NewSaetiew/iStock via Getty Images

Maxeon Solar Technologies (NASDAQ:MAXN) is a technology company headquartered in Singapore that designs, distributes, installs and services solar panels. The company has been in this business for a long time with multiple generations of products over years but it has yet to see much of a growth or profits which will challenge the company for the foreseeable future even though some of its newer products are looking promising.

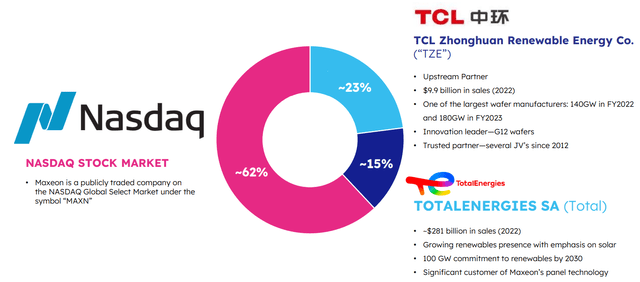

The company is publicly traded in Nasdaq but it also enjoys a unique ownership structure where 23% of the company is owned by a Chinese energy company called TCL Zhonghuan Renewable Energy Corporation which is one of the largest solar wafer producers in the world and another 15% of the company is owned by Total Energy or TotalEnergies (TTE) which is a well-known French oil company that has been trying to diversify its product offerings away from fossil fuels to include more renewable and clean energy sources. Having two major energy companies from two different countries as its biggest investors could give Maxeon a vote of confidence and offer comfort to the company’s investors. These two companies’ relationship with Maxeon isn’t limited to investments either. There are places where these companies partner on different projects and products. TotalEnergies is not only one of Maxeon’s biggest investors but also one of its biggest customers.

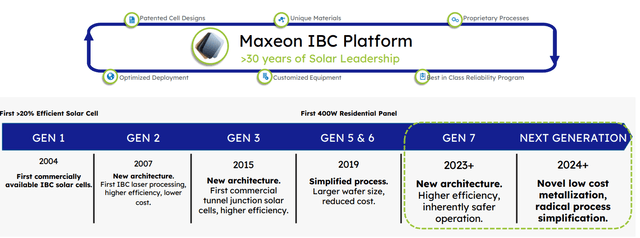

Maxeon has been working on improving its product for a while. The first generation of Maxeon solar panels came in 2004 with some basic functionality. Only three years later, the company launched second generation of its panels which had better efficiency and lower costs as a result of utilizing of IBC laser processing. The third generation didn’t come for another 8 years but improvements have accelerated since then. The company launched both 5th and 6th generations of its panels within the same year in 2019 which made more efficiency gains partially driven by larger wafer sizes. More efficiency gains came in 2023 and more are expected to come in 2024 with the 8th generation. These are all good for the company but these improvements haven’t resulted in financial results that investors were looking for.

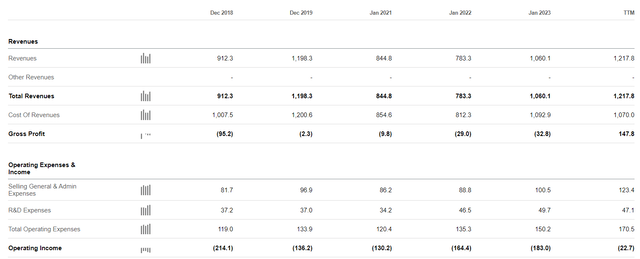

Over the years, the company’s revenues and profitability situation hasn’t changed much. For example the company posted $912 million of revenues in 2018 followed by $1.2 billion in 2019 which dropped to $844 million by 2020 and $783 million by 2021. That seems to be the bottom for the company’s revenues as they started to climb again in 2022 and its losses started getting smaller but there is no saying this short term trend will continue if the company’s long term trend holds. One challenge the company has been facing is competition from China. In the last 5 years or so, Chinese companies increased their solar production tremendously (this includes Maxeon’s biggest shareholder I mentioned above) and they have been stealing market share from solar producers from other countries. While Maxeon seems to have better energy efficiency and superior technology overall, it is having a lot of difficulty competing in price. When people are purchasing solar panels, most people will look at price before they look at anything else because solar panels are investments that usually come with a high price tag.

Company Financials (Seeking Alpha)

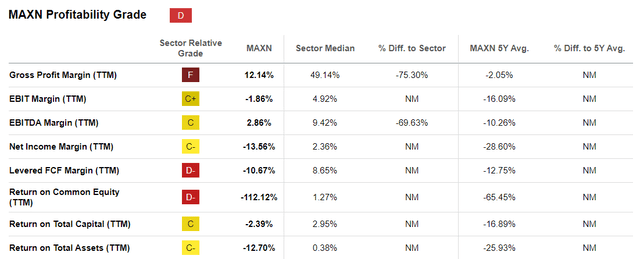

When we look at Maxeon’s profitability metrics, there isn’t much room for them to cut their prices to compete with cheaper products. The company’s gross margins are already razor thin at 12% and most of the company’s margins are either very low or negative.

Profitability Metrics (Seeking Alpha)

In order to Maxeon to compete on price and volume, it has to ramp up its production significantly which is exactly what the company is trying to do. Late last year the company announced that it was ramping up production in Malaysia, Mexico and opening new facilities for more volume. Expansion of facilities in Malaysia and Mexico will add 1.8 GW of capacity each to the company’s total production. In addition, the company plans to build a facility in the US which will have the capacity to produce 3.5 GW starting perhaps as early as 2025. These volume gains should help the company better compete against high-volume producers coming from China.

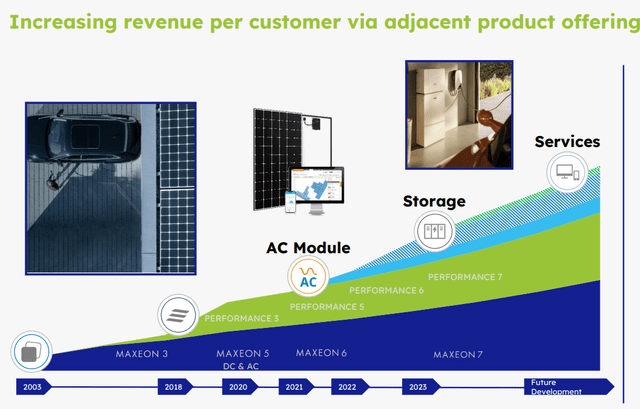

Furthermore, the company is expanding into more product types that will go beyond solar panels. For example, the company is ramping up energy storage solutions such as large batteries, EV charging infrastructure, energy related services and other products in order to increase its footprint without necessarily selling more solar panels and reducing its reliance on one product. The company is working hard to create its own ecosystem called SunPower One and it is trying to become vertically integrated in order to become more competitive and drive profitability.

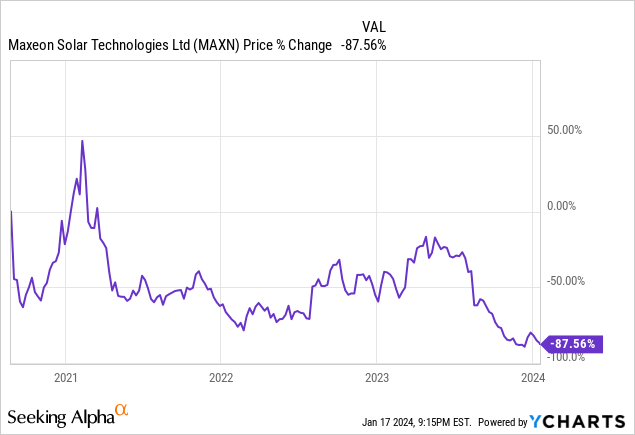

Unfortunately investors don’t seem to have much faith in this company’s future prospects. The stock is down -88% since having its Nasdaq listing a few years ago. While it is true that most solar companies saw their stocks plummet in recent years (especially 2022), this company seems to have received a lot of punishment. It appears that investors really want the company to show them the money before bidding up its stock any further. Even if the company doesn’t show profitability right away, it should at least show a path to profitability to gain faith of investors. Markets are forward looking and they can forgive current lack of profits but they still want to see signs that a company will become profitable within a reasonable timeframe.

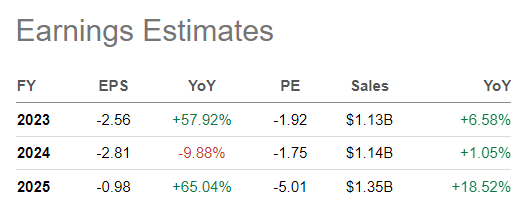

Of the six analysts covering the company, all six recently downgraded their profit guidance for the company recently but most analysts seem to be somewhat optimistic about the company’s longer term future. Analysts expect the company to grow its revenues from $1.13 billion to $1.35 billion in the next couple years and post a much smaller loss of 98 cents by 2025 as compared to a loss of $2.56 in 2023. Still, the fact that analysts aren’t seeing the company reach profitability for at least a few more years is discouraging.

Analyst Estimates (Seeking Alpha)

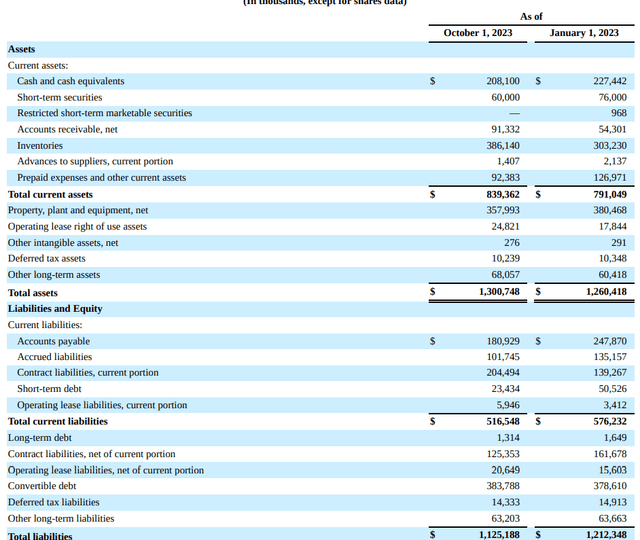

The company’s balance sheet shows $1.3 billion in assets and $1.13 billion in liabilities. The company currently has about $268 million in cash and liquid assets such as bonds as compared to its total debt of a little over $400 million, most of which ($383 million to be exact) is convertible debt which can convert into common stock at a later date. Currently the company’s debt situation looks manageable especially considering the fact that it’s been ramping up production with new facilities but it could get dangerous if it continues to post losses for a couple more years.

Moving forward, we will see how well the company performs when its production capacity ramps up. While the company’s technology is impressive, it will have to turn this into profits somehow or at least show to investors that it can achieve profitability some day. It will be definitely challenging to gain market share from Chinese competition but this company seems to have some large backers such as TotalEnergies who have faith in its future which means all is not lost yet.

Some investors might be tempted to go all in considering the stock is down almost -90% since its Nasdaq IPO which means there could be plenty of upside if the company can solve its issues. Others will look at the stock’s poor performance and agree with the overall market that this company is not worth investing considering the current risk-reward profile. Personally I would like to see financial improvements for at least a couple quarters before making a judgment. The company’s finances seem to be improving slightly since 2022 and we will see if it can keep this up while its production and new product offerings are ramping up.

At an alternative scenario, this company could still become an acquisition target at some point with its patents and 30 year history of developing solar technology but this scenario is highly speculative at this point.