Yuichiro Chino/Moment via Getty Images

Summary

Following my coverage of Lumentum Holdings (NASDAQ:LITE), for which I recommended a buy rating as I turned bullish on the Cloud Light Technology acquisition and that the inventory situation was getting better, this post is to provide an update on my thoughts on the business and stock. I continue to stay buy-rated for LITE. Despite the inventory situation not easing as much as I expected it to, I believe this is a temporary issue and does not have a structural impact on my thesis. I take it as validation that the Cloud Light product is able to help customers achieve cost efficiency (based on the fact that LITE’s largest data center customer is switching to Cloud Light’s product), and this is very positive for the long-term growth outlook. However, I should warn investors that the inventory situation could take longer than expected to fully normalize. As such, the investment position should be nimble enough so that one can size up when the share price pullbacks.

Investment thesis

LITE 2Q24 saw total revenue of $367 million, declining by 27% vs. last year, in line with the midpoint of guidance. Non-GAAP gross margin declined by a lot more than I expected, touching 32.6%, a 12.2% decline vs. last year. The poor gross margin performance led to a sharp decline in non-GAAP EBIT margin from 23.1% last year to 19.6%. As a result, non-GAAP EPS saw $0.32, which was down 79% vs. last year.

Frankly, I am disappointed with LITE results—not the y/y revenue decline that was expected, but the gross margin movements. I previously expected the inventory situation (I talked about this in my 4Q23 and 3Q23 posts) to end in FY24, but I am having doubts after reviewing the 2Q24 performance. In the telecom segment (part of cloud and networking), revenue was down 41% year over year to $202 million, and customers are still bringing down inventories to normal levels. While management reiterated that the excess Telecom segment inventory will be an issue through the balance of FY24, I believe this pain is going to last a lot longer than expected. If we look at peers’ inventory days: Ciena, who is operating at ~145 days vs. its normalized level of 60+ days, suggests a high level of inventory surplus in the system. I turned bullish previously on the LITE inventory situation when I saw the sequential improvement in Ciena inventory days (from 154 days in 3Q23 to 145 days in 4Q23), and that was my mistake. It appears that LITE, which saw its inventory days increase from 127 days in 1Q24 to 139 days in 2Q24, is facing a much deeper problem than it seems. Note that this is inventory on LITE’s balance sheet. The vendors down the value chain also have inventory sitting on their balance sheets that needs to be cleared before they will reorder from LITE. I now believe this situation is going to last way longer than expected, and it may result in earnings volatility.

However, that is not to say that my long-term bull case on LITE is structurally impaired. Cloud Light, which is central to my bull case, was a bright spot during the quarter. Cloud Light’s 8-week contribution of $59.5 million to Datacom’s revenue in 2Q24 was driven primarily by shipments of 800G transceivers. This suggests that LITE’s quarterly run rate is approximately $97 million, which is a 50% improvement compared to its LTM run rate of $200 million prior to the acquisition. A key development in the coming quarters is that LITE’s biggest client in the Datacom segment is going to undergo a product transition in the middle of CY24. The present 800G transceiver design will be phased out in favor of a more recent, energy-efficient SKU from Cloud Light as part of this change. The current SKU will be winding down while the new SKU is ramping up, which will cause near-term headwinds due to the size of this customer during the transition period. Sales for 3/4Q24 will likely take a hit as a result of this. While this is “bad” for near-term performance, what this implies is that Cloud Light has a product that helps customers (and is validated by this large customer) achieve better efficiency (power, which thereby impacts cost). This is very positive for the LITE long-term growth outlook, as I believe exiting data center operators will eventually make this switch. They have to switch in order to stay competitive, especially in the current environment where more and more data centers are coming into the industry. In economic terms, more supply is expected to come into the market, which should pressure pricing. In order to lower marginal costs, these data center operators will need a way to achieve cost efficiency, and that is where LITE is well placed to capture those demands.

On the point of being well-positioned, I was glad to hear that LITE is ramping up a new transceiver manufacturing capacity in Thailand. The new 800G transceivers and the initial ramp of 1.6TB transceivers will be supported by that capacity, which will be available sometime in the summer. By cadence, in 2024, the 1.6TB products will likely generate very little revenue, but in 2025, they will make a much bigger splash. Given that most of the current capacity is being utilized for a major client, this new capacity opens up more room for growth (the current growth constraint is capacity). I don’t see a problem with LITE capturing demand with this new capacity, given that they are already receiving interest from customers.

Our Thai factory has proven photonics manufacturing capabilities and has received numerous customer accolades, giving us confidence in our ability to ramp rapidly. 2Q24 earnings results call

Valuation

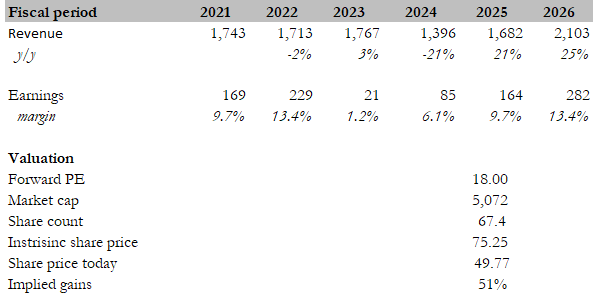

Own calculation

Unlike my previous model, I now believe the recovery progress will be delayed by another year because of the inventory situation. I thought it would end in FY24, but given where things are today, I think a more conservative stance is to expect one more year of delay. My revised model has a price target of $75.25 in FY25 (vs. my price target of $75.79 in FY24). The major change here is that I expect weaker performance in FY24 (-21% revenue growth after annualizing 1H24 and 3Q24 guided performance) and only expect growth to recover back to mid-20% range in FY26 (FY25 growth assumption is based on consensus estimates). I took a similar approach for earnings margin trajectory as well, where I annualized 1H24 net income and 3Q24 guided EPS to derived at $85 million earnings for FY24 ($10 million lower than my previous estimates), and only for LITE to see margin recovery to FY22 level (previous high) in FY26 instead of FY25. I have also tapered my forward PE valuation assumption to the high end of LITE’s valuation range (18x forward PE), just to be more conservative on expectations.

Risks

I think it is becoming more apparent that the inventory normalization duration is the biggest risk to LITE stock’s performance. If subsequent quarters continue to see lackluster improvements in the inventory situation, it might push growth and margin recovery expectations farther out into the future (which means the stock price is not going to see positive traction until then).

Conclusion

My buy rating for LITE remains despite the disappointing 2Q24 results and prolonged inventory challenges. The setback in gross margins and potential delays in inventory normalization have prompted a more conservative outlook, pushing my recovery expectations by another year. Nevertheless, my long-term bullish case remains intact, anchored in the positive impact of Cloud Light Technology on cost efficiency, as evidenced by a major data center customer’s switch to Cloud Light’s product. The ongoing product transition and the expansion of transceiver manufacturing capacity in Thailand also positions LITE favorably for future demand.