miniseries

Investment Thesis

Minerals Technologies Inc. (NYSE:MTX) is a leading mineral product and supporting systems and services provider headquartered in New York. In this thesis, I will analyze its fourth-quarter results along with its future growth prospects. I will also be analyzing its valuation at the current price level and the upside potential in the stock price. MTX has been experiencing consistent profit margin expansion along with continuous investment in technological advancement, giving it an edge over the competition. Its valuation at the current price level provides a favorable risk-reward profile; hence, I assign a buy rating for MTX.

Company Overview

MTX is a global resource and technology-based company that develops and produces a broad range of specialty mineral, mineral-based, and synthetic mineral products. The company’s products have applications in various industries, including the paper, steel, environmental, energy, and consumer products sectors. MTI offers a diverse range of products, including minerals, mineral additives, and synthetic mineral products. Some of their key product categories include precipitated calcium carbonate, bentonite, talc, and perlite. MTI’s products are used in the paper industry to improve the quality and efficiency of paper, as well as to enhance the properties of coatings and fillers. The company provides products for the steel industry, including desulfurization agents and refractory materials. It also offers solutions for environmental applications, such as air pollution control and water treatment.

Q4 FY2023 Result

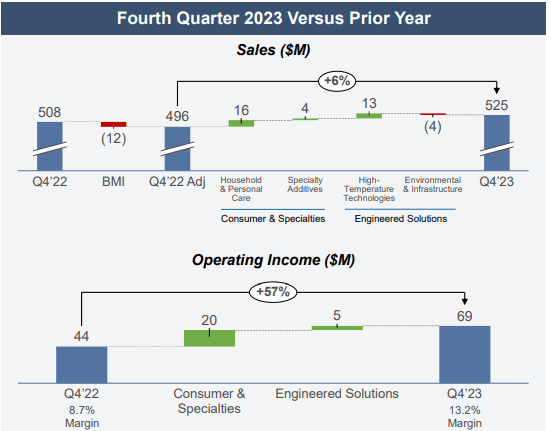

MTX recently reported strong fourth-quarter results, with revenues and EPS beating the market estimates by 3.5% and 2.2%, respectively. The Household & Personal Care product division proved to be the outperformer, with sales growing by 13% y-o-y. However, the Consumer & Specialties segment as a whole witnessed a 3% revenue growth, primarily dragged by the Specialty Additives products that saw a 5% decline. I believe the Specialty Additive products may continue to see subdued sales given the global softness in demand, especially from the Asia Pacific region.

Investor Relations MTX

It reported net sales of $524.5 million, up 3% compared to $507.6 million in the same quarter last year. As I mentioned earlier, the Household & Personal Care products were the primary revenue driver, and I expect it to do well given the consistent new product launches and innovative technology being used to enhance the consumer experience. As per my analysis, the cat litter products found traction among customers and drove the Household & Personal Care revenues. The company did manage to grow revenues despite a slowdown in the global markets, but I believe there is still significant room for improvement on the revenue growth front. The factor that impressed me the most is that it managed to bring down its production as well as operating costs, employing cost-cutting measures and operational changes. It reported an operating margin of 12.7%, compared to 8.5% in the corresponding quarter last year. I believe the decline in production costs played a major role in improving operating margins, complimented by controlled operating expenses. The net income for the quarter stood at $40.8 million, a stellar increase of 91% compared to $21.4 million in the same period the previous year. This brings diluted EPS for the quarter at $1.22, up from $0.62 in the same quarter last year.

Now let us have a look at its balance sheet. As of December 31, 2023, it reported cash and cash equivalent of $317 million against long-term debt of $911 million. The company does have high debt obligations, but it has managed the debt with consistently strong financial performance. Also, the cash balance has been experiencing an increase in the last couple of years, and long-term debt has been witnessing a decline. I do not see any major issues with its balance sheet.

Overall, the company managed to impress me on the cost efficiency front, but a lot needs to be done in the revenue department. I think till the time Specialty Additives products show a recovery, the revenues will remain subdued. The second half of 2024 could be good for the company as the industry is expecting rate cuts, which will improve the spending budget with its clientele. The company has not provided any future guidance, but I expect revenue growth for FY24 to be in the lower single digits; the company could continue to outperform on the profitability front, given its continuing efforts to restrict costs.

Valuation

MTX is currently trading at a share price of $69.18, a YTD decline of 3%. It has a market cap of $2.23 billion. It is trading at a forward GAAP P/E multiple of 11.9x compared to the industry standard of 17x. I believe MTX is trading at a cheap valuation compared to the industry, and it provides a favorable risk-reward profile at the current price level. I expect it to trade at a P/E multiple of 15x in the near future, giving us a target of $87, a 26% upside from the current price level. MTX is a market leader in multiple product categories and I believe it should trade at par with the industry valuation if not at a premium.

Conclusion

The company managed to improve its gross and net profit margins in this high inflationary environment, which is a big positive for the investors. It could witness improved sales figures in the second half of 2024, given the expected interest rate cuts. Its valuation at its current valuation provides significant room for an upside in the stock price. The company does face the risk of high debt obligation, but it has managed the debt efficiently and has seen a decline in debt obligation over the past few years. Considering all these factors, I assign a Buy rating for MTX.