hapabapa

Micron (NASDAQ:MU) stands out as a key player in the DRAM and NAND industry. Its growth is poised to surge, propelled by the increasing demands in AI and its incoming HBM3 products. The company anticipates a recovery in 2024, setting the stage for full momentum in growth by 2025. With the current stock price undervalued, I recommend initiating coverage with a ‘Buy’ rating, assigning a fair value of $96 per share.

Growth Driven by Data Center and AI Workloads

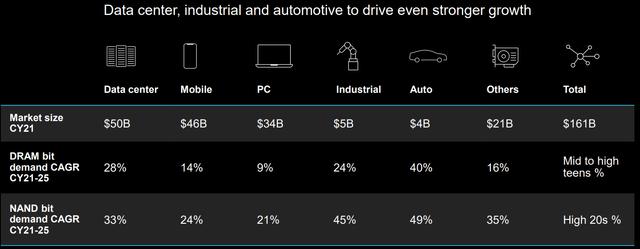

The data center stands out as a crucial growth driver for Micron, with estimated DRAM demand for data centers set to grow by 28% and NAND by 33%. Several factors contribute to this growth expansion. Firstly, Micron anticipates that AI servers will demand significantly more memory, with 6x to 8x the DRAM content and 2x to 3x more NAND content. Considering the early stage of AI adoption, this points to substantial growth potential for Micron’s DRAM and NAND business in the future.

Secondly, in addition to the surging demand for AI-related workflows, Micron’s HBM3 memory products are emerging as frontrunners among their competitors. According to their recent conference, Micron’s HBM3 demonstrates 10% to 15% better performance compared to any other competitive product, coupled with more than 25% improved power functionality relative to their peers. HBM3 proves to be a crucial memory product for AI workflows, and its superior features position Micron to gain market share in the AI-related market. They project that their market share for HBM3 will align with their DRAM industry share by 2025.

Finally, the entire IT industry is witnessing a surge in demand for data analytics, encompassing both structured and unstructured data sets. This heightened demand for data analytics necessitates substantial data storage, thereby stimulating the growth of memory products. In summary, Micron is poised to experience both industry growth and market share gains in the era of AI computing.

2024 For Recovery and 2025 for Growth

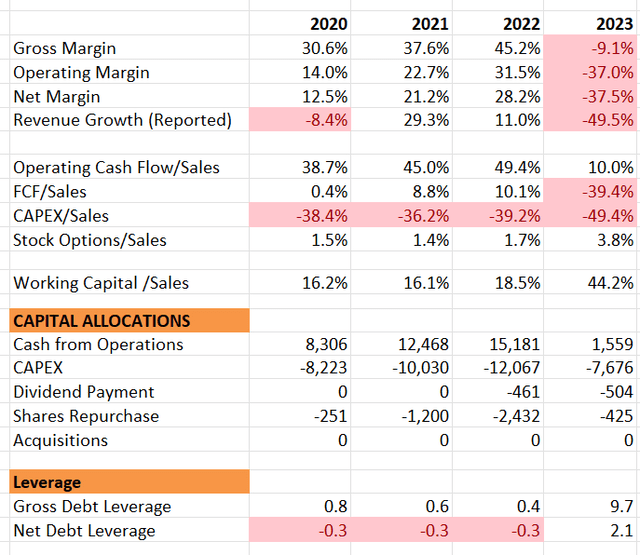

As depicted in the table below, Micron exhibited significant growth in FY21 and FY22. However, the company experienced a notable setback in FY23, with a 49.5% decline in revenue growth. This downturn was attributed to sluggish demands in computing and networking, mobile devices, and embedded memories. Consequently, due to operating leverage, the operating margin plummeted, recording a reported figure of -37%.

The management of Micron has projected an industry recovery in 2024, anticipating full-fledged growth by 2025. In the long term, they anticipate mid-to-high-single-digit growth in DRAM and low-teens growth in NAND. Several pieces of evidence support their optimistic outlook.

According to their disclosures, inventory levels for memory and storage across various industries, including PC, mobile, auto, industrial, and data center, are at normal levels for most customers. This suggests a positive indicator for Micron’s future growth and indicates a return to normalcy in the industry post-pandemic.

Additionally, Micron hinted at an expected mid-single-digit increase in total server unit shipments within the data center market in 2024 during their earnings call. This growth contrasts with the low-double-digit decline observed in 2023, signaling a positive shift in the market.

Furthermore, Micron is set to commence volume production ramp-up for their HBM3E early in calendar year 2024. They anticipate HBM3E to generate several hundred million dollars in revenue in FY24. With the production ramp-up, a substantial growth for their HBM3E products is a reasonable expectation in FY25.

Recent Result and FY24 Outlook

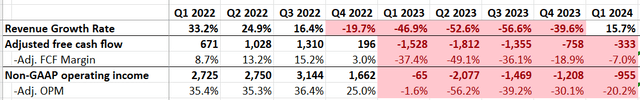

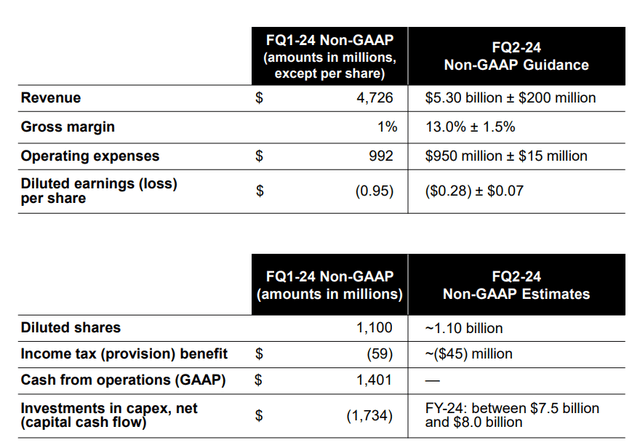

They reported Q1 FY24 on December 20, 2023, and Micron achieved an impressive 15.7% revenue growth, marking a positive turn in their financial performance. Notably, the free cash flow also demonstrated improvement, narrowing down from -$1.5 billion in Q1 FY23 to -$333 million in Q1 FY24.

At the close of the quarter, Micron held $9.84 billion in cash and cash equivalents, juxtaposed with $13.5 billion in debts. Despite the debt load, the company maintains a comparatively low net debt leverage, underscoring a resilient balance sheet and affirming its financial stability.

The recent quarterly results from Micron substantiate their outlook on the industry’s recovery in 2024. Furthermore, their Q2 FY24 guidance suggests an impressive 46% year-over-year growth in revenue. Notably, Micron emphasized that price appreciation is a significant contributor to their full-year guidance, expressing expectations for a continual price increase throughout the year.

Micron appears to have a high visibility of topline growth in the coming years, driven primarily by AI adoption and HBM3. Their projections indicate a robust growth trajectory for HBM3, with an anticipated 50% CAGR in the next few years. Similarly, the data center AI accelerator is expected to experience a substantial 70% growth over the same period. These industry demands position Micron for significant revenue growth.

Moreover, the anticipated price appreciation is poised to notably improve their gross margin, further contributing to the positive outlook for the company.

Kioxia stands as one of Micron’s primary competitors. As per Kioxia’s Q2 FY23 results, there’s a positive trend in the supply-demand balance, with selling prices having reached a bottom. This improvement is attributed to production adjustments made by flash memory manufacturers, impacting overall supply, and the normalization of customer inventory. Kioxia’s market outlook aligns with a recovery anticipated in 2024, and they expect prices to rise steadily throughout the year.

Valuation

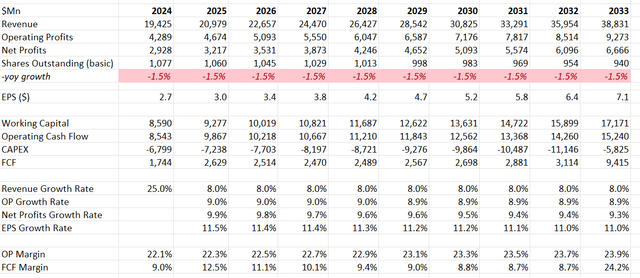

The model indicates a recovery year in FY24, projecting a robust 25% topline growth. Factoring in the price bottom-out and the associated operating leverage, the calculated operating margin is expected to rebound to 22.1% in FY24. For normalized revenue growth, the company’s guidance suggests high-single-digit growth, with the model assuming a conservative 8%. Historically, the memory market has outpaced the overall semiconductor industry in growth. Moreover, the substantial growth opportunities fueled by AI and HBM3 suggest that an 8% revenue growth assumption might be considered conservative.

Micron DCF – Author’s Calculation

The model employs a 10% discount rate, assumes a 4% terminal growth, and factors in a 10% tax rate. Based on these parameters, the estimated fair value stands at $96 per share.

Key Risks

China Restrictions: Mainland China accounted for 14% of the group revenue in FY23. In May 2023, the Cyberspace Administration of China made a decision barring critical information infrastructure operators in the country from purchasing Micron products. This move appears to align with the increasing geopolitical tensions between the U.S. and China, prompting the Chinese government to take precautionary actions.

High CAPEX Spending: Owing to their manufacturing capacity expansion efforts, capital expenditures accounted for nearly 50% of the total revenue in FY23. The company aims to gradually reduce this figure, targeting a mid-30s percentage for capex spending over time. The substantial capex spending is intrinsic to their business model and is expected to consistently impact their free cash flow margin.

Verdict

I believe Micron will persist in gaining market share in AI computing. With the stock price currently undervalued, I am initiating coverage with a ‘Buy’ rating and a fair value estimate of $96 per share.