Andriy Onufriyenko/Moment via Getty Images

Investing in the digital future is no longer a concept of science fiction. The advent of the Metaverse, a network of virtual universes that are all interconnected, has opened up a new avenue for investment opportunities. I had poked fun at the Metaverse concept when it was all the rage a few years back, but in revisiting the space, think it’s worth considering for longer-term investors. One way to play the theme is through the Roundhill Ball Metaverse ETF (METV). METV is a passively managed ETF that began trading on June 30, 2021. It is designed to track the Ball Metaverse Index, a collection of companies involved in the development and operation of the Metaverse.

METV is intended to offer investors a means to gain broad exposure to the Metaverse, including companies involved in computing, networking, virtual platforms, interchange standards, digital payments, content creation, and hardware sales. Despite being passively managed, the ETF rebalances on a quarterly basis to ensure it accurately reflects the evolving Metaverse landscape.

METV Holdings: A Closer Look

Top holdings in METV are all the familiar ones, and include

-

Apple (AAPL): A technology giant that is developing physical technologies and devices used to access, interact with, and develop the Metaverse.

-

Meta Platforms Inc. (META): Formerly known as Facebook, Meta is one of the pioneering companies in the creation and operation of immersive digital environments in the Metaverse.

-

NVIDIA Corporation (NVDA): A leading company in the supply of computing power to support the Metaverse.

-

Microsoft Corporation (MSFT): Another tech titan investing heavily in the Metaverse, with particular emphasis on enterprise applications.

-

Roblox Corporation (RBLX): A company that provides a platform for users to design, create, and operate games within the Metaverse.

The top 10 holdings account for 50% of the portfolio, making this a fairly top heavy fund.

Sector Composition and Weightings

METV’s portfolio reflects a strong emphasis on the technology sector, with a significant portion of its holdings based in the United States. The fund’s sector allocation is largely focused on technology, communication services, and consumer discretionary sectors. However, it’s important to note that these allocations can fluctuate based on market conditions and the fund’s quarterly rebalancing.

Peer Comparison

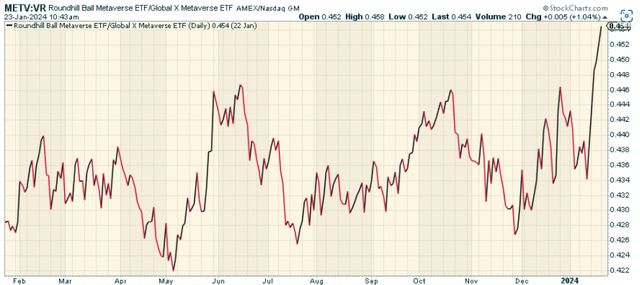

When compared to other ETFs focusing on the Metaverse, METV stands out for its broad exposure and focus on companies directly involved in Metaverse development. For instance, the Global X Metaverse ETF (VR) targets companies that could benefit from the development and commercialization of the Metaverse, regardless of their sector or geographic categorization. In contrast, METV’s focus on companies actively participating in the Metaverse offers a more direct exposure to this burgeoning sector.

Over the last year, METV has outperformed VR nicely.

Pros and Cons of Investing in the Metaverse

Like any investment, putting your money in the Metaverse comes with its pros and cons. On the one hand, the Metaverse is still in its infancy, implying that early investors could potentially reap substantial returns as the technology becomes more mainstream. Furthermore, the Metaverse sector is experiencing significant growth, with some research groups expecting it to be worth over $1 trillion by the end of the decade.

On the flip side, the Metaverse is unproven, and its success is not guaranteed. With numerous companies claiming to operate in the Metaverse, it can be challenging to determine which ones are worth investing in. Additionally, the fees for Metaverse ETFs, including METV, are typically higher than those of traditional ETFs.

Conclusion: Should You Invest in METV?

Investing in the Metaverse via METV can be an attractive proposition for those looking to gain exposure to this emerging sector. The metaverse concept represents the next evolutionary step in the internet’s development. The potential for growth in the metaverse is substantial, considering it amalgamates various cutting-edge technologies such as virtual reality (VR), augmented reality (AR), artificial intelligence (AI), blockchain, and 5G, creating opportunities for innovation and new business models. Companies that are at the forefront of these technologies are likely to benefit from first-mover advantages and could become market leaders as the metaverse economy expands.

Moreover, the metaverse is expected to disrupt numerous industries, including gaming, entertainment, real estate, e-commerce, and education, thus, offering diversification within the investment itself. The interactive and experiential nature of the metaverse could see it becoming a major channel for advertising and social interactions, which would be highly monetizable.

Finally, the metaverse is garnering significant attention and investment from big tech companies, indicating a consensus among industry leaders on its potential. This corporate backing could drive the infrastructure development and adoption necessary to make the metaverse a reality. As with any emerging technology, there are risks, but for investors with a long-term perspective and a tolerance for volatility, METV is one way to play it.