fotostorm/E+ via Getty Images

A Quick Take On Metagenomi

Metagenomi, Inc. (MGX) has filed to raise $100 million in an IPO of its common stock, according to an SEC S-1/A registration statement.

The firm is developing a genetic editing platform to treat a wide variety of diseases.

Metagenomi, Inc. is backed by major pharma firms as strategic investors and partners and is well-capitalized but is operating in a high-risk research area characterized by a slow-moving U.S. FDA for genetic treatments.

I’ll provide a final opinion when we learn more IPO details from management.

Metagenomi Overview

Emeryville, California-based Metagenomi Technologies was founded to create a “comprehensive genome editing toolbox” to help treat diseases through genetic alterations.

Management is headed by Chief Executive Officer Brian C. Thomas, Ph.D., who has been with the firm since September 2016 and was previously Chairman of Haya Therapeutics and has been program manager at the University of California, Berkeley.

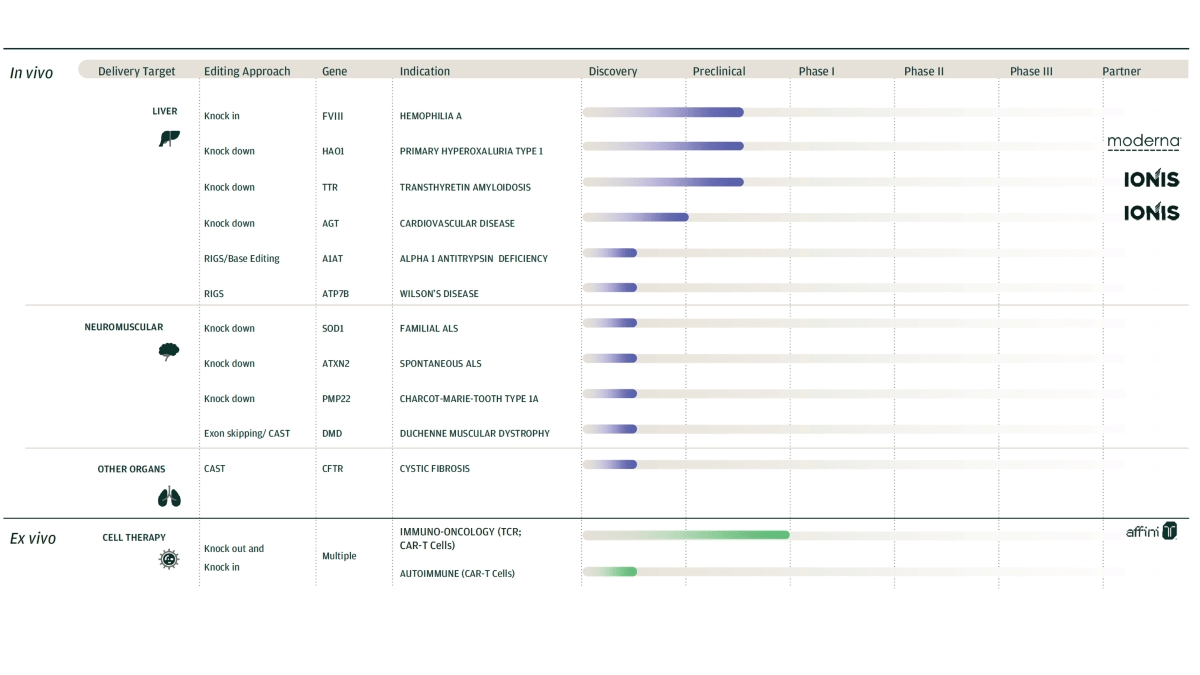

All of the firm’s candidates are still in preclinical or discovery stage of development and Moderna is a significant partner of the company.

Metagenomi’s lead target includes diseases of the liver such as Hemophilia-A, primary hyperoxaluria Type 1 and Transthyretin Amyloidosis.

Additionally, the company’s cell therapy efforts for the treatment of various cancers are nearing Phase 1 trial status.

Below is the current status of the company’s drug development pipeline:

SEC

Metagenomi has booked fair market value investment of $358 million as of September 30, 2023, from investors, including Bayer HealthCare, Humboldt Fund, Moderna, Sake Holdings, Sozo Ventures and RA Capital.

Metagenomi’s Initial Market & Competition

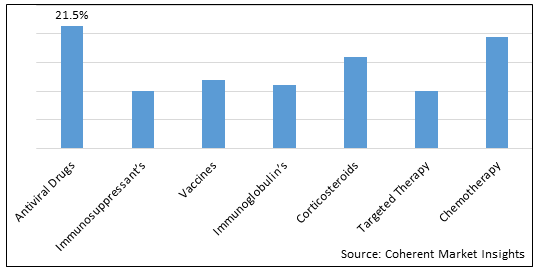

According to a 2023 market research report by Coherent Market Insights, the global market for chronic liver disease treatments was an estimated $15.2 billion in 2023 and is forecasted to reach $31.4 billion by 2030.

This represents a forecast CAGR (Compound Annual Growth Rate) of 10.9% from 2023 to 2030.

Key elements driving this expected growth are a growing elderly population, increasing incidence of liver diseases and a greater number of treatment options available to populations across both developed and developing geographies.

Also, the chart below shows the chronic liver disease therapeutics market share by treatment type in 2023:

Coherent Market Insights

Major competitive vendors that provide or are developing related treatments include the following companies:

-

Caribou Biosciences

-

Editas Medicine

-

CRISPR Therapeutics AG

-

Intellia Therapeutics

-

Graphite Bio

-

Sangamo Therapeutics

-

Precision BioSciences

-

bluebird bio

-

Cellectis

-

Others.

Metagenomi Technologies Financial Status

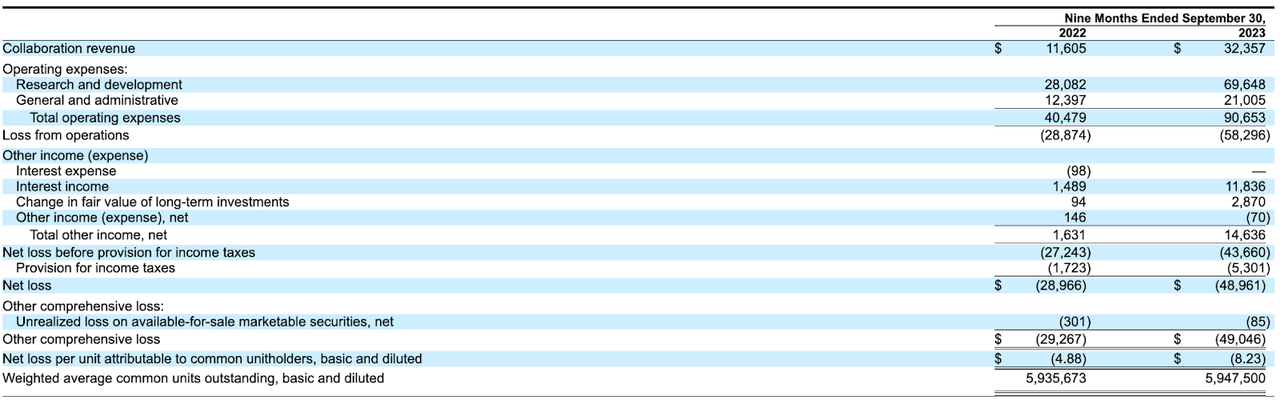

The firm’s recent financial results are atypical of a preclinical-stage biopharma technology company in that they feature significant collaboration revenue. R&D and G&A costs are typically high.

Below are the company’s financial results for the periods indicated:

SEC

As of September 30, 2023, the company had $293 million in cash and $155 million in total liabilities.

Metagenomi Technologies IPO Details

Metagenomi intends to raise $100 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Assuming a successful IPO, the company’s market capitalization at IPO may exceed $500 million, excluding the effects of underwriter over-allotment options.

Management says it will use the net proceeds from the IPO as follows:

for continued research and development of our therapeutic portfolio, including preclinical studies and advancement through potential preclinical proof-of-concept;

for IND-enabling studies and potential initiation of clinical studies for certain of our current programs;

to advance our gene editing platform discovery and early-stage research for other potential programs;

to advance manufacturing capabilities to support early stage clinical development; and

the remainder for general corporate purposes.

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said it is not aware of any legal proceedings that would have a material adverse effect on the company’s financial condition or operations.

Listed bookrunners of the IPO are J.P. Morgan, Jefferies, TD Cowen, Well Fargo Securities, BMO Capital Markets and Chardan.

Commentary About Metagenomi’s IPO

MGX is seeking U.S. public capital market investment to fund advancing its numerous development programs.

The firm’s lead efforts are focused on treating various diseases of the liver, but are still in preclinical stage.

The market opportunity for liver disease treatments is quite large and is expected to grow at a nearly 11% CAGR for the coming years due to a variety of liver disease incidence.

The company’s investor syndicate includes major pharma firms Bayer and Moderna, and MGX is partnering with Moderna on its lead liver treatment program.

As for valuation expectations, given the firm’s strong collaboration relationship with Moderna, who is also an investor, the market capitalization of the company at IPO may be above $500 million.

While the company’s focus has significant promise, the challenge for genetic treatment development is the US FDA’s slow approach to treatment approval.

Genetic treatments can be a high payoff event but also present high risks for treatments that can go awry in a subset of patients.

This is called “off-target effects,” where an editing activity modifies DNA sequences other than the intended target sequences, resulting in complications or severely negative consequences.

Also, the firm is still at a preclinical stage of development, which further increases the risks to investors.

While I don’t think MGX will lack investment capital given the strong slate of institutional investors, it may be some time before public shareholders see the major milestone of Phase 1 safety trials success.

When we learn more details about management’s IPO pricing and valuation assumptions, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.