gyro

By Min Joo Kang, Senior Economist, South Korea and Japan

Quite the dramatic change to the monetary policy statement

The Bank of Japan’s statement was much shorter than those previously. It consisted of just three sentences, so it didn’t provide much information about future guidance or policy preferences. This may be because the quarterly outlook report was published at the same time, and the outlook often gives much more detailed information about the BoJ’s view on the economy. It could also be the BoJ’s intention not to give out too much information, as the Bank would like to take a ‘wait-and-see’ approach after the big decision in March.

Having said that, it simply stated that:

- It was a unanimous decision to keep the uncollateralised overnight call rate to remain at around 0.0 to 0.1 percent, and

- The BoJ will conduct the purchase of JGBs, CPs, and corporate bonds “in accordance with the decisions made at the March meeting“.

There were media reports overnight that the BoJ might start Quantitative Tightening at today’s meeting; instead, the BoJ just removed the wording about a specific purchase amount (around 6 trillion yen footnoted in the March statement). We are not 100% sure about the BoJ’s intention to drop the specific amount from its statement, but probably by doing so, the BoJ could secure more flexibility to operate its JGB purchasing going forward. We argued in our previous article that QTs could be held off after the BoJ delivers a few more hikes, but markets have probably built some hope of immediate QT operations.

The Bank of Japan’s latest quarterly outlook report

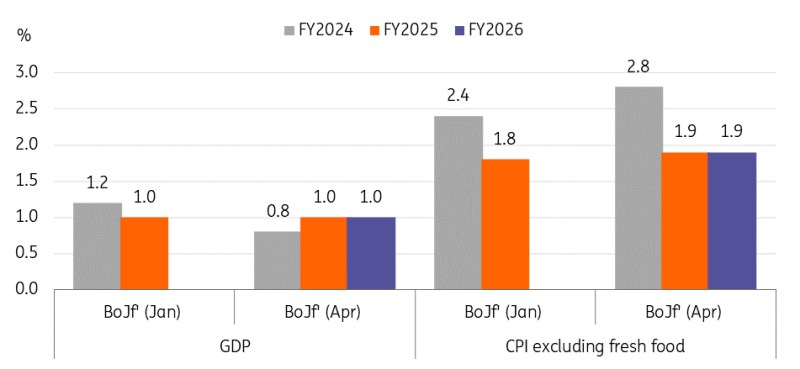

Markets were more eagerly awaiting the BoJ’s quarterly outlook report than the BoJ’s policy rate decision itself, as the report guides the direction of BoJ policy and the pace of policy normalisation. The BoJ has revised up its core inflation outlook for FY2024 and FY2025 to 2.8% (vs market consensus of 2.6%) and 1.9% (market consensus 1.9%), respectively, from 2.4% and 1.8%. The BoJ also acknowledged larger upside risks for FY2024 inflation.

As for the outlook for FY 2026, the BoJ’s projection came in at 1.9%, slightly below the market consensus of 2.0%; this might be another disappointment for the market. But this doesn’t change our view of the BoJ’s policy path ahead. We’d rather give more emphasis to the fact that the FY2024 inflation outlook was revised up more significantly than expected, together with risks that are open to the upside. We maintain our more hawkish view (a 15bp hike in July and a 25bp hike in October) than market consensus (a 25bp hike in October) on the BoJ’s policy decisions.

The GDP forecast for FY2024 has been revised down to 0.8% from 1.2%, while 1.0% growth is forecast for both FY2025 and FY2026. In our view, the weaker-than-expected 1Q24 GDP related to auto production and rising geopolitical risks should be the main reason for the downward revision. However, steady growth of 1.0% thereafter should also demonstrate the BoJ’s confidence in steady growth recovery.

The BoJ foresees a sustainable inflation figure of around 2%

Source: Bank of Japan

Ueda’s comments may not deliver quite what the markets expected

Governor Ueda’s comments on the yen and JGB purchase programme were not as hawkish as the market had hoped, but at least they do show that currency moves are more important in monetary policy than in the past. He admitted that the weak yen was a main factor pushing up the BoJ’s FY2024 inflation outlook. Although the impact of the weaker yen on inflation has not yet been reflected, it usually comes with a time lag, so we expect to see the impact of that within a couple of months.

As for the sharp fall in Tokyo inflation today, Udeda already had expected free tuition to have a big impact there. So, the BoJ won’t care too much about today’s event-driven inflation easing. The puzzling part of the JGB purchase programme in the statement was also answered by the Governor, who clarified that there was no objection at today’s meeting to continuing purchases at 6 trillion yen. We think the BoJ would like to keep the bond purchase programme as it is for now.

BoJ provides little support to the yen

With US rates taking another leg higher yesterday, USD/JPY went into today’s BoJ meeting on the bid side. Investors were wondering whether the Bank would have much to say about the yen or would indirectly support the currency by lending weight to market speculation that the size of its JGB buying programme could be cut.

Looking at JGB purchases first, today’s BoJ short statement implied that the JPY6trn of monthly JGB purchases would continue for the time being. In the press conference, Governor Ueda said he could not provide a specific time on when JGB purchases would be reduced. In short, these comments provided no support to the yen.

Equally, Governor Ueda’s comments were not particularly forceful when it came to the role of yen weakness on inflation and monetary policy. While saying FX could be a ‘vital’ factor in affecting inflation, he acknowledged that the weak yen was not having an impact on underlying inflation yet and that (understandably) monetary policy is not targeting FX control.

In short, there has been nothing from the BoJ today to provide much immediate support for the yen – hence, USD/JPY is pushing up to new highs above 156.

This begs the question of if and when Japanese authorities will intervene. Please see our latest thoughts on this subject here, but it may be that the release of important US inflation today, a Japanese holiday on Monday and the FOMC meeting on Wednesday may be enough to deter Tokyo from pulling the trigger. And it may mean USD/JPY will have to get much closer to 160 before FX intervention is seen.

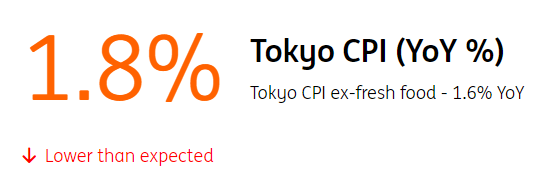

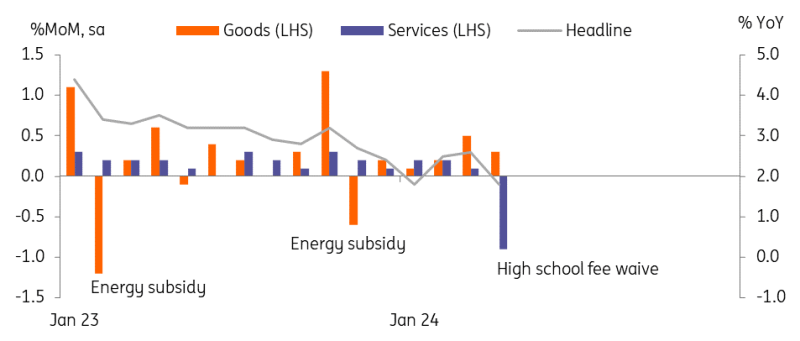

Tokyo inflation slowed sharply in April, mainly due to education subsidies

Tokyo inflation fell below the BoJ’s target of 2% in April, but this month’s sharp decline was mainly driven by education prices, which dropped -8.8% YoY in April from 1.9% in March. The local government decided to waive tuition fees regardless of household income. On a monthly comparison, consumer prices dropped -0.4% MoM sa, with goods prices up 0.3% while services prices down -0.9%. All other major item prices went up apart from medical care and education.

We have previously argued that inflation would remain volatile until May, mainly due to the various government interventions, and we believe that underlying inflationary pressures are still alive. We haven’t seen a clear impact of the weak JPY and higher global commodity prices on inflation yet, but this should come with a time lag, so we expect inflation to return to above 2% in the coming months.

Tokyo inflation slowed faster than expected, mainly due to expanding tuition waive programme

Source: CEIC

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.