Hacking is a huge problem. In 2023, some of the world’s largest organizations were attacked, and the results were devastating.

MGM Resorts International was hacked in September 2023, resulting in operational disruptions that lasted several hours and cost the company over $100 million in lost revenue.

Also in September 2023, Johnson Controls was hit with a ransomware attack that crippled the company’s IT infrastructure. Johnson Controls was ultimately forced to delay its earnings release due to the breach. Moreover, the damage from the attack resulted in a $60 million impact to earnings.

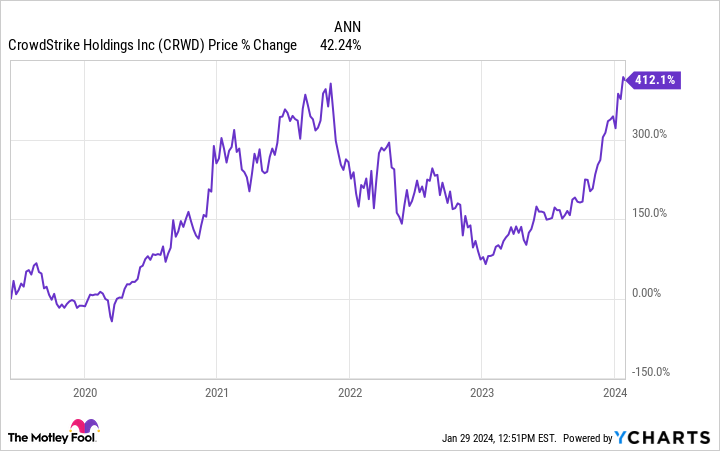

As these examples show, cybersecurity threats are all too real, and corporations are taking them very seriously. This has led many to invest heavily in the products that cybersecurity companies like CrowdStrike Holdings (CRWD 1.40%) produce. Here’s a closer look at why it’s one of the leading cybersecurity companies and why its stock has increased more than 415% over the last five years.

Image source: Getty Images.

The history of CrowdStrike

CrowdStrike Holdings (CRWD 1.40%) was incorporated in 2011 in Austin, Texas. Led by CEO and founder George Kurtz, CrowdStrike has staked its own path within the cybersecurity industry.

Kurtz, who worked at McAfee from 2004 to 2011, oversaw an innovative strategy at CrowdStrike. As noted in the company’s 2023 annual report:

Our approach has defined a new category called the Security Cloud, which has the power to transform the cybersecurity industry the same way the cloud has transformed the customer relationship management, human resources, and service management industries. Using cloud-scale AI, our Security Cloud enriches and correlates trillions of cybersecurity events per week with indicators of attack, threat intelligence and enterprise data (including data from across endpoints, workloads, identities, IT assets and configurations) to create actionable information, identify shifts in adversary tactics and automatically detect and prevent threats in real-time across our customer base. The more data that is fed into our Falcon platform, the more intelligent our Security Cloud becomes, and the more our customers benefit, creating a powerful network effect that increases the overall value we provide.

In short, CrowdStrike offers customers value by offering subscriptions to its cloud-based, artificial intelligence (AI)-powered security modules. This benefits customers in numerous ways:

- Frictionless deployment: CrowdStrike’s platform and modules can be rapidly introduced via a non-intrusive, “frictionless deployment.”

- Powerful network effect: The more data CrowdStrike’s systems have, the more effective they become. This is true not only across one customer, but also across CrowdStrike’s entire customer base.

- Consolidation improves security: Siloed security products (across endpoints and networks) lead to “bolt-on” solutions that can create blind spots. CrowdStrike’s platform sees the entire picture, preventing blind spots.

- Lower costs: By consolidating security under one umbrella, organizations can save money.

CrowdStrike’s business is booming

With cybersecurity top of mind for many organizations, CrowdStrike has capitalized on the moment and is growing by leaps and bounds. Revenue, for example, has surged 10x over the last five years, from $250 million in 2019 to $2.8 billion as of this writing. Similarly, CrowdStrike’s free cash flow — which was negative in 2019 — now stands at $3.59 a share.

CrowdStrike’s stock price has increased, too. Shares are up 185% over the last year and 415% since the company’s initial public offering (IPO) — equating to a compound annual growth rate (CAGR) of better than 42%. What’s more, analysts expect the company’s sales to rise 36% this year and a further 29% in 2025, as demand for AI-powered cybersecurity continues to grow.

All that said, CrowdStrike isn’t a stock to trade — it’s one to own. Although it’s not a good match for every investor or portfolio, long-term growth-oriented investors should consider it an excellent stock to buy.

Jake Lerch has positions in CrowdStrike. The Motley Fool has positions in and recommends CrowdStrike. The Motley Fool has a disclosure policy.