SOPA Images/LightRocket via Getty Images

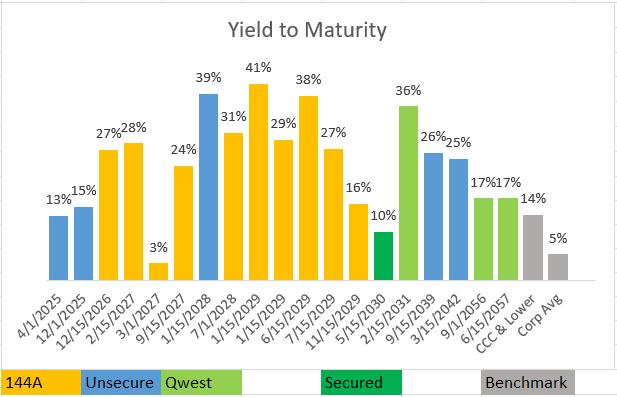

Last week, Lumen Technologies (NYSE:LUMN) reported its fourth quarter and full-year earnings results. The results come as the company is in the midst of a multi-year turnaround strategy and nearing completion of a recently revised transaction support agreement to defer major debt maturities to 2029. Lumen’s debt continues to be priced all over the place, but mainly in distressed territory, with some yields exceeding 40%. I’m currently rating both Lumen stock and debt a “hold” as I wait for further information on the company’s debt restructuring, but the results from 2023 and the outlook for 2024 should give investors reasons to be optimistic.

FINRA

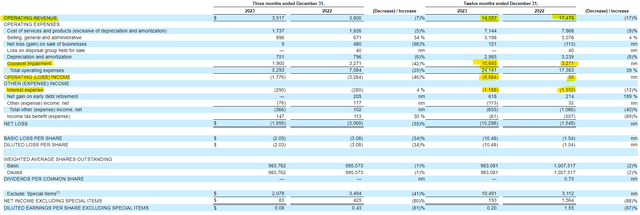

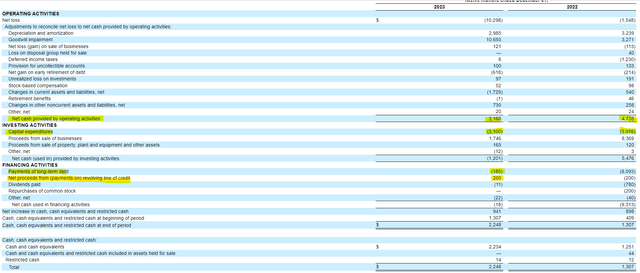

Lumen’s 2023 results reflected the company’s continued efforts to become a smaller and more efficient company. Lumen reported a nearly $3 billion drop in revenue and a $9.5 billion operating loss. The operating loss was driven by a non-cash-related $10.7 goodwill impairment charge. By removing goodwill and incorporating interest expense, Lumen was essentially break even in 2023.

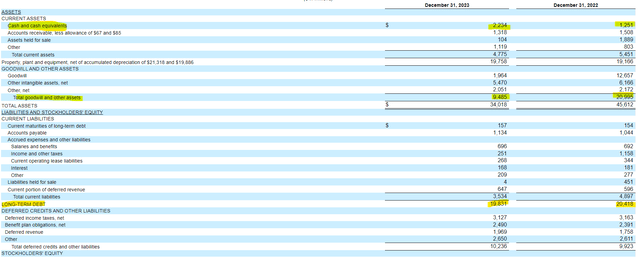

Lumen’s balance sheet saw a radical downsizing in 2023. The company’s $10 billion goodwill write off directly impacted assets and shareholder equity. Lumen’s cash position did grow by $1 billion to $2.2 billion. Long-term debt dropped from $20.4 billion to $19.8 billion. With the goodwill write-off, shareholder equity is now virtually zero.

From a cash flow perspective, Lumen saw a $2.6 billion drop in operating cash flow from a year ago. Free cash flow, which is operating cash flow less capital expenditures, was negative by $1 billion. Despite the negative free cash flow, Lumen did not need to rely on external financing as it sold $1.9 billion worth of assets during the year. Additionally, the entirety of the free cash flow burn consisted of a one-time tax payment regarding asset sales.

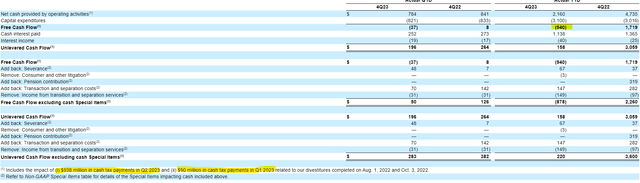

SEC 8-K Earnings Release SEC 8-K Earnings Release

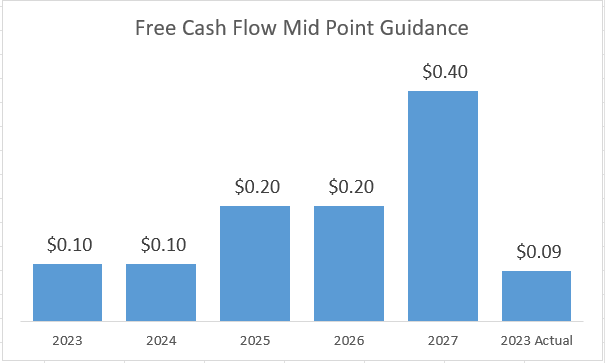

If we remove the tax payment from the cash flow analysis, Lumen generated just under $100 million in adjusted free cash flow for the year. This is in line with the midpoint of the company’s 2023 guidance, which was initially released when Lumen announced its turnaround plan. With all of its challenges, the company’s management has delivered on its guidance for 2023, which lends credibility to their turnaround plans.

Lumen Turnaround Projections and Earnings Results

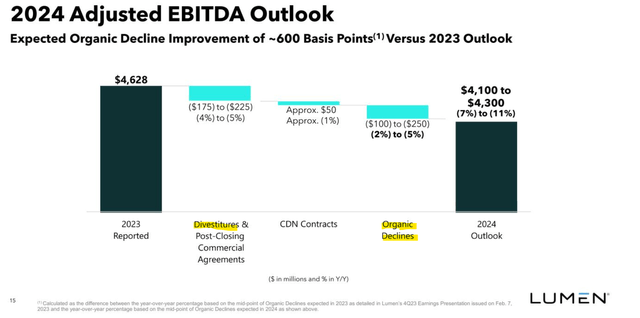

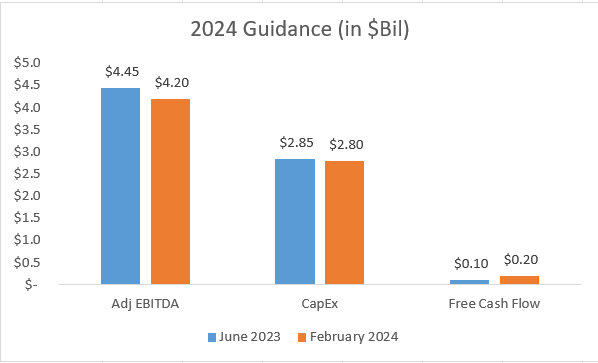

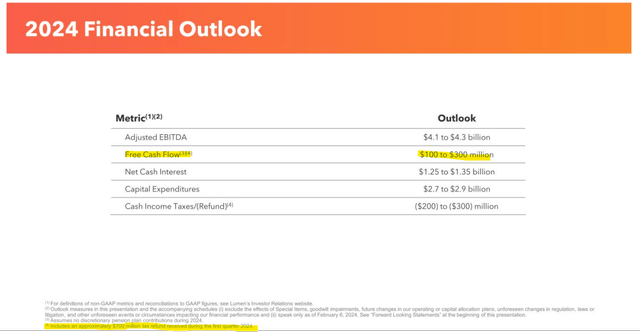

Looking ahead to 2024, Lumen is facing another challenging year. Thanks in part to asset divestitures and organic declines in the business, adjusted EBITDA is expected to decline from $4.6 billion to a range of $4.1 to $4.3 billion. The decline in adjusted EBITDA may be concerning to investors, but it does not tell the whole story about how the company is expecting to perform in 2024.

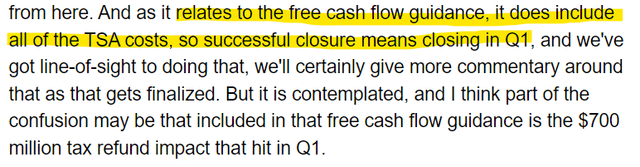

While adjusted EBITDA is projected to drop below the original projections from Lumen’s turnaround plan, free cash flow is expected to rise to $200 million, higher than the original turnaround estimates. Lumen is getting assistance in meeting these cash flow obligations with $700 million in tax refund proceeds that have been subsequently received in the first quarter of 2024.

Lumen Turnaround Guidance and Updated 2024 Guidance Earnings Presentation

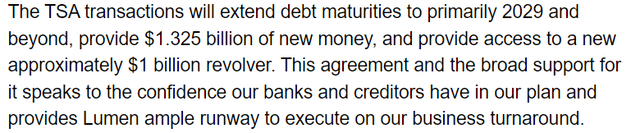

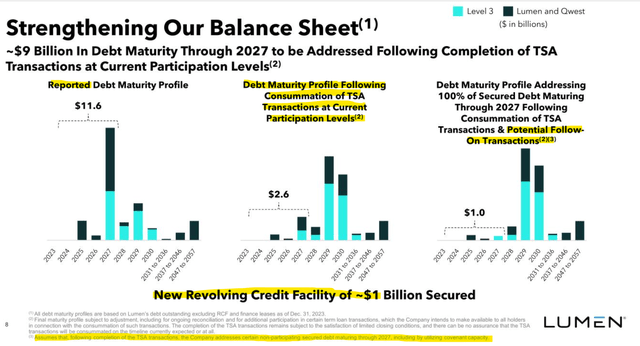

A big unknown to the company’s 2024 financial performance and its viability over the next few years is the treatment of its upcoming debt maturities. Earlier in 2023, the company announced a tentative agreement with bondholders to restructure $16 billion worth of long-term debt and defer the wall of 2027 debt to at least 2029. Recently, the terms were updated, and Lumen is potentially receiving $1.325 billion in new financing along with access to a $1 billion revolver. Based on the most recent balance sheet, this would place total liquidity at over $4 billion. But the debt deal has yet to be finalized, and the terms could still change.

The company is saying that they expect the debt deal to close before the end of the first quarter, and the new financing costs associated with the deal (higher interest expenses) have been baked into the 2024 guidance. Lumen may also utilize some of its liquidity to address non-participating maturities to further reduce the ramp to its refinanced 2029 maturities.

Earnings Call Transcript Earnings Presentation

While Lumen’s risk of accelerated organic declines eroding profitability remains, there are also risks surrounding the new debt agreement. If the deal ends up not backloading enough of the company’s maturities or providing enough liquidity, Lumen may be dependent on upcoming debt maturities as a use of its cash flow versus investing in the capital needed to grow the business. Despite the risks, the progress of the talks between the creditors and management gives me assurance that Lumen will emerge with the liquidity necessary to focus on capital investment.

I am comfortable continuing my holdings in Lumen stock and 2039 maturing debt, but I am not buying or selling anything until the debt deal is finalized. From there, investors can get a full understanding of what Lumen’s financing costs, liquidity, and debt maturity profile will look like over the next five years. It is promising that the new management team has met its first set of goals, but with a large amount of new information coming shortly, I’d rather wait before determining my next steps.

CUSIP: 156700AM8

Price: $30.18

Coupon: 7.6%

Yield to Maturity: 26.45%

Maturity Date: 9/15/2039

Credit Rating (Moody’s/S&P): Caa3/CCC-