RUNSTUDIO

I was in Las Vegas earlier this week, and no, not for gambling. It was for the latest conference of International Council of Shopping Centers, now known as ICSC.

Though, yes, I did hit the roulette tables a few times. My regular readers know I always allow myself $500 to play around with – a hard stop I’m not allowed to cross.

Let’s just say I didn’t walk away with $10,000 this time like I have before. But the Las Vegas visit was still completely worth it.

The information I got at ICSC was phenomenal. And the enthusiasm about the larger retail world was contagious.

This isn’t to say everyone was euphoric. Speakers and attendees alike acknowledged negative aspects as well as positives. For instance, low-end consumers are beginning to pull back on their spending habits.

We’ve already seen plenty of evidence of that this earnings season, with Target (TGT) being one of the latest examples. It traditionally works with higher prices than rival Walmart (WMT), which is driving a number of its customers away.

McDonald’s (MCD) and many other fast-food and casual dining establishments are noting the same, with grocery stores – including Walmart again – winning out for their losses.

In fact, grocery stores are doing so well, the shopping centers they operate in are winning out twofold. As many malls falter and fail, their tenants have to go somewhere – preferably where their customers are already congregating.

The Fall of the Mall

I’ve been saying for a decade and a half now that America built too many malls. The evidence was everywhere, since malls themselves were everywhere.

How many Sears do you really need in a 20-mile radius?

Today, we know the answer to that. As of April, I believe there were only 11 left in the U.S. out of an original 700 or so.

Of course, you could – and in many ways should – argue it was an inside job that took the once-iconic company out. Sears made plenty of mistakes over its last 50 years that ranged from foolish to downright inexcusable.

But there’s also JCPenney’s many issues and Macy’s (M) ongoing profit pitfalls. Those are just two of the many big-box retailers that have been struggling so far this century. And that’s to say nothing about all the smaller stores that have collapsed under the weight of the modern U.S. reality.

The 2020 shutdowns didn’t help the situation whatsoever. But even before they smacked brick-and-mortar retail upside the head with a virtual 2×4, I was warning about “The Harbinger of Mall REIT Relevancy.”

That was the title of my November 11, 2019, article, just before JCPenney – still a publicly traded stock at the time – was set to release its quarterly earnings. “That report,” I wrote, “could include more announced store closures.”

As in, it already had been downsizing, thanks in large part to the rise of e-commerce. Amazon and other online outlets (but mostly Amazon) had been eating away at its profitability for years, by the time the decade was coming to a close.

And, again, that was on top of a pre-existing overabundance of locations, all of which has led to the obvious and continuing decline of the American mall.

Let’s Talk About the American Mall Losers for One More Minute

By mid-November 2019, we knew that Sears would be closing “nearly 100 additional” stores in the near future. But here’s more about the situation retail investors were looking at:

“One could fairly assume the mall REITs were either well aware or had somewhat of an idea these Sears closures were coming. They’ve been working on backfilling Sears and Kmart boxes for years, now. And many industry CEOs, like David Simon, say they welcome the chance to repurpose an old Sears box into something more productive…

“What could be more damning news for the industry are more closures by… JCP. That would add to the dozens of Forever 21 stores (some of which can be more than 100,000 square feet) now expected to shut across the U.S., a Barneys New York bankruptcy… and a Dressbarn liquidation – to name a few somewhat catastrophic events.”

I went on to note that I was moving Pennsylvania Real Estate Investment Trust, or PREIT, from a Hold to a Sell. And we had no interest whatsoever in keeping any position in either Washington Prime or Macerich.

These mall real estate investment trusts (REITs) were already struggling from holding too many Class B and C properties.

As a general rule, Class A malls are located in the best locations with the newest or most recently upgraded buildings that attract the highest number of tenants and shoppers alike. Then it goes down from there.

It was therefore no surprise that the lower-lettered properties struggled most in 2019…

Or in 2020…

Or since.

Today, most of the mall REITs we knew about still exist in some form or another. But that isn’t to say they’re all worth talking about.

So for this article, let’s just talk about the ones that are.

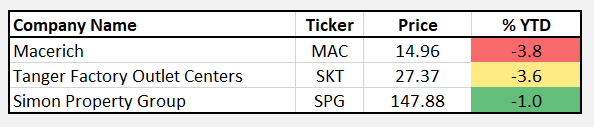

Simon Property Group (SPG)

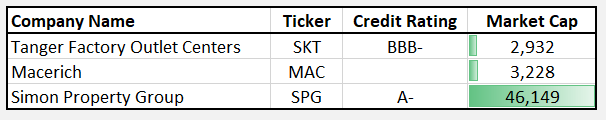

SPG is the largest publicly traded mall REIT with a market cap of $47.6 billion and a portfolio of retail properties which primarily consists of shopping malls, The Mills, and Premium Outlets.

The company specializes in the development, ownership, and management of retail and mixed-use properties that feature top-tier shopping, entertainment, and dining.

At the end of 2023, SPG owned or had an ownership interest in 195 properties located in 37 states across the U.S. which consisted of:

- 93 Malls

- 69 Premium Outlets

- 14 Mills

- 6 Lifestyle Centers

- 13 retail properties described as “other”

The company has additional exposure in the U.S. with an 84% non-controlling interest in The Taubman Realty Group (‘TRG’), which has a portfolio of 24 regional or super regional malls, as well as outlet malls in both the United States and Asia.

The mall REIT has additional international exposure with an equity interest in 35 high-class outlet properties which are located in Europe, Asia, and Canada.

In addition to its international outlet properties, SPG owns a 22.4% equity interest in Klépierre SA which is a real estate company based in Paris that has a portfolio of shopping centers located in 14 countries across Europe.

To complement its traditional real estate holdings, SPG owns investments in the retail operations of SPARC Group and JCPenney and has an e-commerce venture with Rue Gilt Groupe.

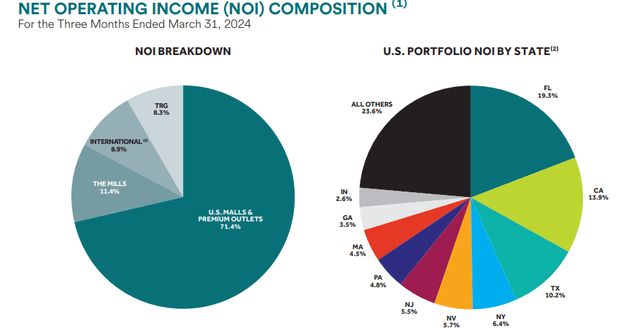

As a percentage of its net operating income (“NOI”), SPG received the majority from its U.S. Malls and Outlets. This category generated 71.4% of SPG’s NOI during 1Q-24. The Mills properties generated 11.4% and 8.3% was derived from its interest in TRG during the first quarter.

Additionally, SPG received 8.9% of its NOI from its international properties, including its interests in the TRG properties located in Asia.

SPG has a diversified portfolio with properties located in the majority of U.S. states, as well as properties spread across Europe. Within the U.S., the company’s largest concentration is in Florida, which made up 19.3% of its portfolio NOI, followed by California and Texas which made up 13.9% and 10.2%, respectively.

The company released its 1Q-24 operating results earlier this month and reported total revenue during the quarter of $1.44 billion, compared to total revenue of $1.35 billion in the first quarter of 2023.

SPG sold its remaining investment in Authentic Brands Group (“ABG”) for gross proceeds of $1.45 billion and reported an after-tax net gain of $303.9 million, or $0.81 per share, which was primarily related to the ABG sale.

FFO for the quarter, which included the gains related to the ABG sale, was reported at $1.334 billion, or $3.56 per share, compared to $1.026 billion, or $2.74 per share for the same period in 2022.

Portfolio NOI during the quarter increased 3.9% compared to NOI in 1Q-23 and occupancy at the end of the first quarter came in at 95.5%, representing a year-over-year increase of 1.1%.

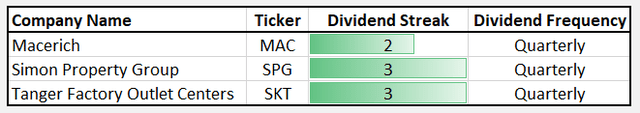

Rent per SF increased 3.0%, going from $55.84 at the end of 1Q-23 to $57.53 at March 31, 2024, and the company announced its Board of Directors declared a 2Q-24 dividend of $2.00 per share, which represents an 8.1% year-over-year increase.

SPG increased its FY 2024 guidance for FFO to come in between $12.75 to $12.90 for the full year, which, at the mid-point of $12.83, would represent an increase of 2.56% compared to FFO per share reported for the full-year 2023.

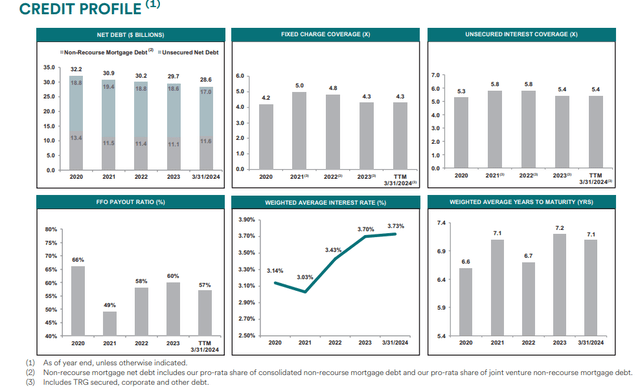

The company has a rock-solid balance sheet with approximately $3.1 billion of cash on hand and $8.1 billion available to it under its credit revolver, for total liquidity of ~$11.2 billion at the end of 1Q-24.

SPG has an A- credit rating from S&P Global and excellent debt metrics, including a net debt to EBITDA of 5.86x and a fixed charge coverage ratio of 4.3x. Almost all of the company’s debt is fixed rate at 96.7%, and it is well-laddered with a weighted average term to maturity of 7.1 years.

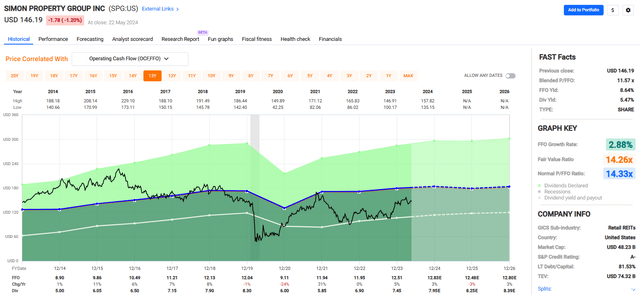

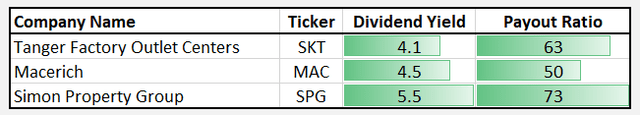

Over the last decade, SPG has generated moderate earnings growth, with FFO increasing 2.88% on average since 2014. At the current price, the stock generates an 8.64% FFO yield and pays a 5.47% dividend yield, with a 10-year average dividend growth rate of 6.41%.

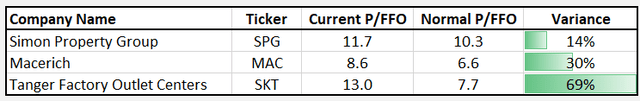

The stock is trading at a P/FFO of 11.57x, compared to its average FFO multiple of 14.33x.

We rate Simon Property Group a Buy.

Macerich (MAC)

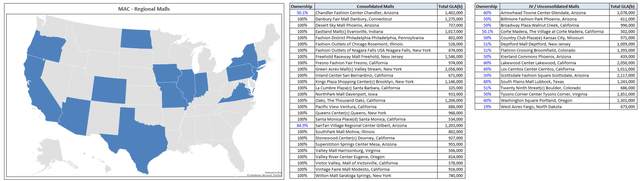

MAC is a mall REIT with a market cap of approximately $3.21 billion and a 47 million SF portfolio which consists of interests in 43 regional malls, 3 power shopping centers, and one property undergoing redevelopment.

27 of the company’s malls are consolidated, while the remaining 16 are unconsolidated and held through a joint venture (“JV”).

For the majority of its unconsolidated JV properties, MAC owns a 50% to 60% equity interest, while it wholly owns all but 2 of its consolidated malls.

Below, I included a list of the company’s 43 regional malls to give you an idea of its geographic exposure. By property count, the company’s largest footprint is in California with 13 properties, followed by Arizona and New York, which have 8 and 5 properties, respectively.

Before I go any further, I want to point out that Jackson Hsieh was recently appointed CEO of Macerich. Hsieh was formally the CEO of Spirit Realty before the company was acquired last year. He’s built a reputation of turning a company around, as he did with Spirit when he transformed the company over his tenure.

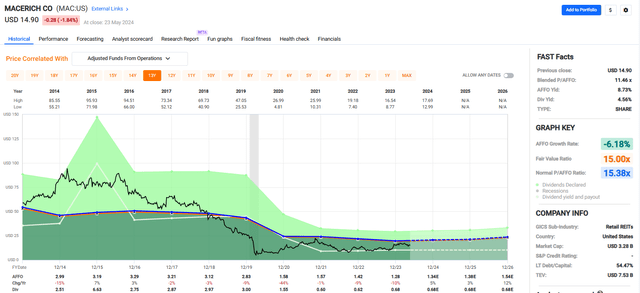

The reason I bring it up is that MAC has had poor execution over the last several years. By that, I mean the company has had a negative AFFO growth rate since 2017.

In 2017, the company generated AFFO of $3.21 per share, which has been eroded to $1.28 per share as of last year.

While normally past performance can give us a decent clue about the company’s decision-making and execution, in this case, I think we need to keep in perspective that the company just got a new leader, one that is well respected and has proven to be successful in the past.

Nonetheless, it’s worth pointing out that the company has delivered miserable results for quite some time.

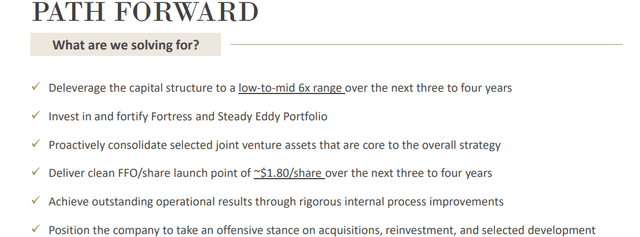

The company’s latest investor presentation is titled “Macerich Path Forward”. The presentation focuses on current issues and strategies for change.

There’s a lot of information, but my main takeaway is that the company is focused on cleaning up its balance sheet and has a renewed focus on its portfolio assets when making investment decisions.

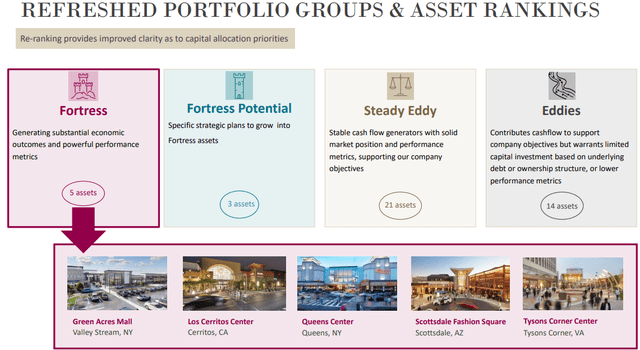

Macerich provided the information below that ranks its portfolio assets from “Fortress” to “Eddies”. The idea is to categorize its properties to improve capital allocation decisions. As one might expect, its “Fortress” properties generate strong earnings, while its “Eddies” warrant limited investment due to some issue with the property.

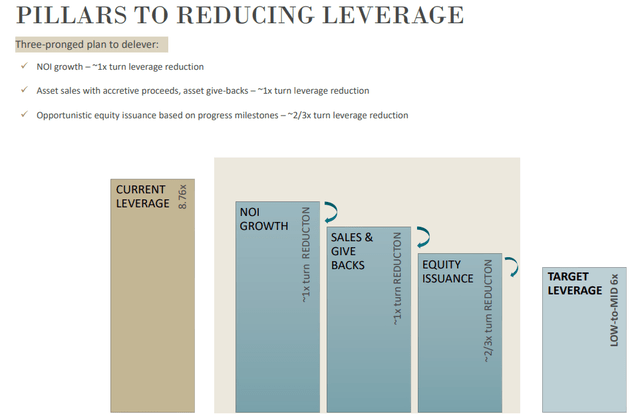

Currently, the company is highly leveraged, with a current leverage ratio of 8.76x. Under its new leadership, MAC has a target leverage ratio of low-to-mid 6.0x, and a three-pronged approach to achieving its goal.

The company intends to grow NOI by increasing its tenant diversity and mix by adding fresh, new stores and brands to its properties. Through NOI growth, the company hopes to achieve 1x turn leverage reduction.

MAC expects to reduce leverage by 1x turn through asset sales and asset give-backs. Combined, the company’s asset disposition program is projected to reduce debt by almost $2.0 billion.

And finally, MAC plans to issue equity opportunistically to achieve further leverage reduction.

Since 2014, the company has had an average AFFO growth rate of negative -6.18%. As previously mentioned, the company had negative AFFO growth for 7 consecutive years, including a -44% drop in AFFO during the pandemic.

The dividend has suffered with multiple cuts over the last decade, resulting in a 2014 dividend of $2.51 being reduced to just $0.68 per share last year.

While I use past performance as part of my evaluation process, investing is forward-looking, especially in light of the change in leadership.

Analysts expect AFFO per share to increase by 5% in 2024, increase by 3% the following year, and increase by 12% in 2026. For the 2026 estimate, there are only 2 analysts, so I’m somewhat skeptical on the projected 12% AFFO growth in 2026.

Currently, the stock pays a 4.56% dividend yield that is well covered with a 2023 AFFO payout ratio of 53.33% and is trading at a P/AFFO of 11.46x, compared to its average AFFO multiple of 15.38x.

We rate Macerich a Spec Buy.

Tanger (SKT)

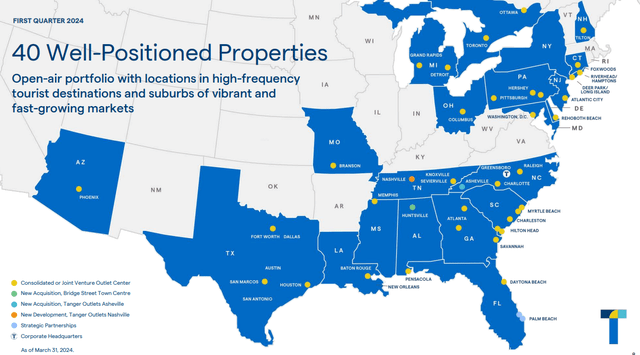

SKT is a leading owner and operator of open-air outlet centers in the U.S. and Canada. The company has over 40 years of experience in the outlet retail shopping industry and currently has a market cap of approximately $2.98 billion.

The company’s portfolio consists of 38 outlet centers, 1 managed center, and 1 lifestyle center that combined total more than 15.0 million SF across 20 U.S. states and Canada.

SKT targets properties located in fast-growing markets, with a focus on locations near tourist destinations. Its properties are concentrated on the East Coast and within the sunbelt region of the country. Additionally, the company has several outlet centers in Canada, which are located in Toronto and Ottawa.

SKT’s properties contain more than 3,000 stores that are operated by over 700 different brands. Its portfolio has a strong and diverse tenant mix with its top 10 tenants including The Gap, Lane Bryant, SPARC, Tapestry, Under Armour, American Eagle, and Nike.

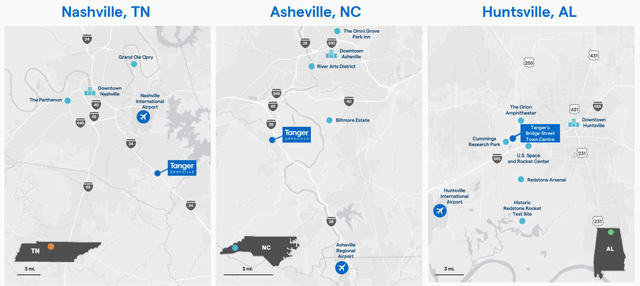

Around a year ago, Tanger began to expand from its traditional “outlet” business model into an “open-air center” platform. On the recent (Q1-24) earnings call, CEO Stephen Yalof explained,

“Both our Asheville and Huntsville centers have proven to be strong contributors and natural fits to our platform. We are executing against our strategic plans for each with new tenant announcements, food and beverage additions, and shopper amenities expected later this year. With our proven track record as operators and asset managers of Open Air Centers, we continue to see opportunities to selectively pursue expansion.”

In addition, Tanger’s peripheral land has continued to be an important driver of incremental growth as the company continues to activate and monetize its real estate with a variety of complementary uses and attractions that add to the diversity of experiences.

Tanger’s solid balance sheet position and operational expertise have provided a wider addressable market for additional acquisition opportunities. At the end of Q1-24, the company had an equity market capitalization of $3.4 billion and $1.6 billion of pro rata net debt (approximately 93% of total debt is at fixed rates). The net debt to adjusted EBITDA was 5.7x for the trailing 12 months.

In April, the Board approved the 5.8% increase in the dividend to $1.10 per share on an annualized basis. The quarterly dividend remains well covered, with a low payout ratio of just 54%.

Also, in Q1-24, the company delivered core FFO of $0.52 a share compared to $0.46 a share in Q1-23. In addition, same center NOI increased 5.2% in Q1-24, driven by robust leasing and positive rent spreads.

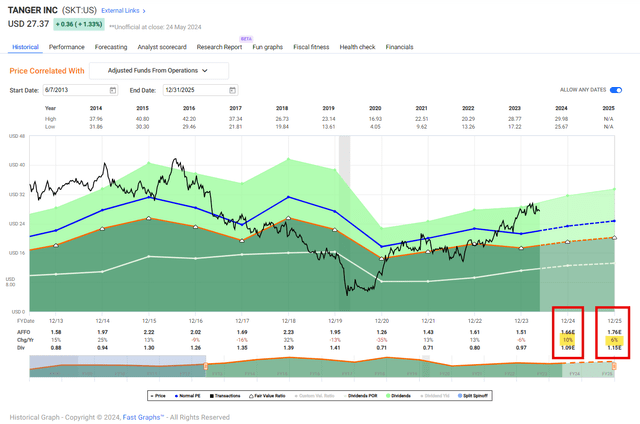

Tanger increased its core FFO per share expectations by $0.01 to a range of $2.03 to $2.11, or 4% to 8% growth over 2023. Consensus growth estimates for 2024 is 10% and 6% for 2025 (using AFFO per share).

Tanger has been an absolute gem to own since COVID-19. I’m happy that I upgraded to a Buy in June 2020 as shares have returned over 370% since that time (compared with 65% for the S&P 500).

I still own shares and will likely continue to own them, even as shares remain pricey. The current dividend yield is 4.0%, and we expect to see sector-leading growth continue.

I would not to be surprised to see Tanger become aggressive in the M&A arena as the company has demonstrated success in the “open-air” arena. I credit the management team and specifically CEO Yalof who I recently met with at the annual ICSC conference in Las Vegas.

Data Duel

(I hope you’re enjoying our new “data duel” feature. Let us know your feedback, please. Thank you)

iREIT® iREIT® iREIT® iREIT® iREIT®

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.