Damir Khabirov

Meta Platforms (NASDAQ: NASDAQ:META) has seen its share price skyrocket from its lows, as investors become less concerned about its AR/VR spending. Apple (NASDAQ: AAPL) entering the industry has likely been a strong source of support. The company does maintain a strong core business, but its ad business continues to see threats.

Our thesis with Meta Platforms is simple. The company is at a $760 billion valuation in a rising interest rate environment. To justify that valuation, you need shareholder returns. The company is chasing an AR/VR dream with no sign of profit, and seeing growing competition across its product lines, making it a poor investment.

Meta Financial Performance

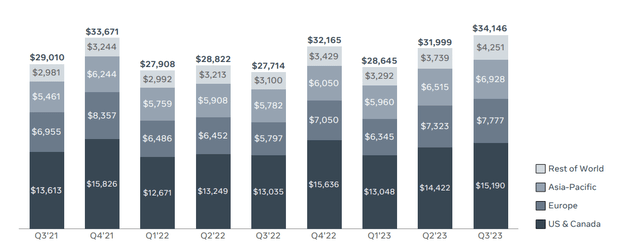

The company’s financial performance shows improved revenue supported by developed markets.

Meta Investor Presentation

The company took a major impact from Apple’s privacy changes, however, it’s worked to improve targeting for advertisers. Still it has achieved what we consider “full penetration” in the US & Canada market and there’s no indication of revenue growth here. Rest of world revenue has remained strong and supported the company’s revenue and Asia-Pacific revenue has grown.

YTD the company’s stock has more than doubled. Most of that has been hype, as clearly evident above, the story around the company’s financial picture has not changed YTD. However, with the emergence of Chat GPT, technology stocks are interesting again, and Meta Platforms remains one of the most popular and well known companies.

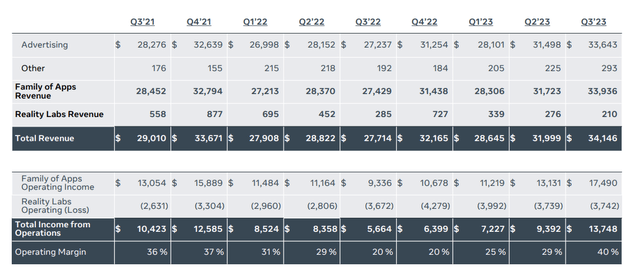

Meta Expenses

However, the company’s margins remain worse than they were several years ago, by a noticeable amount.

Meta Investor Presentation

The company’s advertising revenue along with its overall revenue made it one of the company’s strongest quarters ever from a top-line perspective. However, despite a modest recovery in its operating margin from 25% to 29%, margins still remain well below the 40+% that they were just several years ago.

The company’s most recent quarter had strong margins, as revenue bounced up, but a decline in Reality Labs’ revenue shows the company has no real path to generating returns from the division. The company had massive layoffs and focused to increase margins, but we have yet to see if the company’s recent margin increase is sustainable.

The company is trading at a P/E of ~20x. That’s a 5% shareholder yield, in line with current long-term treasury rates. For a company to be trading at a relatively low yield, we expect the strength in growth to justify it. The last several years do not indicate that that’s the case.

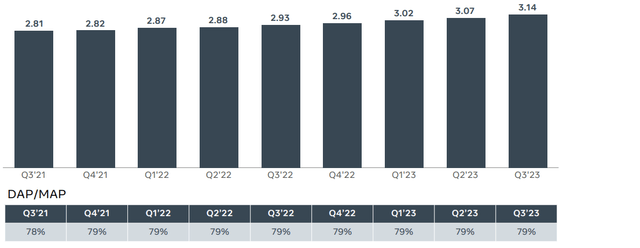

Meta Customer Activity

The company has seen customer activity increase, but growth rates remain fairly fixed.

Meta Investor Presentation

The company’s DAP / MAP ratio has remained roughly constant at 79%. That shows it’s not increasing or improving the ratio. We don’t have the fundamental data here, but our guess is this is an intrinsic property of human activity and social networks, and we don’t expect this ratio to increase dramatically.

Any decrease would be a large cause for concern. The company’s growth rate is now in the mid-single digits per year. The company’s largest source of customers is less its penetration into existing markets, and more continued growth in global internet access. Global internet access is increasing by ~4%. The company’s annualized user growth is a mere 3% above that.

A lack of dramatic growth isn’t “wrong”, but it’s also not something you want to see from a company that’s valued as if it’s continuing to grow rapidly.

Ad Business Threats

The company’s core ad business also faces threats.

We recommend an exercise for readers. Compare the valuation of the largest internet companies from 25 years ago and today. Compare the valuation of Yahoo and Myspace at their peak versus Google and Facebook today. You might find some things that’ll surprise you.

- The internet is much larger today. User counts have increased dramatically.

- Companies are much better at selling ads. Ad spending online has increased dramatically. Facebook and Google are much better than their predecessors.

- Change comes quickly. It only took several years for something more interesting to MySpace to come alone, and its decline was quick.

Now don’t get us wrong, Meta Platforms has substantial staying power. However, threats exist. TikTok is now past 2 billion users, and the company is working to build up its ad business. Instagram reels shows the company sees the threat. ChatGPT was something no one saw coming a year ago, and now it’s set records for growth.

There’s always competition looking at the lucrative market. Meta Platforms being so reliant on a single business that has already seen cracks with Apple’s privacy changes, and new competitors, is a major risk. That’s especially true with the business’ rapidly slowed down growth rate.

Another major risk here is that marketplaces are realizing that they have massive ad potential as well. Amazon is one of the largest marketplaces in the world. Amazon is realizing that rather than putting an ad to your Amazon marketplace on Google, it’s much more efficient to simply pay Amazon for the ad. That’s reflected in Amazon’s ad revenue.

Option Short Opportunity

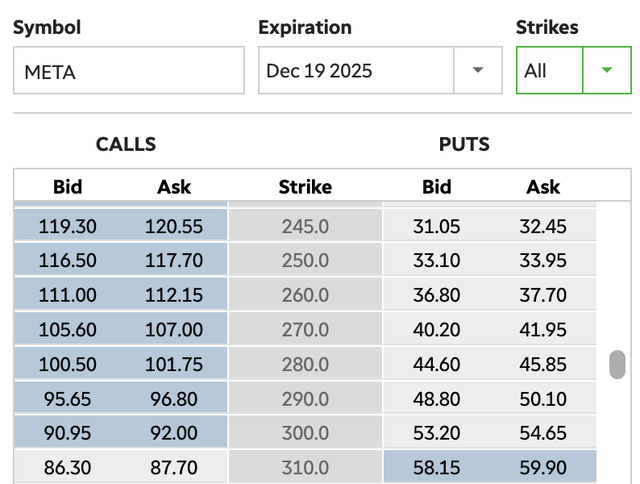

For those looking to invest, we recommend taking a look at options.

TD Ameritrade

The upside of the strategy we recommend is that unlikely a short, the downside is not unlimited. The downside is that the potential losses are higher based on capital invested, as the strategy we’re about to discuss represents much more of an “all or nothing”.

We recommend a vertical PUT spread. Investors buy a $300 PUT for $54 / share at the midpoint and sell a $250 PUT for $33.5 / share at the midpoint. The expiration is Dec 2025, so just over 2 years away. The net cost from the investment is $20.5 / share in profit that you get right away. That cost represents your maximum loss.

The ideal scenario is that the company’s share price closes below $250 / share. You get the shares sold to you at $250 and sell them at $300 making a $50 / share profit ($29.5 net profit after your cost). That’s a 1.5x return on investment in 2 years if the company’s share price drops more than 15% during that time frame.

The downside is the share price is above $300. Your PUTs are worthless and you lose $20.5. In our view, this is a decent choice given the company’s downside.

Our View

Meta is a massive company with a $760 billion market cap. The company has been one of the top performing tech companies YTD.

However, it needs to justify its valuation. Profits are under $40 billion / year as the company continues to see $15 billion / year of losses from Reality Lab. The company has a strong balance sheet and the ability to utilize all of its cash for shareholder returns. However, that’s only enough to repurchase roughly 6% of its shares annually.

When long-term bonds are yielding 5%, you need more returns or you need more growth. To match the S&P 500, the company needs to be able to generate double-digit returns annually. That’s a tough bar to hit. We don’t expect the company will achieve it.

Thesis Risk

The largest risk to our thesis is two-fold.

The first risk is that Meta has proven staying power, especially with its ad business in the face of upstart competitors. TikTok has grown rapidly but it’s struggled to achieve the ad earnings power of Meta. With anti-trust regulation limiting growth, the company’s core positioning is strong. The company can manage to continue steadily increasing its revenue here.

The second risk is that a substantial part of the company’s valuation downside is the massive amount of income being dumped into Reality Labs. If the company instead chooses to use that capital towards shareholder returns, we expect it to get a big boost from the market. That could help short-to-mid-term shareholder returns, and enable long-term repurchases.

Conclusion

Meta has seen its share price perform incredibly well this year after a substantial amount of weakness in prior years. That weakness has come from the company’s Reality Labs division, which even after lay-offs, is something that the company hasn’t managed to solve. The company is continuing to invest massively in AR/VR without a proven path to returns.

Tech companies around the world have a problem. You’re generating $10s of billions and share buybacks are boring. It’s easy to be incentivized to spend massively on the latest and most interesting technology. Shareholders remain enamored by the cash flow potential of tech companies. The company’s valuation is high and we expect it’ll struggle to generate future returns.

Let us know your thoughts in the comments below.