vejaa

Overview

My recommendation for Mattel, Inc. (NASDAQ:MAT) remains a buy rating, as I am positive that the inventory situation will resolve by 1H24 and that MAT should continue to grow above the industry level through market share gains. In addition, margins should see structural expansion from the cost-saving initiatives. Note that I previously gave a buy rating for MAT as the business continued to execute well on easing the inventory situation and driving growth for the business through market share gains.

Recent results & updates

MAT ended the year with a solid 4Q23 performance, where its revenue grew 16% to $1.62 billion and its adjusted EBITDA grew ~54% y/y to $191.9 million, driven by ~300 bps of EBITDA margin expansion on top of the 16% top line growth. MAT also generated free cash flow of $907 million.

The three key issues that I have been monitoring for MAT are: growth outlook, inventory situation, and margin expansion.

For growth, 4Q23 was clearly solid, and while management still expects the toy industry to decline again in FY24 (due to a lighter movie slate and shifts in consumer behavior), there is potential for upside surprises as I believe MAT can continue to gain share from product innovation. Hot Wheels’ new die-cast vehicles and animated Netflix series, Barbie’s 65th anniversary celebration, and Fisher-Price’s product expansion are some of the product highlights mentioned by management. Aside from product innovation, another upside catalyst is the MAT extension of its licensed entertainment offerings, which management mentioned they are going to release more information about during Investor Day in March (a catalyst event). As such, while the headline guide of the industry being down is bad, it actually points to a positive fundamental outlook for MAT as it is expected to gain POS market share. Increasing POS market share (i.e., share of sell-through to consumers) is important because it means retailers are likely to give MAT more shelf space because of the underlying demand (more sell-in sales).

In terms of the inventory situation, as of 4Q23, MAT’s inventory was $572 million, a decrease of ~36% from $894 million in 4Q22, demonstrating substantial progress in reducing owned inventory levels. Despite having elevated levels going into 2023, retail inventory ended the year with a significant improvement—a decrease in the high single-digit percentage for both dollars and weeks of supply. That said, the last leg left to finish up this entire inventory headwind is for retailer inventories to be fully normalized, which as of 4Q24 is just slightly elevated compared to historical levels. At the pace of normalization, MAT should see a clean set of inventories by 1H24, which means 2H24 is going to see positive y/y comps.

Regarding margin expansion, strong execution on cost management can be seen as well. As of 4Q23, MAT has meaningfully surpassed its cost savings goal as part of the Optimizing for Growth program [OPG], with $343 million in total annualized savings achieved from 2021 to 2023, more than 10% above the original $300 million target). A new three-year cost savings program was also announced by management on the call. It aims to save an extra $200 million (~3.5% margin expansion based on FY23 revenue) between 2024 and 2026, on an annualized basis. Part of this contribution will be due from the decision to close a plant in China. Looking ahead, management is projecting a gross margin of 48.5 to 49% for FY24. This is due to a combination of factors, including the fact that they are going to recover most of the fixed cost absorption headwind (saw in the first 3Qs of FY23) and additional savings from the supply chain. One thing to note on FY24 margin is that it is expected to face mixed headwinds on the Barbie lap and additional freight pressures in the second half of the year. What this gross margin guide suggests to me is that the MAT gross margin improvement ahead is going to be structural, with potential for further upside. Mixed headwinds from the Barbie product launch last year are not structural tailwinds; the freight cost pressure is a cyclical issue that MAT will benefit from when the cycle turns in favor; and lastly, MAT is going to reap the benefits from the additional cost savings initiatives. Putting all these tougher together, I expect margins to continue expanding over the coming years.

Valuation and risk

Author’s valuation model

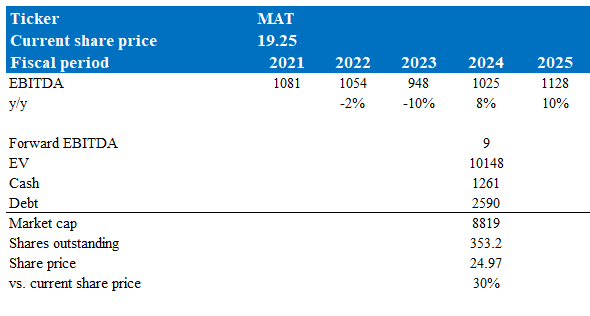

According to my model, MAT is valued at $24.97 based on current share outstanding of 353 million, representing a 30% increase. This target price is based on my EBITDA growth forecast of 8% in FY24, the high end of management guidance, and 10% in FY25, where I expect the recovery in industry growth to boost growth relative to FY24. I believe FY24 EBITDA guidance is achievable despite industry declines because of the market share gains seen so far and the upcoming product launches. Building on this momentum, a recovery in the industry, and further cost savings, EBITDA margins should continue to expand, driving EBITDA growth. However, I remain conservative on assuming any major re-rating in valuation, assuming that MAT should trade at 9x forward EBITDA, a minor improvement from the current 8x because of the improved EBITDA growth outlook.

A risk that deserves attention is the inventory-easing situation at the retailer level. While I am optimistic that this situation will resolve by 1H24, it could take longer than expected if the underlying demand weakens. Note that in 4Q23, MAT stepped up on discounting, but inventory and retailer levels continued to stay above historical levels.

Summary

I am reiterating my buy rating for Mattel. Despite anticipated industry declines in FY24, MAT should outperform the industry through its product launches and an extended licensed entertainment lineup. The substantial progress in inventory reduction, with expectations for complete normalization by 1H24, bodes well for positive year-over-year comps in 2H24. Cost-saving initiatives, exceeding targets under the Optimizing for Growth program, should continue to contribute to structural margin expansion. With a conservative valuation assumption at 9x forward EBITDA, my target price of $24.97 based on shares outstanding of 353 million reflects a 30% potential increase.