AJ_Watt

Synopsis

Metro Inc. (TSX:MRU:CA) operates in both the food and pharmaceutical industries in Canada, serving as a retailer, franchisor, and distributor. It manages an extensive network of supermarkets, discount outlets, and drugstores under several brand names.

When we look deeper into MRU:CA’s historical financial performance, its revenues have grown strongly, and gross margins have expanded. As a result, EPS has consistently grown over the past five years. Its most recent 4Q23 results also share the same trend, showing the robustness and consistency of its business. Canada’s retail market is expected to grow for the foreseeable future, and I believe its strong store expansion and renovation plans position it well to capture this anticipated growth. In addition, inflation over the past few months has been slowing, and I believe this will also be a tailwind for them. When I conducted a comparable valuation, it was clear that MRU:CA outperformed its competitors, and I believe it should be trading at a higher forward P/E. With double-digit upside potential, I propose a buy rating for MRU:CA.

Historical Financial Analysis

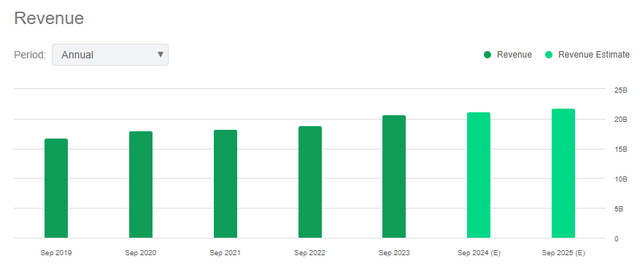

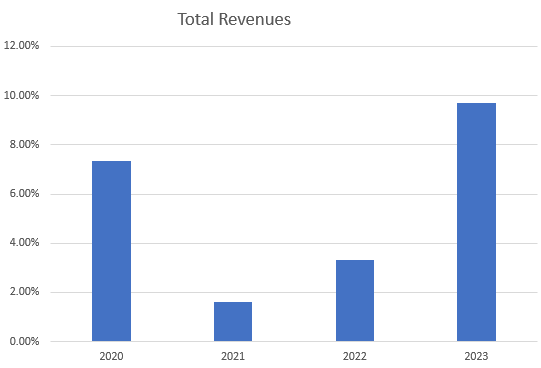

Before discussing its most recent financial results, it’s best to scrutinize its past performance for a comprehensive and holistic understanding. Over the last five years [from 2019-2023], It’s evident that the company’s revenue growth, which dipped in 2021, has been recovering and accelerating since then. In 2020, it reported a growth rate of ~7.3%, but in 2021, rising inflation took a toll on MRU:CA’s revenue, causing it to plunge to about 1.6%. By 2023, it reported a healthy rate of ~9.7%.

Author’s Chart

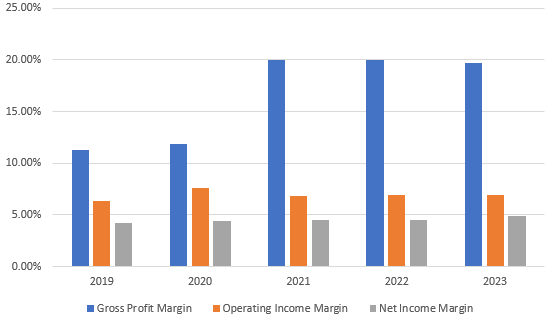

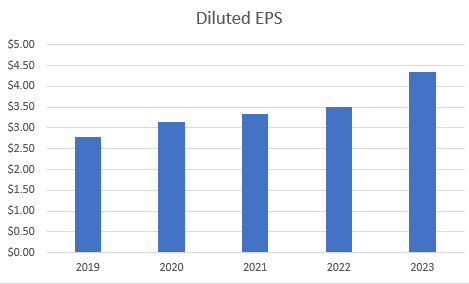

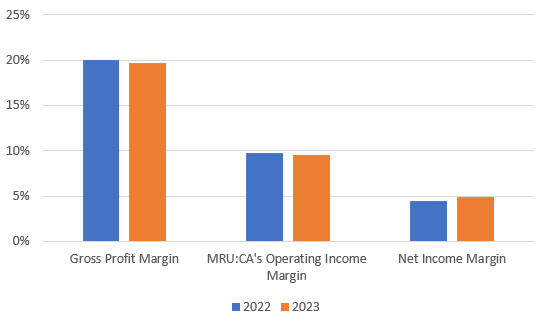

Moving down its P&L, it is also clear that the company did not just preserve its margins; it managed to extend them. In 2019, the gross profit margin [GPM] was ~11%, but by 2023, it had almost doubled to ~19.7%. In terms of operating income margin and net income margin, both remained relatively consistent at ~7% and ~4.5%, respectively. As a result of its strong growth in top-line revenue and consistent margins, the company grew its diluted EPS significantly. In 2019, it was $2.78; by 2023, it increased to $4.35. This represents a 5-year CAGR of ~9.36%.

Author’s Chart Author’s Chart

4Q23 and Full-Year 2023 Earnings Analysis

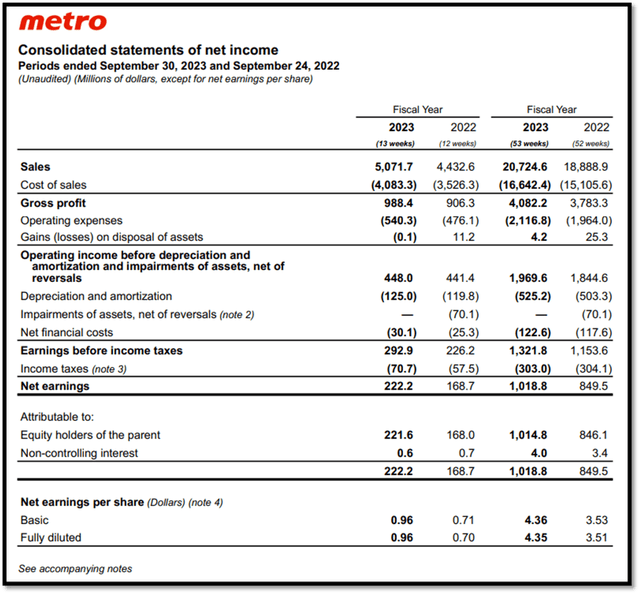

In my opinion, MRU:CA reported very strong results for both 4Q23 and FY2023. I would appreciate to scrutinize its 4Q23 results before delving into its full-year results. Please note that its results are reported in Canadian dollars and are based on MRU:CA’s consolidated statement of income. In this statement, MRU:CA’s calculation of operating income is before depreciation and amortization and impairments of assets, net of reversals which is different from Seeking Alpha’s calculation of operating income I have discussed above.

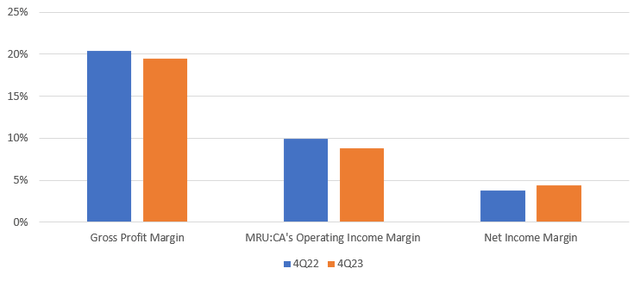

For the quarter, sales were approximately $5.071 billion, growing strongly at 14.4% year-over-year. Next, let’s take a look at its margins, starting with the GPM. The GPM for 4Q23 was ~19%, compared to 4Q22’s ~20%, which is essentially in line. In terms of operating income before depreciation and amortization and impairments of assets, net of reversals in 4Q23 was ~8.8%, while in 4Q22, it was ~9.9%. Lastly, the net income margin for 4Q23 is ~4.38%, versus 4Q22’s 3.8%.

Overall, MRU:CA grew its fully diluted EPS from 4Q22’s $0.70 to $0.96, representing a growth of ~37%. Its ability to significantly grow its top-line revenue in 4Q23 by double digits without much impact on all its margins speaks volumes about its capacity to scale its business without increasing operating costs significantly. I believe this strength positions it well for sustainable long-term growth in future years.

Next, I will be discussing MRU:CA’s FY2023 results. Sales grew by ~9.7% to $20.72 billion. The FY2023 margins also echo the trends seen in its 4Q23 results. Its GPM is around 19.7%, operating income before depreciation and amortization, and impairments of assets, net of reversals, is ~9.5%, and net income margin is ~4.9%, all of which are pretty much in line with FY2022’s margins.

Therefore, I do not see any issues or risks of margin contraction for MRU:CA. In terms of fully diluted EPS, it grew from $3.51 to $4.35, representing a growth rate of 23%. Overall, MRU:CA is looking very strong in terms of its most recent financial results. Its reported strong double-digit growth rates did not come at the expense of its margins, allowing it to grow its EPS and enhance value for equity holders. I believe this is attributed to its robust cost management, and this strength really positions it well for sustainable long-term growth in the coming years.

Author’s Chart Metro Investor Relations

Store Expansion & Renovation strategize Expected to Bolster Growth Outlook

In 2023, MRU:CA opened another eight stores in Quebec, Canada. This expansion included one Metro store and three of its Super C stores, along with a Super C in Gatineau. In Ontario, the company also opened one Metro store and two Food Basics. In addition to these openings, MRU:CA renovated 10 stores, which allowed it to significantly enhance its store square footage by approximately 1.2% of its total food retail network. Furthermore, MRU:CA has planned additional expansions. It has already planned to open another eight new discount stores, and also in the pipeline are 25 renovation projects.

The next question is why the store expansion & renovation strategize is a big deal for MRU:CA, and this boils down to a few key reasons. I believe these expansion and renovation efforts are integral parts of its strategy to grow and modernize its retail network, thereby enhancing its market presence and improving the customer encounter.

Opening new stores and renovating existing ones helps MRU:CA extend its market presence. By increasing the number of stores, particularly in strategic locations, the company can reach more customers and capture more market share, especially in areas previously not covered by them.

Renovations keep the stores modern and appealing, which is vital for maintaining a competitive edge in the retail industry. Moreover, these upgrades better the shopping encounter for customers. Modern, well-designed stores with updated facilities and layouts can attract more customers and encourage repeat visits. A better customer encounter often translates into increased customer loyalty, which ultimately results in more sales. Additionally, as mentioned earlier, its renovations have resulted in a net enhance in total square feet. Therefore, I believe its consistent yet aggressive store expansion & renovation strategize will bolster its future revenue growth outlook.

Abating Inflation to Boost Retail Sales; Canada’s Retail Market Set for Growth, Complementing its Expansion Strategy

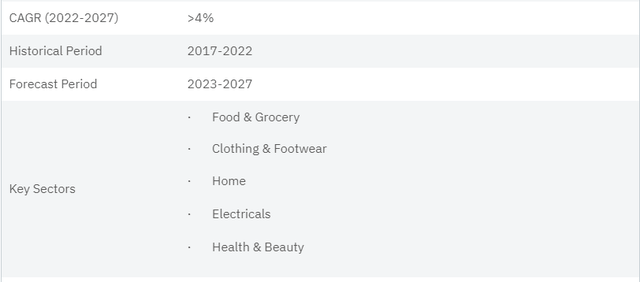

Based on the company profile of MRU:CA, it operates within the retail industry. The Canadian retail market is anticipated to continue its growth trajectory until 2027, with an estimated CAGR of approximately 4%. Consequently, this expanding market is expected to bolster MRU:CA’s growth outlook as it progresses with its store expansion & renovation strategize, aiming to capitalize on this growth.

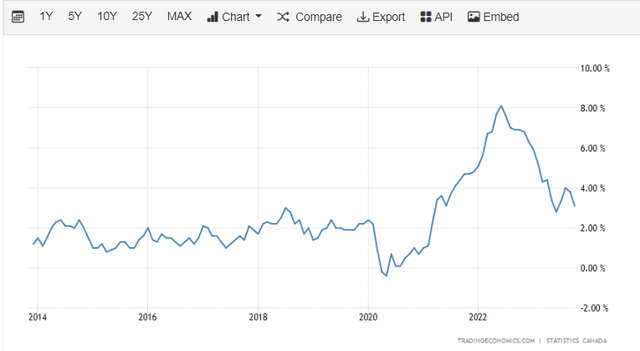

In addition, I believe the abating inflation in Canada will advance boost MRU:CA’s growth outlook. As of October 2023, Canada’s annual inflation rate had dropped to 3.1%. Compared to 2022’s peak of approximately 8%, this signifies a remarkable recovery. Furthermore, this 3.1% rate came in lower than the Bank of Canada’s forecast, thereby bolstering market expectations that the Canadian central bank will not enhance interest rates. With lower interest rates and the potential pause in interest rate hikes, these factors are likely to arouse economic activities and also enhance retail spending.

Comparable Valuation

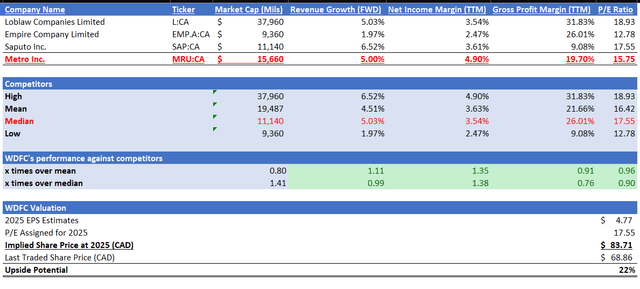

Before making an investment decision on MRU:CA, I strategize to conduct a comparable valuation to ascertain my 2025 target price. MRU:CA operates in the food retail industry, and the competitors listed below are similarly engaged in this sector.

Currently, MRU:CA is trading at a forward P/E ratio of 15.75x, while its competitors have a median ratio of 17.55x. I will examine why it is unjustifiable for MRU:CA to trade lower than its competitors. In terms of forward revenue growth, MRU:CA stands at 5%, which aligns with the competitors’ median of 5.03%. Regarding profitability, it trails its competitors in gross margin but outperforms in net margin. MRU:CA’s GPM is 19.70%, compared to the competitors’ median of 26.01%. However, for its net income margin, MRU:CA is at 4.9%, slightly higher than the competitors’ median of 3.54%. This suggests that MRU:CA has more effective operating expense management.

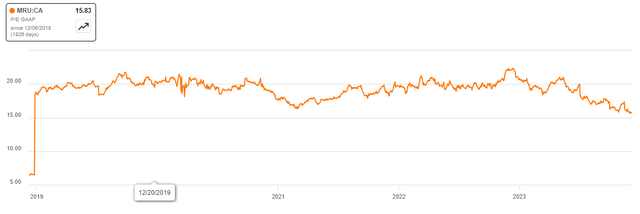

With a forward revenue growth outlook that is in line with its competitors and a better net income margin, I argue that MRU:CA should at least trade at the competitors’ median forward P/E of 17.55x. Additionally, 17.55x is also below its 5-year average [as shown in the chart below], suggesting there is no risk of overvaluation. Therefore, I believe this multiple is conservative.

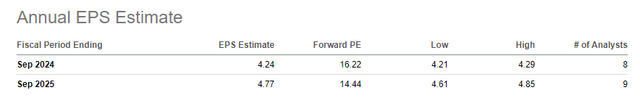

Author’s Valuation Seeking Alpha

The market revenue assess for MRU:CA is projected to be $21.17 billion in 2024 and $21.87 billion in 2025. The market assess for MRU:CA’s 2025 EPS is $4.77. I consider both of these estimates to be reliable, as they align with my earlier discussion on its strengths and growth catalysts. By applying the 17.55x forward P/E to its 2025 EPS assess, my calculated 2025 price target for MRU:CA is $83.71, representing an upside potential of 22%.

Risk of buying MRU:CA

Based on my comparable valuation, it’s clear that most of MRU:CA’s competitors are close in terms of size, with Loblaw (L:CA) clearly outpacing MRU:CA by more than double its size. With everyone so closely matched in terms of size, there could be potential for intense competition as they grow larger and market share becomes increasingly saturated. All of their net income margins are in single digits, indicative of an industry with thin margins. If a price war were to occur, it could significantly impact their already thin margins and thus EPS.

Conclusion

In conclusion, based on my conservative comparable valuation model, which indicates a potential upside of 22%, I propose a buy rating for MRU:CA. Delving deeper into their financials reveals that MRU:CA is actually outperforming its competitors in terms of net margin. Coupled with a similar forward revenue growth outlook and its current forward P/E trading below its 5-year average, I argue that it should be trading at least in line with its competitors.

With MRU:CA’s robust historical and current financial performance, the strong growth in the Canadian retail market, abating inflation, and its aggressive expansion and renovation plans, I believe MRU:CA is well-positioned to capture growth and bolster its future growth outlook.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.