alengo

Introduction

M-tron Industries (NYSE:MPTI), a micro-cap play, specializes in producing certain standardized and customized electronic components that are instrumental in monitoring and addressing the frequency and spectrum of electronic circuit signals.

Until Q3-22, MPTI was a part of the LGL Group, but in October 2022, it got separated into an independent company and made its debut on the markets. Since its listing debut, MPTI has proven to be an outstanding source of alpha for its shareholders, delivering exorbitant returns of 172% at a time when micro-caps, on average, have only delivered single-digit returns.

Return

MPTI- What’s To Like

Exploring the world of MPTI, it isn’t difficult to see why the market loves this stock, as it has a lot of things going for it.

Firstly, note that even though it may have only made its listing debut a few years back, it has built up a vast level of expertise in the field of RF (Radio frequency) components and services, something which it has been involved in since 1965!

Crucially whilst RF components, are used in a whole host of industries, it helps that the industries that predominantly rely on MTPI’s portfolio are those that are not susceptible to the vicissitudes of economic cycles, but those that render critical services in the modern-day era. We’re talking about the likes of the defense and aerospace industries which account for 58% of MPTI’s total business, and you don’t get to cater to these segments unless you’ve built up sufficient domain expertise over time. MPTI also services the who’s who of the sector with the likes of Raytheon (RTX), Lockheed Martin (LMT), and Northrop Grumman (NOC) all making up the client roster, and business opportunities here are just generally stickier.

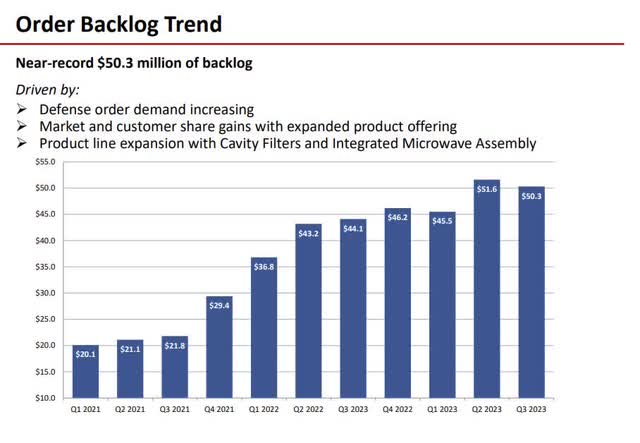

Not only does MPTI cater to stable industries, it is also witnessing tremendous progress in the growth of its backlog, and the pace at which its top line is growing (31% growth as of 9M, and consensus estimates point to a similar trajectory for the whole year)

A couple of years ago, MPTI’s backlog used to hover around the $20m mark, but since then it has more than doubled and is currently trending at the $50m mark.

Jan 2024 Investor Presentation

MTPI is currently generating around $10-$11m of topline per quarter, and given that the backlog typically translates to revenue over 12-24 months, you’re looking at 4-5 quarters of solid revenue visibility.

Besides, given how integral MPTI’s services are to its end markets, this backlog won’t be static and will grow over time. Nonetheless, next year’s topline estimates suggest mid-teens revenue growth,

Investors also need to recognize the changing texture of this backlog. Previously MPTI was bidding for much smaller opportunities, but recently they’ve been targeting much larger programs, which speaks to their growing stature in the market.

When you get involved with larger programs, volumes and ASPs are generally higher (on a TTM basis, MPTI witnessed whopping ASP growth of 117% as of Sep 2023), and there’s innately just better flow through at the margin level, if you can get your cost base right.

In that regard as well, MPTI deserves great credit as they’ve been exiting low-margin businesses, and deepening their automation impetus vis-à-vis labor. It also helps that there is an effort to implement targeted price increases. All this has been reflected in the tremendous gross margin progress seen over the last 2 quarters. In Q2, the group gross margin expanded by over 400bps YoY, and in Q3, the progress was even more impressive coming in at over 1000bps higher YoY.

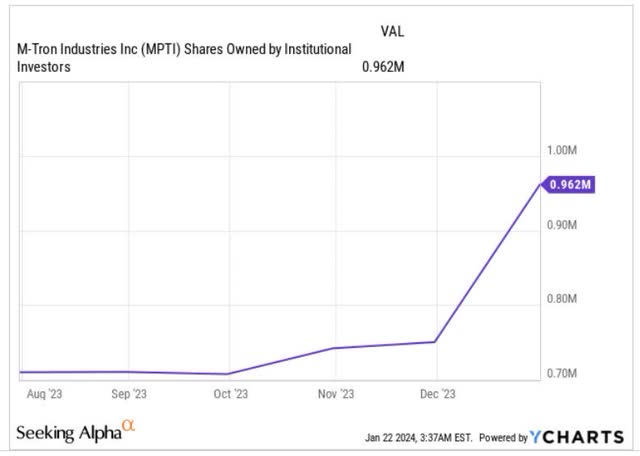

What’s also encouraging to note is that the smart money appears to be taking note of MPTI’s progress and over the last 6 months alone, they’ve increased their stake in the stock by over 35%. Growing institutional participation will be key for MPTI to get better visibility from bigger fund houses and transition from a micro-cap play (current market cap is a little over $115m) to a small-cap play.

YCharts

Closing Thoughts- Is M-tron Industries A Good Buy Now?

Despite some of the favorable themes associated with the business of M-tron Industries, we are not too convinced that the stock would make a good buy at these levels.

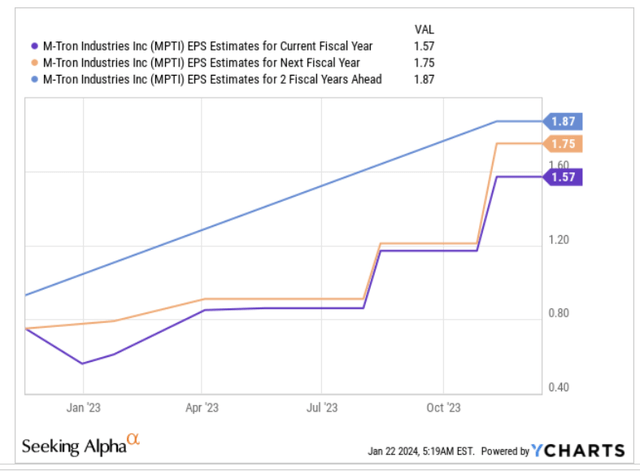

Firstly the valuation quotient comes across as quite pricey, and it is questionable if one is getting sufficient earnings growth for that elevated P/E multiple.

Based on YCharts earnings expectations for the next two years, one is basically dealing with a business that is poised to deliver earnings CAGR of 9% through FY25.

YCharts

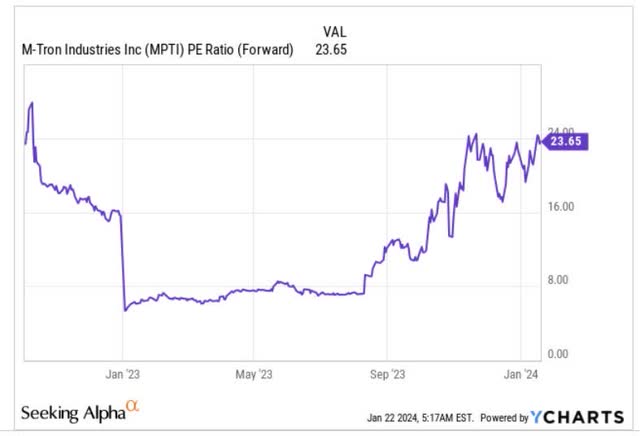

In light of the medium-term trajectory of only single-digit earnings growth, it feels a bit generous to shed out a forward P/E multiple of 23.6x. What makes the valuation quotient even more unfavorable is the fact that MPTI’s other electronic component peers are currently trading at an average forward P/E of roughly 20x, which translates to an 18% discount.

YCharts

Then investors specializing in rotational trades within the broad micro-cap universe are unlikely to find the MPTI stock too attractive at this juncture. Note that the relative strength (RS) ratio of MPTI to the iShares Micro-cap ETF is currently around 65% higher than the mid-point of its trading range and could witness some mean-reversion. It also appears to have pivoted away from the highs seen in November last year, from where it struggled to build momentum.

Stockcharts

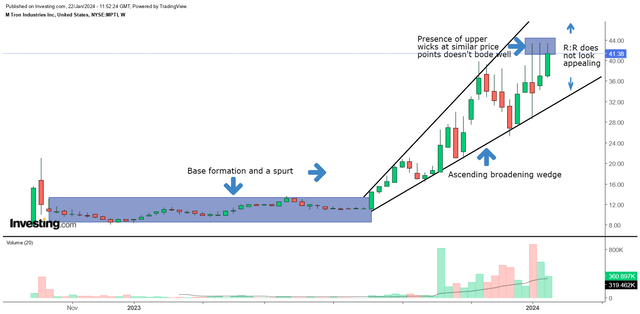

Finally, if we look at MPTI’s own price imprints on the weekly chart, we think it could make sense to not be too bullish here. The chart shows us how the stock had built a long base from Oct 2022 until July 2023 after which we saw a drastic shift in the range of its candles. Basically from August last year, until now, the stock has been trending up in the pattern of an ascending broadening wedge, which on the face of it isn’t the most ideal pattern to build scale.

Investing

Within this channel, the reward to risk at current price levels does not look too appealing and even otherwise notice that the last 3-4 weekly candles have been characterized by some long upper wicks, which suggest fatigue at higher levels, and the tenuous but growing optimism of the bears.

All in all, considering the valuation and technical narratives, we don’t feel that MPTI would make a good buy right now.