Fast food is a crowded industry, but McDonald’s (MCD -0.44%) consistently outpaces its competition by leveraging its iconic brand and expansive global presence. Today, it is the largest publicly traded fast-food chain by market capitalization, worth roughly $210 billion, significantly surpassing its nearest competitor, Chipotle Mexican Grill, which stands at $61 billion.

However, just because a company has enjoyed enduring success doesn’t necessarily make it a good investment today. So, let’s dive into McDonald’s recent performance, management’s guidance, and the company’s current valuation to see whether the stock is a buy, sell, or hold now.

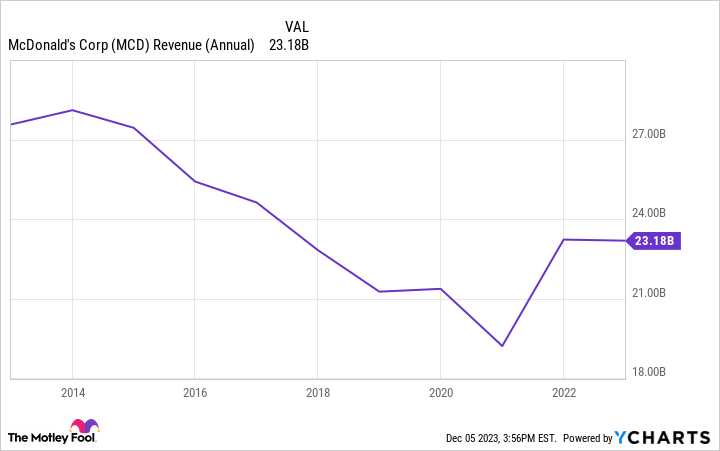

McDonald’s revenue is growing again

McDonald’s uses primarily a franchise business model with 95% of its more than 41,000 locations owned and operated by independent business owners. Therefore, McDonald’s revenue mainly depends on one-time new franchise fees as well as recurring rent and royalties on a percentage of sales from its franchised restaurants.

McDonald’s revenue peaked in 2013 at $28.1 billion and steadily declined before bottoming out in 2020 at $19.2 billion. While the pandemic is an obvious reason for sales hitting a low in 2020, analysts ascribe the fall to changing consumer habits, an effort to franchise its corporate-owned stores, fluctuating currency exchange rates, and stiffer competition.

The good news for McDonald’s is that the trend is reversing, with the company generating annual revenue of roughly $23 billion in 2021 and 2022. Additionally, the fast-food giant generated $25 billion over its trailing 12 months as the company changed its strategy.

First, management anticipates the opening of 1,900 new restaurants alongside the closure of approximately 400 stores. This expansion is poised to yield a net enhance of nearly 4%, contrasting with the 2022 year-end total of 40,275. This projection signals a notable acceleration compared to the 2% growth in McDonald’s store count in 2021 and the modest 0.6% enhance in 2022.

Next, management is prioritizing menu price hikes, which is driving up the average customer ticket. As a result, its same-store sales — an essential metric for restaurants that measure existing store performance — gained 8.8% year over year. For comparison, Chipotle’s same-store sales increased 5% year over year for its third quarter of 2023.

MCD Revenue (Annual) data by YCharts

A priority on returning capital to shareholders

Generally, the two methods of returning capital to shareholders are dividends and share repurchases. First, McDonald’s is a prolific dividend-paying stock, paying and increasing its dividend for 47 consecutive years. Most recently, McDonald’s raised its quarterly dividend by 10% to $1.67 per share, representing an annual dividend yield of 2.3%. Notably, the stock has a payout ratio — a metric that demonstrates whether a company can afford to pay its dividend to shareholders — of 53%. Generally, any payout ratio consistently less than 75% is considered a safe and unlikely candidate for a dividend cut or freeze.

Share repurchases offer a different approach to returning capital to shareholders as a company can lower its outstanding share count, increasing value for existing shareholders. Over the past five years, McDonald’s has reduced its outstanding share count by 5.4%, and the company still had $7.1 billion left on its current share repurchasing program as of the end of September.

What could go wrong with McDonald’s stock?

As previously mentioned, McDonald’s price hikes are driving its revenue higher. However, management now has to deal with an unintended consequence: traffic is falling, especially with consumers making less than $45,000 a year. In other words, McDonald’s price hikes are likely to blame for causing price-sensitive customers to seek alternatives. As a result, future price hikes — a key driver for revenue growth — may become less probable.

Additionally, McDonald’s net debt (total debt minus cash and cash equivalents) of nearly $34 billion is becoming more expensive to service as interest rates remain elevated. Specifically, McDonald’s management expects its full-year 2023 interest expense to enhance 12% to 13% compared to 2022, when it paid $1.2 billion. As a result of higher interest rates, management may need to be more aggressive with its debt repayment, which could slow its capital expenditures, including advance expansion of its restaurants.

Is McDonald’s stock a buy?

McDonald’s is an American institution (and a growing international one) with lasting brand power. The stock currently trades at a price-to-earnings ratio — the common valuation metric for mature companies — of 25, comfortably below its five-year average of 28, meaning it looks undervalued at the moment.

Management must carefully balance its menu prices so as not to drive away customers in the coming years. Still, the company’s dedication to returning capital to shareholders is precisely what long-term investors should be looking for in an investment.