fullvalue/E+ via Getty Images

Investment Thesis

Mettler-Toledo International Inc. (NYSE:MTD) is the market leader in a highly profitable industry, generating exceptional returns on capital while increasing operating margins over decades.

Despite the quality of the business and the positive surprise in Q1 results, the company has made some mistakes regarding capital allocation and debt ratios have increased significantly, which will reduce its ability to reduce share count at low valuation multiples or pursue opportunistic acquisitions.

Due to the high debt ratios, the company hasn’t been able to benefit from the recent decline in valuation.

While it is a company I always have on the radar, its potential to outperform the market resides in its continued ability to increase operating margins, something that becomes harder year after year.

Mettler-Toledo’s Overview

Mettler-Toledo is the global leader in manufacturing and supplying precision instruments and services for many applications in research and development, quality control, production, logistics, and retail.

Its extensive product lineup includes laboratory and retail scales, pipettes, pH meters, thermal analysis equipment, metal detectors, and X-ray analyzers for customers in the life sciences, industrial, and food retail industries.

The current company, which employs over 17,300 people and sells its products in 140 countries, is the result of a series of corporate transactions and mergers, but its origins can be traced back to the invention of the single-pan analytical balance by Dr. Erhard Mettler and the formation of Mettler Instruments AG in 1945.

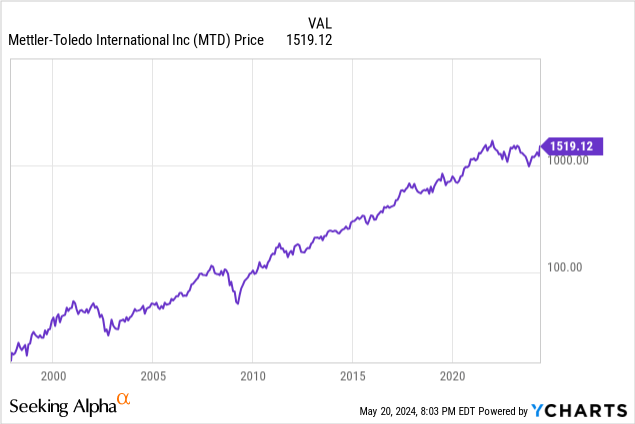

In 1997, AEA Investors Inc. acquired the company from Ciba-Geigy AG and completed its IPO at $14 per share. Since then, Mettler-Toledo has reduced the share count by approximately 30% and is currently trading above $1,500 per share.

The company offers a wide range of products, holding over 5,300 patents and trademarks, and only outsources the manufacturing for certain non-proprietary components.

Revenues are well diversified between geographies, generating 40% in the U.S., 34% in Asia and the rest of the world (including 20% from China), and 26% in Europe, with no single customer representing over 1% of total revenues. The primary manufacturing facilities are located in China, Germany, Switzerland, the U.K., the U.S. and Mexico.

Although most of the revenues come from the sale of new equipment, services and part replacement represent 23% of net sales, a figure that has been growing over the years.

Market Leader

Mettler-Toledo has the largest installed base of weighing instruments in the world, controlling over 50% of the market for lab balances and holding an average market share of about 25% across most product lines.

In emerging markets, where there is greater demand for less sophisticated products, price is the most important factor. On the other side, in the more developed countries and the lab segments, quality and innovation are the main competitive advantage.

Despite some of the markets where Mettler-Toledo operates being highly competitive, particularly the industrial and food retailing markets, where some of the competitors from emerging markets have lower cost structures, Mettler-Toledo has demonstrated its ability to retain and increase market share over the years.

The key factors that I believe explain Mettler-Toledo’s leading position are:

- Regulation: Most of the products require very strict tolerances and exact specifications, and Mettler-Toledo owns the patents for the most critical components.

- Size: While some of the markets are more fragmented, the company has greater resources to invest in R&D, guaranteeing continuous innovation compared to smaller competitors. Additionally, its size provides cost advantages and a more efficient sales and administrative organization.

- Wider Product Portfolio: Offering a broader range of products provides great convenience for many of its clients, who can purchase all the equipment from a single supplier.

- Switching Costs and Reputation: The most sophisticated equipment requires training, making customers reluctant to change to lesser-known suppliers. Over the years, Mettler-Toledo has built a strong reputation around quality and top-notch customer service.

A good example of the stickiness of Mettler-Toledo’s products is the LabX software platform that manages and analyzes the data generated by their balances, titrators, pH meters, and other analytical instruments, enabling customers to collect and archive the data in compliance with the U.S. Food and Drug Administration requirements.

Financials

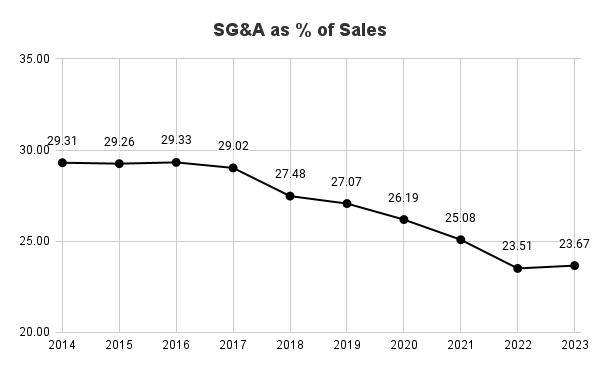

The strong competitive position can be clearly seen in its financial statements, showing a consistent increase in margins year after year. However, there are also some concerns regarding the buyback policy and the rising debt levels.

Growing Margins

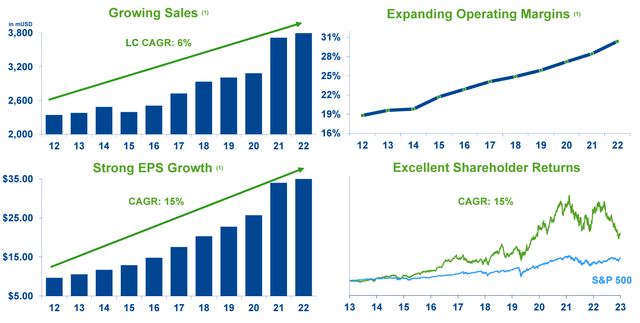

While Mettler-Toledo’s gross margins stood at 44% in 1997, over the last decades they managed to increase them to the current 59.1% (Q1 2024). This margin expansion has been a key factor in the long-term outperformance relative to the major stock indexes, given that revenues have increased at 5.78% CAGR between the same period, a healthy rate, but modest when adjusted for inflation.

Mettler-Toledo JP Morgan Health Conference January 2024

The increase in margins has been mainly caused by: a growing proportion of revenues coming from services, which have higher margins and are less volatile, the focus on the highest margin equipment, and cost optimization.

As illustrated in the chart below, selling, general, and administrative expenses have decreased significantly in recent years.

Tomas Riba (Data from Mettler-Toledo’s Annual Reports)

One notable aspect of Mettler-Toledo’s expenses is the one related to research and development, since there have been no cuts in that area, and they maintained R&D expenses between the historical rate of 4.5-5% of revenues. Given the increase in revenues and the size of the company, I believe the competitive position will not deteriorate due to the higher budget allocated towards innovation.

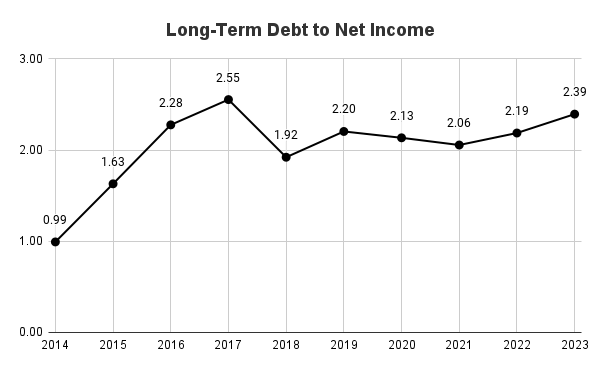

Buyback Policy and Debt

On the other hand, the increase in the long-term debt ratios is something that concerns me since it limits the ability to increase buybacks during a stock drawdown or pursue opportunistic acquisitions.

Tomas Riba (Data from Mettler-Toledo’s Annual Reports)

Since 2014, the company has spent an average of 1.22x its Net Income on share buybacks, exceeding Net Income every year except 2018 (0.93x Net Income).

While I value the return of excess capital to shareholders, and I am a strong advocate towards share buybacks, I don’t think the risk/reward ratio in 2021 was optimal due to the high valuation multiples and the already increased debt, resulting in a significant cost for shareholders.

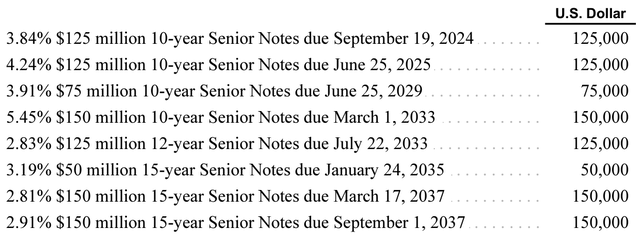

In 2021, the average next twelve months (NTM) P/E ratio stood at 42.5x, way above the previous 5-year average (30.5x), and despite this high valuation, the company spent $1B in share buybacks to reduce the share count by 3.1% YoY. At the same time, the company was paying higher interest on some of the previously issued Senior Notes.

Mettler-Toledo 2023 Annual Report

During the recent stock drop in the second half of 2023, and particularly in Q4 2023, when valuation decreased as low as during the breakout of the pandemic at 23.2x NTM P/E, the company didn’t boost its share buybacks, and only spent $224M during Q3 and $176M during Q4 (compared to $250M per quarter during 2021).

First Quarter Results

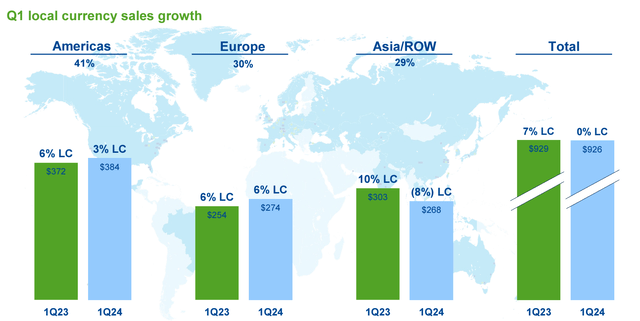

In the first quarter of the year, the company exceeded expectations for both revenues and earnings. While consensus expected a 4.4% decline in revenues and an 11% drop in earnings per share (EPS), the company delivered a positive surprise by keeping revenues flat YoY and increasing EPS by 2%, despite weak demand in China.

Mettler-Toledo Q1 2024 Earnings Presentation

The declining trend in China continued for another quarter with a 19% decrease in Q1’s revenues, caused by the tough comparables due to the significant spending during COVID and the inventory buildup.

On the positive side, lab revenues, which account for 57% of Mettler-Toledo’s sales, increased by 2%, and revenues in the U.S. and Europe increased by 3% and 6%, respectively.

Also, it is important to note that during the quarter, the company benefited from the recovery of the fourth quarter’s shipping delays related to a new external European logistics service provider. Excluding this benefit, revenues in Q1 would have declined by 6% YoY.

From a qualitative perspective, the company highlighted the recently redesigned portfolio of standard and advanced-level laboratory balances with up to 30% better measurement in performance, reduced power consumption, and improved packaging and design.

In the food retail business, the company released the new FreshBase Plus AI scale with advanced image recognition technology, which I have been able to test myself, and it is really impressive how it can distinguish between different kinds of vegetables when you place them on the scale, saving time to customers and retailers.

Finally, in the industrial business, the company continued its product development on terminals and digital load cells that provide integration into factory automation systems, which saves programming cost and time and eliminates the need for an additional gateway to the server or cloud.

Expected Growth

Although for the next quarter the company is expecting declining revenues in China of ~20% due to the still high comparables, which will normalize during the second half of the year, I’d like to focus on the long-term expected growth of the company.

From a long-term perspective, I believe the performance will be driven by lab spending, the ability to gain market share in other segments, and margin expansion.

Given the global nature of the company, revenue growth can be forecasted based on the global laboratory equipment and consumables market, which is expected to grow at 5.8% CAGR until 2028, in line with past growth rates.

On the margins side, the company has a strong track record of margin improvement. Looking ahead, management remains confident about its ability to increase margins through organic growth, innovation that leads to an increase in prices, operational excellence, the implementation of automation in the business, and the expansion of the highest margins segments.

While it is hard to determine where the ceiling is in operating margins, and the management targets a long-term goal of a 100 basis points yearly increase, the truth is that it becomes harder every year.

If the company continues increasing the services part of the business, operating margins could reach similar levels to tech companies (~35-40%), but I believe determining the increase in margins is the key factor to determine if an investment in Mettler-Toledo will outperform the market.

Assuming revenue growth in line with past performance and the market forecast (5.8%) and a decrease in share count of about 3% per year, taking into account the current valuation and the expected share buybacks ($850M in 2024), the overall expected growth in EPS would be at 8.8%, and that is why the increase in margins is the factor that will determine the long-term outperformance.

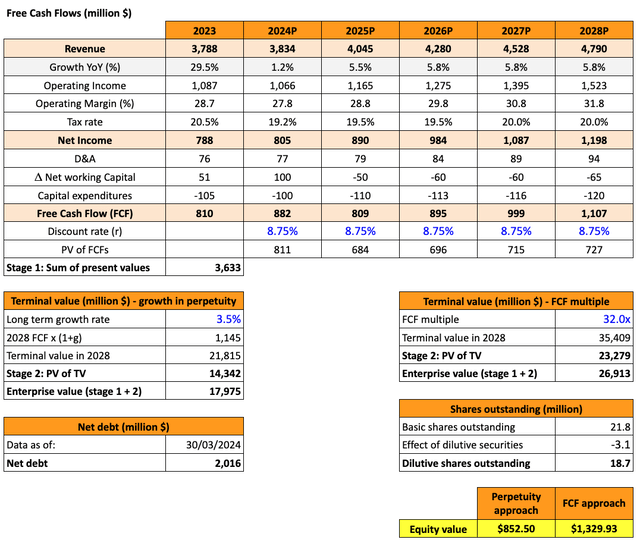

In that scenario, despite the outstanding quality of the company, the current valuation might not be justified. If we take into account the increase in operating margins, the company is still overpriced, as shown in the DCF model below.

Using an 8.75% discount rate (r), taking the current cost of debt (5.45%), a 9% cost of equity with a 1.06 beta, a 3% yearly share reduction, a 3.5% long-term growth rate consistent with inflation, and a 32x FCF multiple (10-year average), the fair price for Mettler-Toledo would be at $1,091 per share.

Since this scenario assumes the margin expansion, I believe at current prices the company is overpriced. Moreover, if the management fails to sustain the increase in operating margins, investors could face the risk of a decline in share price over the short term and significant underperformance over the long term.

Valuation

With the recently published Q1 results, the share price increased by 17% on the day after the release and went back to its historical valuation levels. As shown in the chart below, Mettler-Toledo is currently trading at 32x LTM FCF.

Despite the positive surprise and the beat in expectations, as stated before I don’t see a great risk/reward opportunity at current valuations, but I believe between 20-25x LTM FCF it could be a good opportunity to acquire a great business at a fair price with some margin of safety.

Risks

While many investors may be concerned about the recent decline in demand from the Chinese market, I view this as a short-term risk. Over the long term, I expect the company to benefit from the tailwinds of increasing spending on life science research activities. The company has been operating in China for over 35 years, and the nature of the business will present this cyclicality from time to time in all the regions where it operates. The fact that Mettler-Toledo is well diversified between geographies should reduce the overall volatility.

Trade Restrictions and Supply Chain

However, I see some risks related to China and the policies of the Chinese government.

From a cost perspective, if there is an increase in tariffs or trade restrictions, it would lead to higher costs. Also, the company needs government approval to convert earnings from the operations in China into other currencies and to repatriate these funds.

Moreover, a disruption in global supply chains, as we recently saw as a result of the Israel-Hamas war, could increase shipping costs, cause shipment delays, or reduce shipping capacity.

Debt

As stated before, one of the major risks I see for Mettler-Toledo is the increase in debt.

Although current levels are sustainable, an increase in interest rates could lead to higher amounts of cash flows used to pay down debt, pausing or reducing the share buyback program.

If a tightening in the financial markets was combined with a decrease in revenues caused by lower spending in scientific research, the earning per share growth could be damaged.

Taxes

One of the points most relevant thoughts that Warren Buffett shared during the last Berkshire Hathaway Inc.’s Annual General Meeting was the possibility of an increase in corporate taxes.

Given the fiscal deficit of many OCDE countries, I see this as a real possibility, and an increase in corporate taxes would have a significant impact on Mettler-Toledo’s bottom line figures.

Intellectual Property

Since Mettler-Toledo’s competitive position is highly dependent on its intellectual property and trade secrets, if any competitors were able to develop similar products, it would have a long-term impact on the company’s revenue and market share.

Although I believe the company is taking the right steps to continue on top of innovation, developing products with higher added value and high technology components, it will be important to keep an eye on its market share over the following years.

Conclusion

While I consider Mettler-Toledo as a high-quality business, with growing margins, pricing power, great returns on capital, and a long track record of value creation for shareholders, the current share price would require higher growth rates or a continuous increase in margins over the following years.

Despite the positive surprise in the recently published Q1 results, I believe the company is overpriced, and from a risk/reward perspective I do not find much value in buying at current prices, assigning it a hold rating until valuation decreases.