Chalabala/iStock via Getty Images

LyondellBasell Industries (NYSE:LYB) is a global petrochemicals company. It also owns a US Gulf Coast refinery it plans to close in the first quarter of 2025. Per the company’s investor presentation, it operates in six segments: Olefins and Polyolefins-Americas; Olefins and Polyolefins-Europe, Asia, International; Intermediates and Derivatives; Advanced Polymer Solutions; Refining; and Technology. The biggest contributors in 2023 (88% of EBITDA) were Olefins and Polyolefins-Americas and Intermediates and Derivatives.

The company offers a good $5.00/share dividend now yielding 5.1%. Market capitalization is about the same as a year ago.

LYB has a +20% inside ownership. Most of this is a carryover from the original owner of Basell before it merged years ago with Lyondell Chemical.

While LyondellBasell may interest dividend and ESG investors, I am downgrading it from buy to hold. Its stock price is near its 52-week high and one-year target yet demand for its chemicals has been and is softening, especially outside the US.

Restructuring: A Sale to INEOS and Eventual Refinery Closure

In December 2023, LyondellBasell announced the sale of its ethylene oxide and derivatives business, along with a Bayport, Texas production facility, to English chemical company INEOS for $700 million. The divestiture was done because LYB considered the business to be non-core and INEOS wanted to expand further into the US. The transaction is expected to be complete in 2Q24.

LyondellBasell had planned to shutter its 268,000 BPD Houston oil refinery by the end of 2023. In part because refining was so profitable in 2022, the shutdown was delayed with a new deadline of the first quarter of 2025. In 2022, the refining business reported EBITDA of $921 million, which was 15% of total EBITDA. Last year was different: LYB refining’s 2023 EBITDA was $379 million, or 8.4% of total EBITDA.

To be fair, the market for US refineries is tough for sellers; however, LyondellBasell is also using the closure to meet decarbonization goals.

Full year 2023 Results and Guidance for LyondellBasell

LyondellBasell’s full-year 2023 net income was $2.1 billion or $6.46/share. This compares to full-year 2022 net income of $3.9 billion, or $11.81/share, (and 2021 net income of $5.6 billion or $16.75/share.)

EBITDA was $4.5 billion in 2023 compared to $6.3 billion in 2022.

Cash from operations in 2023 was $4.9 billion compared to $6.1 billion in 2022.

In 2023 LyondellBasell also successfully started up the world’s largest propylene oxide plant. Propylene oxide is used to make other chemical intermediates like glycols which in turn are used in plastics, cosmetics, pharmaceuticals, and food. Other intermediates from propylene oxide are used in foam, furniture, car seats, building insulation, solvents, resins, waterproof clothing, and aircraft deicers.

According to the company’s 4Q23 and full year 2023 report look-ahead for 2024, “seasonally slow demand and economic uncertainty are expected to provide continued headwinds for most businesses. Relatively low ethane raw material costs are continuing to benefit North American Olefins & Polyolefins margins… LYB is aligning first quarter operating rates with global demand and expects to operate Olefins & Polyolefins Americas assets at approximately 80%, and both Olefins & Polyolefins EAI assets and Intermediates & Derivatives assets at approximately 75%.”

Natural Gas and Natural Gas Liquids Prices

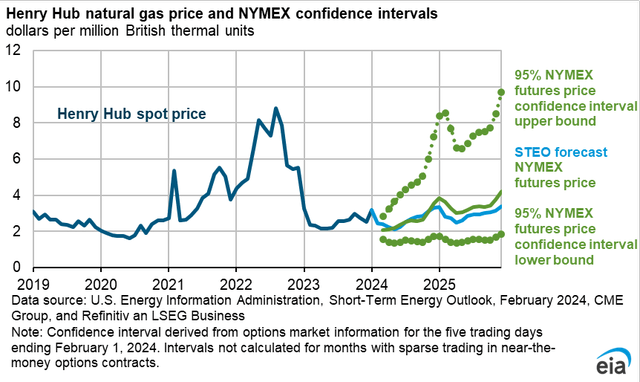

The Energy Information Administration’s (EIA’s) most recent Short Term Energy Outlook (STEO) 5-95 confidence interval for gas prices is shown below.

The February 16, 2024, NYMEX futures Henry Hub natural gas price for delivery in March 2024 was only $1.61/MMBTU. The forward price through October 2024 does not exceed $2.35/MMBTU. Lower natural gas prices reflect both warm 2023-2024 winter weather and the Biden administration’s shutdown of new LNG export terminal permitting. Lower prices benefit gas consumers like LyondellBasell.

Internationally, for reference to the Henry Hub US gas prices of $1.61/MMBTU, liquefied natural gas is:

- $7.85/MMBTU for March 2024 at TTF (Title Transfer Facility in the Netherlands);

- $8.57/MMBTU for April 2024 for the JKM (Japan Korea Marker) Asian reference price.

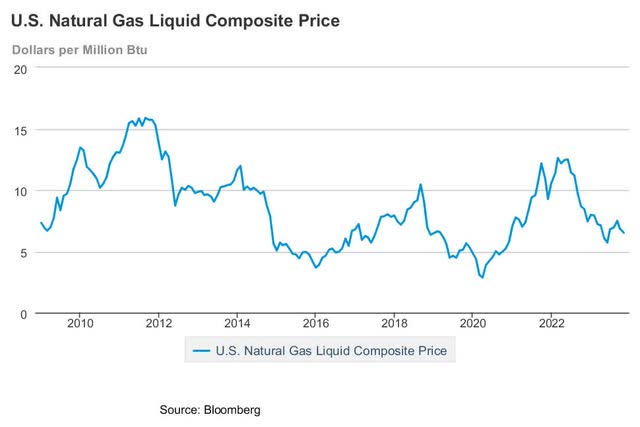

An EIA graph comparing natural gas to natural gas liquids prices from 2009 forward, is shown below. Per the EIA, “the natural gas liquids (NGPL) composite price is derived from daily Bloomberg spot price data for natural gas liquids at Mont Belvieu, Texas, weighted by gas processing plant production volumes of each product.”

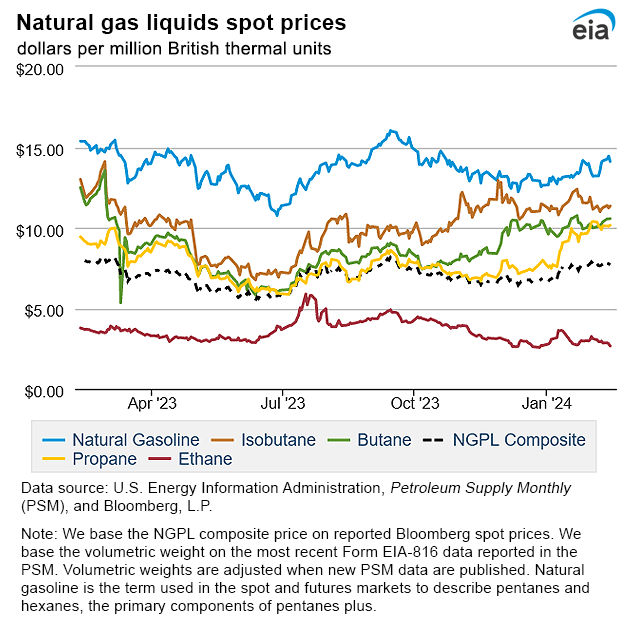

Natural gas liquids comprise key olefin feedstocks like ethane and propane but also include butane, isobutane, and natural gasoline (pentanes and hexanes). The second graph shows these individual prices as well as the composite, again based on processing plant volumes (ethane is by far the largest volume recovered.)

EIA and Bloomberg EIA Natural Gas Weekly

Macro

US equity markets are influenced by the Fed’s decisions on interest rates. Rate cuts appear unlikely in the next few months.

Also in the STEO, the EIA expects real (not nominal) GDP to increase by 1.8% in 2024 and 1.6% in 2025. Chemicals use tends to track GDP fairly closely, although note LYB is a global corporation, and this estimate is only for the US.

There is concern with China’s economic slowdown due to its balky, overbuilt real estate and potential government takeover of a larger part of the economy. And in Europe, chasing the net zero goal has led to higher energy prices and even some de-industrialization in Germany, as well as protests by farmers as governments talk about increasing farming costs, culling animal herds, and decreasing use of nitrogen fertilizers.

Competitors

LyondellBasell is headquartered in Houston, Texas; however, its SEC reporting addresses are in Houston, London, and Rotterdam.

Among US-based companies or those with significant US operations, ethylene competitors include China Petroleum & Chemicals (SINOPEC), CP Chem-a Chevron (CVX) and Phillips 66 (PSX) joint venture (which Elliott Investment Management is urging Phillips 66 to sell), DuPont (DD), Saudi Basic Industries (SABIC), Westlake Chemical (WLK), and chemicals divisions of Exxon Mobil (XOM) and Shell (SHEL).

Other chemicals competitors include Celanese (CE), Dow (DOW), Eastman Chemical (EMN), and international competitors like BASF, Bayer, INEOS, Mitsubishi Chemicals, and Sumitomo Chemicals. As noted, INEOS bought LyondellBasell’s ethylene oxide and derivatives business.

LyondellBasell competes with virtually every US refiner. Total operable US oil refining capacity in November 2023 was 18.3 million BPD so LYB’s capacity share is a tiny 1.4%. Since the company committed to shutting the refinery in 1Q25, it is in a less advantageous position with its suppliers, employees, and customers compared to competitors who plan long-term ongoing US Gulf Coast refining operations.

Governance

On February 1, 2024, Institutional Shareholder Services ranked LyondellBasell’s overall governance as a very good 2, with sub-scores of audit (7), board (2), shareholder rights (2), and compensation (3). In this measurement, a score of 1 represents lower governance risk and a score of 10 represents higher governance risk.

As of September 2023, LyondellBasell’s ESG ratings from Sustainalytics were “medium” with a total risk score of 20.7 (31st percentile). Component parts are environmental risk 13.5, social 2.1, and governance 5.1. Controversy level is 2 (moderate) on a scale of 0-5, with 5 as the worst.

On January 31, 2024, shorts were 1.6% of the floated stock.

Insider ownership is a large 20.45%. This is primarily private Access Industries, the pre-merger owner of Basell.

The company’s beta is 1.19, representing slightly steeper volatility than the market due to more cyclicality in chemicals and refining margins.

On December 31, 2023, except for the large inside ownership, a majority of LyondellBasell’s stock was held by institutions, some of which represent index fund investments that match the overall market. The six largest institutional holders were Vanguard (9.6%), BlackRock (7.2%), Dodge and Cox (5.0%), State Street (3.7%), Wellington (2.5%), and JPMorgan (2.1%).

JPMorgan and State Street have recently withdrawn from activist financial organization Climate Action 100+, whose companies manage $68 trillion. BlackRock transferred its membership to BlackRock International. Climate Action 100+ has picked 170 companies in energy, utilities, and other sectors for “engagement.” One of these target companies is LyondellBasell.

BlackRock, Wellington, State Street, and JPMorgan are signatories to the Net Zero Asset Managers initiative, a group that manages $57 trillion in assets worldwide and which limits hydrocarbon investment via its commitment to achieve net zero alignment by 2050 or sooner.

Although LyondellBasell is not an energy producer, its need for feedstock of affordable hydrocarbons to make petrochemicals could conflict with the goals of these groups.

Financial and Stock Highlights for LyondellBasell

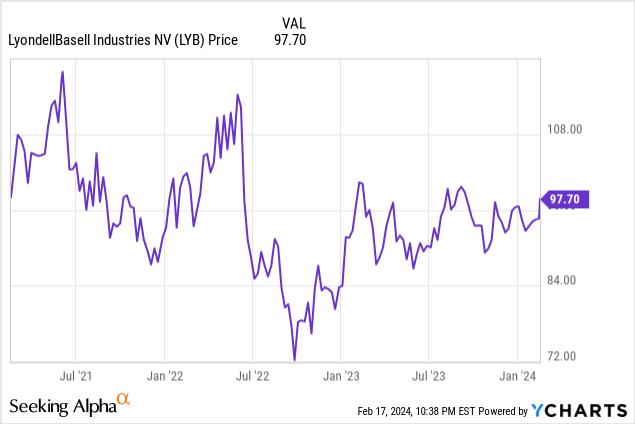

LyondellBasell’s market capitalization at the February 16, 2024, stock closing price of $97.70/share is $31.7 billion.

The 52-week price range is $81.24-$102.05 per share, so the closing price is 96% of both the 52-week high and the one-year target of $101.35.

Trailing twelve months’ earnings per share (EPS) of $6.99 gives a trailing price/earnings ratio of 14.0.

The average of analysts’ estimated EPS for 2024 is $8.47 and for 2024 is $9.94 for a forward price-earnings ratio range of 9.8-11.5. LyondellBasell has beat analysts’ EPS estimates by $0.08-$0.43/share in the last three quarters.

LyondellBasell earned $4.9 billion in operating cash.

Twelve-month returns on assets and equity are good at 6.1% and 16.4%, respectively.

On September 30, 2023-the most recently-available balance sheet–the company had $23.655 billion in liabilities, including long-term debt of $10.2 billion, and $36.875 billion in assets giving LYB a liability-to-asset ratio of 64%.

LYB pays a dividend of $5.00/share, a yield of 5.1%.

The company’s mean analyst rating is 2.7, or “hold,” leaning toward “buy” from twenty-four analysts. At least one analyst considers LYB to be near fair value.

Notes on Valuation

Book value per share is $39.91, less than half its current market price, indicating positive investor sentiment.

The EV/EBITDA ratio is 8.3, below the preferred ratio of 10 or less, suggesting LYB stock is bargain-priced.

Positive and Negative Risks

The key negative risk for LyondellBasell is oversupply of plastics capacity, particularly from Asia, relative to demand.

A risk for its European businesses is the manufacturing and demand slowdown there.

More generally, potential investors should consider their overall global economic outlook and how chemicals demand may change.

A positive risk is that natural gas (especially) and NGL prices are on the lower side of the cycle. This is particularly true in the US, a key manufacturing hub for LyondellBasell, but also globally.

Higher-than-historic US interest rates and the potential for more inflation are negative risks.

Recommendations for LyondellBasell

LyondellBasell may appeal to ESG-seeking investors for its ESG focus and to dividend-seeking investors for its 5.1% dividend.

Like every natural gas and NGL consumer, LyondellBasell is advantaged by now-lower costs of both.

The ratio of enterprise value to EBITDA indicates a relative bargain. The forward price/earnings ratios are also moderate.

Despite its relatively good governance and ESG ratings, LyondellBasell is one of the energy, petrochemical, and utility companies in the crosshairs of the Climate 100+ activist group. While inclusion on the Climate 100+ list is not a knock on LYB, LyondellBasell is nonetheless (still) far more focused than many on ESG-type Circular and Low Carbons businesses. Prominently, as part of its decarbonization efforts it plans to shutter its Houston oil refinery by 1Q25.

Also, interests of the +20% private equity/inside owner may not align with the interests of public investors.

For growth and long-term investors, I recommend LyondellBasell as a hold. The company’s stock price is at the high end of its 52-week price range and near its one-year target. Although the company is experiencing lower feedstock and US energy costs, it is contending with cost issues in European manufacturing. Demand limits, particularly in Europe and Asia, are a sufficiently large issue such that LYB is cutting production to 75-80% of capacity at several locations.