Comezora/Moment via Getty Images

Investment Thesis

Microchip Technologies (NASDAQ:MCHP) is a diversified provider of microcontrollers, analog, and related computer chips for a wide range of industries. It has historically had strong growth as the company focused on expanding the breadth of its product line in order to provide its clients with a one-stop shop. When I first covered Microchip almost six months ago (Q1FY24, ending June 30th 2023) they had just completed their 11th quarter of sequential revenue growth at a CAGR of approximately 25%. However, management stated that they had started to see weakness in their client base. Around this time, interest rates were hitting their peak and clients were looking for ways to reduce their extra inventory that had amassed in the prior quarters. Management warned that the following quarter would see sales decline and they hinted that Q3 could be even worse. Q3 earnings were released at the start of February, and the decline in sales has been significant (-22.8% peak to present) and the guidance for next quarter is even worse (-42.1% peak to guide).

This article will look at where Microchip is in their current business cycle and how they expect the business to perform going forward. I will also discuss why I believe Microchip is an excellent investment in the long term, but also why I am avoiding it for now. Lastly, I will provide a discounted cash flow analysis and what I am looking for performance-wise to make Microchip a buy.

Sales Are Down Substantially and Guidance is Worse

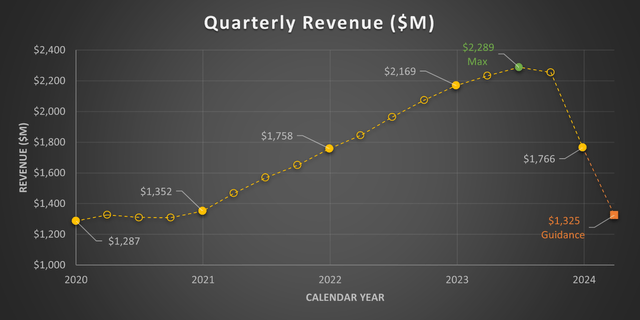

Microchip was on a roll. Sales increased at roughly a 25% CAGR throughout 2021 to June of 2023. Starting in September’s quarterly results, sales began to decrease as clients cancelled or pushed out orders. At the time, management said that they were working with their customers and helping them adjust their orders, even if they were non-cancellable. I still believe this was the right thing to do because forcing your customers to buy your product is counterproductive to forming business relationships and it merely delays the decline in orders to following quarters.

This situation has continued to play out as customers look to reduce their inventory and Microchip continues to accommodate push-out and cancellation requests. On the latest earnings call, management disclosed that Microchip’s total days of inventory had increased to 185 days, up 18 days from the prior quarter. They also forecast that inventory will reach 225 to 230 days by the end of the next quarter. Their distributors have also seen increasing inventory levels, rising to 37 days. At the same time, Microchip does not have the ability to know how much extra inventory manufacturing clients have, but they believe that inventory destocking is underway at multiple levels of the supply chain because the number of products being produced and sold using Microchip’s components is far greater than the number of components Microchip is currently selling. At the start of 2023, Microchip’s products had a lead time around 52 weeks, currently lead times have decreased to only 8 weeks which is in line with pre-pandemic norms.

The reduction in demand has caused sales to plummet. In the last quarter, sales were $1766M, which is down 22.8% in just two quarters. Guidance for the next quarter predicts sales in the range of $1225M to $1425M. At the midpoint, sales will be down 42.1% in three quarters. Microchip isn’t the only chip company in this market seeing weakness. Texas Instruments (TXN) has seen their revenue decline by 22.2% from peak to latest release, but that has been over five quarters rather than two for Microchip.

Quarterly revenue (Microchip Filings, Author’s Chart)

Returning to the earnings call, the only end markets where demand has remained strong is aerospace and defense. The largest sales declines in the quarter were for analog products (-30.9%) followed by mixed-signal and microcontrollers (-22.3%) while the ‘other’ category held fairly steady. Despite direct questioning from analysts, management could not indicate when they expect sales to rebound or at what rate the rebound will likely take. The reason they gave for this lack of transparency is the lack of long-term supply agreements—they have no way of knowing what inventory levels their clients have beyond their direct distributors—and lower lead times have reduced the need for placing early orders.

When questioned on how this cycle compares to previous business cycles, management said this time is different, because historically when sales decline, the bottom is reached within three quarters, and both the rate and amount of decline is lower. They discussed how during the 2008 global financial crisis their sales only dropped 36% and they were able to identify the bottom. At present, sales are forecast to decline by over 40% and despite being the third quarter of declines, the bottom cannot be called.

On the bright side, management confirmed that all revenue declines are related to declining sales volume. They are not reducing prices in any way because the price of a component is determined during its design and remains largely unchanged throughout the product’s life (which can be decades). Management also confirmed that declining sales is due macroeconomic and inventory reduction alone, not added competition from China. Microchip generates 20% of their sales in China, and despite China’s recent focus on building out legacy node chipmaking (which is ideal for analog and microcontrollers) management sees minimal overlap in the types of chips being produced. Microchip also has an advantage over upstart competitors due to the wider catalog of components offered and their design software.

Management is Properly Controlling the Balance Sheet

Microchip has a skilled management team that knows how to control expenses and reduce debt. Since FY2019, Microchip has paid down $7.1B in debt; including another $392M last quarter. At the end of the quarter, their total debt outstanding was $5707.2M. I have included their schedule of maturing debt below. Microchip will likely need to issue new debt in the coming quarters because forecast sales will not be strong enough to continue aggressive debt paydown. Unfortunately for them, the interest they will have to pay will also increase because the maturing debt has interest rates below 1%.

Debt maturity schedule (Microchip Filings, Author’s Chart)

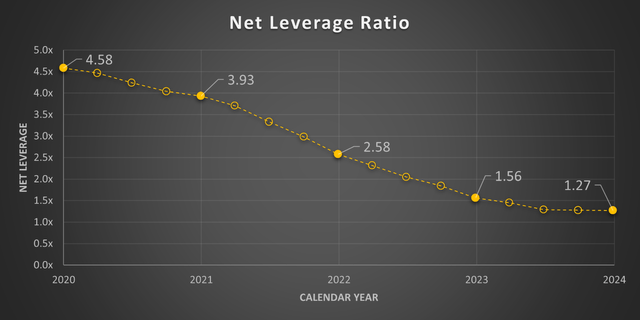

Microchip’s debt levels matter a lot because shareholder returns (which I will discuss later) are tied to the net leverage ratio. The net leverage ratio is defined as the gross debt less cash and short-term investments divided by adjusted EBITDA. At present, the net leverage ratio decreased to 1.27, but will likely rise as sales fall, leading to lower adjusted EBITDA.

Net leverage ratio (Microchip Filings, Author’s Chart)

To manage the declining sales volume, management announced on the earnings call that they would be reducing CAPEX going forward, scheduling fab shutdowns, and implementing short-term pay cuts. Microchip recently reached preliminary terms with the Department of Commerce for $162M in CHIPS act funding. Management stated that the money will be used for ongoing projects at their existing manufacturing facilities, but due to reduced demand they will slow the rate at which the expansions take place. Additionally, they announced a two-week shutdown of their wafer fab facilities in each of the following 2 quarters. The intent of the shutdown is to reduce inventory buildup. Lastly, to go along with the shutdowns, all salaried employees will get a 10% pay cut as long as shutdowns last and management will take a 20% pay cut. The reasoning behind the pay cuts was to fairly distribute the cost of a shutdown among all members of the company, rather than factory workers only. Additionally, reducing payroll expenses is part of their long run plan to “avoid layoffs, and in the process protect manufacturing capability, as well as high-priority projects, which are important for our customers and us to thrive in the long-term” (Ganesh Moorthy, CEO). This is the right call in the long run, but it remains to be seen if this will cause some employees to switch to other semiconductor firms.

Shareholder Returns

Microchip is a very shareholder-friendly company. Shareholder returns are based on a percentage of adjusted free cash flow; defined as cash flow from operations less CAPEX and prepayments. In the last quarter, adjusted free cashflow was $763.4M. Over the coming quarter, the company plans to distribute 82.5% of this cash to shareholders in the form of $243M in dividends ($0.45 per share) and $386.8M in share repurchases. Despite the decline in sales, this is the largest quarterly return to shareholders in the company’s history.

Microchip’s current shareholder return policy is to increase the amount of adjusted free cash flow returned to shareholders by 5% every quarter until returns reach 100% of adjusted free cash flow so long as the net leverage ratio is under 1.50x. If the net leverage ratio stays below this threshold, returns will reach 100% in the quarter ending March 2025. They are also targeting to split the returns 50/50 between dividends and share buybacks, but the exact amount of share buybacks will vary based on performance.

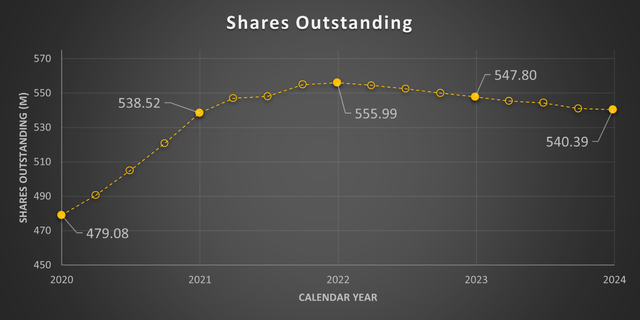

Since the start of the share buyback program in 2022, the company has repurchased approximately 25.9M shares. This has resulted in a net reduction of 15.6M shares outstanding and the neutralization of 10.3M shares related to stock-based compensation and convertible debt. Typically, the company buys back 0.2% to 0.5% of net shares outstanding each quarter.

Common shares outstanding (Seeking Alpha, Author’s Chart)

Valuation

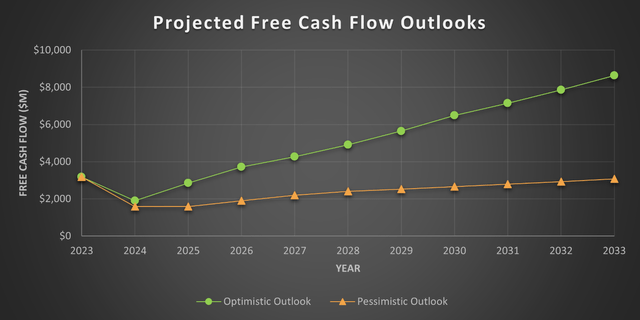

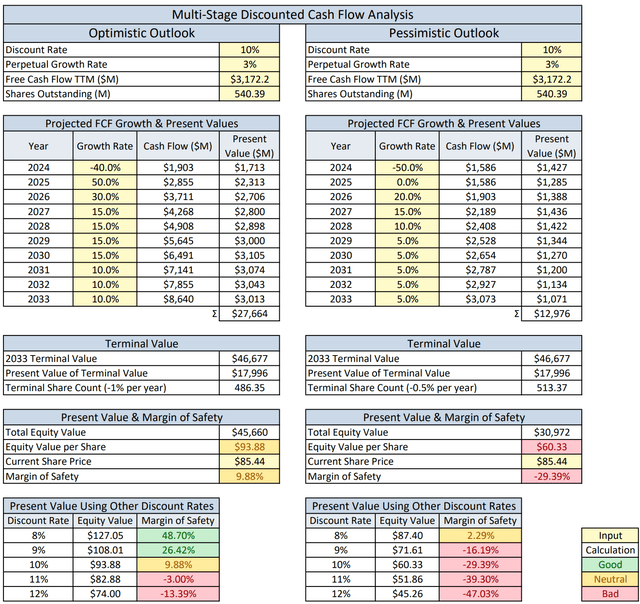

Since management couldn’t give confident forward guidance and it is apparent that the sales decline will be severe, I am going with two different discounted cash flow analysis outlooks. In my optimistic outlook, I am predicting free cash flow falls 40% this year before rebounding through 2025 and 26. After rebounding, I am modeling a 15% CAGR which is just below their long run performance of 16% through the 2020’s and a 10% growth rate in the early 2030’s. On the pessimistic side, I am predicting free cash flow will fall 50% and fail to recover. In this model, I am treating the last few years as an anomaly, driven by supply constraints leading customers to overorder and seek out new suppliers they would not normally use. In this model, the free cash flow never returns to current levels. In both models, the perpetual growth rate (the rate of growth beyond the model range) is 3%. Additionally, I have accounted for share buybacks in this model. The optimistic model assumes 1% of shares outstanding are repurchased annually, while the pessimistic model assumes 0.5% of shares outstanding are repurchased annually.

Projected free cash flow outlook (By Author) DCF analysis (By Author)

Though I like the company, its current valuation isn’t looking good in either model. In the optimistic model, the present value is $93.88 per share, while the pessimistic model sees the stock being worth only $60.33 per share. At a current price per share of $85.44 there is very little margin of safety in the optimistic model, while the pessimistic model screams sell.

For comparison, my previous analysis 6 months ago indicated a fair value of $97.98 per share (but it didn’t account for share buybacks; with buybacks included, it would have predicted $107.77 per share). However, at the time of that analysis, the share price was $80.23 per share. Despite greater risk and uncertainty today, the share price is higher while the margin of safety is less. Therefore, I must reiterate my hold rating.

When Microchip Becomes a Buy

I believe Microchip is a good company with the potential for strong growth, but the current stock price does not adequately compensate for the risks associated with the negative sales outlook. In my last article, I covered Microchip’s strengths in detail, so I won’t repeat them here, but I do believe in their future.

Microchip will become a buy when either of two events occur. First, would be a rebound in sales. On the last 3 earnings calls I have listened to, management has only seen demand difficulty going forwards and talked about clients needing to cancel or delay orders. I want to see sales bottom and start to pick back up, at least in guidance. Alternatively, I want to see a large drop in share price commensurate with the decline in revenue. Though I would prefer the company to remain strong, a steep decline in share price that yields a decent margin of safety in relation to the pessimistic outlook would be worth buying even if a bottom in sales has not been identified.

Conclusion & Risks

I want to buy more shares in Microchip because of its shareholder-friendly policies and market potential, but I just cannot justify it at the moment. The few shares I do own are a rounding error in my portfolio, so I’m not interested in determining a time to sell. Now the hard part is timing when to buy. Until a bottom in sales is identified or the share price declines substantially, Microchip is worth watching, but it’s not worth buying.

Microchip’s revenue looks like the first large hill of a roller coaster. It climbed at a great rate, but now it is falling even faster. Hopefully, the next quarter will mark the bottom in revenue, but even management is uncertain what the future holds. Bad guidance does not always lead to share price declines, take Enphase’s (ENPH) recent earnings and guidance for example, but Enphase was able to identify a bottom, Microchip has not.