TomasSereda

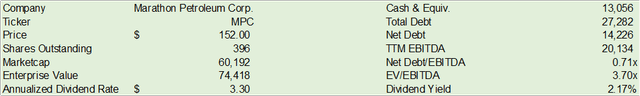

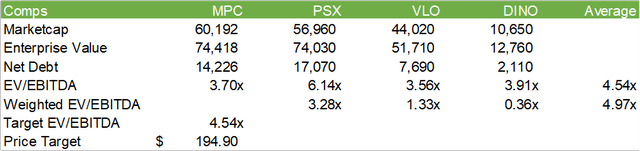

Marathon Petroleum Corp. (NYSE:MPC) may experience a relatively flat year as the new fiscal year commences. As oil prices are expected to be flat-to-down for CY24 and refined products attempting to make their climb, I anticipate much of the value derived from holding MPC shares will come from buybacks and dividends with some growth resulting from their 65% ownership stake in MPLX. With $8.3B left in the repurchase program, I believe there is value to be realized in holding MPC shares. MPC trades below its peers at 3.70x EV/EBITDA, providing room to appreciate. I provide MPC a BUY recommendation with a price target of $194.90/share.

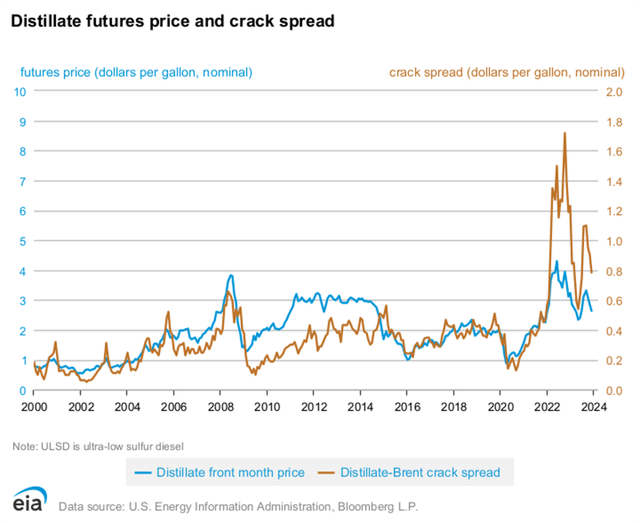

In the third quarter, we saw strong demand and global supply tightness supporting refining margins. Diesel cracks led the barrels inventories remain tight and European distillate production ran below capacity.

Operations

Refining & Marketing

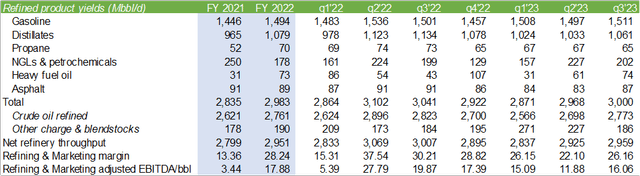

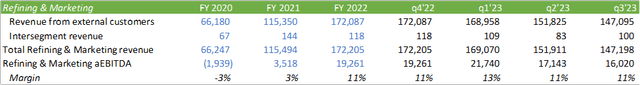

Refining assets were 94% utilized in the quarter, processing 2.8MMbbl/d of crude across their 13 refineries. Higher crack spreads drove aEBITDA up by $1.2b for the quarter, with 93% margin capture, 6% lower resulting from two unplanned outages at the Galveston Bay and Garyville facilities. These outages resulted in a loss of 4.7MMbbl.

Q4’23 utilization is expected to be sequentially lower at 90% with crude throughput volumes of 2.6MMbbl/d due to turnaround pull forwards resulting from the two outages. Reuters reported that the Galveston Bay facility was brought back online on November 17, 2023, with turnaround costs of -$300mm to be reported in Q4’23.

Refining margins have been in decline since late 2023 averaging $26.16/bbl in Q3’23 for Marathon, down from $30.31/bbl a year ago. I believe this trend may continue as the price of crude is anticipated to remain relatively flat throughout 2024. Despite the shipping challenges in the Red Sea, gasoline and oil prices haven’t reacted as extremely as they had in 2022 during Russia’s Ukraine invasion. Given Marathon’s LIFO accounting methodology, I believe that the firm might be able to realize stronger margins if WTI continues to drag down at a faster rate than diesel and gasoline.

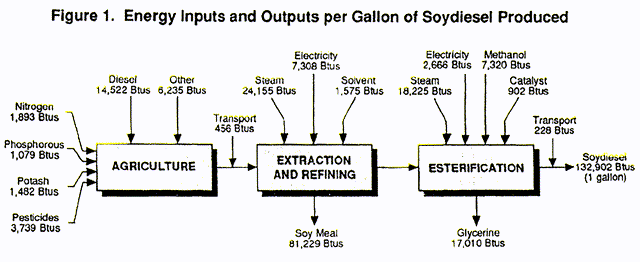

Management guided that the Martinez Renewables fuel facility, the 50/50 JV with Nestle, will commence operations by the end of 2023 with capacity of 730MMgal/year of renewable fuels. The Martinez facility will be one of the renewables facilities next to Dickinson, which is located in North Dakota and Virent in Wisconsin, which is currently developing biofuels and progressing towards commercialization. Dickinson is expected to be supplied with vegetable oil from the Green Bison Soybean Processing plant in Spiritwood, North Dakota, to produce 75MMgal/year of renewable diesel. The Spiritwood facility has the capacity to process 150,000 bushels of soybeans per day for an annual yield of 600MMlbs of refined soybean oil for 40% of the Dickinson capacity. Total renewable fuels capacity will be 914MMgal/year of renewable fuels between the Martinez and Dickinson facilities. Marathon has one Ethanol biofuel facility with processing capacity of 475MMgal/year, two renewable diesel feedstock facilities, and is evaluating their biocrude processing project with Fulcrum Bioenergy. I believe it will play well to Marathon’s renewables operations that they have a secured source of soybeans as demand for the crop continues to rise. According to the USDA, 200MM bushels of soybeans were crushed in November 2023, a 5% increase from the previous year. According to the DOE, it takes 41lbs of soybeans to produce one gallon of renewable diesel.

In addition to this, Marathon is in the process of developing other renewable facilities for long-term capture in hydrogen and renewable natural gas (“RNC”). Marathon will be involved in two of the seven hydrogen hubs approved for funding by the DOE with one in the Appalachia region and one in the Heartland area. Management discerned that the project is in the very early stages of grant negotiations and expects capital investments by Marathon on these two facilities to begin in late 2024-2025. On the RNC side, through a JV with LFBioenergy, Marathon is planning to build out 13 RNG facilities that will capture the gases from dairy cows. From there, Marathon can take that captured RNG and transport it to their Dickinson and Martinez facilities to use as a base to produce renewable diesel products. Long-term, Marathon plans to allocate 40% of growth capital to renewables and carbon-reduction projects.

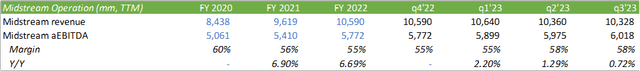

Midstream

MPLX (MPLX) experienced significant growth in Q3’23 with aEBITDA growing to $1.5b for the quarter and $6,018mm on a trailing basis, a 72bps increase from the previous year. With 65% ownership of MPLX’s outstanding units, Marathon can utilize MPLX’s strong cash generation and increased dividend rate to finance shareholder incentives and capital investments. Management suggested that distributions from MPLX will reach $2.2b in cash on an annual basis and will cover MPC’s dividend and more than half of their planned 2023 capital program.

MPLX generated $1.4B in distributable cash flow in Q3’23 and increased their distribution by 10% for an annualized rate of $3.40/unit. Progress on the Agua Dulce Corpus Christi Pipeline continues to be made and is expected to be brought online in Q3’24 and expects volumes to increase over the next two years on their Wink to Webster crude pipeline as segments come into service. The firm is also expanding their BANGL pipeline to 200Mbbl/d and is expected to be completed in the first half of 2025, which will support growth in NGL production in the Midland and Delaware Basins. MPLX anticipates bringing on two new gas processing plants in the Delaware Basin with total capacity of 1.4Bcf/day. Lastly, MPLX will have the Hamon Creek II gas processing plant operational in 1h24. I believe this added capacity will significantly bolster MPLX’s DCF, and in turn, flow through to MPC. Management remains very adamant about keeping MPLX separate and that they will not be bringing the midstream asset back underneath Marathon’s umbrella.

Valuation & Shareholder Value

Marathon returned $3.1b to shareholders in Q3’23 through buybacks and dividends. As of October 25, 2023, Marathon has increased their quarterly dividend rate by 10% to $0.75/share, annualized to $3.00/share for a yield just under 2%. In addition to the dividend increase, management also announced a $5b share repurchase program in addition to the $4.3b remaining in the September repo program. As of their Q3’23 call in October, the firm had $8.3b remaining in the share repurchase program.

We intend to grow the Company’s earnings and we will exercise strict capital discipline… We are firmly committed to returning excess capital through share repurchases to meaningfully lower our share count.

The fact that we’ve got cash on the balance sheet to allow us to take advantage of volatility is a plus.

Compared to peers, MPC trades at a relatively low valuation and has room for mean reversion. I believe given their growth prospects in the renewables space, MPC should be well-positioned for future initiatives, especially as the firm pulls back on capital investment and bolsters free cash flow generation. Though I anticipate 2024 to be a relatively flat year in terms of operating growth, I believe that share buybacks will have the bandwidth to compensate for a flat year. I provide MPC a BUY recommendation with a price target of $194.90/share.