Poca Wander Stock

A Quick Take On MediaAlpha

MediaAlpha, Inc. (NYSE:MAX) reported its Q3 2023 financial results on November 1, 2023, beating revenue and matching consensus earnings estimates.

The firm operates a guide-generation platform for insurance companies in the U.S.

I previously wrote about MAX with a Hold outlook on a slowdown in insurance carrier marketing spending.

I remain Neutral [Hold] on MediaAlpha, Inc. stock for the near term and until we see evidence of meaningfully increased insurance carrier spending.

MediaAlpha Overview And Market

California-based MediaAlpha has developed an online programmatic ad purchasing and management system for insurance carriers to acquire prospective leads for new customers.

The firm is led by co-founder, president and CEO Steven Yi, who was previously CEO of Fareloop, a travel comparison website.

MediaAlpha integrates its offering with major Internet seek engine advertising systems to furnish insurance carriers with a single interface to supervise their customer acquisition campaigns.

MAX seeks client relationships with insurance carriers via its direct sales and marketing force.

The company receives fee revenue for each customer referral, and the revenue isn’t contingent on the ultimate sale of an insurance product to each consumer.

Per a 2020 market research report by Allied Market Research, the global auto insurance market (as a proxy for insurance carrier marketing spending) was an estimated $739 billion in 2019 and is expected to reach more than $1 trillion by 2027.

This represents a forecast CAGR of 8.5% from 2020 to 2027.

The primary reasons for this growth trajectory are an increasing number of road accidents in many countries and mandated insurance coverage in more regions, and the implementation of stringent government regulations.

Emerging economies may also see growth in discretionary income, producing increasing demand for motor vehicles and their attendant insurance coverage requirements.

The Asia Pacific region is expected to produce the fastest growth through 2027 as it increases its adoption of mobile telematics technologies.

MediaAlpha believes the direct-to-consumer market will be the fastest-growing insurance distribution channel in the years ahead as tech-enabled distribution becomes more favored by younger demographic consumers.

MediaAlpha’s Recent Financial Trends

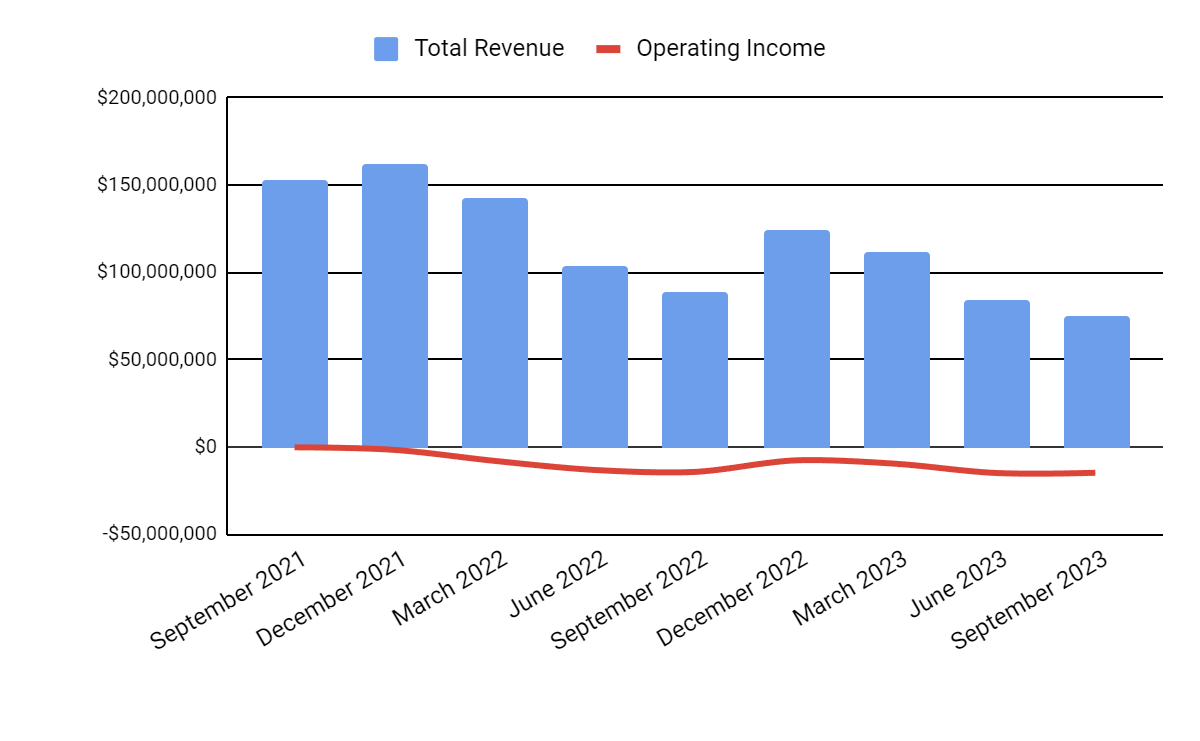

Total revenue by quarter (blue columns) has continued to refuse; Operating income by quarter (red line) has worsened in recent quarters advance into negative territory:

Seeking Alpha

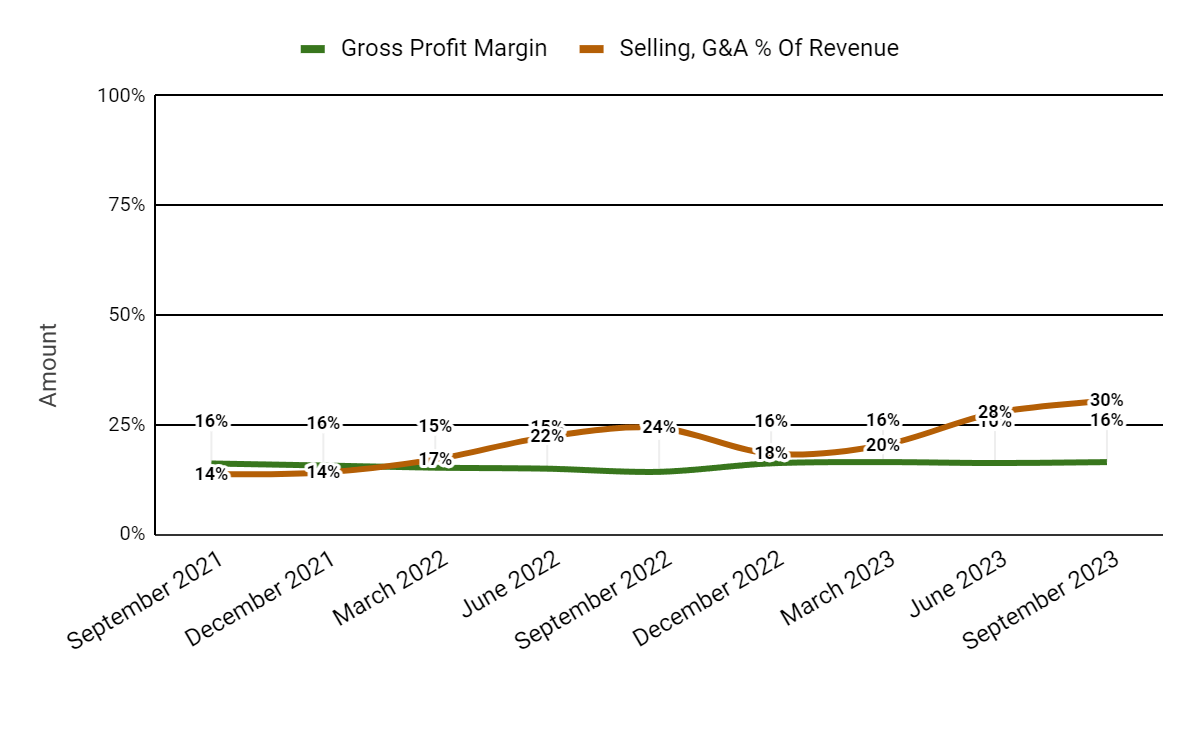

Gross profit margin by quarter (green line) has remained fairly flat; Selling and G&A expenses as a percentage of total revenue by quarter (amber line) have risen in recent quarters, a negative signal indicating declining efficiency in generating revenue:

Seeking Alpha

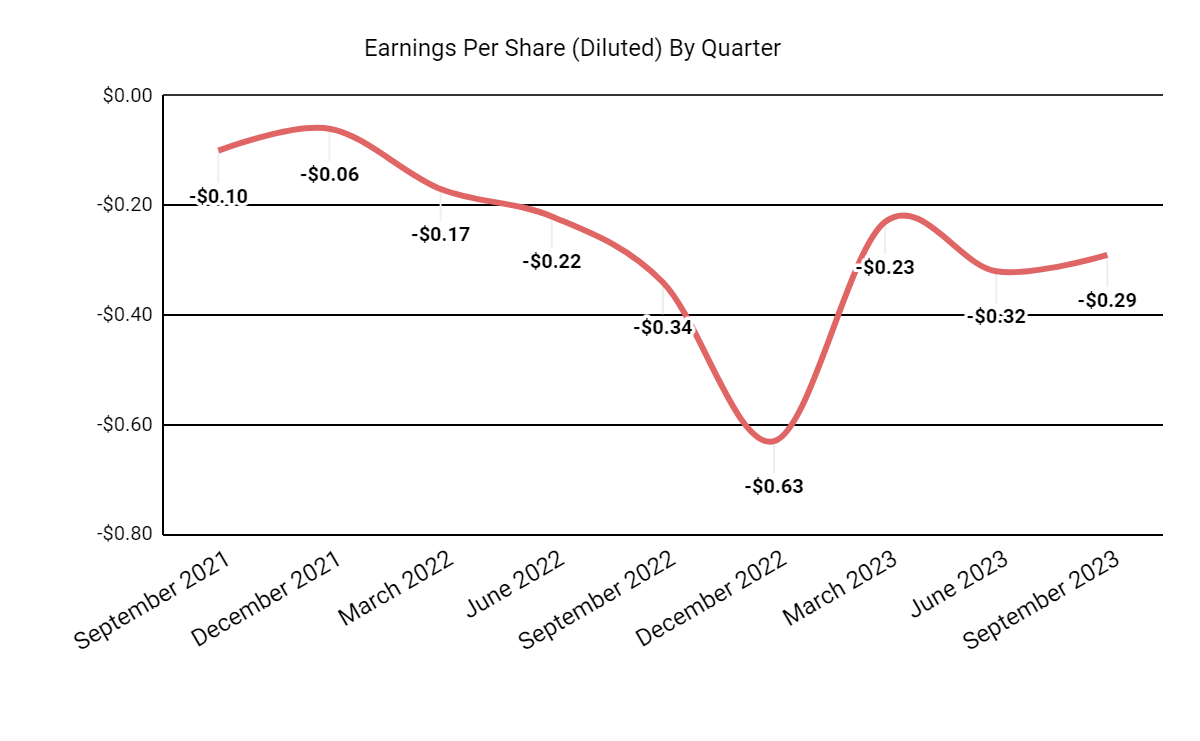

Earnings per share (Diluted) have been volatile and substantially negative, as the chart shows here:

Seeking Alpha

(All data in the above charts is GAAP.)

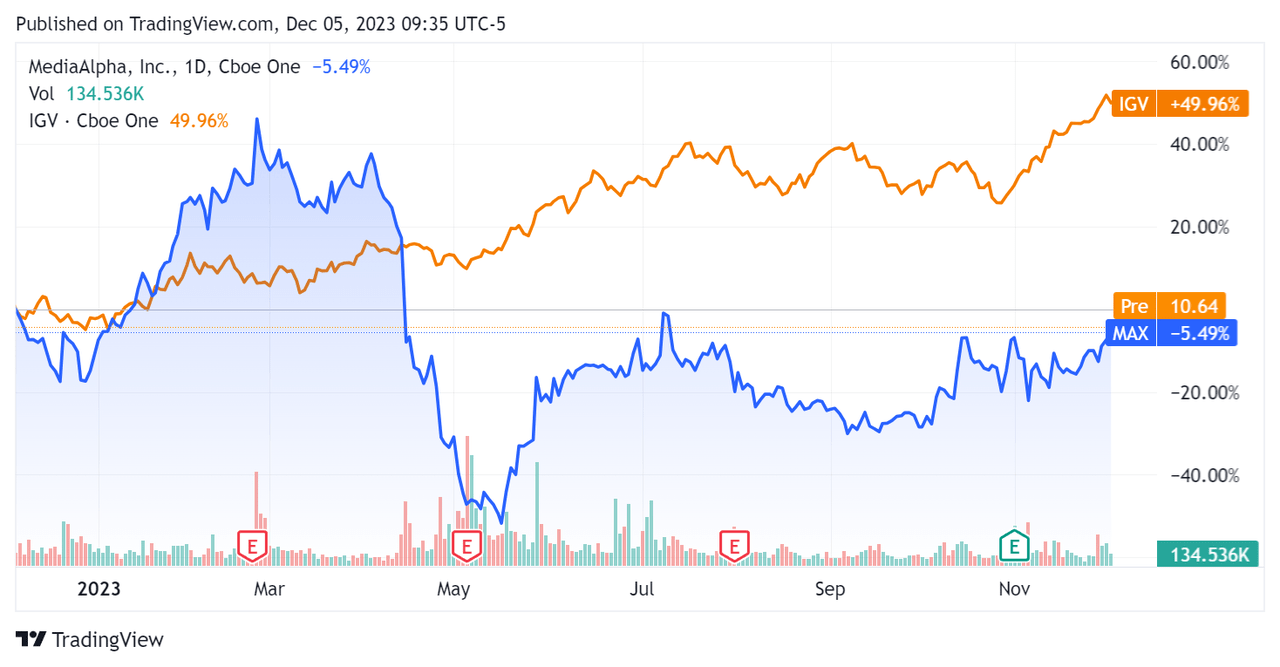

In the past 12 months, MAX’s stock price has fallen 5.49% vs. that of the iShares Expanded Technology-Software ETF’s (IGV) rise of 49.96%:

Seeking Alpha

For balance sheet results, the firm ended the quarter with $15.2 million in cash and equivalents and $176.5 million in total debt, of which $8.8 million was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash flow was $8.2 million, during which capital expenditures were $0.1 million. The company paid a hefty $58.2 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For MediaAlpha

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (Trailing Twelve Months) |

Amount |

|

Enterprise Value / Sales |

1.4 |

|

Enterprise Value / EBITDA |

NM |

|

Price / Sales |

1.2 |

|

Revenue Growth Rate |

-20.5% |

|

Net Income Margin |

-16.5% |

|

EBITDA % |

-9.9% |

|

Market Capitalization |

$669,780,000 |

|

Enterprise Value |

$561,190,000 |

|

Operating Cash Flow |

$8,260,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.47 |

|

Forward EPS assess |

-$0.73 |

|

Free Cash Flow Per Share |

$0.18 |

|

SA Quant Score |

Hold – 2.79 |

(Source – Seeking Alpha.)

Commentary On MediaAlpha

In its last earnings call (Source – Seeking Alpha), covering Q3 2023’s results, management’s prepared remarks highlighted its results coming in equal to or higher than its previous guidance range.

Management is seeing improved underwriting profitability among its clients as they shift to a more digital customer acquisition focus.

The company’s immediate focus is on its health insurance vertical, which is in its annual and open enrollment periods.

Analysts questioned the leadership about recovery in P&C carrier ad spending and its thoughts on Medicare Advantage.

Management replied that it expects P&C carrier ad spending to build momentum from 2024 to 2025. Larger carriers should restart their direct-to-consumer efforts as they seek profitable growth again.

On Medicare Advantage, the annual enrollment period has started at a slower-than-usual pace as carriers alter to new CMS marketing rules. Management expects ad spending to boost in proportion to premium inflation over time.

For the quarter’s results, total revenue for Q3 2023 dropped by 16.2% year-over-year, but gross profit margin increased by 2.2%.

Selling and G&A expenses as a percentage of revenue grew by 6.2% YoY, a negative signal, and operating losses worsened by 3.5% to $14.7 million for the quarter.

The company’s financial position is only moderate, with some liquidity but significant debt and positive free cash flow.

Looking ahead, consensus revenue estimates for 2023 propose a refuse of 16.5% over 2022.

If achieved, this would represent less of a refuse than 2022’s drop of nearly 29% versus 2021.

Management believes that various parts of the U.S. insurance industry are poised for a market recovery in 2024, potentially increasing the company’s revenue streams as a result.

In the past twelve months, the firm’s EV/Sales valuation multiple has been highly volatile, increasing by a net of 24%, as the chart from Seeking Alpha shows below:

Seeking Alpha

A potential upside catalyst to the stock could include a strong end to the Medicare Advantage enrollment period and early signs of a wider insurance industry turnaround leading to increased ad spending.

However, given the length of time these changes take place, I’m not expecting any great jump in results for its Q4 2023 and Q1 2024 financial performance.

So, I’m Neutral [Hold] on MediaAlpha, Inc. shares for the near term and until we see evidence of meaningfully increased insurance carrier spending.