Julian Prizont-Cado/iStock Editorial via Getty Images

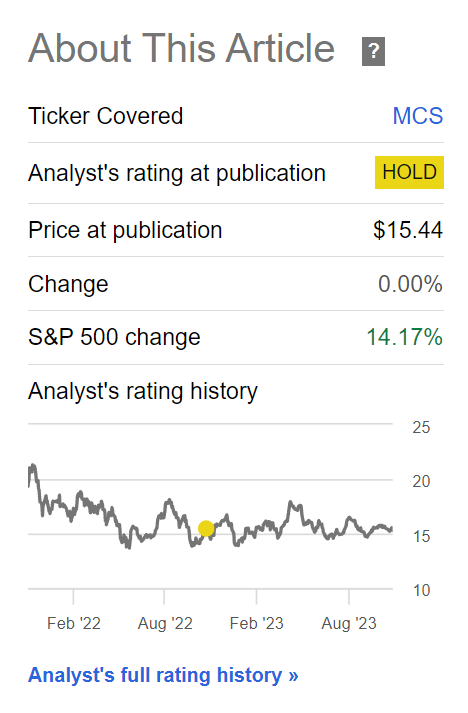

It has been a year since I wrote a cautious initiation article on The Marcus Corporation (NYSE:MCS). I was worried that a ‘new normal’ in movie theatre attendance may lead to permanently lower profitability in MCS’ theatres. So far, MCS’ stock price has done basically nothing in the past year since my article (Figure 1).

Figure 1 – MCS has done nothing in the past year (Seeking Alpha)

With 2023 coming to a close, let us revisit our prior prediction that movie attendance will not return to pre-COVID levels and its implications for The Marcus Corporation’s business.

Brief Company Overview

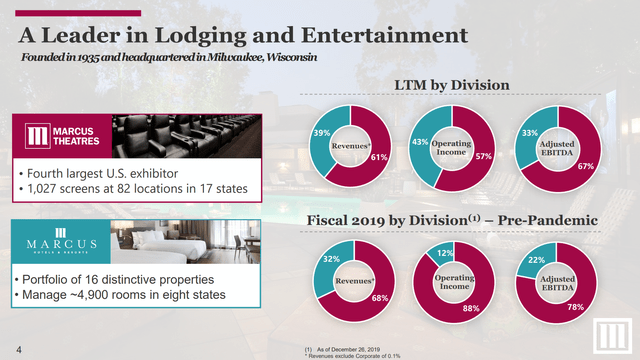

The Marcus Corporation is a conglomerate operating in two industries within the leisure sector: Lodging through Marcus Hotels & Resorts and Entertainment through Marcus Theatres. Marcus Theatres is fourth largest theatre chain in the U.S. with over 1,000 screens in 85 locations. Marcus Hotels & Resorts own and/or operate 16 hotels and resorts in eight states (Figure 2).

Figure 2 – MCS overview (MCS investor presentation)

Before the COVID-pandemic, approximately 2/3 of the company’s revenues and almost 90% of operating income were derived from the theatre business. However, the business mix in the last twelve months has become more balanced as entertainment profits have scaled lower.

Movie Attendance Still In The Doldrums…

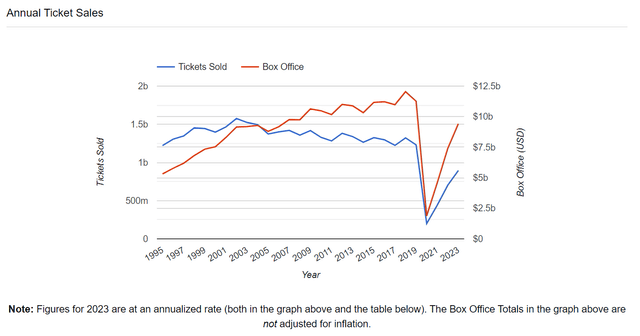

Last year, I made the bold prediction that movie theatre attendance would not return to pre-pandemic levels, and so far, I have been proven correct. Despite multiple blockbusters this year including the Barbie movie, the Super Mario Brothers movie and Chris Nolan’s Oppenheimer, annual box office for 2023 is only expected to be $9.4 billion, ~80% of 2019’s levels. In fact, if not for movie ticket inflation, box office numbers would be even worse, as tickets sold is only projected to be 900 million, or 73% of 2019’s 1.23 billion (Figure 3).

Figure 3 – Movie attendance is still far below 2019 levels (the-numbers.com)

The problem, as I have explained in my prior article, is that the movie business has fundamentally changed in the last few years, with the theatrical release window shortened and many blockbuster movies hitting streaming platforms like Disney+ and HBO Max weeks after their theatrical runs.

Furthermore, during the COVID-pandemic, as consumers were forced to stay at home, many took the opportunity to upgrade their home theatre systems with large screen TVs and stereo systems.

So for many consumers, it no longer makes sense to buy expensive tickets to movie theatres to watch mediocre movies when they can get a similar experience from the comfort of their own homes. That is the primary reason why movie theatre attendance is still down 27% from 2019 levels.

For me personally, instead of catching 8 to 10 movies a year like before the COVID pandemic, this year, I only watched a few of the blockbusters like the Barbie movie and Oppenheimer. For mediocre movies like Disney’s Elemental, we simply waited for the movie to become available for streaming.

…Reflected In Structurally Lower Theatre Profitability

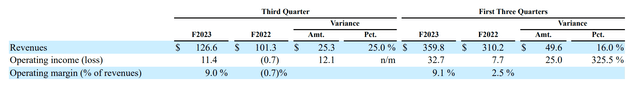

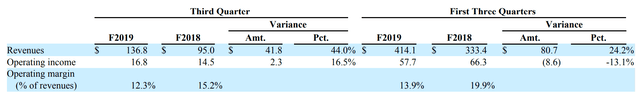

For the Marcus Theatre segment, 2023 revenues rose 16% YoY in the first 9 months to $360 million, and operating income surged to $33 million, up 326% YoY (Figure 4).

Figure 4 – Marcus Theatres operating results, 2023 (MCS Q3/2023 10Q report)

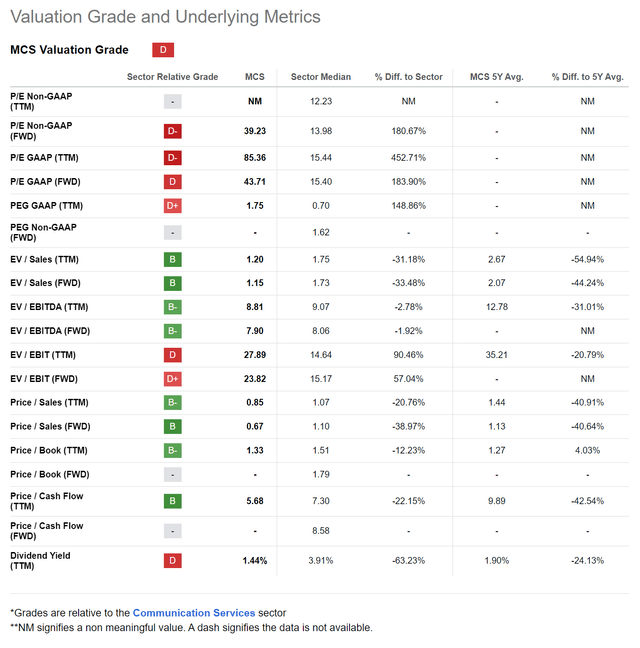

While these results may seem impressive at first glance, they are still significantly lower than results in 2019 at the same point in time. In fiscal 2019, the Marcus Theatre segment recorded $414 million in revenues (large YoY increase in 2019 was due to the acquisition of Movie Tavern) and $58 million in operating income (Figure 5).

Figure 5 – Marcus Theatres operating results, 2019 (MCS Q3/2019 10Q report)

So true to my prediction, theatre revenues and profits are materially weaker in the ‘new normal’.

But Hotels Operating At Peak Levels

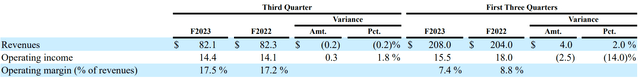

On the other hand, the Marcus Hotels & Resorts segment has been performing well since the COVID reopening, delivering $208 million in revenues in the first 9 months of 2023, up 2% YoY (Figure 6). Revenues would have grown 8.3% YoY if 2022 figures were adjusted for the sale of The Skirvin Hilton in Oklahoma City that was sold in December 2022 but kept in the segment results in 2022. Operating Profits slipped 14% YoY to $15.5 million on the back of the sale of The Skirvin and rising labour costs.

Figure 6 – Marcus Hotels & Resorts operating results, 2023 (MCS Q3/2023 10Q report)

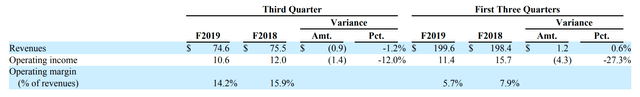

However, both revenues and operating profits are currently exceeding 2019 levels (Figure 7).

Figure 7 – Marcus Hotels & Resorts operating results, 2019 (MCS Q3/2019 10Q report)

Overall Financials Improved YoY

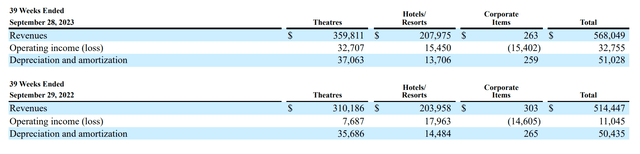

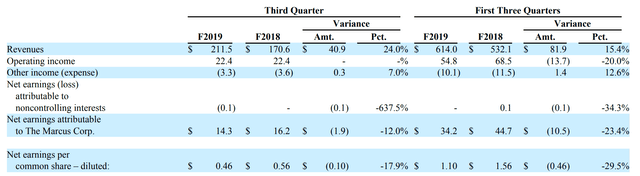

Putting it all together, overall financial performance for MCS has improved YoY, with revenues of $568 million and operating profits of $33 million in the first 9 months of 2023 vs. $514 million and $11 million in 2022 (Figure 8).

Figure 8 – MCS financial summary, 2023 (MCS Q3/2023 10Q report)

However, they are still below 2019 levels due to the structurally lower theatre revenues mentioned above (Figure 9).

Figure 9 – MCS financial summary, 2019 (MCS Q3/2019 10Q report)

Analysts Have Come Around To ‘New Normal’

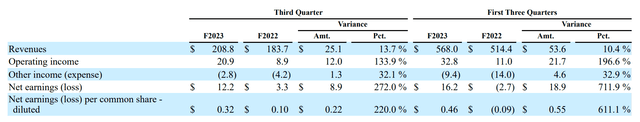

In my last article, I mentioned Wall Street analysts were too aggressive with their expectations for MCS to earn $0.70 / share in 2023. So far in 2023, MCS has earned $0.46 / share for the first 9 months of the year (Figure 10).

Figure 10 – MCS earnings summary (MCS Q3/2023 10Q report)

Given Q4 is seasonally weak for theatre attendance, Wall Street has now ratcheted down 2023 estimates to just $0.35 / share. Furthermore, 2024 expectation is now looking for $0.49 in EPS. It appears Wall Street analysts have finally come around to my ‘new normal’ thesis (Figure 11).

Figure 11 – MCS earnings estimates (Seeking Alpha)

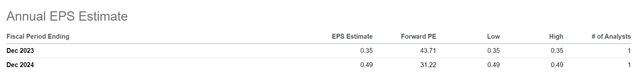

Valuation Is Still Too Expensive On Earnings…

Given lowered earnings forecasts, MCS’ high valuation stands out like a sore thumb, with Fwd P/E of 43.7x, almost triple the Consumer Discretionary sector median 15.4x (Figure 12).

Figure 12 – MCS is trading at a 43.7x Fwd P/E (Seeking Alpha)

On EV/EBITDA, MCS’ valuation looks more reasonable at 7.9x Fwd EV/EBITDA vs. 8.1x for the sector.

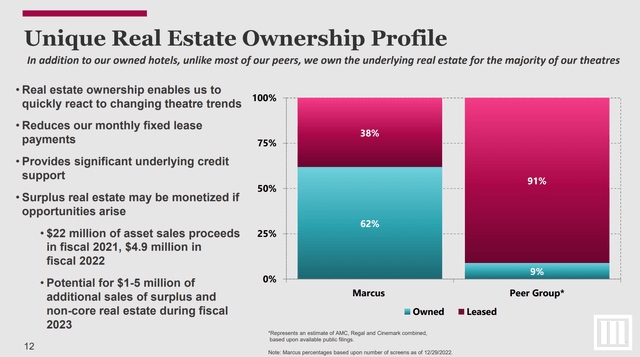

…But MCS Has Valuable Real Estate Assets

On the positive side, MCS’ business model is quite unlike other movie exhibitors as it owns the majority of its real estate, reducing monthly fixed lease payments (Figure 13). MCS’ real estate assets also allow the company to raise liquidity by selling assets if the need and opportunity arises.

Figure 13 – MCS has unique real estate holdings (MCS investor presentation)

The recent sale of The Skirvin hotel mentioned above provides an important datapoint on the value of MCS’ real estate assets. MCS sold The Skirvin for $36.8 million in December 2022. Net of expenses and mortgage repayment, MCS was able to book a $6.3 million gain on sale.

However, given the elevated interest rate environment and poor sentiment towards commercial real estate, it may be hard for MCS to surface much additional value in the near-term.

Conclusion

In summary, I believe my initial assessment of the Marcus Corporation remains accurate, as the theatre business has structurally lower profitability due to changes in consumer behaviour. I believe MCS stock is more than fully valued at 43.7x Fwd P/E.

However, balanced against MCS’ poor profitability is the company’s underappreciated real estate assets. Unfortunately, the path to surfacing value in MCS’ real estate assets may be challenging given the current high interest rate environment and poor commercial real estate sentiment.

I maintain my hold rating.