gaspr13/E+ via Getty Images

Marine Products (NYSE:MPX) manufactures recreational fiberglass powerboats under the Chaparral and Robalo brands. The company sells its boats to an extensive global network of authorized dealerships, including over 300 dealers as of the company’s June presentation. The company prides itself on innovative design and efficient operations. With strong earnings, the Marine Products also has the ability pay out a good dividend – the stock has a dividend yield of 5.20% at the time of writing.

Marine Products’ Company History (MPX June Investor Presentation)

After a long period of revenue and earnings growth, Marine Products is due to face more challenging year-over-year financials after a market normalization and economic pressures. Already reported in Q3, earnings have begun to fall off. The stock has followed – after a high of $17.81 in August, the stock price has nearly halved:

YTD Stock Chart (Seeking Alpha)

Strong Long-Term Financial Trends

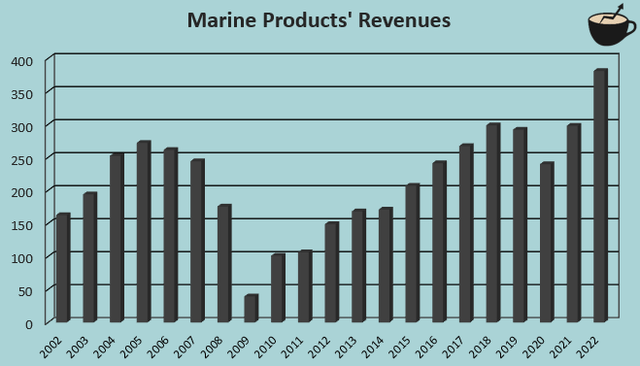

After a sharp freefall in revenues during the great financial crisis, Marine Products’ revenues have grown at quite a rapid pace – from 2010 to 2019, representing more normal market conditions, Marine Products’ revenues have grown at a CAGR of 12.5%. The good performance seems to be completely due to organic efforts, as the company has no cash acquisitions in the period.

Author’s Calculation Using TIKR Data

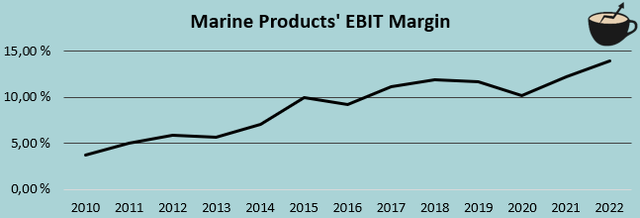

With the growth, Marine Products has achieved a significant amount of operating leverage – the company’s EBIT margin has increased from 3.7% in 2010 to 13.9% in 2022. With the long-term financial trends, the stock seems to be a very good organic outperformer in terms of earnings growth.

Author’s Calculation Using TIKR Data

In addition to great earnings growth, Marine Products has a strong balance sheet. The company holds $60.7 million in cash and holds no interest-bearing debt. As boat sales seem to be quite cyclical, demonstrated by the atrocious revenue performance from 2007 to 2009, the strong balance sheet provides safety to the company’s operations, making the investment safer.

Upcoming Turbulence Started in Q3

The great long-term financial trends seem likely to see a change in upcoming quarters, already represented in the reported Q3 result. In the quarter, Marine Products reported revenues of $77.8 million and an EBIT of $10.4 million, a -22.3% and -28.8% decrease year-over-year respectively. After several high-growth quarters, the financial change comes quite suddenly – in Q2, Marine Products still managed to grow revenues by 21.2%.

In Marine Products’ Q3 earnings call, the weak result is attributed to a market normalization after a post-Covid surge; after the pandemic started to subside, Marine Products saw a large enhance in demand. New boat sales were very high in 2020 at the same time as Marine Products’ revenues were struggling due to industrywide supply chain constraints, but as supply chain issues have been sorted, dealerships started to enhance inventory with increasing availability, making Marine Products’ revenues weak in 2020 and strong in 2021 and 2022, very much contrary to boat sales for dealerships. The trend is starting to shift, making Marine Products’ financials come down into a more historical level as represented by the Q3 result. Trailing revenues still stand at $421.4 million compared to 2019 revenues of $292.1 million prior to the pandemic – I believe that the revenue level has significant downside in the short term, although inflation and Marine Products’ long-term growth should still have created a foundation for a higher revenue level than in 2019.

In addition, Marine Products sees pressures from the macroeconomic situation along with many other companies – higher interest rates and an economic slowdown understandably influence boat demand, making dealerships more cautious in their inventory purchases; Marine Products has grounds for a short-term revenue downfall.

I wouldn’t be too worried about the upcoming turbulence as a long-term investor, though – the decreases seem to be very much in line with the industry. For example, MasterCraft Boat Holdings’ revenues decreased by -38.5% in the similar period to Marine Products’ Q3, and Malibu Boats’ revenues decreased by -15.3%.

Attractively Priced After the Stock Fall

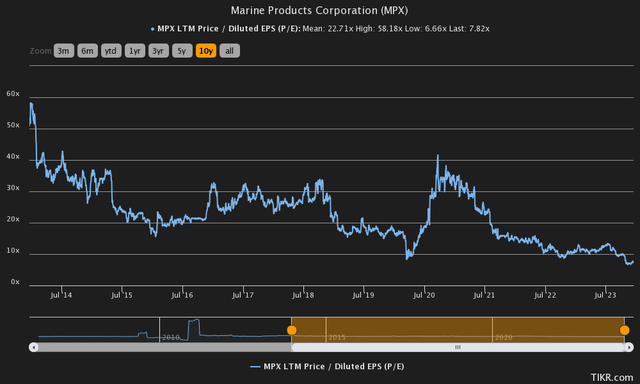

With the significant stock price fall in recent months, the probable upcoming earnings deterioration seems to be priced in. The stock currently sits at a forward P/E multiple of 7.8 – the ten-year average of 22.7 is multiples above the current multiple.

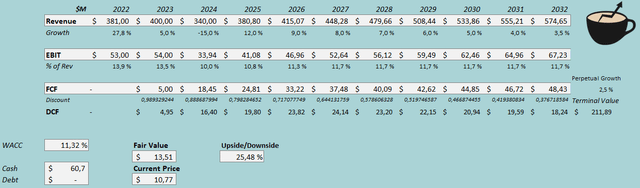

To display the valuation better, I constructed a discounted cash flow model with my financial estimates. I calculate Marine Products’ revenues decrease by around -20% in Q4, making the 2023 revenue growth 5%. After the year, I expect the market normalization to continue with a 2024 revenue decrease of -15%, making the revenues $340.0 million in the year compared to 2019 revenues of $292.1 million. After the year, I calculate the company’s long-term growth trend to continue with a 2025 growth of 12%, that slows down into a perpetual growth rate of 2.5% in steps. From 2024 to 2032, the revenues represent a CAGR of 6.8%. As Marine Products’ sales level comes down, I calculate margins to also decrease – for 2024, I calculate an EBIT margin of 10.0%, 3.5 percentage points below the 2023 calculate of 13.5%. After the year, I calculate the EBIT margin to scale back into a level of 11.7% achieved in 2027 – the estimated margin is the same as Marine Products’ 2019 margin. The company seems to mostly have a good cash flow conversion, although capital expenditures do have increased quite significantly in 2023, which I calculate to carry onto 2024.

With the mentioned estimates along with a cost of capital of 11.32%, the DCF model estimates Marine Products’ fair value at $13.51, around 25% above the stock price at the time of writing.

DCF Model (Author’s Calculation)

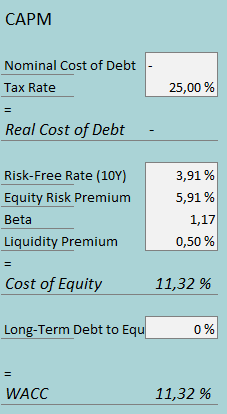

The used weighed average cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

As Marine Products has chosen to keep a strong balance sheet, I don’t believe the company will draw any interest-bearing debt for financing purposes in the future either – I calculate the strong balance sheet to continue in the future with a long-term debt-to-equity ratio calculate of 0%. For the risk-free rate on the cost of equity side, I use the United States’ 10-year bond yield of 3.91%. The equity risk premium of 5.91% is Professor Aswath Damodaran’s latest calculate for the United States, made in July. Yahoo Finance estimates Marine Products’ beta at a figure of 1.17. Finally, I add a small liquidity premium of 0.5%, crafting a cost of equity and WACC of 11.32%.

Takeaway

I believe that Marine Products is due to face a significant earnings fall, as already demonstrated in the reported Q3 result. The market normalization should bring down the company’s revenue level into a more sustainable level, upon which Marine Products should still be able to build long-term growth on. With a significant stock price fall in recent months, the stock seems to already price in such a scenario – moreover, my DCF model seems to suggest that the stock is undervalued.

Despite an estimated undervaluation, I am not yet confident enough for a buy rating – financials in the upcoming quarters are likely to have very significant turbulence, likely also varying from my estimates. On a long-term basis, the stock seems quite attractively priced if my estimates hold water, but for the time being, I have a hold rating.