-to-day volatility. As a merger is announced, stocks usually trade at a few percentage points below the merger price, adjusting for the risk that the deal will fail.

MNA acts as a liquidity risk provider for merger deals. So, it will benefit from either an increase in merger deal success rates or an increase in merger deal discounts. The latter point is essential because merger deals are becoming more discounted, adjusting for the probability of FTC blockage. As one example, one of MNA’s more extensive holdings is Discover Financial (DFS), which will be bought for $35B but currently trades over 13% lower due to FTC risk. Further, DFS is currently just $10 over (or 9%) its pre-merger price, potentially limiting its downside risk if the FTC blocks it – which is highly debated in both political and financial spheres.

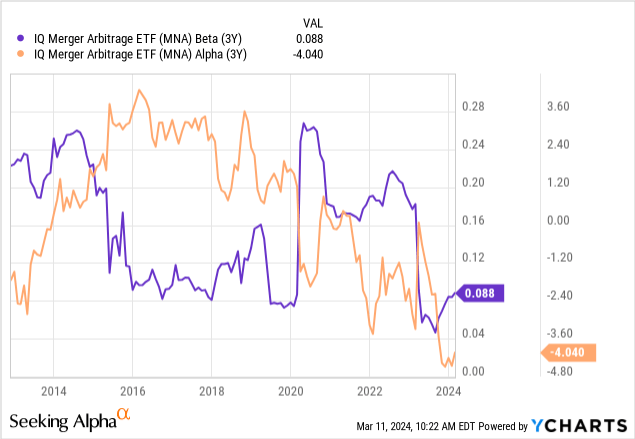

Because MNA focuses on arbitrage, it carries less correlation to broader stocks, making it a historical alpha-generator. Its beta to the S&P 500 is very low at ~0.09X, never being much over 0.25X, while its alpha was around 3X during the peak merger years of 2015-2018. See below:

MNA would be a valuable fund if not for poor external circumstances. The key to long-term wealth creation in financial markets has little to do with short-term performance and far more with managing value-at-risk. Historically, MNA has very low correlations to the broader stock market and generally low overall volatility at 5.3% annualized over the past 200 days vs. 11.8% in the S&P 500. While its strategy has not worked well recently, it was a tremendously diversified alpha generator before 2020. In my view, investors should not be quick to write it off due to its long-term positive returns and, most importantly, its tremendous diversification value. Since its beta is low, it should lower overall portfolio volatility while ideally giving positive returns above interest rates.

Merger Arbitrage – 2024 Profitability Outlook

It is a global fund, with ~40% of its holdings outside the US, so the FTC’s anti-merger stance is not essential for a portion of MNA. That said, much of the antitrust activity seen in the US is also seen in Europe. Since 2020, the rise in living costs has dramatically pushed people toward an inflationary mindset, where they care more about lower prices. As someone who analyzes companies, I would say that most firms outside of the largest ~100 have lost out to inflation as well, not raising consumer prices as fast as costs. That said, most American consumers will not necessarily understand that view, with many pointing to corporate greed as the cause of inflation. Thus, so long as global consumers are in a low-personal savings environment, I expect antitrust sentiment to remain or grow.

Although the Biden admin’s role in the FTC’s strategy is notable, it is an increasingly global phenomenon. Notably, anti-monopoly and antitrust sentiment is rising and, to a great extent, is one of the few bipartisan views. Over 80% of US Democrats support antitrust laws, and 62% of Republicans. Independents have the lowest support at 60%, but that is still a majority. Going into an election year, nobody will win votes by openly supporting merger activity, potentially hampering MNA’s potential regardless of who wins in November.

That said, I am not bearish on MNA today. While I do not expect the FTC, or global equivalents, to allow many more extensive mergers, MNA is likely benefiting from a greater risk-adjustment discount on merger deals than in the past. Before the merger crackdown grew in 2022, many stocks under merger deals traded very close to acquisition prices, creating lower returns and higher risks for merger arbitrage.

Today, that discount has grown. Still, it isn’t easy to quantify precisely. MNA’s largest holding is WestRock (WRK) at ~6%. WRK is expected to be acquired by Smurfit Kappa (OTCPK:SMFTF) for SMFTF’s price plus $5, or $47.91, or a ~6% premium over WRK’s current price. That is a lower discount due to the smaller chance that the FTC blocks the deal; however, investors should research the deal’s exact pricing, as it could differ from mine.

MNA’s second-largest holding is Karuna Therapeutics (KRTX), which trades at $319 with a $330 acquisition price, giving it ~ a 3.5% upside today. Next is US Steel (X), with a $55 deal, now trading at $47.5, providing a solid ~16% upside opportunity. Then, we have Pioneer Natural Resources (PXD), a long-term bullish stock of mine, trading at $242 vs. a $253 acquisition price, giving it a 4.5% upside.

Again, this metric is not widely measured, but for the most part, I believe we’re seeing more significant discounts on mergers due to the increase in risk adjustments. Thus, as long as we assume a consistent rate of deal failures, MNA should begin to gain some ground due to the more significant M&A merger upside. MNA does have a higher 77 bps expense ratio, but to me, that is relatively fair given its low beta to the S&P 500 and history and potential for decent returns.

The Bottom Line

Overall, I am slightly bullish on MNA today. There are three reasons behind my view. One, MNA is buying merger deals at seemingly greater discounts to acquisition prices, offsetting higher deal failure rates. Two, MNA has a very low market correlation, so those potential positive returns are a great way to lower portfolio volatility by focusing on alpha generation.

Lastly, I believe there is a decent probability that M&A deals will be more successful over the coming year than over the two years past. One recent significant deal failure was JetBlue (JBLU) and Spirit (SAVE). As detailed in my recent article, I think one or both airlines will likely fail without the merger. Thus, I see a scenario where the FTC’s decision will potentially result in mass worker layoffs, potentially causing the Biden admin to step back from its strong antitrust policy. Another, Capital One (COF) and Discover, I expect will not be blocked because both are not in strong financial positions, having risks seen in regional banks; therefore, the merger should lower the risks of the banking industry.

Based on history, a Trump win would be bullish for MNA because his admin allowed many mergers to go through. Still, even with Biden, I think merger success may increase simply due to the economic needs of many firms. We’re seeing many merger deals among higher-risk firms that are losing profits to inflation. While lower margins benefit consumers, a sufficient decline in company margins results in layoffs. It might be argued that the Biden admin will do more to stop unemployment than inflation. In today’s circumstances, I would argue mergers protect employment (particularly for blue-collar workers, not accountants, managers, etc. – who are often laid off in mergers), albeit potentially adding to inflation.

My latter view is speculative, depending on November and how the government reacts to Spirit Airlines’ potential impending failure. That said, increased government approval of mergers would be very bullish for MNA since discounts on FTC-questioned deals are so high now. Nobody will get rich by investing in MNA, but the potential for positive returns without high market correlation makes it a good ETF to put 3-10% of one’s portfolio in.