Robert Way

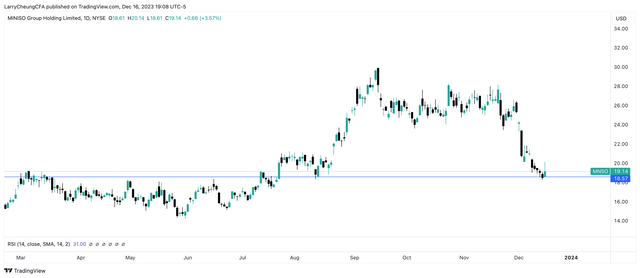

MSNO can stage a tactical rebound if it defends the critical 18.5 Neckline Area

One of the relatively lesser known companies within China that has vastly outperformed retail indices appreciate the China Consumer CQQQ ETF is a mid-cap company named Miniso (NYSE:MNSO). The stock has risen nearly 150% earlier this year before a large pullback after its latest quarter results that resulted in more than a 33% retracement. We think that the recent share repurchase program of 667,000 shares (which represents .2% of shares outstanding) is a first sign that management wants to instill stability in its stock at today’s levels. Combined with a modestly positive outlook, we think MNSO is a tactical buy to target 21-22/share as long as it doesn’t violate the 18.55 neckline level amid its current volatile trading range.

MNSO’s Line in the Sand (Trading View)

The founder Guofu Ye controls more than 70% of the shares outstanding, so any transactions made by Mr. Ye are likely to significantly influence the stock price.

The Catalysts for Miniso

Many investors may be unfamiliar with this mid-cap retail company, which doesn’t have nearly as much coverage as BABA, JD, or PDD. So, first some background.

Miniso is one of the largest branded retailers of lifestyle products that first originated in China but now has rolled out quite successfully in North America. The company had its first store in 2003 and now has 6100 stores globally, with more than half of them operating in China. As a corporate philosophy, the company follows the ‘Three Highs, Three Lows’ principle, where ‘Three Lows’ refers to low prices based on low costs and margins while the ‘Three Highs’ refers to higher efficiency, technology, and product quality.

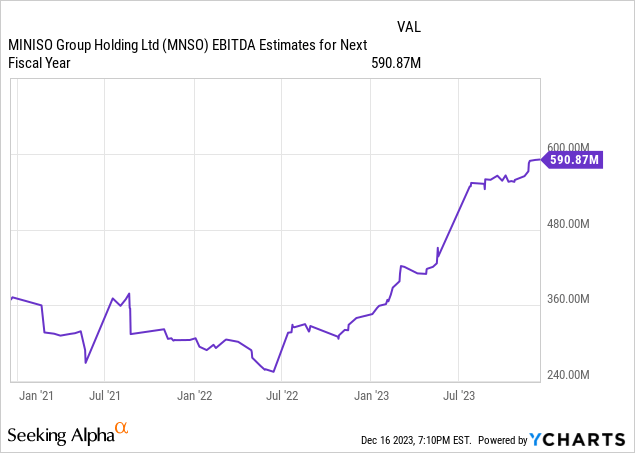

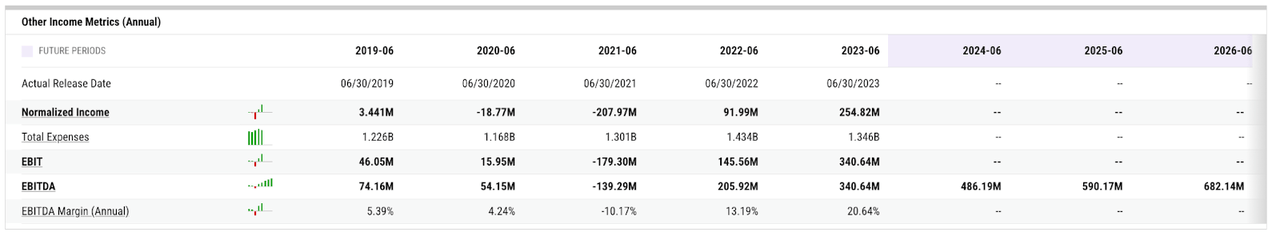

From a financial performance standpoint, Miniso now has 5000 stores globally. The company has grown topline revenue in the 7-10% profile since 2020 but in the last 12 months was projected to grow almost 37%. The company also grew EBITDA 50% year over year from fiscal year 2022 to 2023 after swinging from an operating loss in 2021. Going forward, the outlook for EBITDA for MNSO is quite aggressive as we can see that estimates for EBITDA into 2024-2026 is at least 20-25% growth.

EBITDA Estimates Next 2 Years (Ycharts)

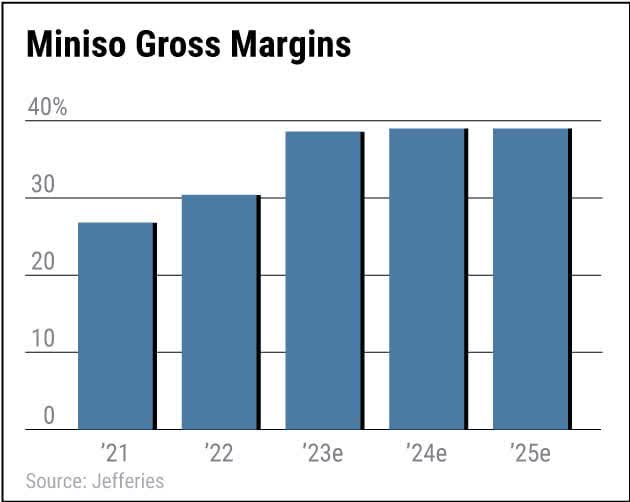

MNSO is known to have a strong supply chain and retail partner model that allows it to source new products that attract new customers. IP Product is an important business segment of their sales – accounting for 24-25% of their total revenue. Another important strategy is to continue their international expansion to allow it to advance scale beyond the Chinese market. The company is focused on a pricing strategy centered around product differentiation through its private labeled products and therefore is not going to enter price wars to contend on pricing, a strategy that has plagued Alibaba and JD.com over the past 12 months in an attempt to win over customers. On the other hand Miniso’s product differentiation strategy has allowed it to adopt gross margins north of 40%, which explains its strong outperformance compared to traditional e-commerce players.

MSNO Gross Margins (Jefferies)

The total number of company stores is growing mid-teens (at 16% year over year) and its revenue per stores is growing YoY at 24%-25% in both their mainland China and international stores. MNSO is increasingly focused on expanding in the U.S. market with a target of opening another 15 stores before the end of 2023. Revenue contribution from markets outside of China now comprise 33-34% of the company’s overall business.

Risks, thoughts on Entry & Valuation

One of the biggest risks of the company’s fundamental narrative is that, for now, Miniso is not yet as widely known among many consumers in North America as it remains a niche player in retail compared to larger players with more established brand presence. The company’s operating performance trajectory to simultaneously grow 20-25% Revenue AND EBITDA in the coming years 2024-2026 embeds the assumption that more retail consumers will enthusiastically buy MNSO’s products. In other words, the largest risk we see relates to executing well to establishing a brand presence in the new markets that they are entering.

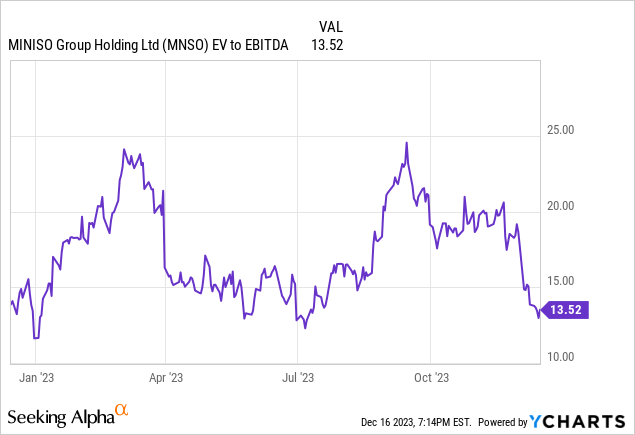

We appreciate the confidence of management’s stated strategy to repurchase $200 million of its own stock discussed from September 2023 and believe that it will uphold the 17.4X Forward P/E multiple that the company currently has been given in the marketplace. The company is also trading near a 1-year trough a widely followed Wall Street valuation metric – the EV/EBITDA multiple – as investors re-rate the growth story. If MNSO is able to keep growing at analyst consensus figures (and it has in the past several quarters), then the current entry for the stock is quite de-risked (on a valuation basis) relative to the stock price earlier in 2023.

For investors to assess the waters in MNSO, selling out of the money puts on this name with early 2024 expiration is most likely a safe way to establish a starter position and gain partial exposure if the stock can find its footing. Upon advance stability, I will be adding light exposure to this promising growth name.