FinkAvenue

Investment Thesis

Microsoft Corporation (NASDAQ:MSFT) is truly in its stride. The firm is executing their commercialization of AI strategy perfectly by providing users with great AI-enhanced versions of existing products.

The latest fiscal Q2 results see Microsoft boasting great levels of revenue and margin growth, with the firm enjoying a solid mix of high-margin sales, particularly in their Azure cloud business.

Shares are currently trading at what I calculate to be a fair valuation, with 2024 growth already fully baked in.

Nevertheless, Microsoft is currently leading the AI race comfortably, especially from a commercialization standpoint, and warrants a Buy rating.

Company Background

Microsoft is an American technology corporation headquartered in Redmond, Washington. Known for their involvement in ChatGPT, their operating system Windows, the Surface and Xbox line-up of personal electronic devices, the Office productivity suite, and their Azure cloud computing service, the company is an absolute tech powerhouse.

The company’s proven expertise across a wide range of products and services has allowed the firm to become an integral element of essentially every single digital market present in today’s economy.

The firm’s recent push into AI through significant investment and the partial acquisition of OpenAI’s ChatGPT, the launch of Copilot, and integrations of AI into Azure has only further strengthened the bullish sentiment held by those on Wall Street towards the company’s future prospects.

FY24 Q2 Earnings Analysis

Microsoft delivered impressive results for the second quarter of fiscal year 2024, surpassing analysts’ expectations on both revenue and earnings.

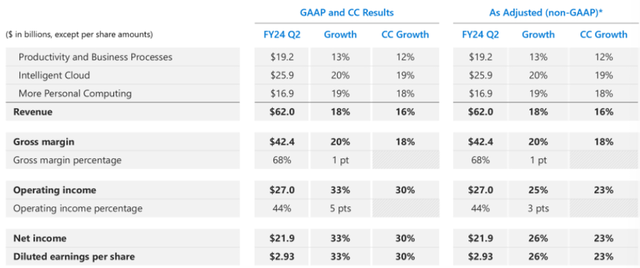

Microsoft FY24 Q2 Earnings Presentation

The company’s revenue increased 18% year over year to $62 billion, driven by its cloud business, which grew 24% to $33.7 billion. Operating income rose 33% to $27 billion, and Microsoft’s net income rose 33% to $21.9 billion. The company’s diluted earnings per share was $2.93, up 33% from the same period last year.

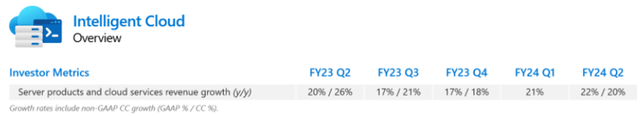

Microsoft FY24 Q2 Earnings Presentation

The company’s cloud business, which includes its Azure cloud infrastructure, SQL Server, Windows Server, Nuance, GitHub, and enterprise services, was the main growth driver for the quarter. The Intelligent Cloud segment produced $25.88 billion in revenue, up 20% and above the $25.29 billion consensus among analysts.

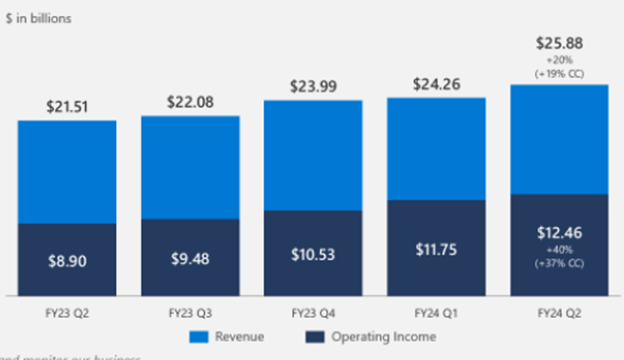

Microsoft FY24 Q2 Earnings Presentation

Operating income also grew 40% thanks to an improved mix of product sales and more demand for consumption-based services.

CEO Satya Nadella said that Microsoft’s ability to apply artificial intelligence across its Azure cloud business helped win new customers and boosting productivity for the segment.

I find this ability for Microsoft to commercialize their AI initiatives as very positive. In the Q1 results many investors were still questioning how soon Microsoft will be able to extract real returns from their AI investments, and it appears that they have already managed this successfully.

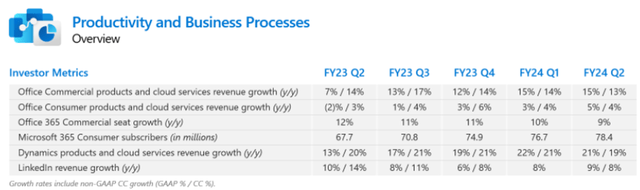

Microsoft FY24 Q2 Earnings Presentation

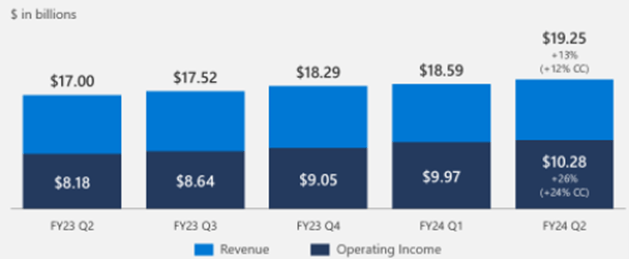

Microsoft’s Productivity and Business Processes segment, which includes its Office products, LinkedIn, Dynamics and other services, also performed well, generating $19.2 billion in revenue, up 13%.

Microsoft FY24 Q2 Earnings Presentation

Operating income also increased 26% YoY to $10.28B, all the while operating expenses actually decreased 5% YoY thanks to operational improvements in efficiency.

The company’s Office 365 Commercial revenue grew 17%, while its Microsoft 365 Consumer subscribers grew to 78.4 million. This significant increase in subscribers may have come as more customers are incentivized to enjoy the new Copilot AI features present in the 365 suite.

The company’s LinkedIn revenue increased by 9%, as the professional network saw more engagement and advertising revenue. This is largely in line with my expectations as LinkedIn becomes a more integral part of the workspace and professional hiring process.

Microsoft FY24 Q2 Earnings Presentation

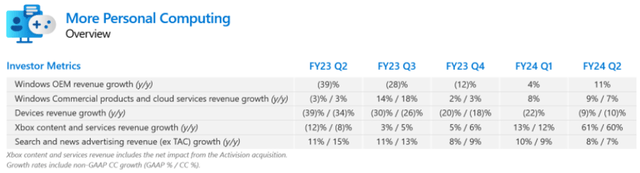

More Personal Computing, which includes its Windows, Xbox, Surface, and other devices, contributed $16.89 billion in revenue, up about 19%. The segment saw mixed results, as Windows OEM revenue decreased 28% due to the softening PC market, while Windows Commercial products and cloud services revenue increased 14%.

The softening sale of OEMs also hurt Microsoft’s operating margin for the segment, which decreased from 36% one year prior to around 25% in Q2 FY24. While a more robust PC market should help ignite further growth in OEM sales, it is regrettable to see the lack of profitability present in the firm’s other businesses within this segment.

Microsoft also completed its largest acquisition ever, buying video game publisher Activision Blizzard for $68.7 billion. The fiscal earnings from the newly acquired gaming company were added to the Xbox Content and Services revenue, which increased 3%.

Microsoft News | Investor Relations

The Activision Blizzard acquisition has allowed Microsoft to become more vertically integrated within the gaming industry, which could see the firm create a more streamlined experience for their Windows and Xbox customers compared to those of rivals Nintendo or Sony’s PlayStation.

The company’s Surface revenue increased 12%, as the company launched new devices such as the Surface Laptop Studio and the Surface Duo 2.

While I do like the gains being made by the Surface lineup both qualitatively among reviewers and quantitively on the income statement, I find it difficult to believe Microsoft could truly create an Apple-like relationship with customers for their laptops.

Overall, Microsoft’s Q2 results for 2024 showed that the company is well positioned to capitalize on the increasing levels of AI integration into work processes by offering customers great AI-enhanced products and services.

Microsoft has also been particularly apt at generating real returns from their AI-driven growth with operating income increasing by 44% YoY, leaving the firm with an operating margin of 44% and a ROIC of 28.7%.

The company’s strong growth in its cloud business, its diversified portfolio of AI products and services, and its strategic acquisitions, demonstrate that Microsoft is not resting on its initial advantage in AI and machine learning, but is continuing to set the benchmark for others to follow.

Valuation – Q2 2024 Update

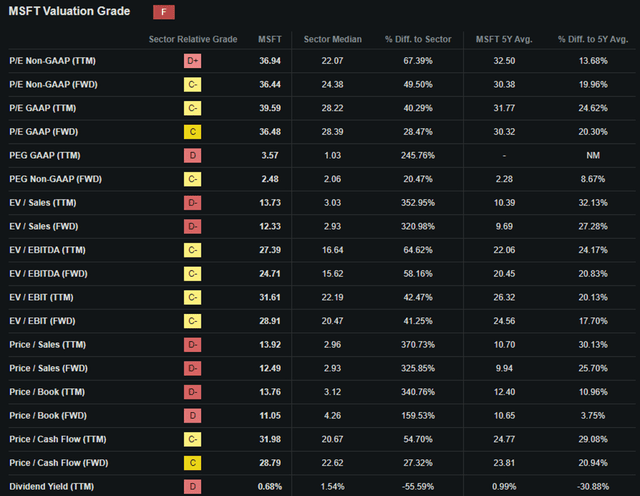

Seeking Alpha | MSFT | Valuation

Seeking Alpha’s Quant has assigned Microsoft with an “F” Valuation rating. While the underlying multiples appear quite elevated, it is difficult to immediately understand how accurate this quant rating may be.

The firm is currently trading at a P/E GAAP TTM ratio of 39.59x, which represents a 24% increase relative to their running 5Y average. This ratio is up from 29x back in October, when I last wrote about Microsoft.

I believe investors are clearly pricing in considerable future growth for Microsoft, thanks to further AI-related revenue growth and a resumption in PC demand. However, I still think the considerable growth forecast could be difficult to achieve in a recessionary market environment.

Microsoft also has a P/CF ratio FWD of 31.98x and an EV/Sales FWD of 12.33x. While these metrics are certainly quite elevated and not exactly indicative of a value opportunity, I believe they are mostly appropriate given the firm’s huge growth prospects.

Seeking Alpha | MSFT | 1Y Advanced Chart

From an absolute perspective, Microsoft shares have outperformed the Nasdaq 100-Index tracking fund, the Invesco QQQ Trust ETF (QQQ), by over 20%, earning investors massive returns as the stock reaches all-time high valuations.

While this performance is at least partially warranted by the excellent fiscal performance achieved by Microsoft, investors have also appeared to have priced in significant future growth, as evidenced by the significant increase in multiple valuations.

The Value Corner

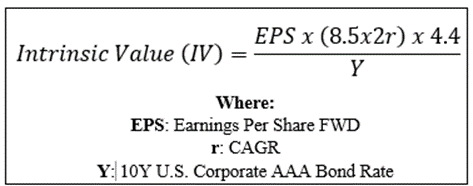

By utilizing our specially formulated Intrinsic Valuation Calculation, we can better understand what value exists in the company from a more objective perspective.

Using Microsoft’s current share price of $408.59, a revised 2024 EPS of $11.21, a realistic “r” value of 0.15 (15%), and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 4.74x, I derive a base-case IV of $401. This represents pretty much a fair valuation in shares.

When using a more pessimistic CAGR value for r of 0.12 (12%) to reflect a scenario where Microsoft struggles to increase net incomes as a globally spanning recession results in a slowdown in corporate spending on IT, shares are valued at around $338 representing a 21% overvaluation in shares.

Considering the valuation metrics, absolute valuation, and intrinsic value calculation, I believe Microsoft is trading at what should be considered a fair valuation at best and a real overvaluation given a bear case.

In the short term (3-12 months), I find it difficult to say exactly what may happen to the stock. While the strong future growth prospects are alluring, any short-term catalyst could result in a sudden drop in share prices, especially given the growth already seemingly baked into the share price.

In the long term (2-10 years), I believe Microsoft will continue to strengthen their position at the forefront the AI race while also extracting consistent profits from their traditional business operations.

What I really like about Microsoft at present time is their ability to integrate AI into current generations of products. It is this exact ability that allows Microsoft to give consumers the benefits of AI while also extracting real income from the innovation.

Risks Facing Microsoft – Q2 2024 Update

Microsoft continues to see real risks arising from the competitive nature of the business environments in which they operate along with the emergence of some AI-related regulatory frameworks.

Despite Microsoft’s great AI products, the company is going to start facing significantly more competition in 2024 from its rivals.

With the likes of Amazon (AMZN), Alphabet (GOOG, GOOGL), and Apple (AAPL) currently in the midst of developing their own AI tools, Microsoft may see their absolute advantage in the field deteriorate unless they remain highly innovative with their own product.

Many of these rivals have massive amounts of data and content for their AI to learn from which could see these competitors usurp Microsoft’s top spot in the AI race.

From an ESG perspective, Microsoft also faces some real threats related to the regulatory governance associated with AI products and services.

Both the U.S. and EU and planning significant AI frameworks aimed to tackle some of the potential threats and risks associated with the widespread implementation of AI into the workplace and the lives of billions of people.

While I do see these frameworks as a necessary element of regulation to protect the end consumer, Microsoft must ensure they are cooperative and constructive with the regulators in order to ensure their AI products are not hampered or throttled in any way that could cause damage to their existing use cases.

Despite this ESG change, I believe Microsoft would still make for a solid ESG-conscious investment pick given their net-zero targets and positive attitude towards societal equality and governance.

Of course, opinions may vary and I urge you to conduct research of your own into Microsoft’s ESG risk profile should these matters be of particular importance to you.

Summary

Microsoft has shown investors through its fiscal Q2 results that it is still at the forefront of the AI race. Their ability to turn what seemed initially like a costly innovation into a profit-generating powerhouse is incredibly impressive and suggests the firm is accurately meeting consumer expectations for their products.

Even in their other business divisions, Microsoft is in their stride generating both top line and bottom-line growth. Quite simply, there is very little to criticize Microsoft on regarding their current execution of business operations.

The valuation however is a slightly more difficult element to analyze. While the IV calculation suggests a fair valuation in shares at the present time, there are still some real risks associated with this quantitative analysis.

As illustrated by the inflated valuation metrics and bear-case IV overvaluation, most of the growth for 2024 in Microsoft shares appears to already have been baked in to the share price. I therefore believe, any negative economic or external factor could send shares downward as investors discount the stock against these influences.

I still rate Microsoft a tentative Buy and believe the firm is well positioned to benefit from massive future growth thanks both to their AI-enhanced products and traditional service provision.

However, I remain cautious about the valuation and may change my opinion should there be any deterioration in either Microsoft’s profitability or the health of the macroeconomic environment as a whole.