Eoneren

Investment Thesis

Of course, AI is probably an overused buzzword at the moment, and the start of Meta’s (NASDAQ:META) Metaverse hasn’t been very positive so far, but that shouldn’t stop us from seeing the potential and synergies that arise from the company’s enormous existing user base in combination with these new technologies. The company will have a lot of data to feed its AI systems and is already starting to incorporate various technologies into the apps. But even if we leave AI and metaverse entirely out of the equation, the company’s core business is performing excellently and continues to be a cash generator. This, in combination with the low valuation and the recently initiated dividend, makes it a clear buy for me.

The past: Q1 & Trends

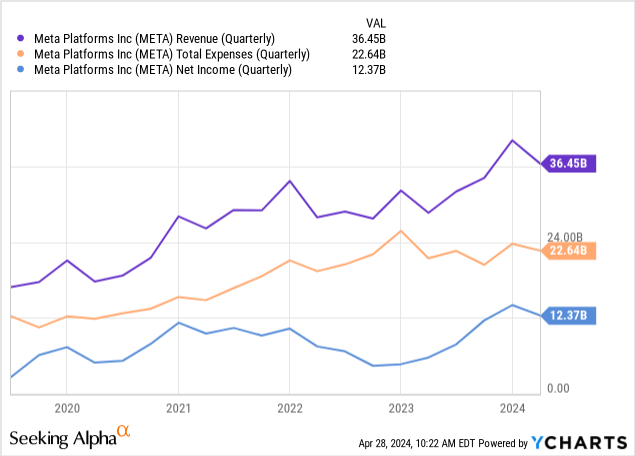

First, a short overview over a longer period for revenues, expenses, and net income.

The Q1 results were better than expected in both revenue and EPS. The 20% increase in ad impressions and the 6% higher average price per ad are particularly noteworthy. 2024 capital expenditures were also considerably revised upwards ($35-40B vs. $30-37B), but given the relatively new challenges and opportunities presented by the emerging AI revolution, this does not seem surprising. Viewed positively, this could even be seen as a necessary step; after all, META is one of the few companies that can spend such sums and is trying not to fall behind in future technologies.

| In millions, except percentages and per share amounts |

Q1 2024 |

Q1 2023 |

|

|

Revenue |

$36,455 |

$28,645 |

27% |

|

Costs and expenses |

22,637 |

21,418 |

6% |

|

Operating margin |

38% |

25% |

|

|

Net income |

$12,369 |

$5,709 |

117% |

|

Diluted earnings per share |

$4.71 |

$2.20 |

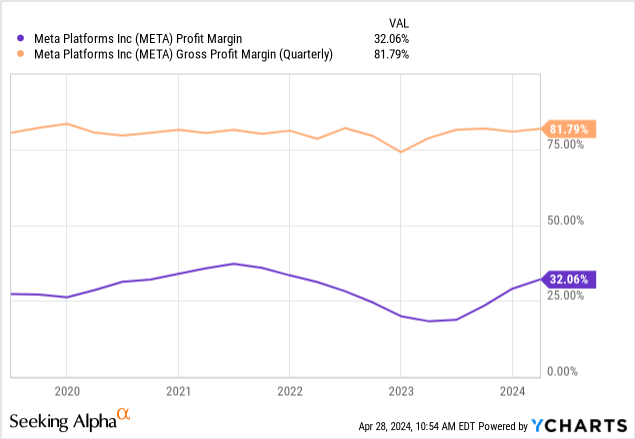

In my view, the company has delivered fantastic figures, which is particularly evident compared to the previous year. Not only was there a 27% increase in revenue YoY, but margins also improved significantly.

The present: Valuation

The company’s enterprise value is $1.10T, its market cap is $1.12T, and it has more cash than debt.

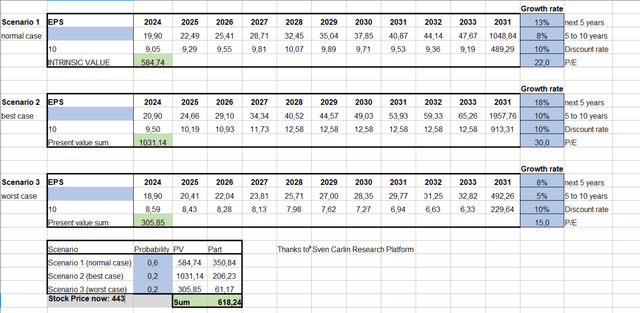

I have created a discounted cash flow model with three scenarios to determine the current fair value. A few remarks:

- The “normal case” is indicated as the most probable variant (weighted with 60%).

- Of course, one has to estimate a lot, but the growth figures of the “normal case” are already less than the average of the last five years.

- This approach allows us to approximate a fair value: it could be seen here if a share were strongly overvalued or undervalued. It is also a systematic approach to put the current P/E ratio of various stocks in relation to their growth.

- The result is that based on the growth estimates, the current fair value would be a stock price of $618

- A change in the normal case numbers from 13% for the next five years and 8% for 5-10 years to 10% and 6% and a fair P/E ratio of 20 (i.e., a more pessimistic base case overall) would result in a current fair value of $537.

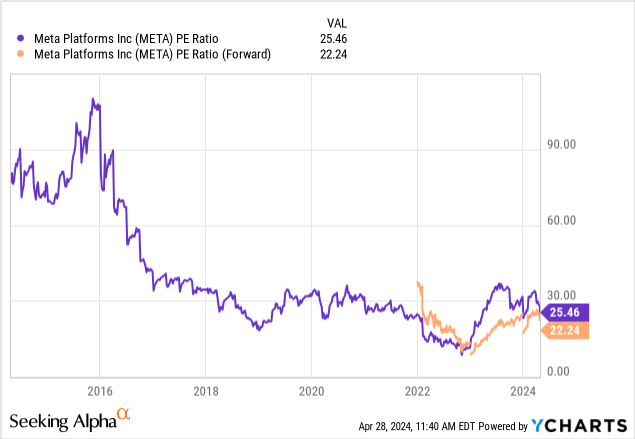

The following chart shows that the forward P/E ratio has rarely been as low in the last ten years as it is currently.

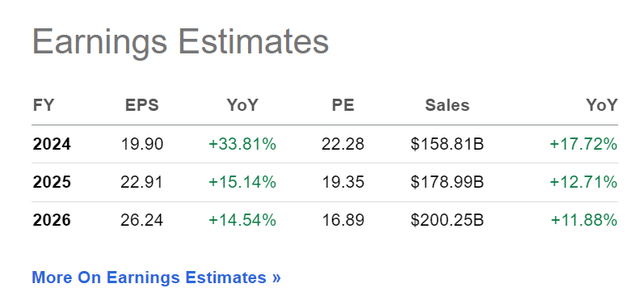

If the earnings estimates are only reasonably accurate, then even the PEG ratio for this year will be below one (PEG ratio = PE ratio/growth rate). According to Peter Lynch, the PEG ratio of a fairly valued company should be 1.0 or less. If it’s above 1.0, the company is considered overvalued.

In addition, the share has recently become even more attractive for investors thanks to the recently introduced dividend. In addition to share buybacks, investors now have another way of benefiting directly from profits.

The future: Outlook

That’s the past, but the most essential part of the company analysis is the outlook for the future, and in the case of Meta, a lot is going on here.

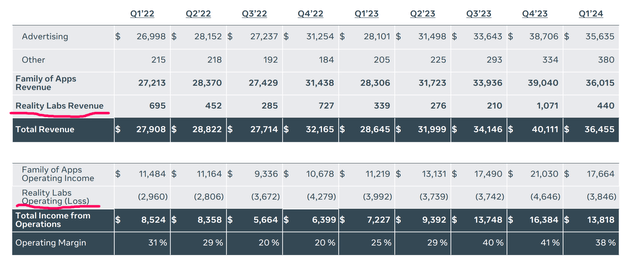

Reality Labs

The Metaverse division remains a worry overall and continues to produce massive losses. 2022 this division lost around $13B, and in 2023, around $16B.

Furthermore, this area produces almost no revenue and tends to stagnate or even decline. It is unclear whether this area will be put under further pressure or boosted by the new competition from Apple (AAPL). Why potentially boosted? Because Apple will draw overall attention to mixed reality devices. The partnership with Ray-Ban has only existed since 2023 and has the potential for success as these glasses are smaller, cool-looking, and therefore suitable for everyday use. The reviews are still not entirely positive, but the experience sounds much more encouraging than its clunky predecessors and better than the reviews I’ve seen for Apple’s device.

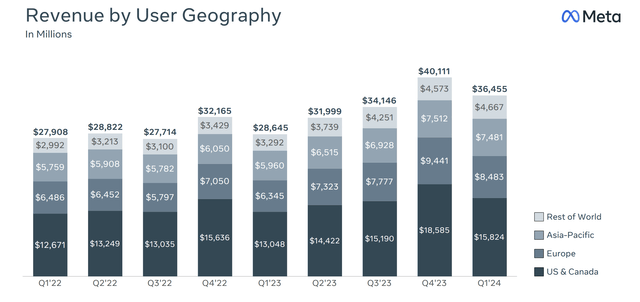

Asia & rest of the world

If you look at the sales development broken down by region, it seems there is not much room for growth left in the USA and Canada. Europe is still growing, but I think it’s fair to say that Asia and the rest of the world still have the most upside potential. You also have to bear in mind that of the more than 3 billion users of the various Meta platforms, the majority must be outside North America and Europe, which combined have a total population of less than one billion. This means that the current monetization per user in the USA and Europe is significantly higher than in the rest of the world. At the same time, however, economic growth in many emerging markets is considerably higher than in the USA and Europe. Taking this logic further, it suggests that users in emerging markets will likely become more valuable in the future.

I have personally spent several years in Southeast Asia and would definitely confirm that Facebook and Instagram are hugely popular there. In my subjective opinion, they seem more popular there than in Europe (but WhatsApp is used much less).

TikTok Ban

I want to address this point only briefly as the final word has not yet been spoken, but it looks more likely that TikTok will either have to be sold or banned (Seeking Alpha news article). For Meta, either nothing changes or a strong and popular competitor disappears. It sounds to me like they can only win.

Meta AI

Of course, the company is also trying not to lose ground in the seemingly revolutionary AI race but, on the contrary, to make this area an essential part of its product range. Anyone interested in the details can find lots of information on current research at meta.ai. Recently, Llama 3 was released, which is currently considered the best free large language model available, and the company is also working on generative AI for images and videos.

So, how does this area fit in with the rest of the company? What synergies could arise? The company has countless opportunities to use AI on its existing platforms; here are a few examples.

- One research project, for example, is trying to create real-time translations of a video that simultaneously transports the expression and lip movements into the new language. It’s easy to imagine how this could be built into WhatsApp, making video calls with people who speak other languages much more accessible.

- Tools to cut out objects, animate drawings or pictures, or generative AI in general should improve the user experience on Instagram

- For the metaverse, which is probably still Mark Zuckerberg’s long-term vision, much of the AI research is crucial, from translations to NPCs using LLMs with long-term memory to pure world-building. The potential synergies here are truly endless and seem incredibly powerful.

I believe this is also why the company is making models such as Llama 3 and generative AI available for free: to collect as much data as possible now and put their systems out there to be used by as many people as possible to build even better products in the long term.

Furthermore, with AI, I believe that who owns the data will be very crucial. Data is one of the challenges when it comes to further improving the capabilities of AI models because you can only feed them with as much data as is (legally) available. There are also increasing disputes about who can use what data to train their models, such as in the lawsuit from the New York Times against OpenAI. Yes, on Meta’s platforms, there is also a lot of low-quality text, but many conversations are going on, and there are many high-quality images.

Meta has billions of users and owns several of the most widely used apps in the world. This is a huge advantage in the long term, especially if various AI tools are already built into these apps. In the short term, the company is unlikely to earn any money with its AI products, but rather, as in the metaverse sector, it will initially only have to invest.

Risks

Which brings us to the risks. It is by no means certain that this strategy will work. If you take a pessimistic view of the company’s current path, you could argue that the company will continue to depend on the existing cash cows to generate billions for many years to come to finance the expensive research and investment in the metaverse and AI.

Furthermore, both areas are pretty new to mankind, and the market leaders of recent years will not necessarily become the leaders in these segments. These risks are common to companies like Meta and Google: both have a fantastic starting position and financial resources but could be completely disrupted in a worst-case scenario. In recent years, we have seen how quickly new players can rise to the top and reach hundreds of millions of users. ChatGPT is the latest example, and I’m sure that ChatGPT is already getting millions of searches that Google used to get.

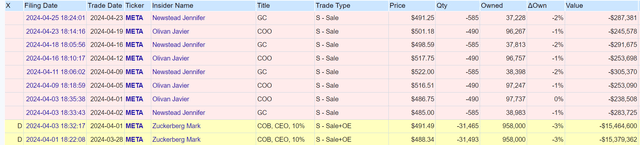

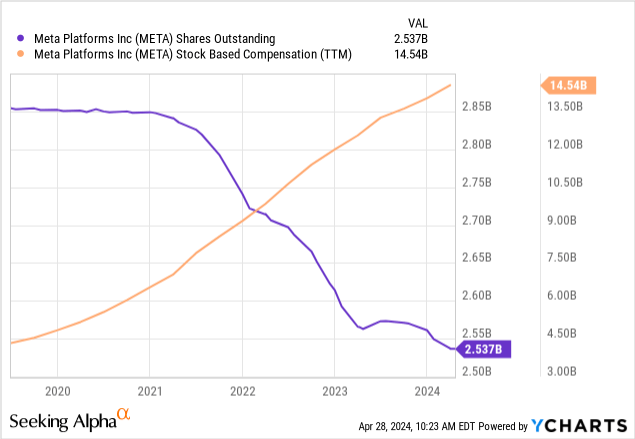

Share dilution, insider trades, and SBCs

These three things are standard checks I make in every article, as excessive stock dilution and stock-based compensation can put shareholders at a disadvantage. In addition, insider trades sometimes contain valuable info about management’s confidence. As can be seen below, SBCs are massive; keep in mind that net income in the first quarter of 2024 was about $12B, so the SBCs of the last 12 months eat up an entire quarter of net income.

These are all insider trades from the past month. Usually, I insert a picture of the last six months here, but the list would be too long in this case. If you want to see it yourself, check out openinsider.com.

Conclusion

Not everything is perfect at the company; of course, there are risks, but where are there no risks? If these were to materialize, it would be a slow, gradual process that would manifest itself in several years of falling advertising revenue. This means that investors probably have more than enough time to adapt accordingly.

However, the company’s current situation is very positive overall, as my checklist below summarises. The core business’s revenue still climbs higher, and there is enormous potential in two potential future technologies. Of course, AI is also a buzzword now used annoyingly often. Still, with Meta, the story sounds particularly promising: the company already owns some of the largest apps in the world, it already has a vast user base that can be channeled into new projects, and these users provide a lot of training data for AI.

Given this potential, the fact that the company has started to pay a dividend, and the relatively cheap valuation, all these arguments combined make Meta, in my opinion, a strong buy.

|

Investor’s Checklist |

Check |

Description |

|

Rising revenues? |

Yes |

Increasing over longer periods |

|

Improving margins? |

Yes |

Possible competitive edge |

|

PEG ratio below one? |

Yes |

PEG ratio below one may suggest undervaluation |

|

Sufficient cash reserves? |

Yes |

Vital for the survival & growth, especially of unprofitable companies |

|

Rewards shareholders? |

Yes (buybacks and dividends) |

Returning capital to shareholders |

|

Shareholder negatives? |

Yes (high SBCs) |

Actions that disadvantage shareholders |

|

Stock in an uptrend? |

Yes |

Trading above its 200-day moving average? |