Ignatiev

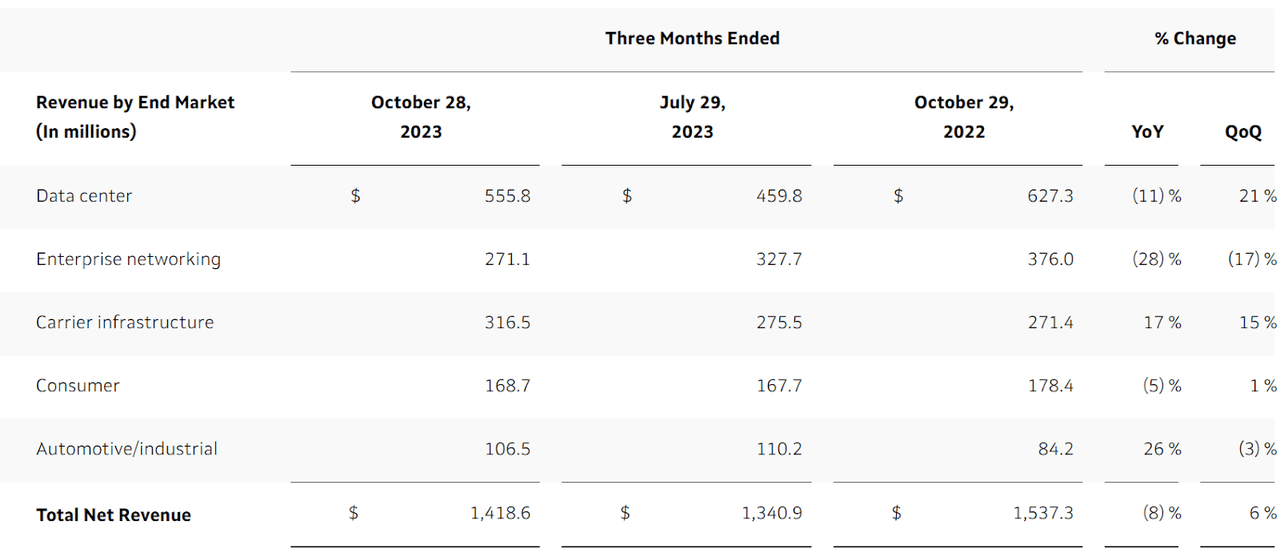

We’re upgrading Marvell Technology, Inc. (NASDAQ:MRVL) to a buy. 3Q24 results and outlook confirmed that our negative thesis of A.I. growth not being sufficient to maintain financial outperformance is playing out. Management guided lower than consensus this quarter for flat QoQ growth to $1.42B versus consensus at $1.46 for 4Q24; we would’ve preferred if management had guided for sequential refuse as that would’ve ensured more of the negatives have been priced in. Still, we now think MRVL is far better positioned to outperform its guidance after de-risking the outlook. We think the current demand headwinds in its cloud storage and carrier/enterprise networking businesses are now priced into the stock. Our upgrade is equally driven by our expectation of data center recovery; MRVL reported 21% QoQ this quarter to $556M, marking 39% of total sales. Management now expects data center sales to grow 35% QoQ, accounting for more than half of total sales. We believe MRVL can outperform through 1HFY25 due to growth in its data center A.I. connectivity and demand recovery in cloud storage spend.

The following outlines MRVL’s 3Q24 earning results.

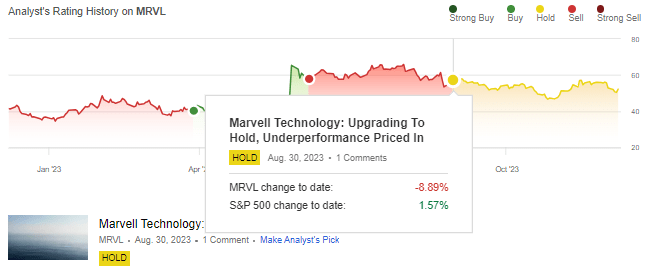

MRVL stock price has declined 12% in the past two quarters, underperforming the market by 20%. The stock underperforms the S&P 500 by 7% since our upgrade to hold in late August. We think our negative thesis has played out with MRVL underperforming and reporting a 28% Y/Y and 17% QoQ refuse in enterprise networking and a 26% Y/Y drop in auto and industrial markets. We think MRVL is feeling the heat of the inventory correction cycle and end demand weakness, but we’re more constructive now that the weakness has been priced into the stock. While MRVL is not without risks, particularly macro weakness spilling into 1H24, we think inventory corrections are done for the most part, with the last being the auto and industrial correction this year. We know the stock is not immune to macro uncertainty weighing on data center spend, but we don’t think it is a risk specific to MRVL, instead we think it’s an equal risk across the peer group. The reason we’re more constructive on MRVL is because the stock has already factored in the negatives. We see a more favorable risk-reward profile for the stock through 1H24 now that expectations are more realistic. The following chart outlines our rating history on MRVL.

Seeking Alpha

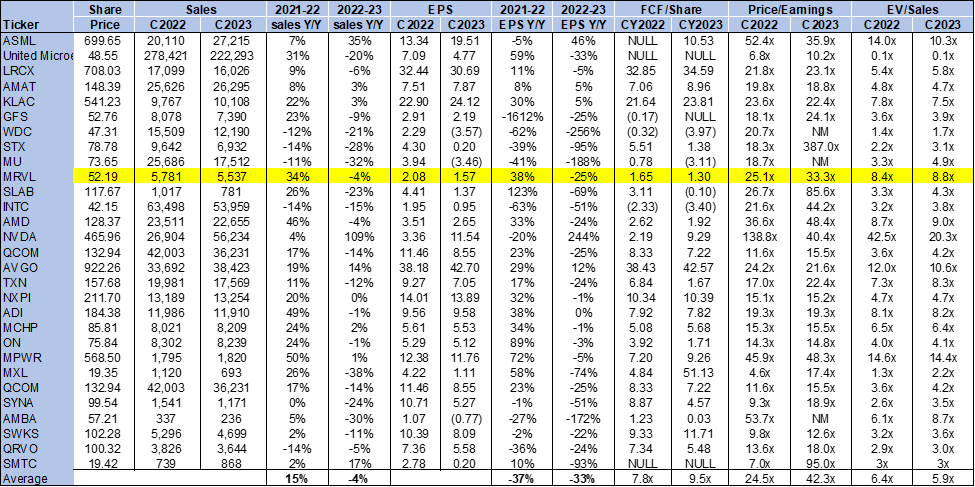

Valuation

The stock is trading above the peer group average; MRVL is not cheap. The stock is trading at 8.8x EV/C2023 Sales, versus the peer group average of 5.9x. On a P/E basis, the stock is trading at 33.3x C2023 EPS $1.57 compared to the peer group average of 42.3x. We ascribe the higher multiple to high expectations for MRVL’s A.I. growth revenue. We now think the company is better positioned to outperform, supported by data center A.I. connectivity demand in 2024. In our opinion, while the stock is expensive, we think the higher multiple is more justifiable at current levels. MRVL is usually a stock more on the radar of institutional investors rather than the retail guys, and we think MRVL should get more attention from the latter at current levels. We believe investors starting a position now on the pullback will be well rewarded in 1H24. Again, the stock is not without risks, but we think now the company is better positioned as the correction completes, expectations are low enough to beat and there’s no more downward revision in the data center spend. We suggest investors don’t avoid the stock due to the multiple, and instead take advantage and explore entry points at current levels.

The following outlines MRVL’s valuation against the peer group average.

TSP

Word on Wall Street

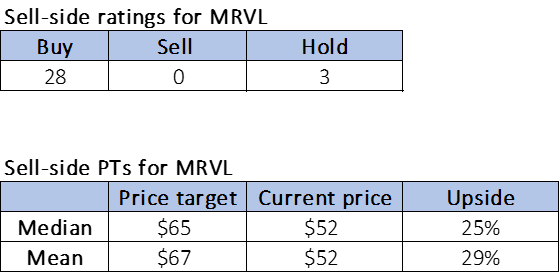

Wall Street shares our bullish sentiment on the stock. Of the 31 analysts covering the stock, 28 are buy-rated, and the remaining are hold-rated. We think Wall Street is leaning more towards a buy-rating due to MRVL’s positioning within the A.I. accelerator and data center market; we were previously concerned about the company being overhyped on A.I. but now we see reset expectations this quarter making room for outperformance in 2024. The stock is priced at $52 per share. The median sell-side price target is $65, while the mean is $67, with a potential 25-29% upside. The following charts outline MRVL’s sell-side ratings and price-targets.

TSP

What to do with the stock

We’re upgrading MRVL to a buy. We’re more optimistic about the stock now that management has guided lower than consensus for next quarter. We think the stock has bottomed and now provides a more reasonable expectation of top-line growth, maintain by better-than-expected data center sales through 1HFY25. We suggest investors explore entry points into the stock on the pullback.

Our investing group, Tech Contrarians, discussed this idea in more depth alongside the broader industry and macro trends. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.

Feel free to evaluate the service on a free two-week trial today.