wellesenterprises

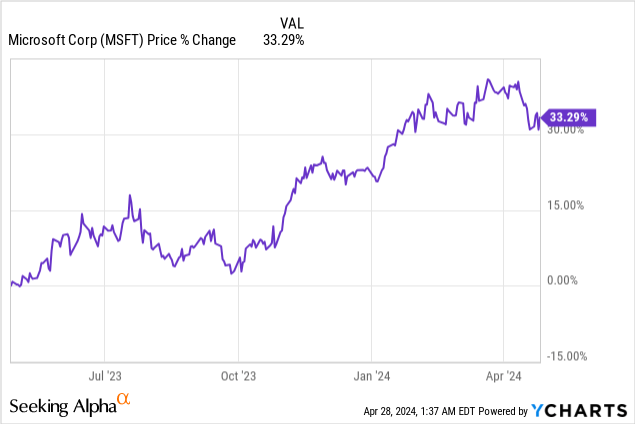

Microsoft (NASDAQ:MSFT) submitted a very solid earnings report for its third fiscal quarter last Thursday that showed enormous free cash flow strength as well as accelerating Cloud growth. Microsoft also saw double-digit top-line growth in all of its core business segments, including Personal Computing, which until recently has been a drag on Microsoft’s revenue performance due to a slowdown in the consumer electronics market in 2023. While I like Microsoft’s FQ3 results and the significant free cash flow especially, shares of the tech company remain very highly valued based off of earnings and free cash flow. As a result, I believe the risk profile is still unappealing, and growth investors may want to wait for a drop before engaging!

Previous rating

I rated shares of Microsoft a sell back in January due to the company’s being very highly valued, especially in relation to other large-cap U.S. tech stocks. The market, however, has been doing fairly well so far this year, which has kept shares of Microsoft afloat as well. I also highlighted in my last work that the company’s Personal Computing segment was seeing solid recovery momentum, which continued in FQ3. While Microsoft’s free cash flow still looks great, I believe investors are overpaying for the company’s potential.

Microsoft beats earnings and top-line estimates

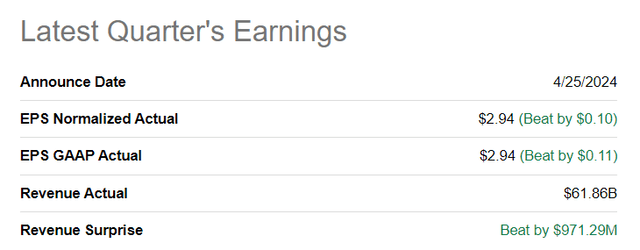

Microsoft as well as Alphabet (GOOG) reported strong results for their last financial quarters, offsetting some weakness that was introduced into the market earlier by Meta Platforms’ CapEx and revenue guidance. Microsoft generated $2.94 per-share in adjusted earnings in its third fiscal quarter on revenues of $61.86B. Both earnings and revenues beat consensus expectations.

Strong Cloud momentum, Personal Computing rebound, FCF margin expansion

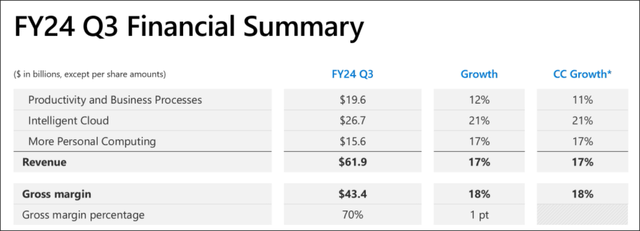

Microsoft saw double-digit top-line growth in all of its businesses, including Intelligent Cloud (+21% Y/Y), Personal Computing (+17% Y/Y) and Productivity (+12% Y/Y). The consolidated top line grew 17% year over year, showing a 1 PP deceleration compared to the previous quarter. However, Cloud saw a 1 PP acceleration of its top-line due to strong demand for the company’s Azure Cloud services.

Personal Computing maintained its momentum in the third fiscal quarter due to a continual recovery in the device market. Personal Computing was Microsoft’s problem child during last year’s down-turn in the consumer electronics market, but the outlook has improved and IDC, as an example, is now forecasting low single-digit growth (+2.0% Y/Y) for device shipments in FY 2024.

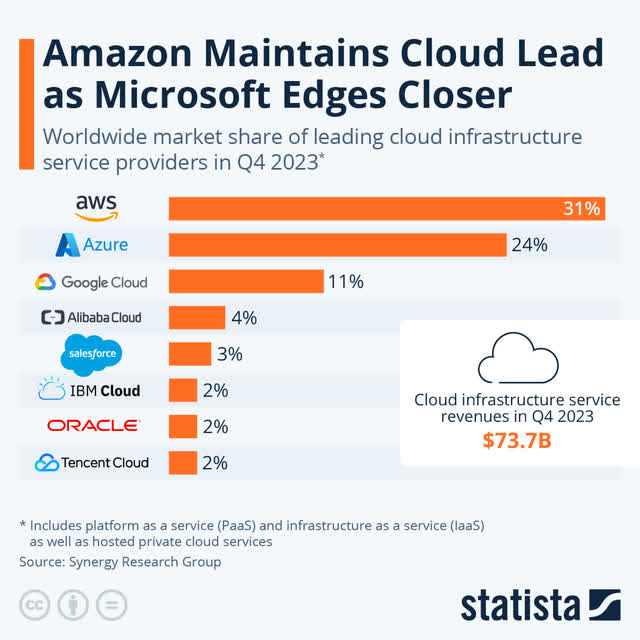

Turning to Microsoft’s main revenue driver, Intelligent Cloud. Microsoft owns the second-largest public cloud service platform, with a market share of approximately 24% (as of Q4’23). Amazon’s AWS continues to dominate the Cloud infrastructure market, but Microsoft has been catching up: a year earlier, Microsoft had a market share of only 21%.

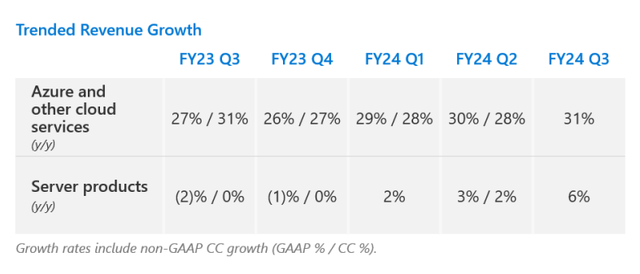

Microsoft’s Cloud segment, like I mentioned above, saw a revenue acceleration in the third fiscal quarter of 1 PP Q/Q, due to strong demand from the corporate sector for Cloud solutions. In the third fiscal quarter, Azure and other cloud services saw 31% year-over-year revenue growth, and it was the third straight revenue acceleration for this particular segment. Azure clearly has momentum, in part due to market share growth, and I expect this momentum to continue in 2024 as more companies spend money on Cloud services to scale their IT transformations.

Enormous free cash flow power

Microsoft generated a massive $21.0B in free cash flow in the March quarter on revenues of $61.9B, which implies not only 130% Q/Q growth, but also an impressive 33.9% free cash flow margin. Microsoft is one of the most free cash flow-profitable companies in the market, and the company generated $4B more in March quarter FCF than Google and $8B more than Meta. Both Google and Meta themselves reported very strong quarters in terms of free cash flow as well. For Google, the strength in free cash flow resulted in the company’s first dividend announcement ever, and it was the main reason why I continue to see Google being at the cusp of an upside breakout.

|

$ billions |

FQ3’24 |

FQ2’24 |

FQ1’24 |

FQ4’23 |

FQ3’23 |

Y/Y Growth |

|

Revenues |

$61,858 |

$62,020 |

$56,517 |

$56,189 |

$52,857 |

17% |

|

Cash Flow From Operating Activities |

$31,917 |

$18,853 |

$30,583 |

$28,770 |

$24,441 |

31% |

|

Capital Expenditures |

($10,952) |

($9,735) |

($9,917) |

($8,943) |

($6,607) |

66% |

|

Free Cash Flow |

$20,965 |

$9,118 |

$20,666 |

$19,827 |

$17,834 |

18% |

|

Free Cash Flow Margin |

33.9% |

14.7% |

36.6% |

35.3% |

33.7% |

0% |

(Source: Author)

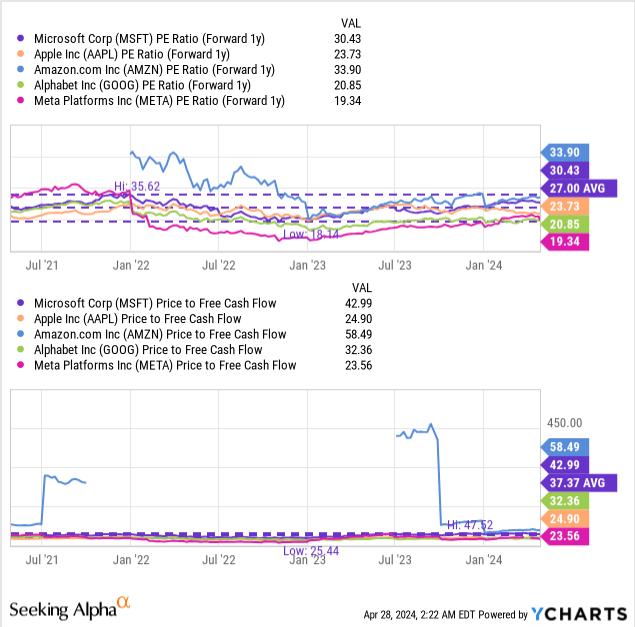

Microsoft’s valuation

Shares of Microsoft are highly valued relative to other large-cap tech companies with considerable, recurring free cash flows and earnings. In my last work on Microsoft I indicated a potential fair value for shares of Microsoft of ~$400 which I derived by multiplying the company’s 3-year average P/E ratio with the consensus estimate at the time. In terms of valuation (fair value) nothing has changed for me with regard to Microsoft. Since Microsoft’s shares are currently trading at $406, I believe shares are slightly overvalued and therefore a sell.

Microsoft’s earnings (and free cash flow) are also quite expensive (30.4X P/E, 43.0X P/FCF) relative to other large-cap U.S. companies that pull in a lot of free cash flow. In my opinion, Meta and Google especially represent much stronger earnings/FCF value for investors that look for capital returns through buybacks (Google just announced a $70B buyback, while Meta has a $50B buyout plan in place). Meta and Google trade at 30%+ lower P/E ratios than Microsoft (and Google’s Cloud business is also crushing it right now). For investors that look for Cloud growth, Google may be a much-better priced alternative to bet on the Cloud market.

Risks with Microsoft

I continue to believe that Microsoft is about fairly valued, which was the last time the reason why I down-graded shares to sell. The biggest risk for Microsoft is a potential slowdown in the Azure market which, since the segment is the firm’s main revenue driver, could have an outsized effect on Microsoft’s consolidated top-line growth. What would change my mind about Microsoft is if the company saw a serious decline in its free cash flows (margins).

Final thoughts

Microsoft delivered a very good earnings report on Thursday, which showed continual recovery momentum in Personal Computing and slightly accelerating top-line growth in Cloud, Microsoft’s most important revenue growth driver. From a free cash flow perspective, the third fiscal quarter was also very solid, with MSFT growing its free cash flow 130% Q/Q and 17% Y/Y. Microsoft is doing well in Cloud, and may continue to benefit from a recovery in the consumer electronics market, but I view the valuation as unattractive. As I said last time, I believe Microsoft is about fairly valued at ~$400 and investors may want to wait for a drop before engaging here!