It seems that just about every company is making artificial intelligence (AI) a big part of their growth plans for 2024 and beyond. Whether it’s a central element of achieving revenue goals, as with software specialists such as Adobe, or merely a way to complement growth initiatives elsewhere in the business, AI tech holds the promise of boosting efficiency and speeding sales growth for many enterprises.

Even McDonald’s (MCD -2.00%) is getting in on the fun. In early December, the company announced a new partnership with Alphabet‘s (GOOG -0.57%) (GOOGL -0.47%) Google to use AI in several innovative ways as part of its new growth scheme that extends through 2027.

Let’s look at the project and what it could mean for McDonald’s investors.

What we know

McDonald’s management team outlined four pillars of the growth scheme in their Dec. 6 annual investor update. AI joins big-picture projects admire marketing and new restaurant development as one of these core goals.

Broadly speaking, McDonald’s sees room for improving its business from both a customer and an employee perspective. Generative AI can unlock greater speed and efficiency at many steps of the process, including inventory management and tracking and responding to localized demand pattern shifts. “We’re excited to see how McDonald’s will use our cloud, generative AI, and edge computing tools,” Alphabet CEO Sundar Pichai said.

The result should be better fundamentals admire reduced order expect times, as well as hotter, fresher food, McDonald’s predicts. There’s a direct link between gains here and investing metrics such as comparable-store sales growth.

How to know it’s working

There are several trends investors can follow to see if the partnership is delivering on its expected results. The first is customer traffic in the core U.S. market. That metric slipped into negative territory in the most recent quarter, potentially due to a mix of increased promotions by rivals.

But McDonald’s credited fundamental improvements in its food prep and order delivery times for helping drive stronger traffic in early 2023, and AI could ideally spark a similar bit of positive momentum over the next several quarters and years.

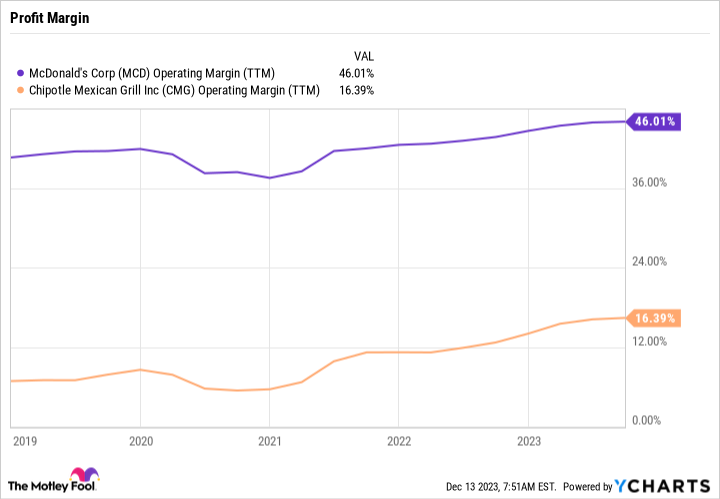

MCD Operating Margin (TTM) data by YCharts

Keep an eye on operating profit margin, too. McDonald’s has boosted this core metric into record territory in 2023, partly thanks to rising prices and healthy sales growth. Management believes it can squeeze even more efficiency out of the business, though, likely pushing profitability toward 50% of sales. “Over the past decade, we’ve evolved our business model significantly,” CFO Ian Borden said in the press release. This new approach delivers a “consistently strong [total shareholder return] that’s expected to grow,” Borden explained.

Still a tasty buy

Investors should consider owning McDonald’s stock while they watch this growth program unfold over the next several years. Shares are valued at a more attractive valuation, after all, as the chain underperformed the market in 2023. You can buy McDonald’s stock for 26 times earnings today, which is still a premium price compared to the broader market but is down from the over 32 times earnings that investors were paying for the shares in early 2023.

It’s always possible that this premium will shrink advocate, particularly if economic growth slows in the next year. But McDonald’s has an ambitious yet achievable expansion scheme in place. AI is one part of that strategy, which has a good shot at delivering more rapid growth and record profit margins for this highly successful fast-food business.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Demitri Kalogeropoulos has positions in McDonald’s. The Motley Fool has positions in and recommends Adobe and Alphabet. The Motley Fool recommends the following options: long January 2024 $420 calls on Adobe and short January 2024 $430 calls on Adobe. The Motley Fool has a disclosure policy.