Bloomberg/Bloomberg via Getty Images

Elevator Pitch

I have a Buy investment rating for Mitsubishi Electric Corporation (OTCPK:MIELF)(OTCPK:MIELY) [6503:JP]. My earlier September 18, 2023 initiation article was focused on the company’s Q1 FY 2024 (YE March 31) EBITDA miss and its mid-term ROE target.

In this update, my decision is to upgrade my rating for Mitsubishi Electric from a Hold to a Buy, taking into consideration the stock’s multiple positives. These positives included continued share repurchases, a potential turnaround of the factory automation systems business, and recent corporate moves to ride on emerging growth trends.

Investors can deal in Mitsubishi Electric’s shares on the OTC (Over-The-Counter) Market and in Japan. The average daily trading value for Mitsubishi Electric’s shares listed on the Tokyo Stock Exchange in the past 10 trading days was around $80 million (source: S&P Capital IQ). Readers can buy or sell the company’s Japan-listed shares with US stock brokers such as Interactive Brokers. The 10-day mean daily trading value for the company’s OTC shares was approximately $1.2 million, which implies that the liquidity of the OTC shares is also reasonably good.

Continued Share Buybacks

Mitsubishi Electric is continuing with share repurchases, and this is expected to move the company closer to reaching its FY 2026 ROE goal of 10% with the shrinkage of its equity base via buybacks.

I previously noted in my September 2023 write-up that MIELF has already planned to allocate JPY600 billion to “shareholder capital return initiatives like dividends and share buybacks” for the FY 2022-2026 time period to support its medium-term ROE target.

On January 10, 2024, Mitsubishi Electric issued an announcement disclosing that it had invested JPY3.5 billion in buying back the company’s own shares for December 2023. This brings the total amount of monies that the company had spent on share repurchases between May 1, 2023 (inception of new buyback program) and December 31, 2023 to JPY37 billion.

More significantly, Mitsubishi Electric has already completed close to three-quarters (or 74% to be specific) of its JPY50 billion share buyback plan that expires at the end of March this year. As such, it is highly probable that the company will be able to complete the JPY50 billion share repurchase program in full by the end of fiscal 2024 (April 1, 2023 to March 31, 2024).

In conclusion, MIELF’s recently announced share buybacks give me greater confidence that the company can achieve its targeted FY 2026 ROE of 10%, as it has been delivering on its shareholder capital return initiatives in line with its plans.

Factory Automation Systems Business Might Potentially Witness Turnaround

I highlighted the poor performance of MIELF’s factory automation systems business (part of the Industry & Mobility segment) in my September 18, 2023 initiation piece. The underperformance of the company’s factory automation systems unit led to below-expectations Q1 FY 2024 EBITDA and a -15% share price pullback between mid-July 2023 and mid-September 2023.

Looking ahead, there is a good chance that the worst for Mitsubishi Electric’s factory automation systems business is over with a potential turnaround in sight.

According to a January 11, 2024 Nikkei news article (translated from Japanese to English using Google Translate), Mitsubishi Electric’s Chief Financial Officer was quoted as outlining his expectations that the company’s “FA (Factory Automation) orders will recover in the fiscal year ending March 2025 (FY 2025).” The CFO’s comments are consistent with the most recent industry statistics. The value of machine tool orders in Japan increased by a healthy +9% to roughly JPY127 billion for the final month of the prior year on a month-on-month basis.

Also, it is relevant to note that the sell-side analysts have increased their earnings projections for Mitsubishi Electric in recent months. In specific terms, the consensus FY 2025 and FY 2026 EPS estimates (in local currency or JPY terms) for Mitsubishi Electric were revised upwards by +1.2% and +1.4%, respectively in the past three months as per S&P Capital IQ data.

To sum things up, it is highly probable that the MIELF’s factory automation systems business will do better going forward, considering management commentary, industry statistics, and changes to consensus forecasts.

Capitalizing On Growth Trends

Recent news flow suggests that Mitsubishi Electric is making the relevant business decisions and moves to allow the company to leverage on emerging growth opportunities.

MIELF revealed on January 22, 2024 that it is partnering “HACARUS Corporation” in the “development of AI-based visual-inspection applications for manufacturing.” In this disclosure, HACARUS Corporation is referred to as a company engaged in the “development, sales, and support of products and solutions for DX (Digital Transformation) using AI, IoT (Internet of Things), and robots.” As a growing number of countries face demographic headwinds like an aging population, demand for visual inspection solutions without the need for human intervention is likely to rise.

Earlier on January 17, 2024, Mitsubishi Electric disclosed that the company signed “a Teaming Agreement with Northrop Grumman Corporation (NOC) for the purpose of potentially developing networking defense equipment related to integrated air defense systems.” Based on research provided by the Stockholm International Peace Research Institute, worldwide military expenditures increased for eight straight years running between 2015 and 2022. It is realistic to assume that MIELF’s deal with NOC will pay off with rising geopolitical conflicts.

Mitsubishi Electric’s Solutions Leveraged To Emerging Growth Trends Showcased At CES 2024

MIELF’s December 19, 2023 Press Release

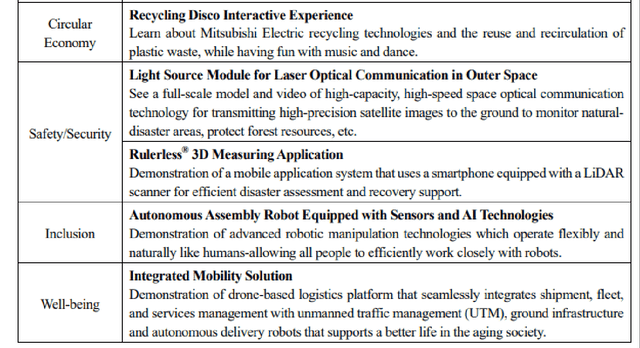

As per the chart presented above, Mitsubishi Electric has come up with new products to meet trends such as “circular economy”, “safety/security”, “inclusion” and “well-being”, which were presented at the CES 2024 technology event.

In a nutshell, MIELF is well aware of key business and consumer trends, and the company has ventured into partnerships and developed new solutions to take advantage of relevant opportunities.

Closing Thoughts

My view is that Mitsubishi Electric’s P/B multiple can re-rate from the current 1.36 times (source: S&P Capital IQ) to 1.75 times in time to come. I arrive at my target P/B metric of 1.75 times based on assumptions of a 10% ROE, a Perpetuity Growth Rate of 3%, and a 7% Cost of Equity. As per the Gordon Growth Model, a stock is justified to be trading at a P/B ratio equivalent to [ROE minus Perpetuity Growth Rate] divided by [Cost of Equity minus Perpetuity Growth Rate]. The multiple positives for the company mentioned in this article should drive an improvement in its ROE and the expansion of its P/B multiple.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.